US Clothing & Accessories spend drops in 2025

Clothing & Accessories are worst major category

Consumer spending at Clothing and Accessories establishments fell 3.9% YoY between January 1 and March 23, 2025, according to Earnest debit and credit card data. That makes the category the worst performing major category so far this year.

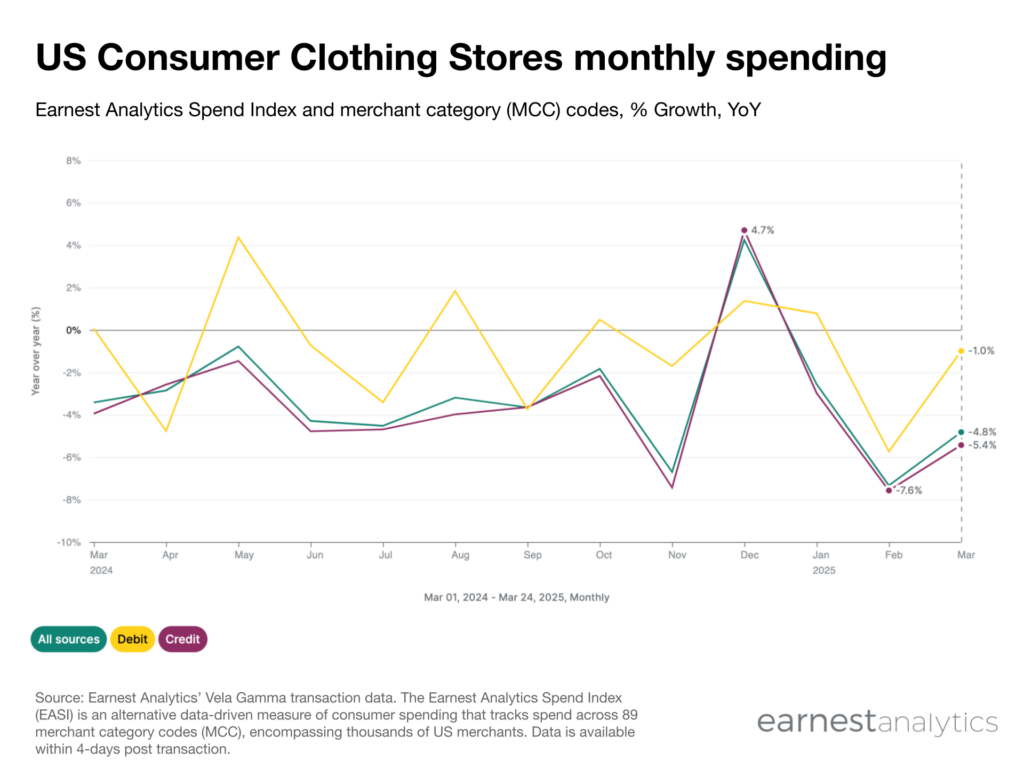

Preliminary March growth represents a deceleration from February after accounting for Leap Day 2024 (shown below without an adjustment for 2024’s Leap Day). March 1-23rd data reflects the worst monthly trend since November 2024. The deceleration is driven mostly by lower credit card spending growth. Debit card growth outperformed credit for most of the last 12 months, similar to total trends. This could suggest younger shoppers were bigger drivers in Clothing and Accessory spending growth.

Credit card ticket falls, offsetting debit card strength

The average credit and debit card transaction size at Clothing and Accessories Stores was $122 in the first 23 days of March, 2025. Average basket size has mostly declined YoY since December 2024. March represents a further deceleration from February, but an improvement from deeper declines in early 2024.

Consumer and Accessories Store tickets are unique compared to other categories in terms of growth by source. There is a meaningful divergence between debit card tickets, +1.2% YoY in March so far, and credit card, -2.1% YoY.

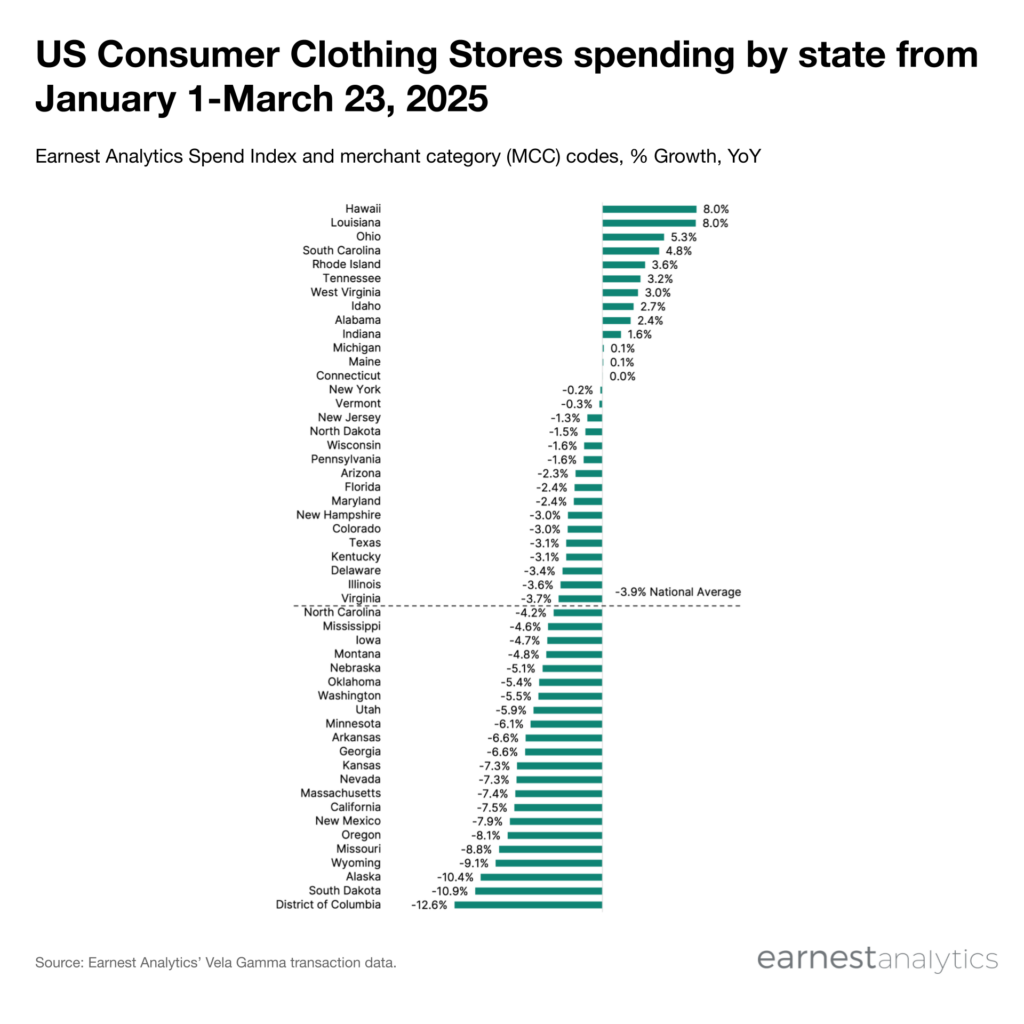

Clothing & Accessories Stores see pullback across most states

Consumer spending at Clothing and Accessories Stores grew the fastest in Hawaii, Louisiana, and Ohio. Alaska, South Dakota, and The District of Columbia were the slowest growing states. Nevertheless, clothing spending fell in most states.

Forecast: March likely to bring continued Clothing Stores declines

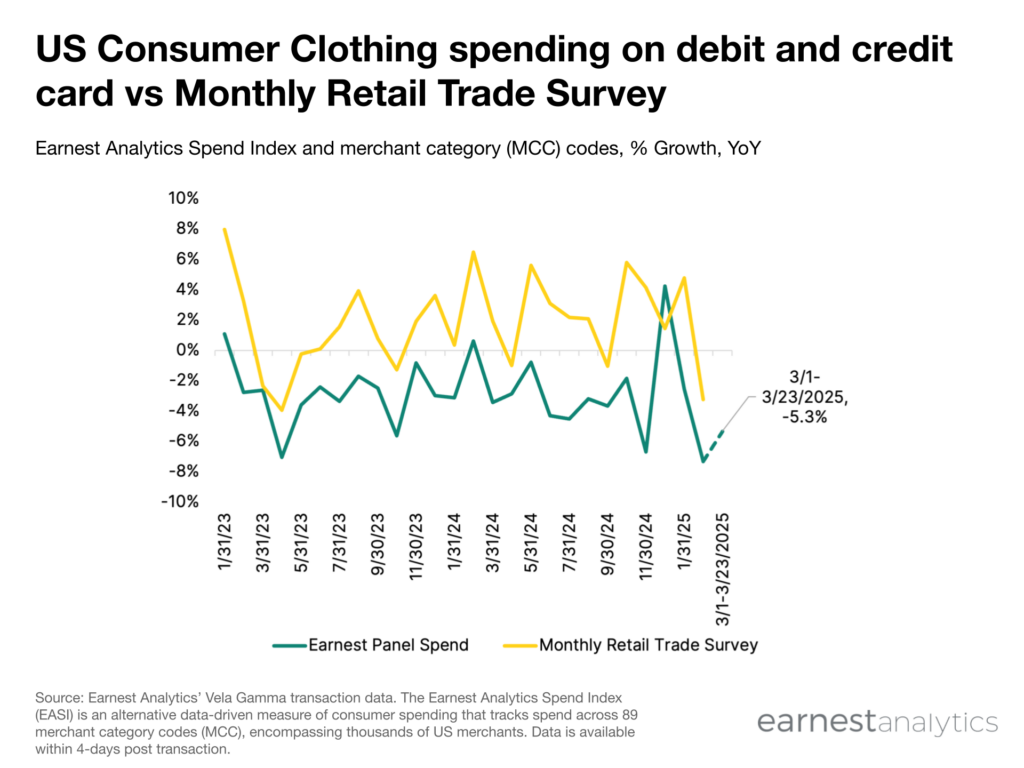

Earnest’s panel spending at Clothing Stores tracks the US Census Bureau’s Monthly Retail Trade Survey (MRTS) Clothing & Clothing Accessories Stores trends with a 0.72 r2 since January 2018. Earnest’s panel fell 5.3% YoY in March as of the 23rd, compared to -4.0% in February 2025, adjusted for Leap Day. This implies a continued organic deceleration in Monthly Retail Trade Survey results reported by the Census Bureau.