Shein’s dominance faces pressure pre-IPO as laws, trends shift

Shein outperforming broader apparel slowdown headed into IPO

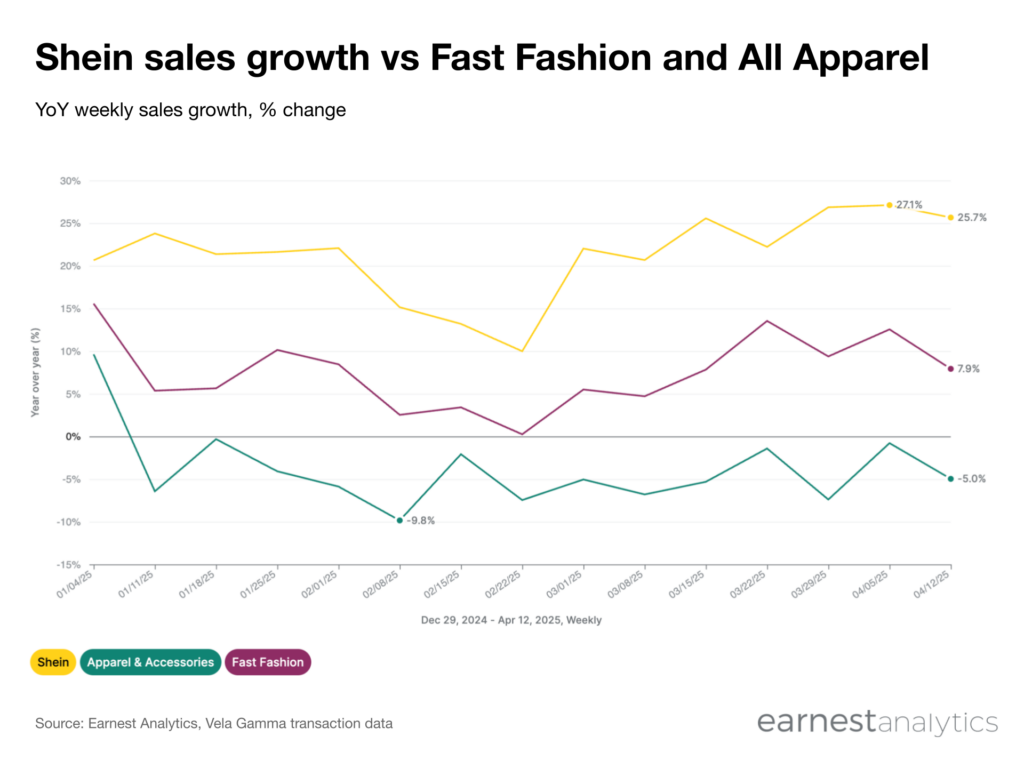

Sales continue to grow in 2025 headed into a potential Shein IPO according to Earnest credit card transaction data. Sales accelerated at the Chinese fast fashion giant after slowing immediately following the US government announced changes to tariff policy.

Shein continues to outperform the broader Apparel & Accessories category, including other Fast Fashion retailers. Sales grew 35.7% YoY the week ending April 12th. That is nearly triple the 7.9% YoY growth at all Fast Fashion companies. The broader Apparel & Accessories category continues to struggle in 2025 across most US states. Shein’s relative performance has put it on top of the Fast Fashion market. However, the category has shifted in the past 12 months headed into Shein’s IPO.

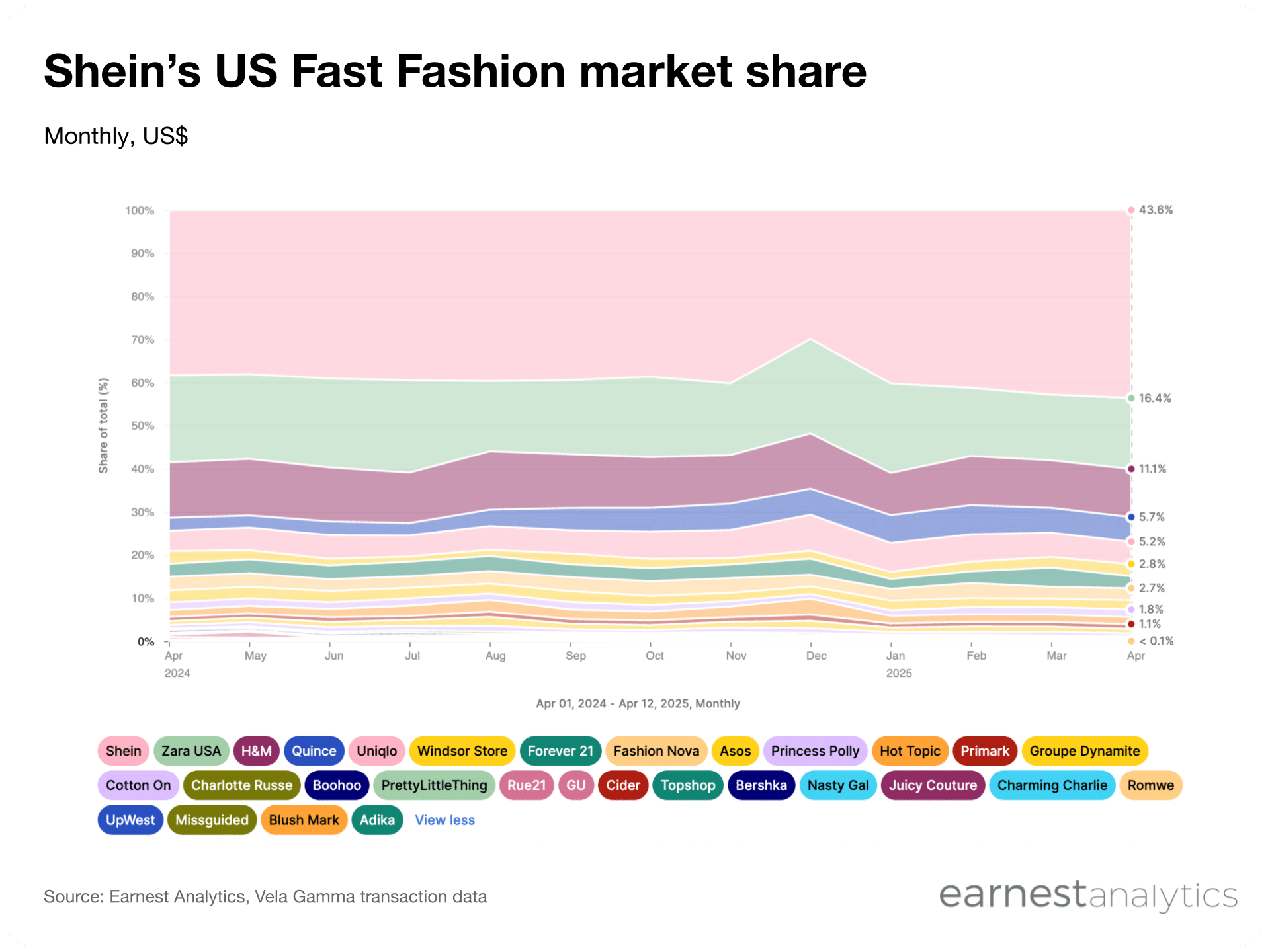

Shein still growing its Fast Fashion market share

The Chinese fast fashion juggernaut continues to gain share in the US Fast Fashion market. Shein comprised 43.6% of sales during the first 12 days of April 2025, up from 38.5% last April. Zara had the second largest share at 16.4% during the same period, followed by H&M’s (HNNMY) 11.1% share.

However, the formerly fourth largest Fast Fashion retailer Uniqlo (FRCOY) was unseated in recent months, replaced by fast growing DTC brand Quince. Quince consistently grew triple digits most of 2025, leaning into its high value, unbranded value proposition (see data in Dash).

Quince sells luxury basics at low prices by cutting out middlemen and streamlining its supply chain. The new brand is joined by Pact, ABLE, and other DTC retailers that could challenge the ultra-low-cost fashion that has dominated US spending post-pandemic.

Quince growth shows Shein customer now looking for value and quality

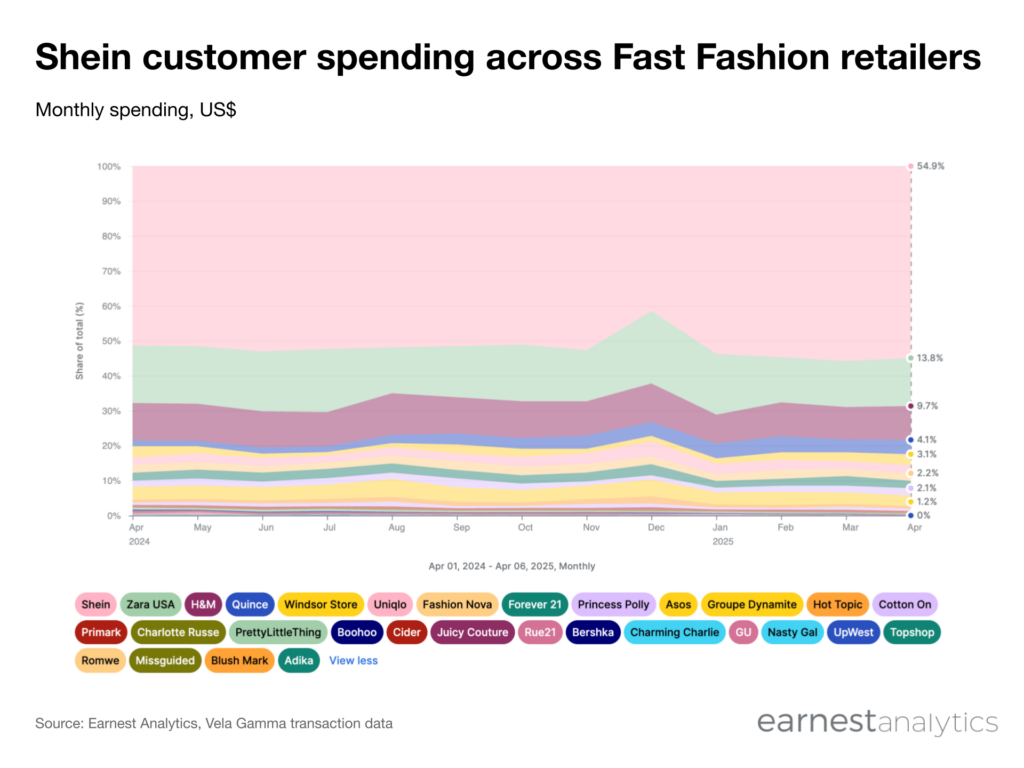

Quince is the fastest growing apparel brand among Shein customers according to Earnest credit card transaction data. Shein customers spend 4.1% of their Fast Fashion wallets at Quince in the first 12 days of April, 2025. This represents a meaningful increase from 1.6% in April 2024 (see data in Dash).

This shift could show how customer preferences are changing in the US after 5 years of Shein’s Fast Fashion dominance. Shein’s trend-driven customer is beginning to look for value within higher quality goods. It is a space in which Shein doesn’t currently compete. Shein’s IPO comes at a pivotal time both in terms of international trade changes, as well as consumer shifts.