Peloton is keeping customers, but are they adding enough?

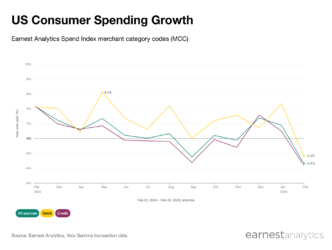

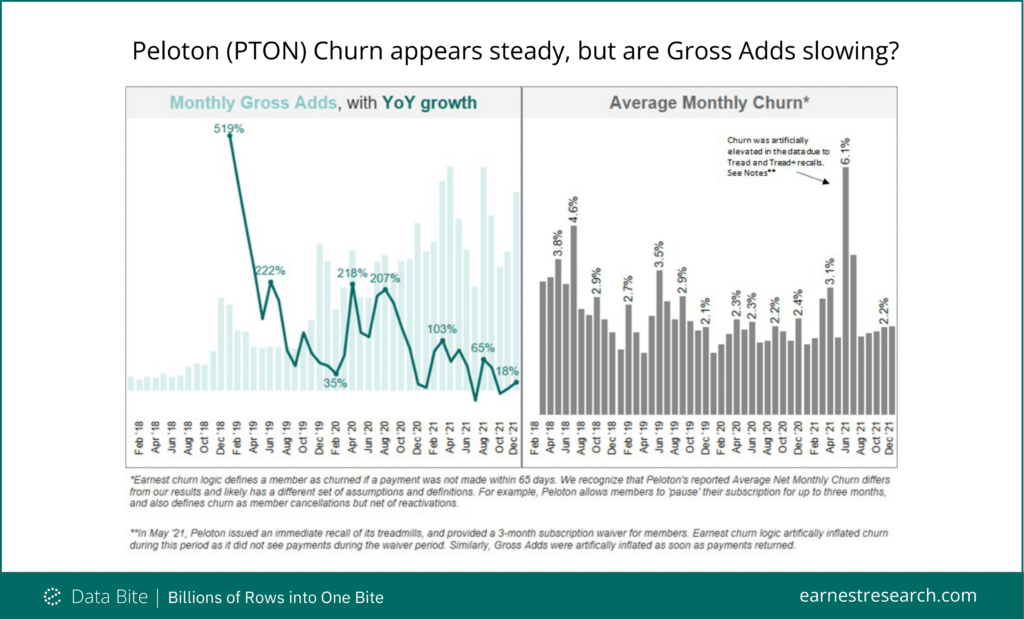

Recent news that Peloton ($PTON) would be pausing equipment production made waves for the company which had once been a beneficiary of the pandemic. Earnest Analytics (FKA Earnest Research) data revealed that while subscriber churn* rates remain within historical norms of 2% per month, new subscriber growth is slowing. From a Covid-19 peak of over 200% YoY in April and August 2020, monthly gross adds to Peloton’s Connected Fitness Subscription fell to 18% YoY in December 2021. This deceleration is in line with a broader slowdown in the Home Fitness category during the holiday season, as well as a surprising recovery at some gyms.

The fact that the news comes during New Years Resolution season, a historically busy time for fitness companies to add new members, suggests that Peloton also saw flagging demand for its equipment that would not yet be reflected in the new subscriber numbers.

Note: Data includes Peloton’s Connected Fitness Subscription, excludes Digital offering.