Publix Gains Share of Supermarket Wallet from Kroger

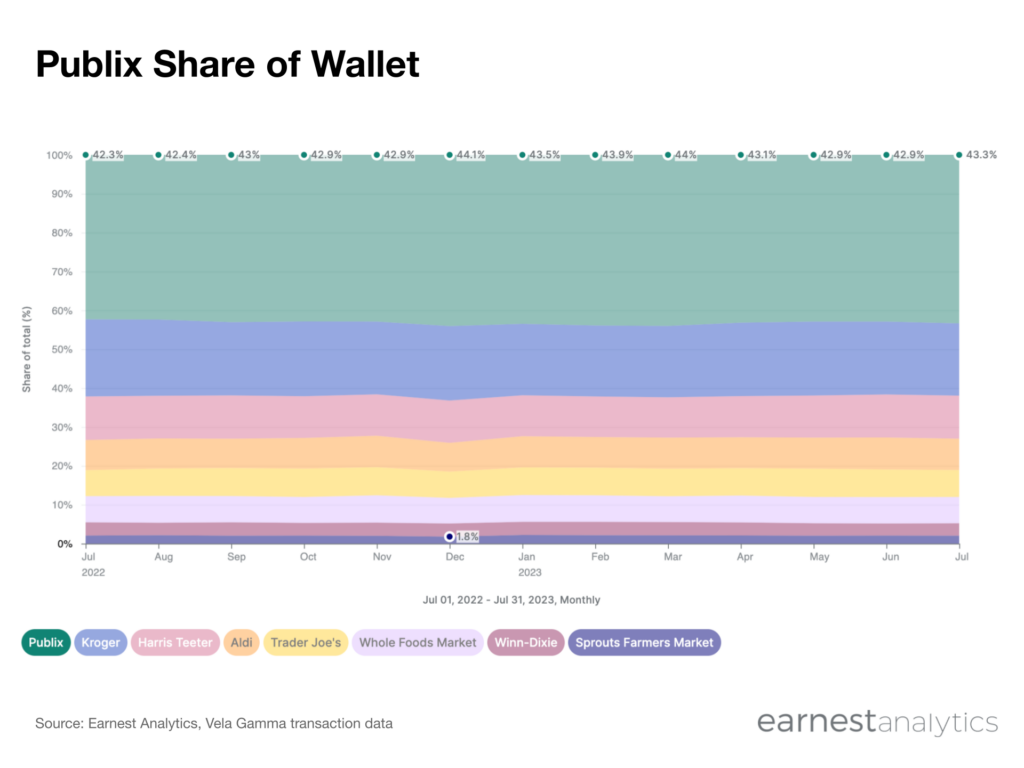

Publix gained nearly 1 point of share of wallet among its customer base from competing supermarket chains in the trailing 12 months according to Earnest credit card data. The popular Florida-based grocer commanded 43.3% of its customers’ supermarket dollars in July 2023, up from 42.3% in July 2022. Unlike a market share analysis that measures spend across multiple brands, share of wallet captures how a brand’s own customer spends relative to its competitors. The increase in share of wallet shows that Publix succeeded in getting existing customers to spend more at their stores over the past year, a trend that has continued for several years now.

The gain in Publix’s share of wallet largely came at the expense of mid- and high-end grocers Kroger (and its corporate cousin brand Harris Teeter) and Whole Foods. Hard discounters Aldi and Trader Joe’s meanwhile made inroads with Publix shoppers over the past year, growing their share of Publix customers’ wallet from 7.8% to 8.1%, and 6.7% to 6.9%, respectively, from Q3 2022 to Q3 2023. Sprouts Farmers Market’s share of Publix customers’ supermarkets remained largely unchanged.

Publix shoppers only spent around 3.2% of their supermarket dollars at Florida rival Winn-Dixie in July 2023, down from 3.4% in July 2022.