Consumers are pulling back at restaurants so far in 2025

Restaurant spending is underperforming in 2025

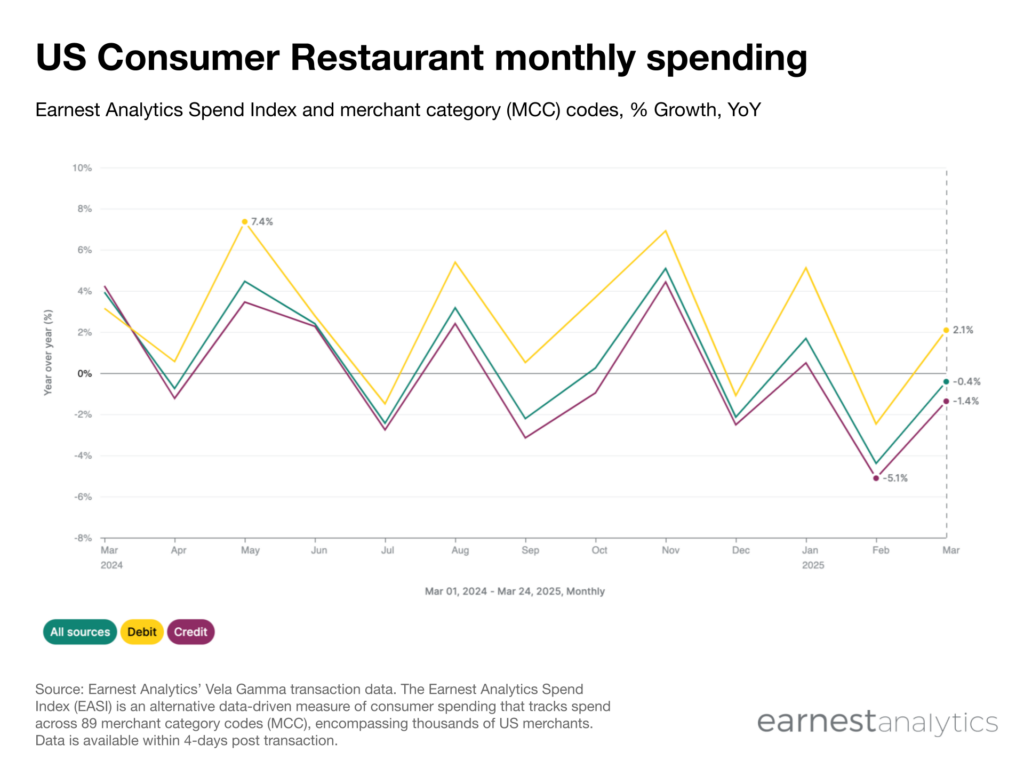

Food Service & Drinking Places spending grew 0.5% YoY between January 1 and March 23, 2025, according to Earnest debit and credit card data. That means the category slightly underperformed vs. aggregate spend growth.

Preliminary monthly data for March shows an improvement from February (shown below without an adjustment for 2024’s Leap Day). But March 1-23rd data reflects a deceleration from 5.6% YoY growth in January 2025. The deceleration from January is driven both by lower debit and credit card spending growth.

Similar to General Merchandise trends, debit card growth outperformed credit for most of the last 12 months, a trend which has continued. Debit cards are more likely to be used by younger shoppers.

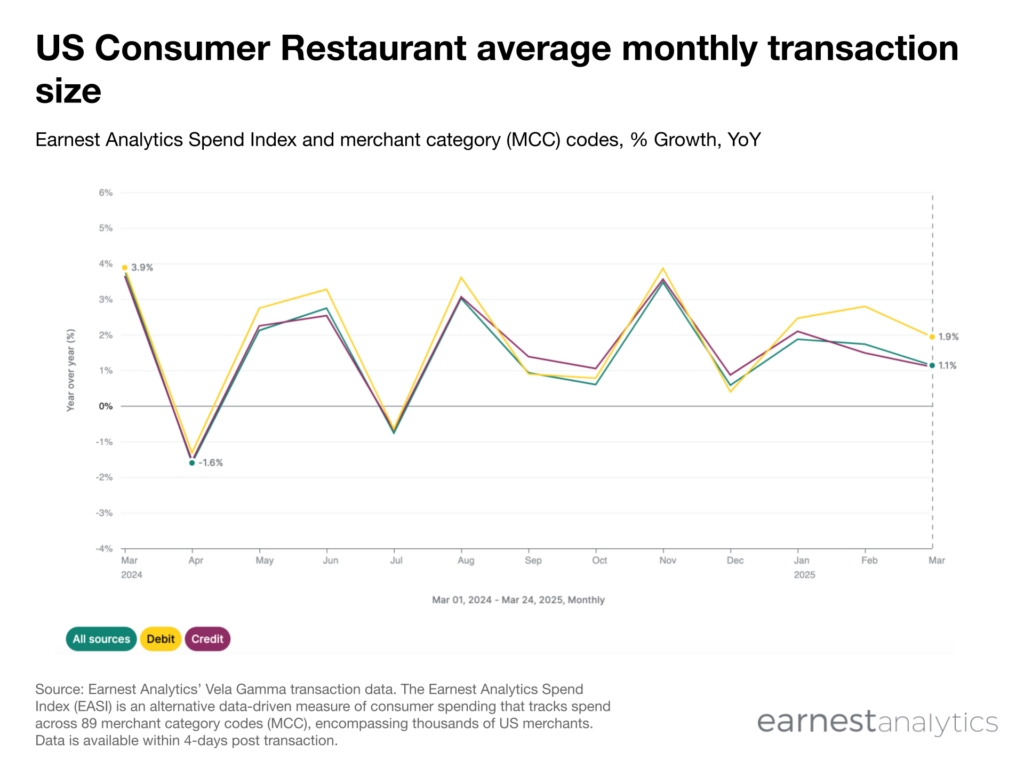

Restaurant tickets posting healthy growth

The average credit and debit card transaction size at Restaurants was $29 in the first 23 days of March, 2025. The category includes Eating Places and Restaurants, Bars, Cocktail Lounges, Discotheques, Nightclubs and Taverns – Drinking Places (Alcoholic Beverages), as well as Fast Food Restaurants.

Tickets have mostly grown YoY since March 2024. March represents a slight deceleration from February.

This steady increase in prices helps explain why value oriented chains like Chili’s are thriving. It could also be why more discretionary out-of-home restaurant spending, like coffee, is struggling. Even Starbucks’ turnaround is threatened by sluggish reloads on its vaunted store cards as it loses wallet share.

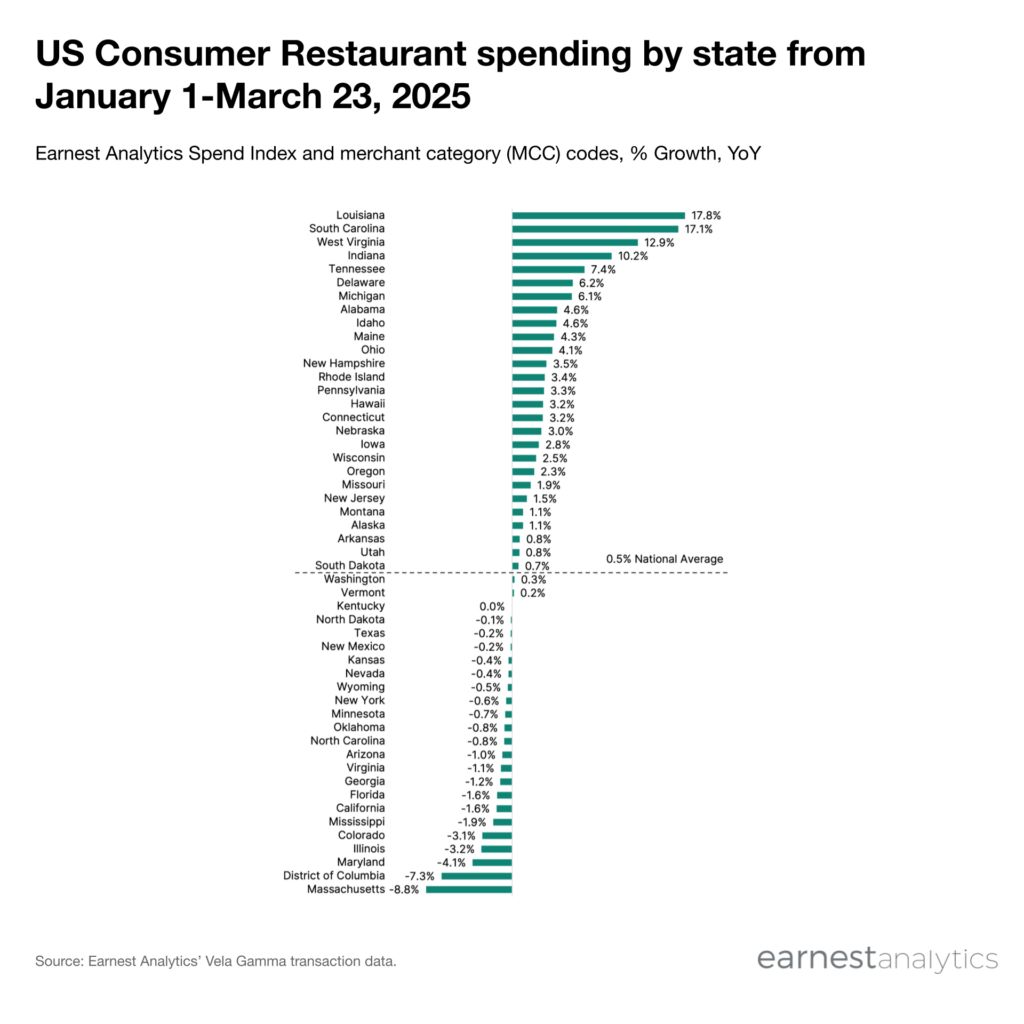

Restaurant spending grew fastest in smaller states

Consumer spending at Restaurants grew the fastest in Louisiana, South Carolina, and West Virginia. Maryland, The District of Columbia, and Massachusetts posted the biggest declines. Similar to total spending trends, smaller states outperformed, with Pennsylvania being the only state with over 9 million people to post growth.

Forecast: March Restaurant spending rebounds

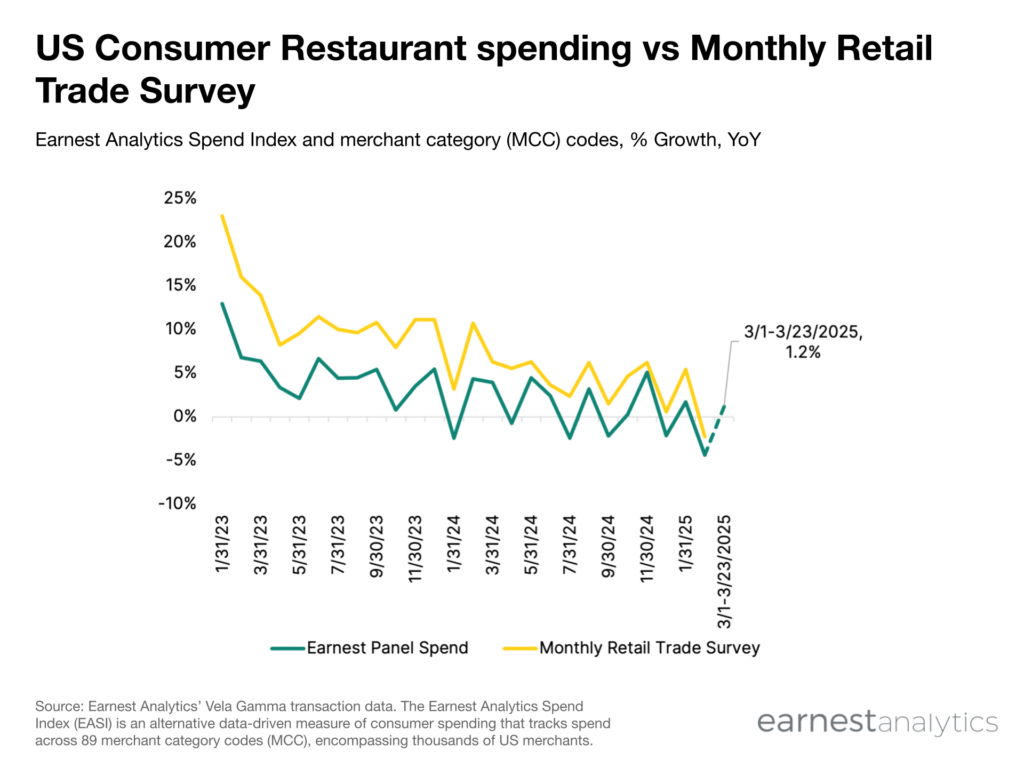

Earnest’s panel spending at Restaurants tracks the US Census Bureau’s Monthly Retail Trade Survey (MRTS) Food Services & Drinking Places trends with over a 0.95 r2 since January 2018. Earnest’s panel spending grew 1.2% YoY in March as of the 23rd, compared to -1.4% in February 2025, adjusted for Leap Day. This implies a rebound in Monthly Retail Trade Survey results reported by the Census Bureau… download report to continue reading.