Discounters benefit, Target lags as high-earners trade down in 2025

Most large retailers outgrowing, Target sales continue to underperform

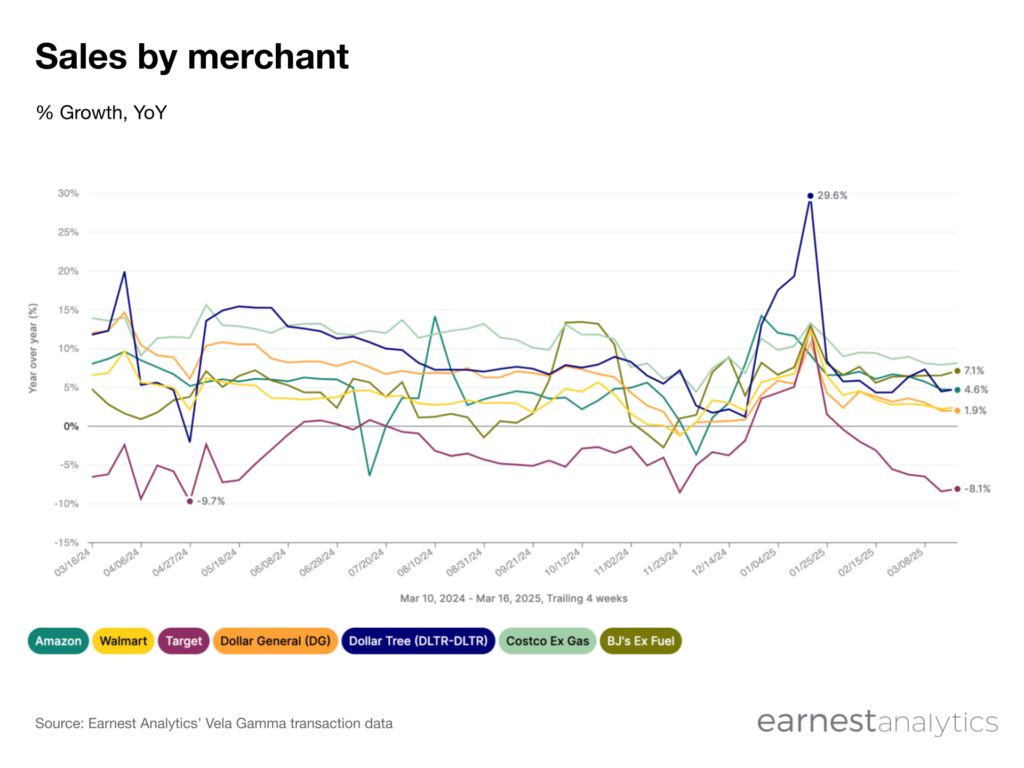

Weakening spending was broad-based in the first few months of 2025. However, spending at Walmart, Dollar General, Dollar Tree, and Costco outgrew their respective subcategories. This suggests these retailers are consolidating spend in a volatile environment. Amazon’s deceleration was more pronounced than Online Marketplaces. But spending at the ecommerce giant still grew mid-single digits in the four-weeks ended March 16, 2025.

Target sales continued to materially underperform. The retailer is facing ongoing operational challenges (e.g. higher discretionary mix, boycotts, assortment issues, etc.) and consumer protests about their shift away from DEI policies.

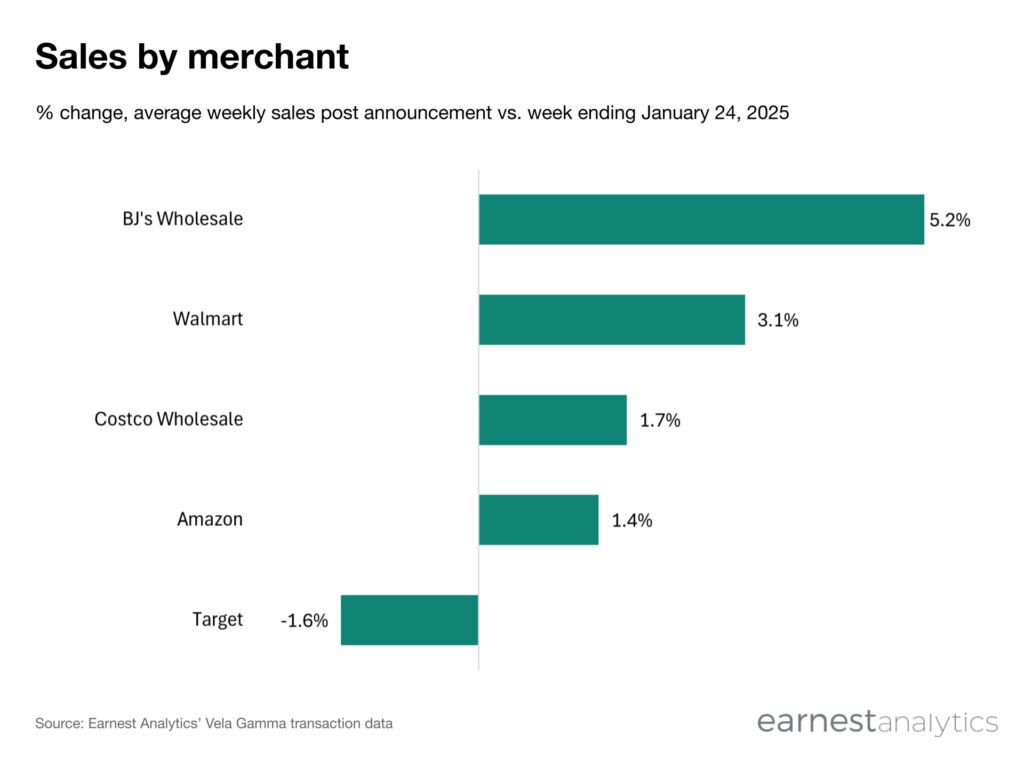

Target boycotts materially impacting sales

Target announced it was rolling back its DEI initiatives on January 24, 2025, spurring calls from activists to boycott the retailer. In the weeks following the announcement, Target sales declined 1.4% on average compared to sales the week of the announcement.

This decline compares to higher sales levels over the same period at competing retailers, such as BJ’s Wholesale, Walmart, Costco, and Amazon, indicating Target’s policy decision negatively impacted its business.

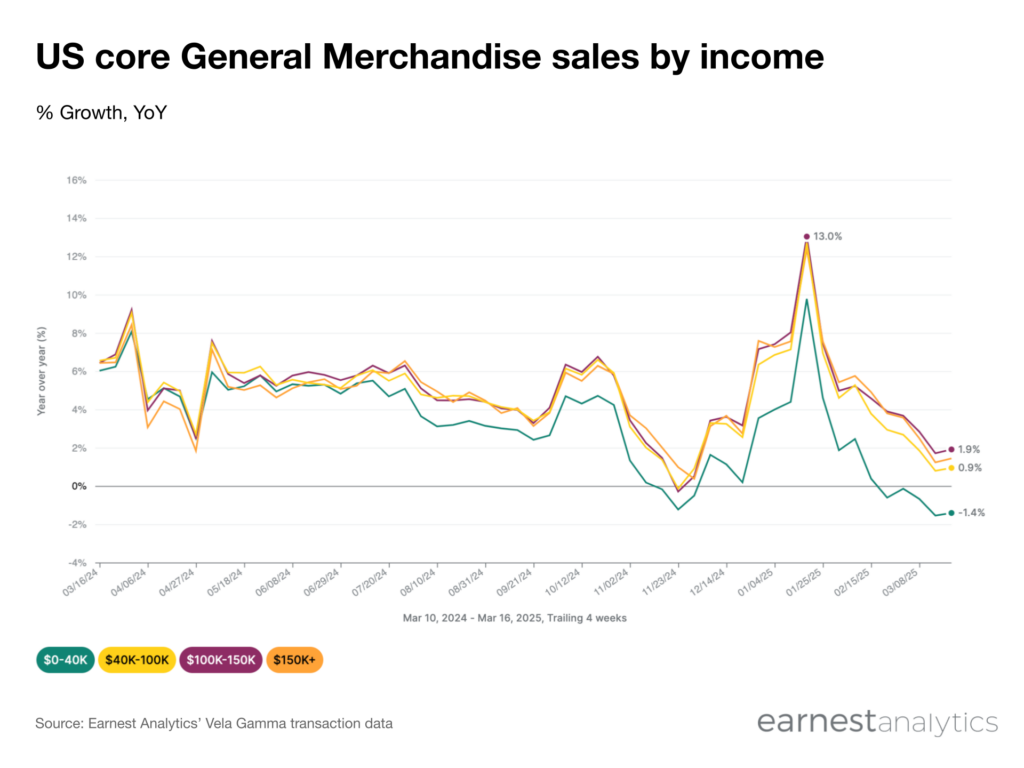

High-earners outpaced lower income consumers since Summer 2024

Spending on core General Merchandise (i.e. Big Box Retailers, Dollar Stores, and Warehouse Clubs) grew at similar rates across income demographics throughout the first half of 2024. However, spending among low income households began to weaken in July 2024, and high income earners (those making >$100k) began to consistently outspend middle income earners in November 2024.

This dynamic was highlighted by Dollar General on a recent earnings call, who noted trade-downs and trade-ins became apparent in 4Q24 and continued into 1Q25.

“What has really become apparent leaving Q4 and moving into Q1 is the trade-down is back, both the mid- and upper-end trade-down, and as we moved into Q4 seems to be accelerating.” – DG 4Q24 Earnings Call

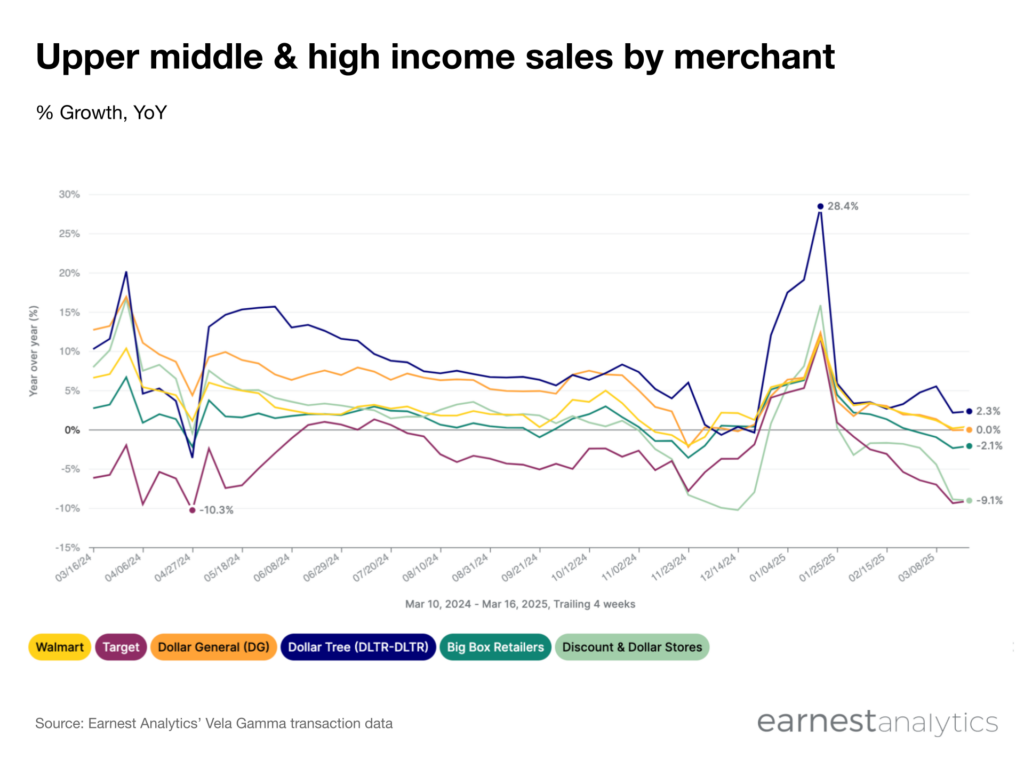

Dollar Tree, Dollar General, & Walmart gain share among high-earners

Dollar Tree, Dollar General, and Walmart outperformed their respective subcategories among high earners, suggesting these retailers may be benefiting from consumer trade-downs. Dollar Tree and Dollar General high income spending growth outpaced the Discount & Dollar Store subcategory by 660bps and 430bps on average over the last year, with the outperformance widening in 2025.