Off-Price Department Stores Won the Pandemic, But are Losing 2022

Read the free case study: Comparing Department Store Performance with Consumer Spending and Earnings Data

Off-price retailer T.J. Maxx and mid-tier retailer Kohl’s were the largest department stores by sales in the US for the past four consecutive years, consolidating their leads during the pandemic from 14% to 17%, and 18 to 19% between 2019 and 2021, respectively. Meanwhile Nordstrom, Macy’s, and Marshall’s rounded out the top five largest stores, each commanding double digit market share. Those top five brands grew their combined market share from 65% to 71% at the expense of J.C. Penney and the combined share of 34 smaller retailers. Impressively, T.J. Maxx grew its transactions per customer despite not having as sophisticated of a web presence as other major competitors.

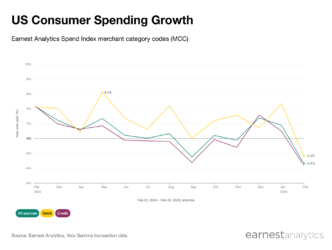

However, falling spending among T.J. Maxx and Kohl’s core cohort of stimulus recipients could already be driving YoY sales declines compared to department stores with less middle and lower income exposure. The changing macro environment presents an opportunity for department stores to claw back some of the share lost during the pandemic.

Download the full case study for free here: Comparing Department Store Performance with Consumer Spending and Earnings Data.