Dollar General Moves Upmarket with Popshelf

While many retailers took a cautious approach to expansion following the COVID outbreak, Dollar General bucked the trend, deciding instead to launch a new concept, Popshelf, mid-pandemic. Courting a new type of customer, it plans to open up to 50 of these locations by the end of the year.

Key Takeaways

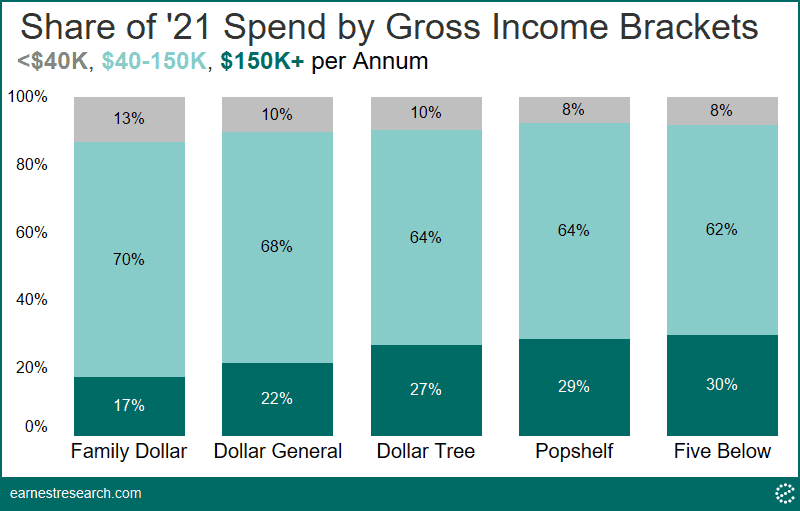

- Popshelf is attracting higher-income shoppers: 29% of its customer spend in 2021 came from households with annual earnings of more than $150K, while this figure was 22% at its parent, Dollar General.

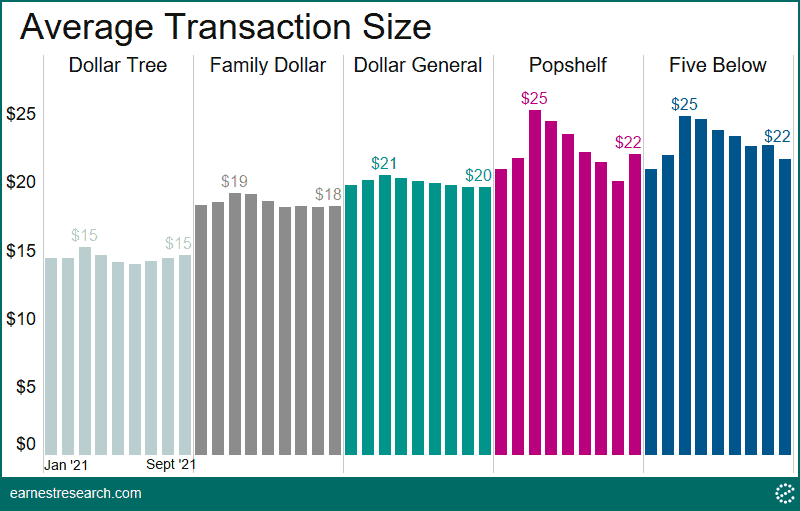

- Popshelf’s basket size has closely mirrored that of Five Below’s: September’s ticket size was $22 on average for both retailers, notably 10-20% higher than that of their dollar store peers.

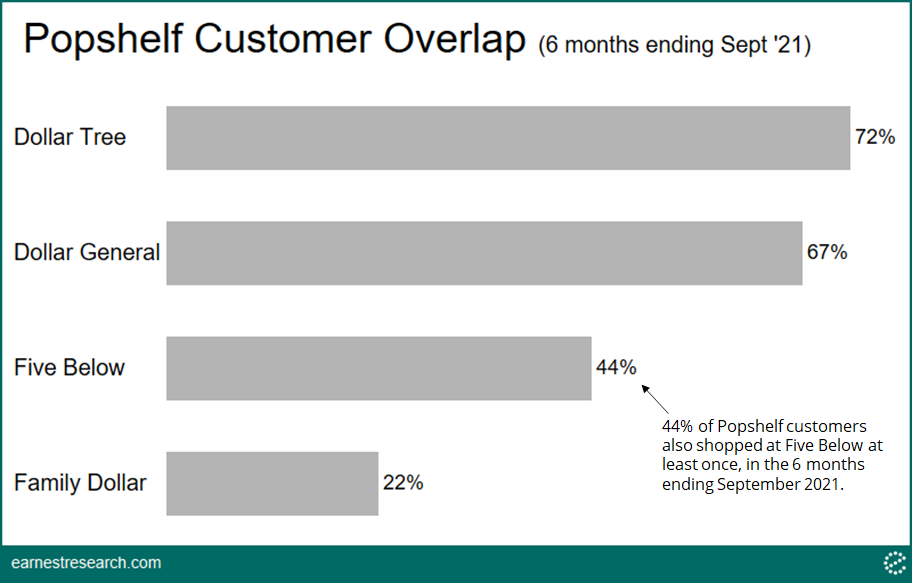

- The dollar store shopper is chief among Popshelf’s current customer base, but at differing levels: roughly 70% of Popshelf’s shoppers transacted at Dollar Tree and Dollar General in the past 6 months, but just 44% transacted at Five Below, and 22% at Family Dollar.

A year after its launch, Popshelf proves it’s attracting a new type of customer

Unveiled in October 2020, Dollar General’s new retail concept, Popshelf, would offer a wider merchandise assortment — everything from beauty and health products, to home decor, and arts and crafts — and treasure-hunt shopping experience, with almost all items priced at $5 or less. It marked a significant departure from the dollar store behemoth’s core market, with the goal of courting a new type of customer: the suburban woman, with household income between $50k to $125k.

By that measure, Popshelf has succeeded. Households with annual earnings of more than $150k comprised 29% of all consumer spend with the new retailer in 2021, while just 22% and 17% of consumer spend with Dollar General and Family Dollar, respectively, came from households in that income bracket. Spend with Popshelf by income was nearest to that of Five Below, which both saw 92% of its customer spend come from households making more than $40k annually.

Upscale aim leads to a growing basket size

With concerns about inflation on the rise, and reflected by Dollar Tree’s announcement that it will add more items to their stores selling for above $1, Popshelf’s higher margin business might be especially important in the coming months and years. During a quarterly earnings call in May, the company’s COO, Jeff Owen, reported the gross margin rate for a Popshelf store was about 40%, or 8% higher than that of a traditional Dollar General store.

The higher price point of its products has led to comparisons to Five Below, and other discount and value-based retailers competing for the same middle-class suburban shopper, like Big Lots, Ollie’s, HomeGoods, and Bed Bath & Beyond.

The Popshelf basket’s resemblance to that of Five Below is borne out by transaction data: in March and April of this year, the average ticket size for Popshelf climbed to $25 and $24, respectively, likely driven by stimulus payments, and mirroring Five Below. For the month of September, average ticket size for Popshelf and Five Below stood at $22. Importantly, these levels are 10% greater than Dollar General in September, and more than 20% greater than Family Dollar and Dollar Tree.

Drawing in the competition

In their most recent earnings call, management reported that Dollar General is on track to open up to 50 Popshelf locations by the end of fiscal year 2021. Longer term, its plans for the concept are ambitious, claiming it could open as many as 3,000 stores. In the post-COVID era of retail’s focus on eCommerce, Dollar General’s bet on an expanding brick-and-mortar footprint is daring.

With only about two dozen stores open today, Popshelf is already proving that it can draw in the dollar store customer, but interestingly at differing rates. In the 6-month period ending September 2021, 72% of Popshelf customers had also shopped at Dollar Tree, 67% at Dollar General, 44% at Five Below, and 22% at Family Dollar. As its number of locations increases, so will cross-shop from other retailers in the dollar and discount category. The question will then become: will they be able to win and retain these customer’s dollars from competitors over time?

Will Dollar General’s plans for the new banner mean increased pressure on the sales of its retail peers? With consumers expected to return to stores with less hesitancy in 2022, competitive and customer intelligence is needed to understand how the trend plays out.