Walmart’s switch could double Klarna adoption

Affirm dominates Walmart customers’ BNPL spending for now

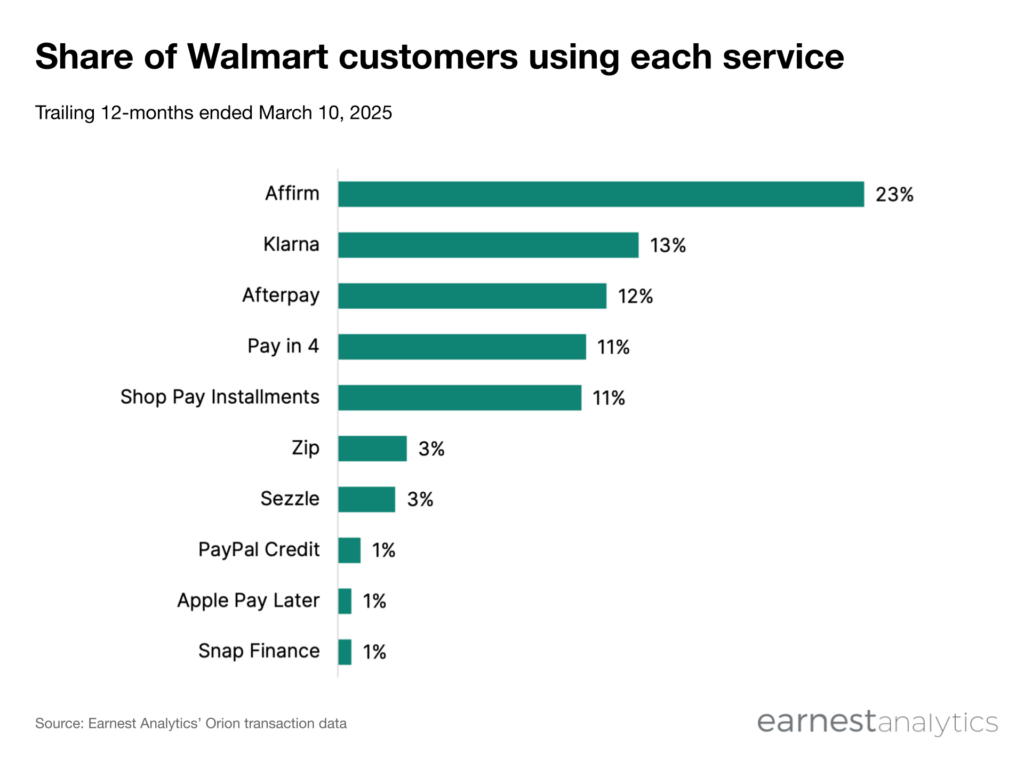

Approximately 23% of Walmart customers used Affirm, at Walmart or elsewhere, in the last year according to Earnest debit and credit card transaction data. However, Walmart recently announced it is replacing Affirm as the retailer’s exclusive buy-now-pay-later (BNPL) provider. The new loan provider, Klarna, has a much smaller existing overlap with Walmart customers. Only 13% of Walmart shoppers made a Klarna payment in the last year. This could be attributed to the Affirm’s ongoing partnership with Walmart. However, that may be about to change.

Still, these two services represent the two most commonly used BNPL services among Walmart customers. Afterpay, Pay in 4, Shop Pay Installments, Zip, Sezzle, PayPal Credit, Apple Pay Later, and Snap Finance all trail.

The shakeup comes as Klarna looks to IPO. The agreement will see Walmart’s in-house fintech startup OnePay handle the user interface, while Klarna will extend credit and make underwriting decisions. This also comes after a resurgence of overall BNPL spending in 2024 after a post-pandemic lull.

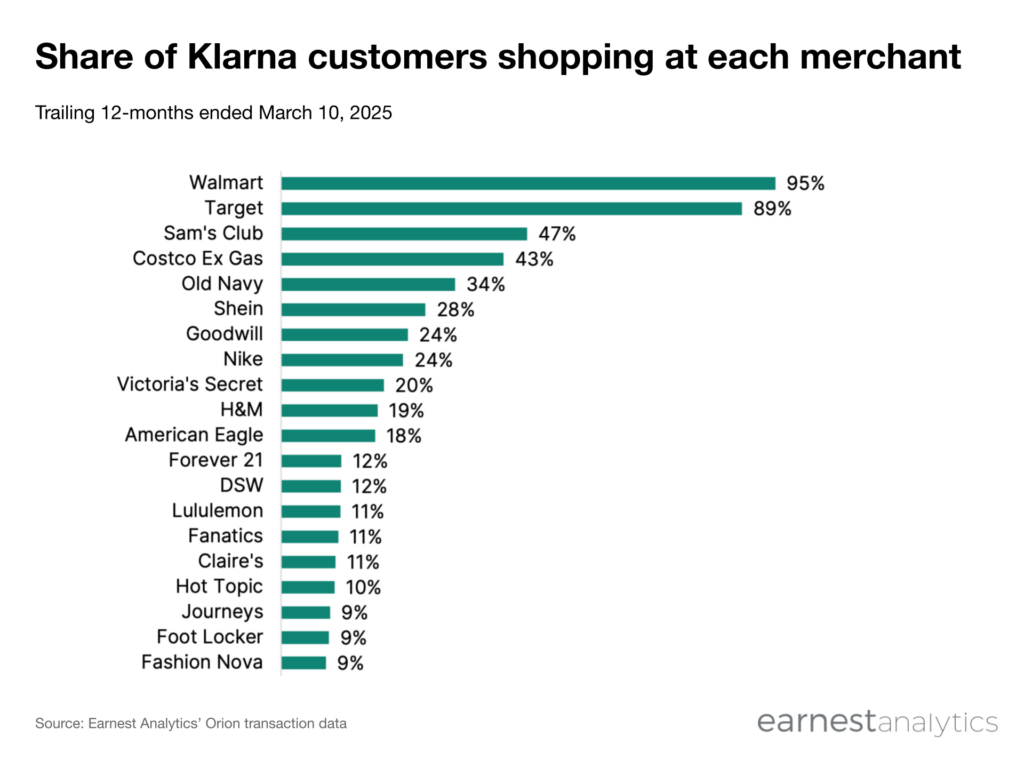

Klarna could double user base in US

Mirroring the retailers’ ubiquity, over 95% of Klarna customers shopped at Walmart in the last year. Given that nearly every consumer shops at Walmart, if Klarna could reach Affirm’s level of penetration into Walmart shoppers, it would effectively double its penetration in the US. The bigger question is if Klarna will be able to parlay use via OnePay into customer retention given its service’s UX will largely be white labeled.

This partnership could make the retailer more attractive for Klarna users, and give it an edge over other big box retailers. BNPL adoption could also help Walmart smooth out the impact of slowing consumer activity across categories beginning in February.