Gen Merch slowing in 2025 after modest growth in 2024

Mass Merchant sales accelerated, Discount & Online Marketplace decel

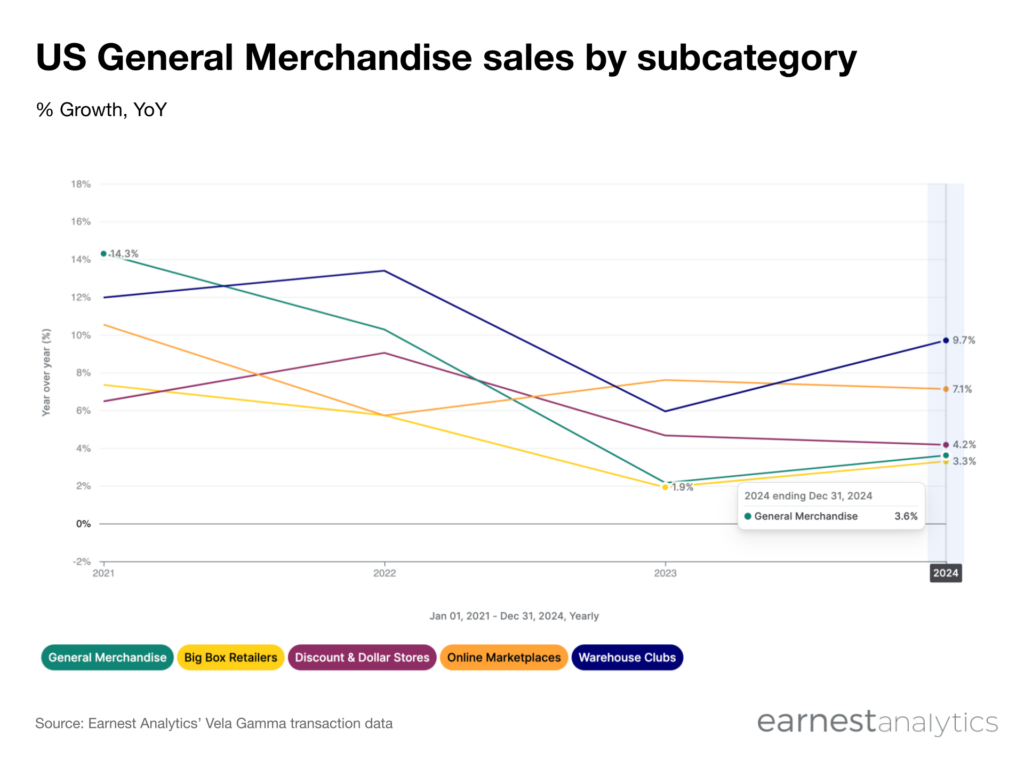

Consumers spent 3.6% more on General Merchandise in 2024 vs 2023 according to Earnest transaction data. This represents a moderate acceleration from 2023’s 2.2% YoY growth, driven by Warehouse Clubs and Big Box Retailers.

Spending grew 9.7% YoY at Warehouse Clubs and 3.3% YoY at Big Box Retailers in 2024. Warehouse Clubs was the strongest performing subcategory, while Big Box Retailers performed roughly in-line with the overall category. Spend in both subcategories accelerated from their 2023 level of 5.9% and 1.9%, respectively. The Warehouse Club outperformance highlights consumers’ increased willingness to consolidate spend on essential items through bulk purchasing at certain retailers.

Spending on Online Marketplaces and Discount & Dollar Stores in 2024 grew faster than the category at 7.1% YoY and 4.2% YoY, respectively. However, this was a slight deceleration from the prior year.

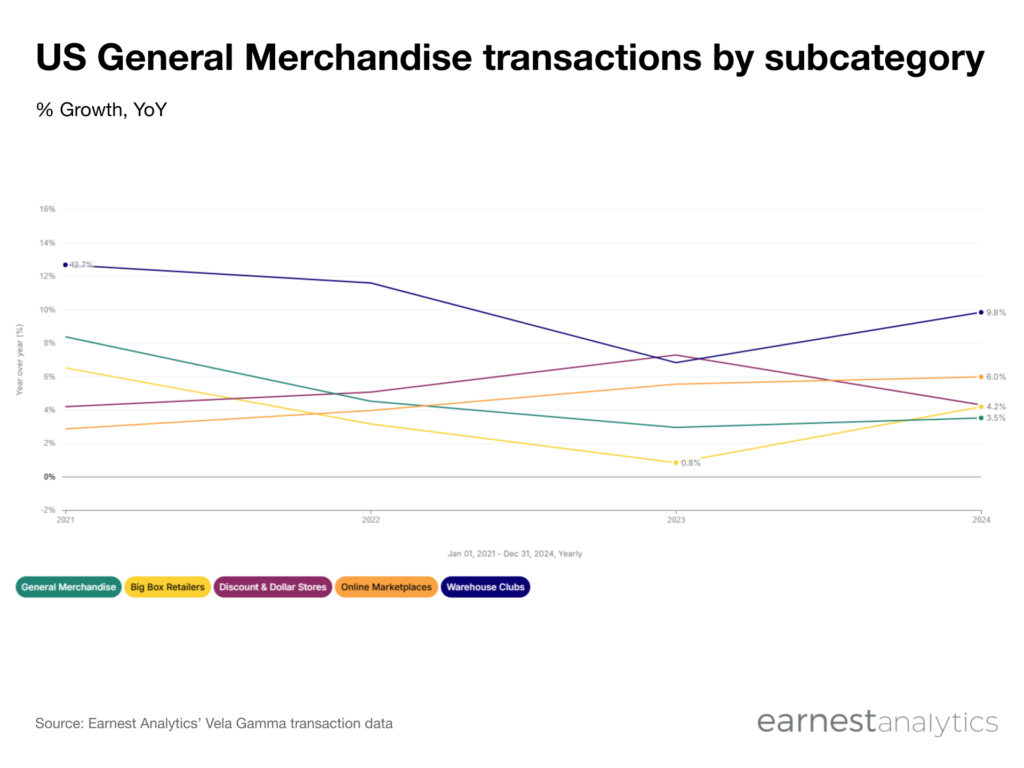

Transactions drove General Merchandise spending resilience

Following years of historically elevated inflation, General Merchandise average order value remained flat in 2024 (see data in Dash), while transactions increased 3.5% YoY. The transaction strength was primarily driven by higher order frequency, which grew 3.4% YoY.

Transaction growth at Big Box Retailers accelerated 340bps to 4.2% in 2024, while Warehouse Clubs accelerated 300bps to 9.8%. In contrast, Discount & Dollar Store transaction growth slowed meaningfully, from 7.3% in 2023 to 4.3% in 2024. Online Marketplace transactions remained relatively stable at 6.0%, which is surprising considering the rise of Temu and TikTok Shop.

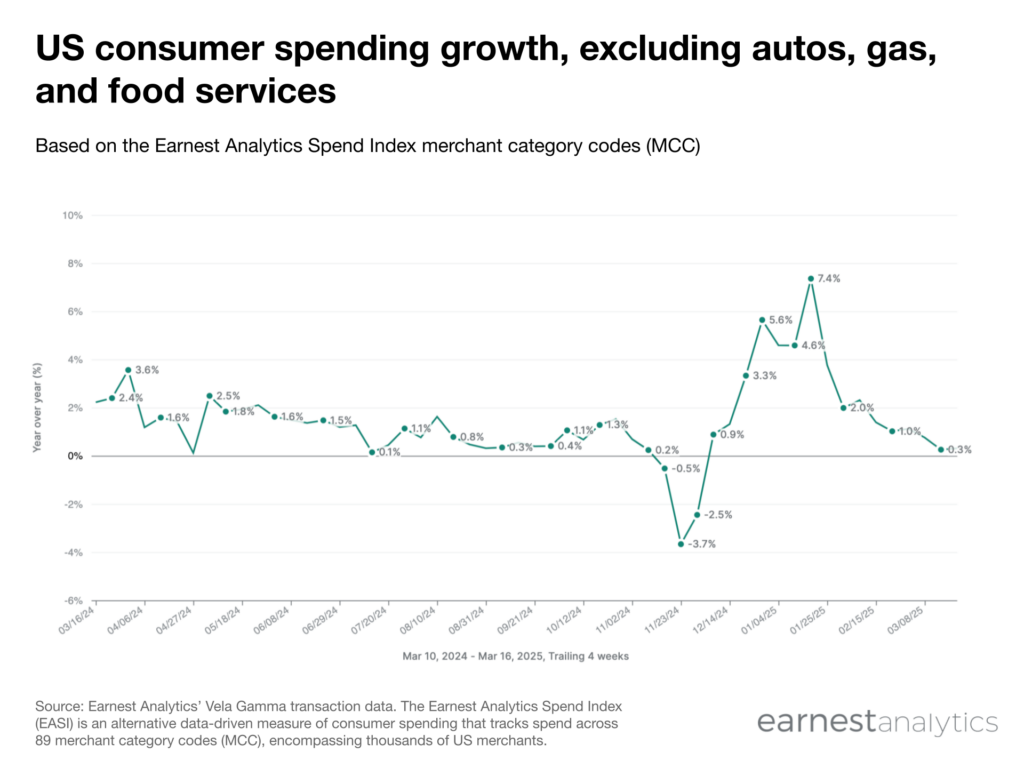

Spending weakened starting late January amid economic uncertainty

Core US retail spending (i.e. excluding autos, gas, and food services) increased 0.3% in the four-weeks ended March 16, 2025, continuing its slide beginning in late January as consumers brace for increased economic uncertainty and the new administration’s proposed policies. This growth represents a 410bps slowdown from the December 2024 exit rate and follows soft February spending.

Average ticket drove weaker spending, declining 0.4% YoY in the same period, while transactions increased 0.7%.

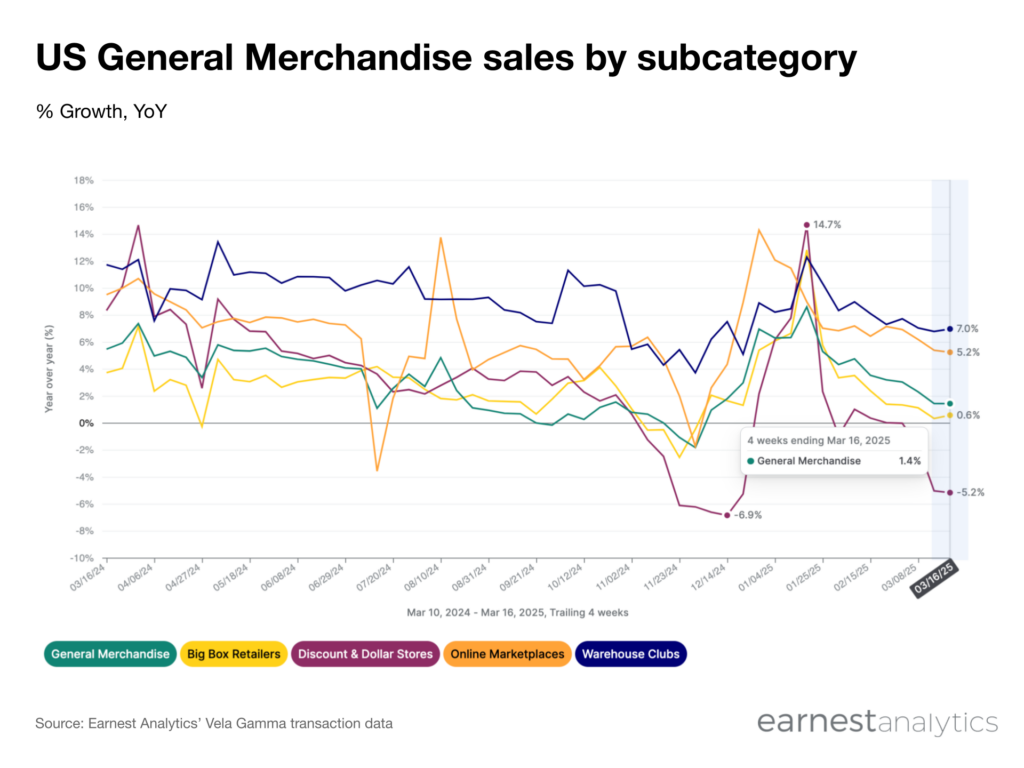

General Merchandise continues to outperform broader retail spending

General Merchandise spending grew 1.4% in the four-weeks ended March 16, 2025, continuing to outpace the broader retail market. This relative strength comes as many retailers reiterate consumers’ focus on value, convenience, and essential spending.

Despite the outperformance though, General Merchandise spending was not immune to the weaker spending environment, slowing 420bps from its December 2024 exit rate. This slowdown was broad-based across subcategories, with spending growth at Big Box Retailers, Discount & Dollar Stores, and Online Marketplaces each decelerating more than 300bps during the same period. Warehouse Club spending growth slowed 100bps.

Notably though, spending growth at Big Box Retailers outpaced Discount & Dollar Stores thus far in 2025 after underperforming in recent years. Warehouse Clubs and Online Marketplaces continued to outperform, growing 7.0% and 5.2%, respectively, in the four-weeks ended March 16, 2025.

Despite the softer overall spending environment, there are pockets of encouragement within the General Merchandise category.