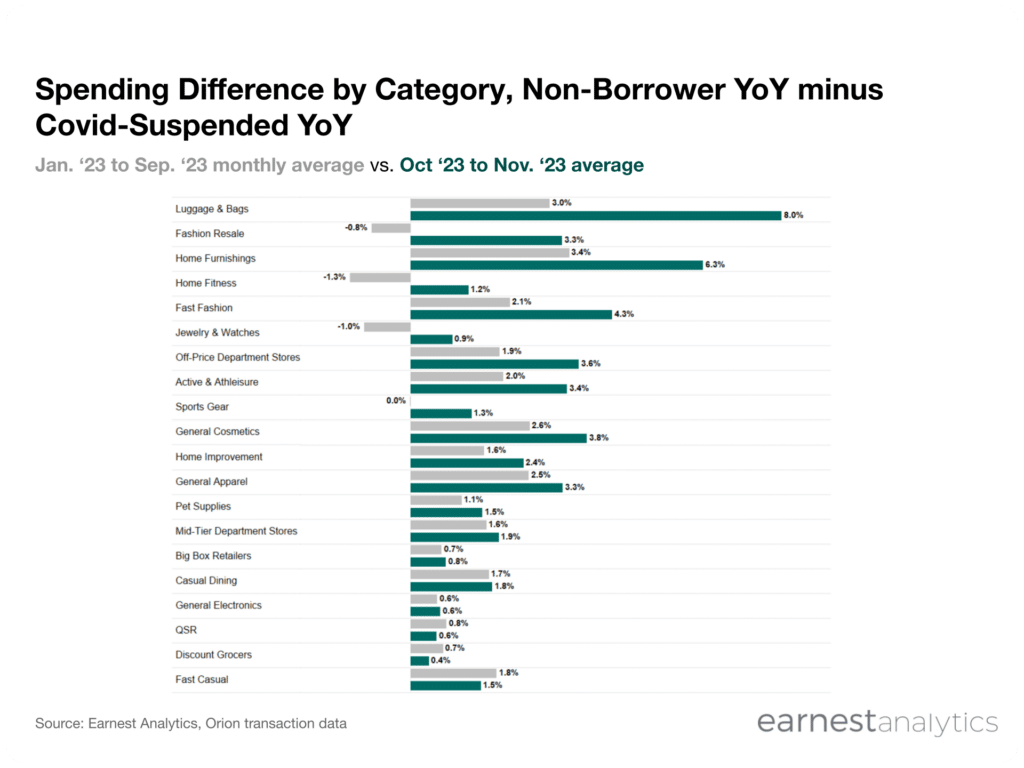

Luggage, Fashion, & Home impacted most by student loan resumption

Student loan payments for millions of borrowers restarted in October 2023 and several major categories are already experiencing a widening in the YoY spending gap between Non-Borrowers and the Covid-Suspended cohort.

Luggage & Bags, Fashion Resale, Home Furnishings, Home Fitness, and Fast Fashion saw the largest widening, with Non-Borrowers outspending Borrowers by 2-5 additional points in October and November 2023 compared to the average monthly spending gap prior. The spending gap widened by ~1 to 2 points for Jewelry & Watches, Off-Price Department Stores, Active & Athleisure, Sports Gear, and General Cosmetics. Home Improvement and General Apparel experienced ~1 point of incremental outspending.

In contrast, QSRs, Discount Grocers, and Fast Casual restaurants saw less outspending from Non-Borrowers after student loan payments resumed, suggesting minimal impact in the first two months of student loan repayments.

Nordstrom Off-Price, Wayfair, Big Lots, and Old Navy were among the most impacted retailers by the resumption of student loan payments, with Non-Borrower’s increasing their outspending by ~3 to 8 points in October and November 2023. Burlington Stores, Macy’s, Marshalls, American Eagle, Lowe’s, and Lululemon rounded out the group of companies most impacted, each seeing at least a point of additional outspending.

Download Student Loans Payment Report