Tepezza Disrupted

More than a year after the landmark FDA approval of Horizon Therapeutics’ Tepezza (teprotumumab) to treat Thyroid Eye Disease (TED), we looked at how drug volumes have performed in our claims database. Tepezza is the first and only FDA‐approved treatment for patients with TED, although what would have probably been a steady ramp of ongoing prescriptions, was suddenly disrupted in late December 2020 due to the government-mandated “Operation Warp Speed” COVID vaccine-production needs.

About the Data

Earnest Healthcare provides visibility into $1 trillion of de-identified U.S. healthcare claims, capturing 25% of all annual U.S. pharmacy claims and 30% of all U.S. medical claims. This dataset includes insight into drug prescriptions, medical procedures, adjudicated pricing, and diagnosis group, with the ability to cohort by particular geographies (region, state, etc.), channel (telehealth, office, etc.), facility type (in/outpatient, ASC, etc.), insurance type (commercial, Medicare, etc.) and more. Learn more here.

Key Takeaways

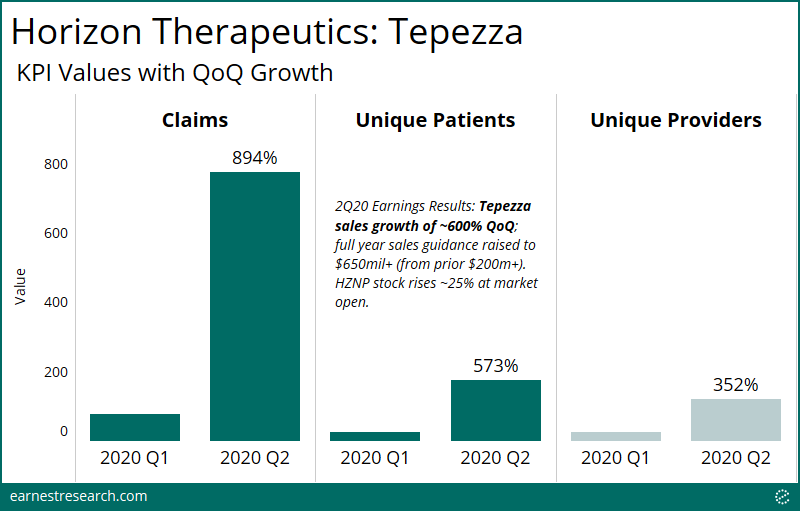

- Earnest data on Tepezza for the crucially-watched 2Q20 quarter – the first full quarter following FDA approval – showed meaningful strength: ~9x QoQ growth in the number of claims, ~6x growth in new patients, and ~4x growth in new providers.

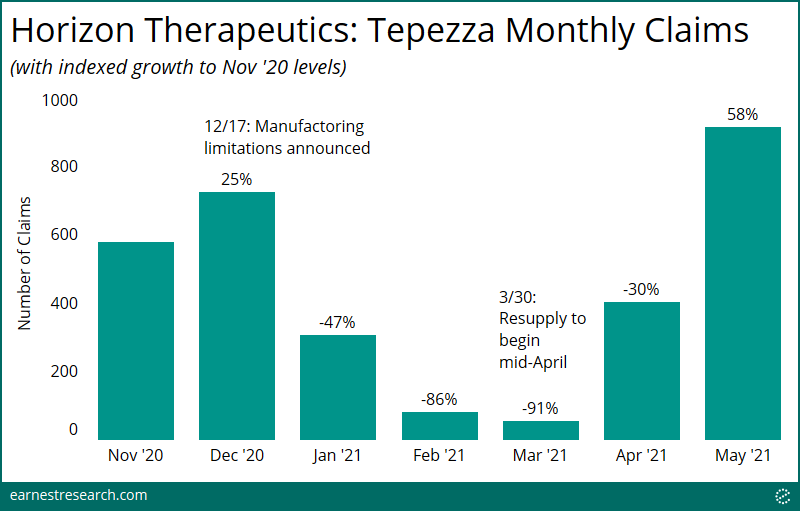

- Earnest data captured the December 2020 Operation Warp Speed’s resulting decline in prescriptions, with volume falling ~90% in March 2021. Following the FDA’s approval to resume manufacturing in April, the number of claims then rebounded, reaching ~60% growth above prior-to-disruption levels in May 2021.

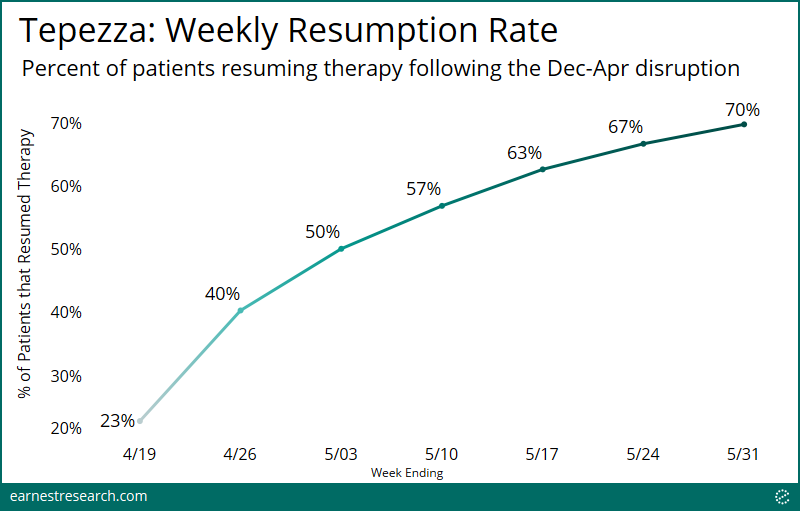

- Every week, an increasing number of patients who were administering Tepezza, but whose treatment was then disrupted due to the manufacturing pause, have resumed therapy: About 25% of patients resumed in the mid-April initial week, a figure that has now climbed to ~70% by the end of May.

Crucial Signs of Growth

Prior to Horizon Therapeutics’ crucial 2Q20 earnings report (i.e. the first full quarter following FDA approval of Tepezza), Earnest healthcare data on Tepezza confirmed strength with ~9x QoQ growth in the number of claims, and ~6x growth in new patient starts. The number of new prescribers also grew ~4x despite the noted impact of COVID on ophthalmology office closures, signaling the potential for continued uptake amongst new prescribers in addition to new patients.

Backtest

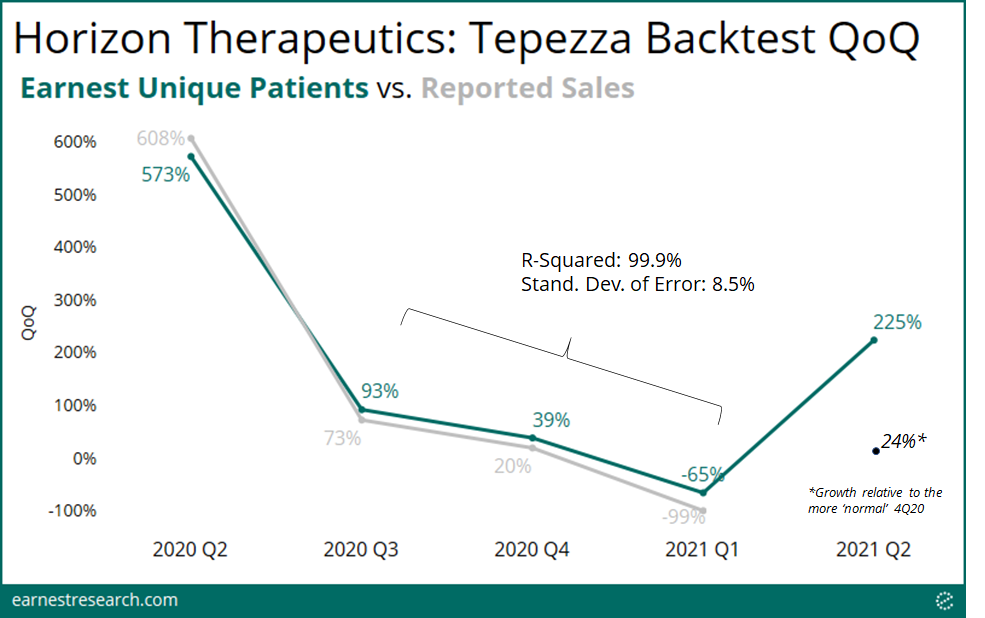

Earnest delivers our claims dataset daily to allow for real-time tracking of prescriptions, new patients, and sales. Our backtest tool compares Earnest claims data to company reported sales to give insight into historical correlation, and to provide the most up to date view of the quarter in progress.

Earnest data shows patient growth of 225% QoQ for the preliminary quarter of 2Q21. Tepezza sales will undoubtedly accelerate this quarter as it’s off of a base of effectively zero sales in 1Q21 due to the manufacturing disruption, and so looking at Earnest patient growth relative to the most recent uninterrupted quarter (4Q20) yields growth of 24% (adjusted for backfill). We’re seeing patients and claims volume fully rebound relative to pre-supply disruption levels. Please reach out for further detail on backtest interpretation.

Supply Shortage

Claims data can also provide added granularity to gain an informed view of industry dynamics.

When Horizon announced manufacturing limitations on Dec. 17th, 2020 due to the Government-mandated ‘Operation Warp Speed,’ and that “the company currently anticipates that this drug supply shortage will begin at the end of December and could last through the first quarter,” Earnest data captured the resulting ~90% decline in prescription volume as well as its subsequent rebound following the FDA’s approval to resume manufacturing, reaching now ~60% growth above Nov. ‘20 levels.

Resuming Therapy?

Tepezza is now being resupplied, but will patients resume therapy? We asked the data.

We identified ~250 patients in the data who were administering Tepezza therapy, but whose treatment was then disrupted due to the manufacturing pause. Indeed, following the resupply in mid-April, an increasing number of patients every week resumed therapy: ~25% in the initial week to now ~70% by the end of May.

Horizon’s management has still maintained Tepezza full year 2021 net sales guidance of greater than $1.275 Billion, representing YoY growth of more than 55%. Will Horizon successfully grow its rare-disease portfolio and secure blockbuster status for Tepezza? Monitor along with Earnest Healthcare Claims data.