Retail Battle Royale: Amazon Prime Day 2021

Prime Day is touted by Amazon as one of the largest online shopping events of the year. This year, Walmart and Target expanded their concurrent online shopping events to compete with Amazon’s Prime Day. Earnest analyzed the impact of the retail battle royale in late June on the performance of Amazon, Walmart, and Target.

Key Takeaways

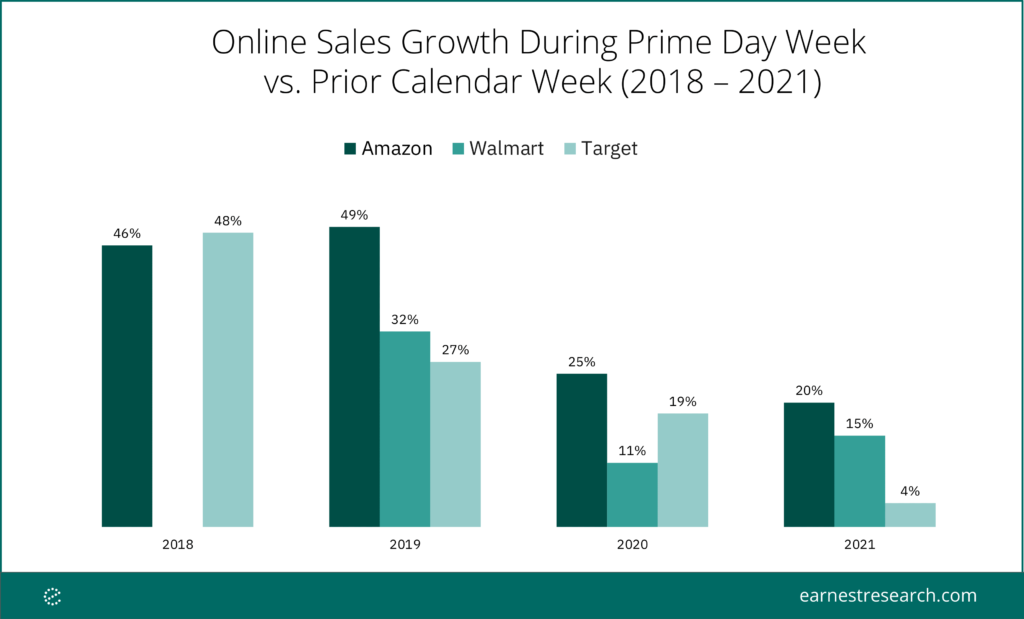

- Overall sales growth decelerated compared to previous ecommerce events.

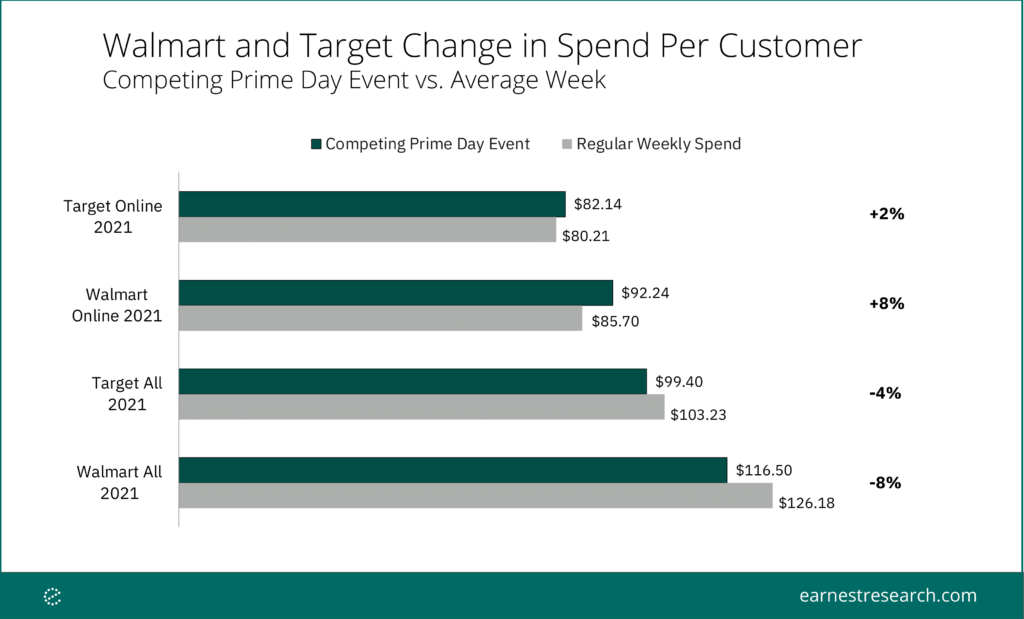

- Walmart’s online spend per customer growth outperformed Target’s.

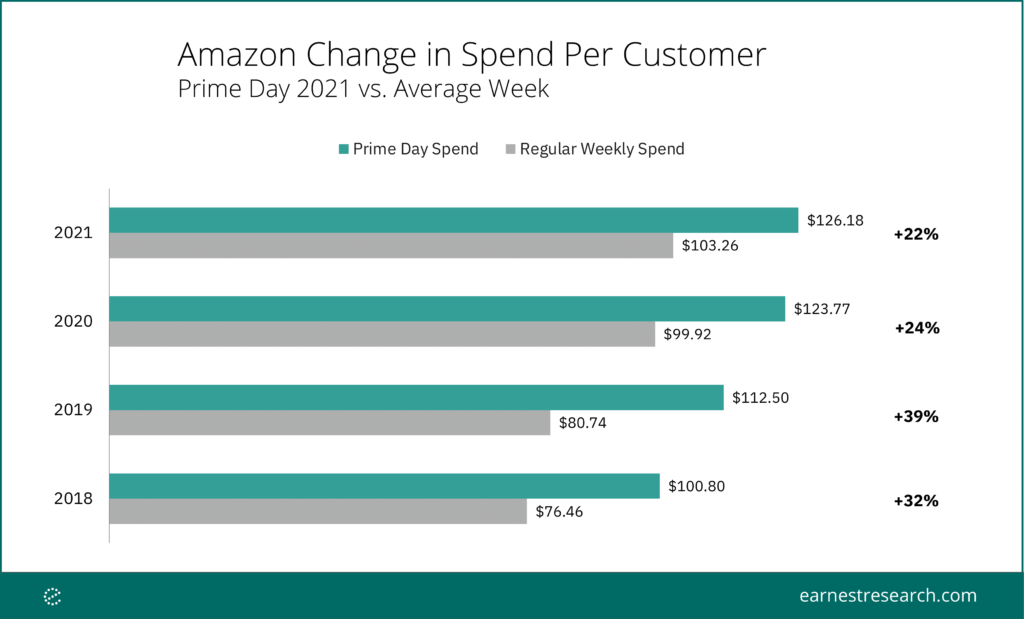

- Amazon remained the champion of sales and spend per customer growth online.

Prime Day gains in 2021 were more muted than past years with Amazon online sales increasing by 20% WoW. The lift was less than half of what the retailer experienced in both 2018 and 2019 and slightly lower than in 2020. Amazon’s focus on third-party performance in its Prime Day press release also suggested dampened results.

Average spend per customer growth at Amazon was also more subdued in 2021 than in previous Prime Day periods, which might have been affected by the two-week long Spend $10, Get $10 promotional event leading up to this year’s Prime Day. However, average spend per customer saw persistent growth and reached a historical high of $126.

Even with competing sales events that spanned longer than Prime and the Prime halo effect, Target and Walmart did not experience the same level of growth in average spend per customer across online channels as Amazon. Despite extending deals to brick-and-mortar, spend per customer fell compared to the prior week for Walmart, driving total spend per customer across in-store and online lower during Deals for Days. Similarly, Target saw a small uptick in spend per customer during Deal Days, but total spend per customer across in-store and online fell compared to prior weeks.

**Walmart’s Deals for Days extended to stores while Target’s Deal Days was exclusively online.

Despite slowing Amazon Prime Day sales growth, Amazon was still the undisputed winner of the 2021 summer ecommerce events. Amazon continued to grow its spend per customer whereas brick-and-mortar rivals online spend per customer growth may have come at the expense of in-store spend.

Follow us for more insights on the latest in the retail space.

Notes

Analysis excludes sales from Whole Foods, Walmart Online Grocery, and Shipt.

Sales timelines are defined as calendar weeks that contain the start of a sales event through at least 3 days after the sales event to ensure inclusion of transactions that post at a lag.