Shein, Temu active customers decelerated after tariff changes

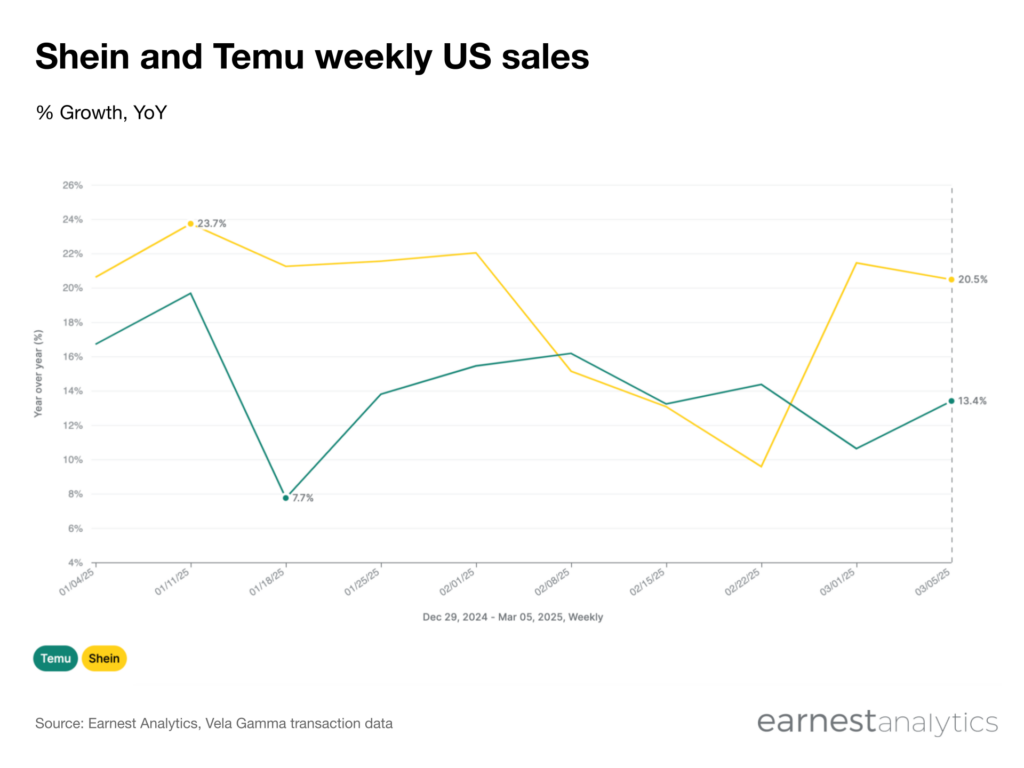

Shein sales decelerated in February

Shein’s US sales growth decelerated from 22.0% YoY to 9.6% YoY between the weeks ended February 1st and February 15th according to Earnest debit and credit card data. The retailer’s model depends heavily on shipments directly sent from Chinese factories to consumers in the US. Its orders average under $50 according to credit card spending data (clients may view in Dash).

The deceleration coincides with the cancellation of a minimum exception for tariffs on small shipments on February 1st. The end of the so-called de minimis exception was paused on February 7th. During the back and forth, Shein’s sales also fluctuated. As of the week ended March 1st, sales growth accelerated to near pre-tariff news levels. But new 20% tariffs declared on March 3rd could further impact sales.

Temu sales during the same period of tariff uncertainty were largely unchanged. However, February consumer spending was weak compared to January. The month was marked by rising economic uncertainty, decelerating growth, and a spending boycott in protest of government changes.

This overall downturn marks a notable turn since the holidays. Both Shein and Temu outperformed most other major retailers by sales growth in November and December.

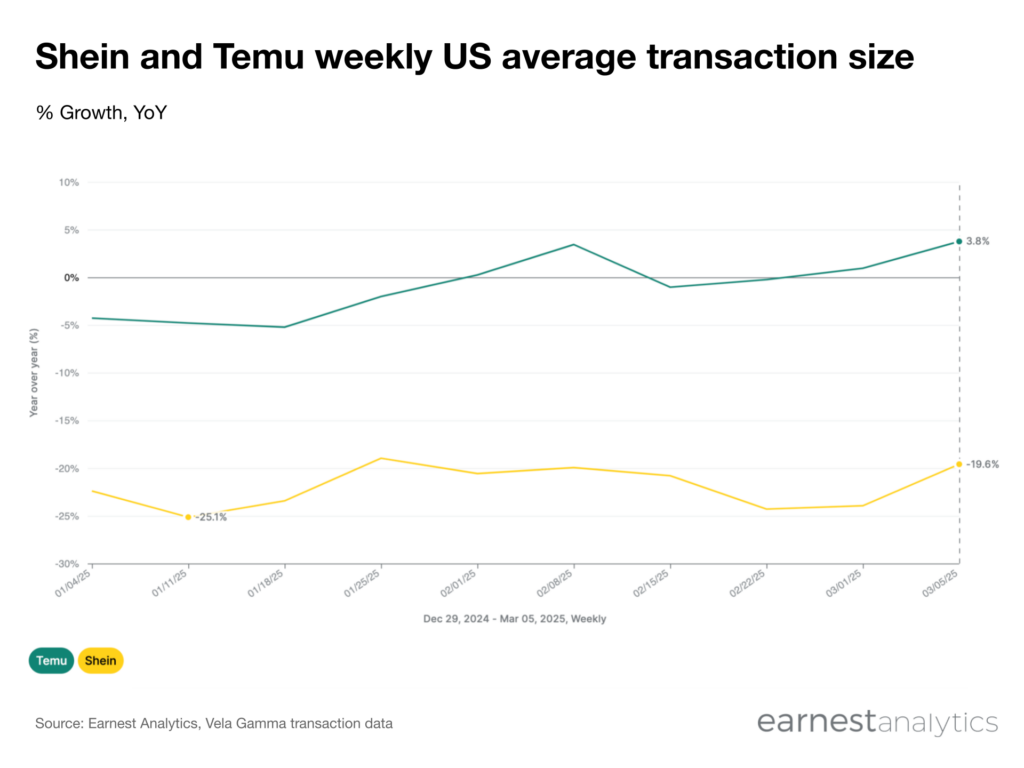

Temu prices trending upwards post-tariff news

Prices at the popular Chinese home and miscellaneous goods retailer Temu swung to positive YoY growth since the tariff news. Temu’s average transaction size grew in all but one week compared to year ago levels. Average transaction size does not account for changes in basket, but could suggest upwards pricing pressure at the retailer.

Shein’s average transaction size during the same period remained about 25% smaller than it was in a year prior. Shein’s sales growth in recent periods largely stemmed from increases in active customers and transactions, not order value.

Shein could also have benefited from TikTok Shop’s brief outage in January 2025.

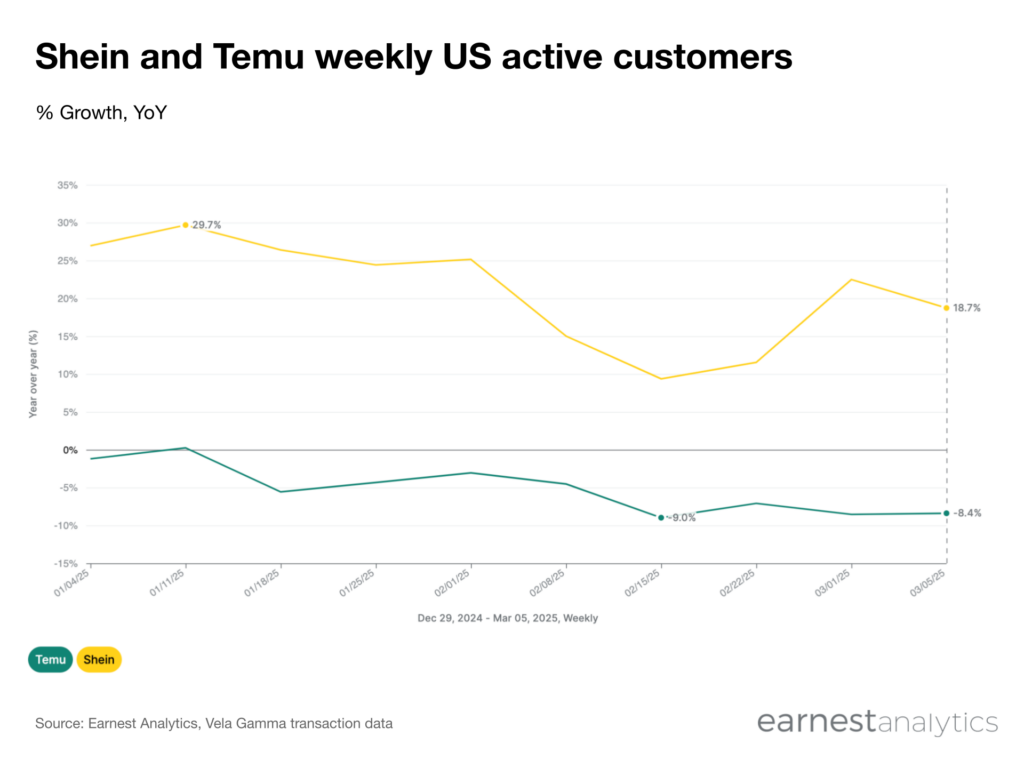

Active customers dip during tariff uncertainty

The biggest driver of Shein’s sales slowdown during February 2025 was decelerating active customers. Active customer growth between weeks ended February 1st and February 15th fell from 25.1% YoY to 9.4% YoY. The negative press and uncertainty could have resulted in dissuading customers to transact on the platform.

Temu’s active customers also declined during the same period. Customers using the platform worsened from -3.1% YoY to -9.0% YoY during the same period.

With the de minimis exception still in effect, Shein and Temu have yet to be impacted directly by new tariffs. But uncertainty in trade policy could be dissuading customers anyway.

Track General Merchandise spending for free