Egg prices dip after record highs; Cal-Maine faces investigation

Egg shortage data says prices at all-time highs, but decelerating

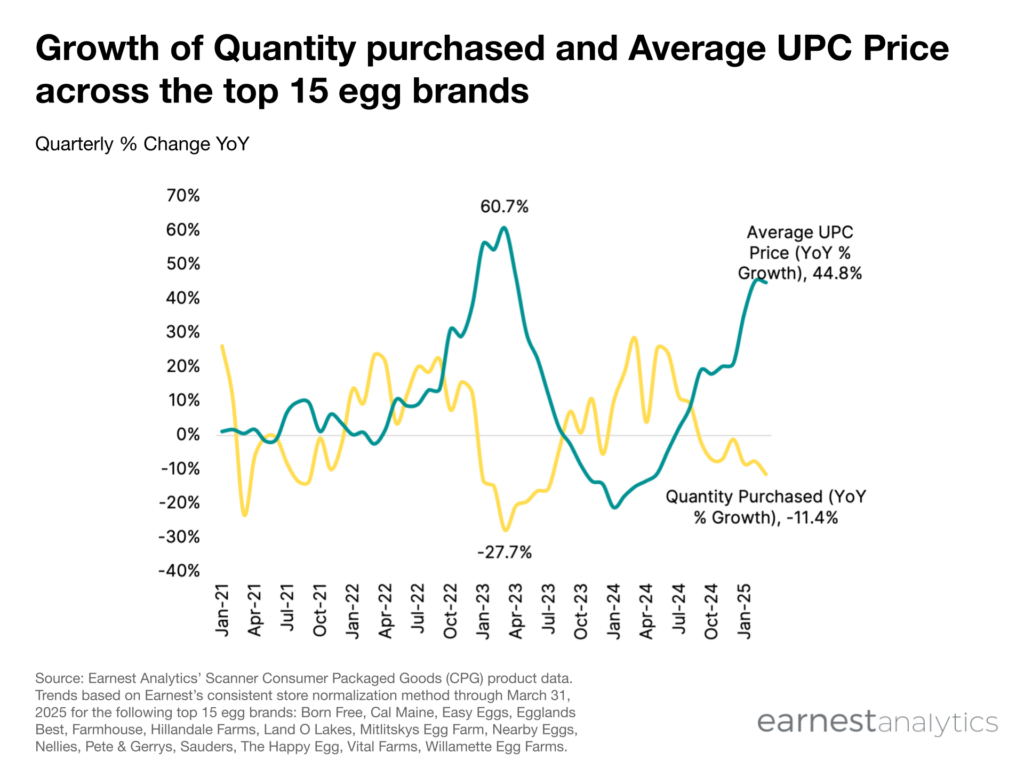

Amid the ongoing avian flu outbreak and resulting egg shortage, this year’s Easter holiday is shaping up to be associated with high egg prices. According to Earnest Scanner Consumer Packaged Goods (CPG) product data, egg prices surged 45% year-over-year in March 2025.

Starting 2025, egg purchases plunged as egg shortages fueled faster price increases. The average price per Universal Product Code (UPC) purchased reached a record high of $7.50 across the top 15 egg brands in March 2025. This is near double pre-pandemic prices and 23% above the previous all-time high of March 2023, prior to the ongoing egg shortage. Average egg prices for the first 13 days of April remain elevated but show a small decrease for the first time in nearly a year, at $7.30, representing a -1.6% decrease over March prices.

Meanwhile, demand continues to fade as prices increase, with a -11.4% YoY decrease in quantity purchased in March 2025.

Cal-Maine egg prices increases outpace industry

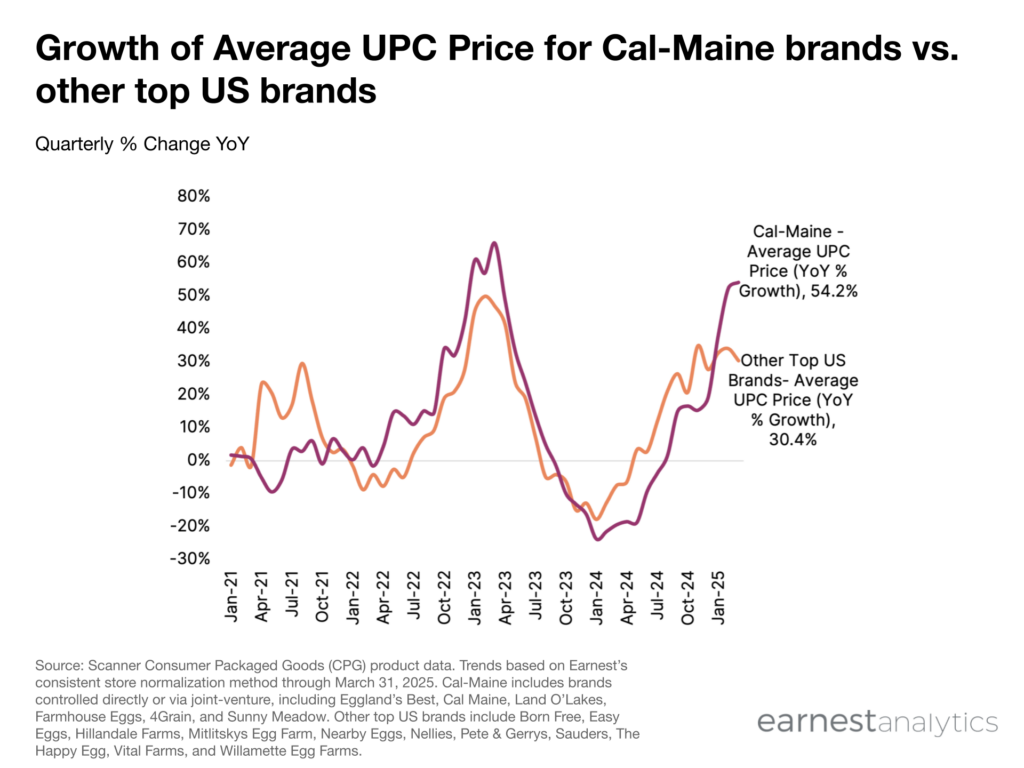

Earlier this month, Cal-Maine Foods, Inc., the largest egg producer in the United States, disclosed that it is under investigation by the DOJ’s antitrust division over egg prices. The company’s sales for the first quarter of fiscal year 2025 (13 weeks ending March 1, 2025) nearly doubled compared to the same period in fiscal 2024.

According to Earnest’s data, the average UPC price for Cal-Maine’s brands* was up 54% YoY in March 2025, higher than the rest of the top 15 US brands at 30% YoY.

Despite the higher price increases, Cal-Maine’s average UPC price remains lower than other top US brands, at $7.3 vs. $7.8 in March 2025, respectively.

* Brands controlled directly or via joint-venture, including Eggland’s Best, Cal Maine, Land O’Lakes, Farmhouse Eggs, 4Grain, Sunny Meadow.

About Earnest’s egg shortage data

Figures on the US egg shortage come from Earnest Scanner Consumer Packaged Goods (CPG) product data. Track share of shelf, predict revenue surprises, and drill down into brand and category level performance by household demography across thousands of brands and hundreds of manufacturers.

Scanner Consumer Packaged Goods (CPG) data is sourced from thousands of retail stores and millions of underlying US households across grocery and drugstore chains. Available exclusively to investors.

Request information on Scanner CPG data