Old Navy, Shein, and TikTok Shop to benefit from Forever 21’s bankruptcy

The race is on for Forever 21 customers

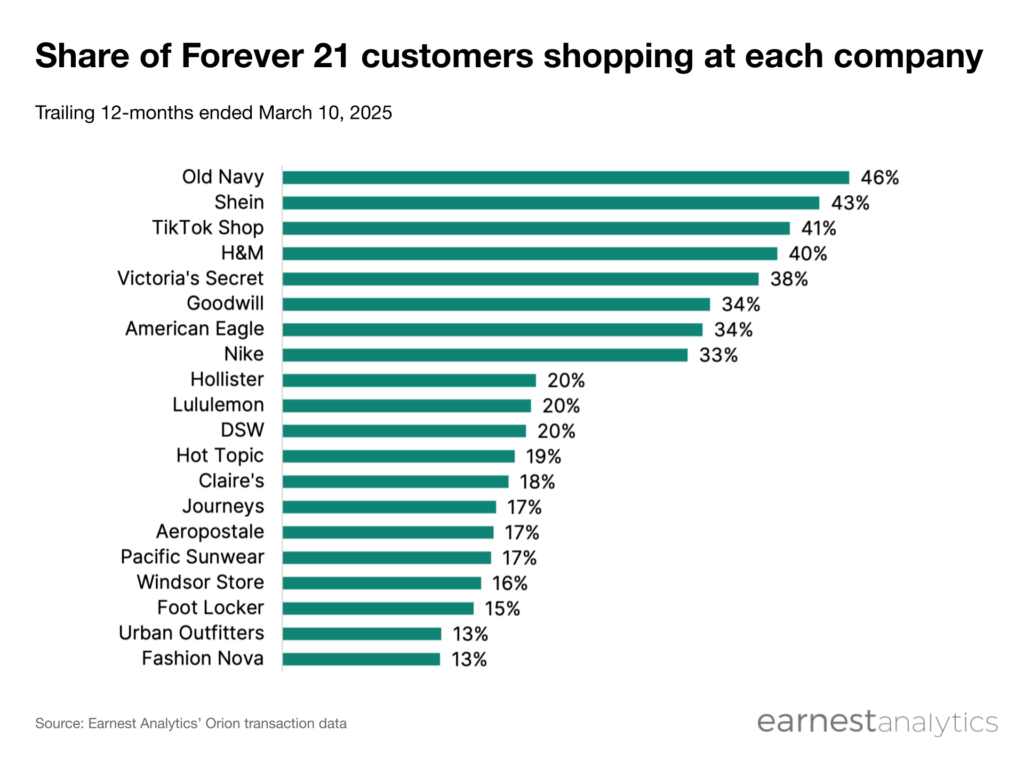

Around 46% of Forever 21 customers shopped at Old Navy (GAP) last year, according to Earnest credit card data. Old Navy and Fast Fashion brands like Shein and H&M could all stand to gain from Forever 21’s closure in 2025.

The apparel retail landscape is shifting due to Forever 21’s bankruptcy. Other brands can now capture a larger market share as Forever 21 customers begin to shop more at other popular retailers. The Apparel & Accessories companies with the highest percentage of Forever 21 customers could see the biggest lift in sales. They include Shein, TikTok Shop, H&M, Victoria’s Secret (VSCO), Goodwill, and American Eagle (AEO).

These companies have a unique opportunity to attract and convert these customers. Forever 21 has a 43% and 41% customer overlap with Shein and TikTok Shop, respectively. The failing retailer’s 40% customer overlap with H&M could also see a significant boost. Forever 21 also shares a notable percentage of customers with Victoria’s Secret (38%), Goodwill (34%), and American Eagle (34%). Forever 21’s customer base is diverse, spanning various demographics and preferences. Companies must effectively target and engage these potential new customers. They could offer exclusive discounts, promotions, and similar products.

By capitalizing on this opportunity, companies could increase sales and market share. Forever 21’s bankruptcy is a turning point in retail.

Of these companies, overlap increased the most at TikTok Shop (+15.1% YoY), Hollister (ANF, +3.5% YoY), and JD Sports (+2.6% YoY), while falling the most at Rue21 (-4.8% YoY) and H&M (-4.5%) over the last 12 months. Fashion Nova, Urban Outfitters (URBN), Foot Locker (FL), Windsor Store, Pacific Sun (i.e. PacSun), and Aeropostale rank among the lowest major brands in terms of brand overlap among Forever 21’s customer base. They may see some uplift from Forever 21’s bankruptcy, but the overall impact is not likely to be big.

Shein was likely a key driver in Forever 21 bankruptcy

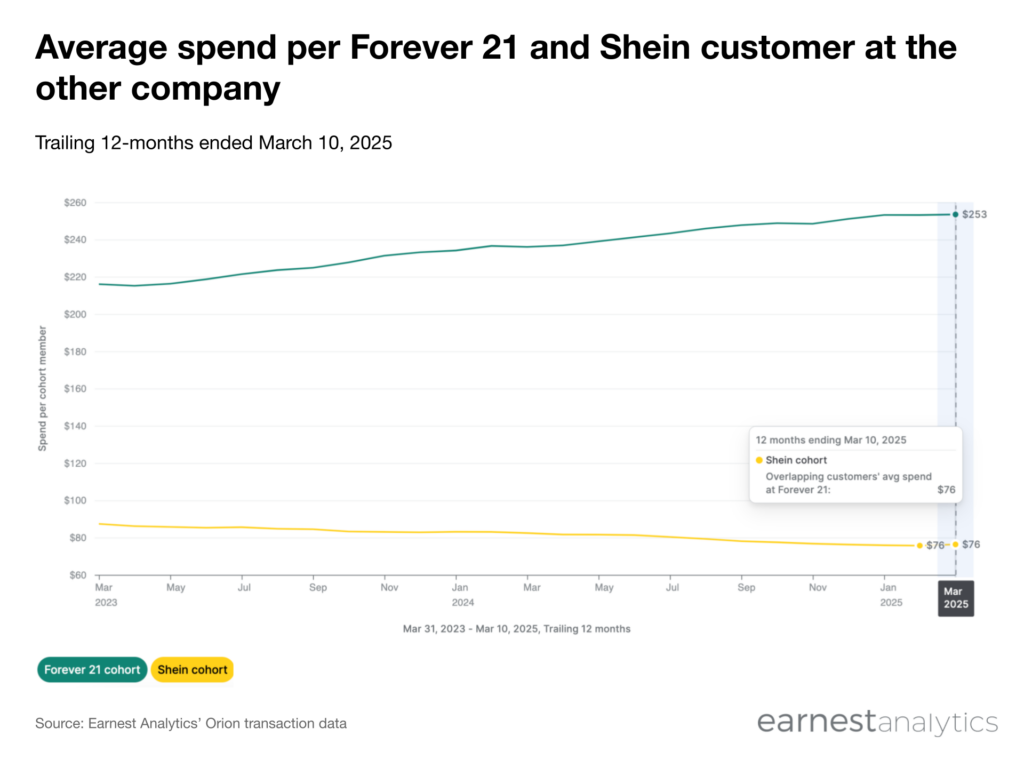

The data reveals a shift in customer spending between Shein and Forever 21 over the 12-month period ending March 10, 2025. Shein customers spent $76 at Forever 21 in the trailing 12-months ended March 10, 2025. That is a decrease from $87 the year prior. In the same period, Forever 21 customers spent $253 dollars at Shein, up from $216 the year prior.

Overall, these figures suggest a potential shift in market share from Forever 21 to Shein. Forever 21 customers appear to be increasingly attracted to Shein’s offerings, while Shein customers are showing less interest in Forever 21. This trend could be indicative of broader changes in the fast-fashion landscape, with Shein potentially gaining ground at the expense of established brands like Forever 21.

As Forever 21 customers spent more at Shein, the overlapping customer cohort also grew to around 43% of Forever 21 customers, increasing the competitive impact.