The Child Tax Credit is Driving Early Back-to-School Spending

On July 15th, just a few weeks before the ‘21 Back-to-School season was about to start, the IRS sent the first batch of monthly Child Tax Credits (CTC’s) to 35 million American families. This credit, part of the American Rescue Plan passed in March ‘21 to battle the pandemic, expanded the previous credit of $2K per child to $3K per child ($3600 for under age 6). Importantly, it also allowed the credit to be refundable, meaning, families can now receive $250 per month per child ($300 for under age 6) in the form of direct payments from the IRS vs. just as a taxable deduction previously.

Similar to our Stimulus analyses, we identified CTC recipients in the data* and analyzed their spending behavior. The first payment in July, which came right before the start of the Back-to-School (B2S) season, is particularly timely for spending at traditional B2S retailers in the East & West South Central and Mountain states, which have earlier school start dates than the rest of the country.

With the surge of the Delta variant casting a cloud on plans for a return-to-normal classroom environment, B2S spending is once again in the spotlight, with the CTC an added variable in the health of the B2S consumer. We will continue monitoring B2S spending through Labor Day, when the rest of the country’s schools are due to reopen.

[See our 2020 B2S analyses: Part One and Part Two, as well as our 2019 analysis here.]

Key Takeaways

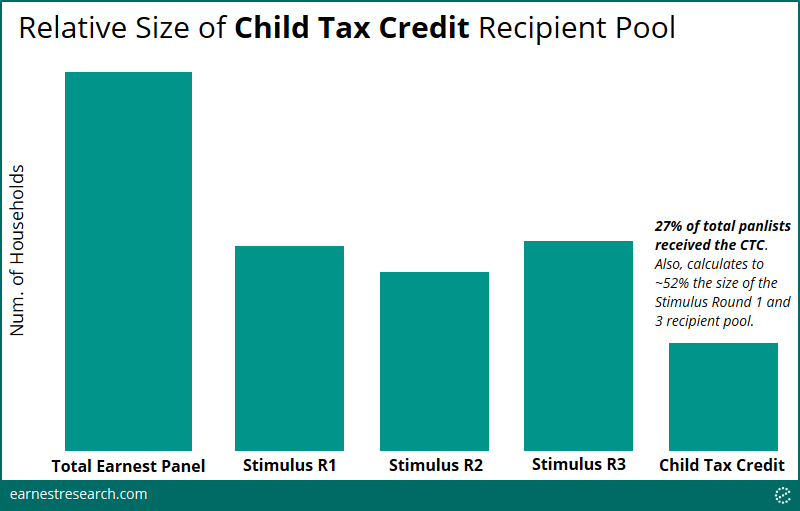

- Roughly 25% of panelists received the Child Tax Credit in July, inline with IRS reported figures. The size of the recipient pool is half the size of those that received the stimulus checks over the past year; but roughly all CTC recipients – 97% of them – received the stimulus checks as well.

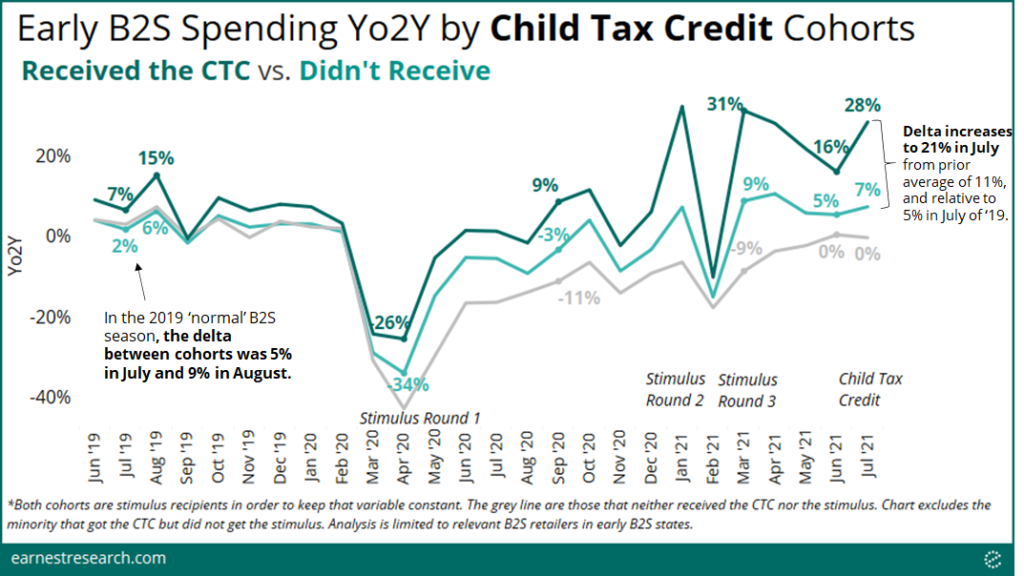

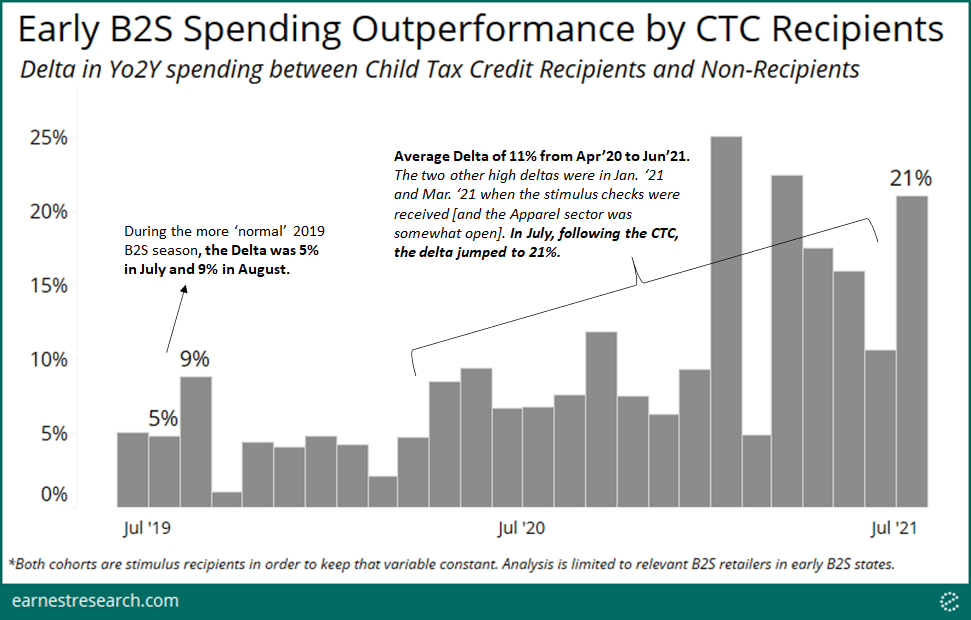

- The impact of the Child Tax Credit can be seen across relevant B2S retailers in states that have earlier back to school start dates, where Yo2Y spending among CTC recipients in July jumped ahead of non-recipients by 21%. Historically, this delta was 11% on average over the past year, and it was 5% during the more ‘normal’ comparable period of July 2019.

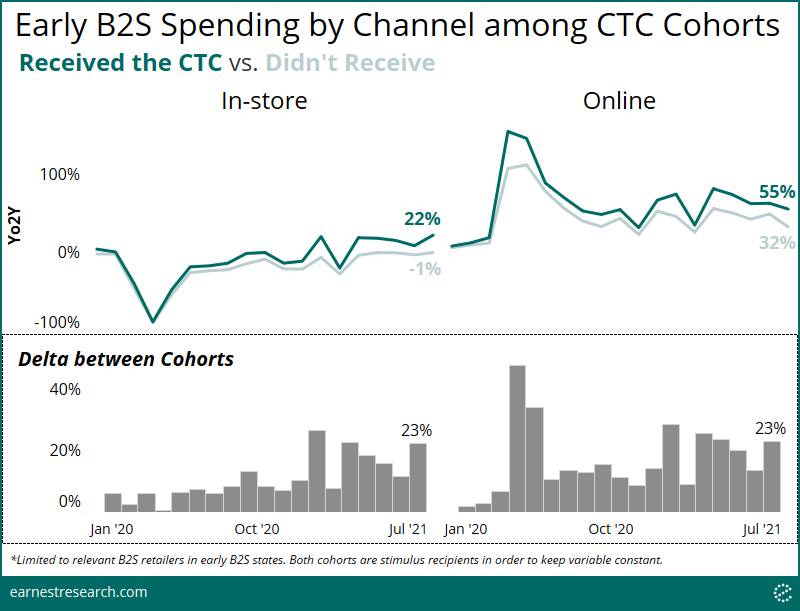

- CTC recipient outspending jumped across both in-store and online channels; the latter channel of which continues to grow at a much faster rate, at 40% Yo2Y vs. in-store’s 10%.

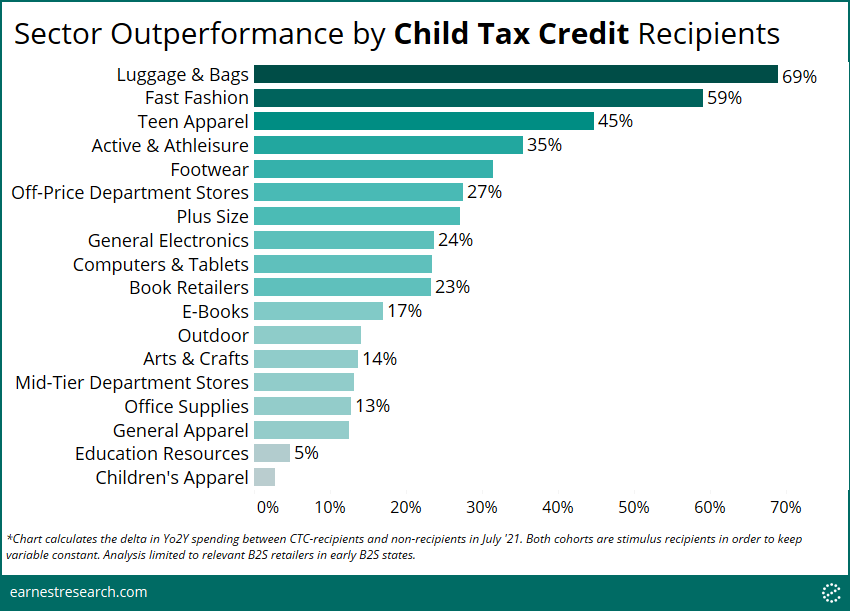

- The largest sectors benefiting from the CTC were in traditional B2S Apparel (Luggage & Bags, Teen Apparel, Footwear, etc.) where recipients’ spending outgrew their peers by over 30%. Electronics and Computers & Tablets also saw 25% of higher growth from recipients, perhaps in preparedness for remote-learning.

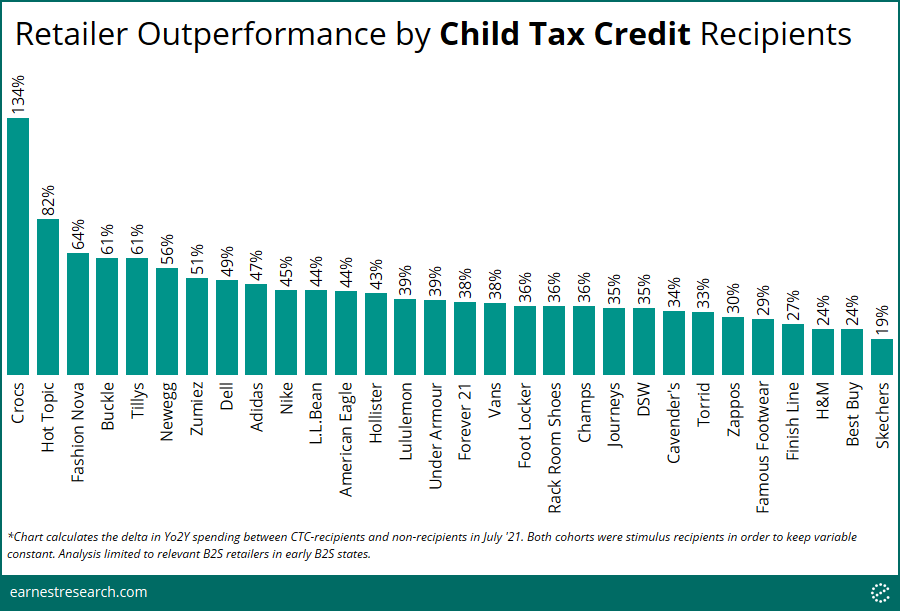

- Top of the list of retailers that benefited include Crocs, Hot Topic, Fashion Nova, Buckle, Tillys, Zumiez, Adidas, Nike, Newegg, and Dell, all seeing over 45% of higher growth from CTC recipients.

Size of the recipient pool

The IRS’ news release states that 35 million families received the CTC, of which 86% were sent via direct deposit. There are 128 million households in the US, of which 40% (~50 million) are households with kids under the age of 18. This equates to the first CTC check reaching roughly 27% of total households (23% via direct deposit) and 68% of households with kids.

We see equivalent figures in our data where 27% of total panelists received the Child Tax Credit in July. Additionally, to put this in context of stimulus recipients, this equates to roughly half the size of the first and third rounds of the stimulus recipient pool.

Each round of stimulus payment spurred spending across the retail environment, adding over 20 points of growth based on our research. Another direct payment from the IRS ought to spur spending to some degree as well. We looked at the composition of CTC and Stimulus recipients to understand the degree of a potential impact from the CTC recipient pool.

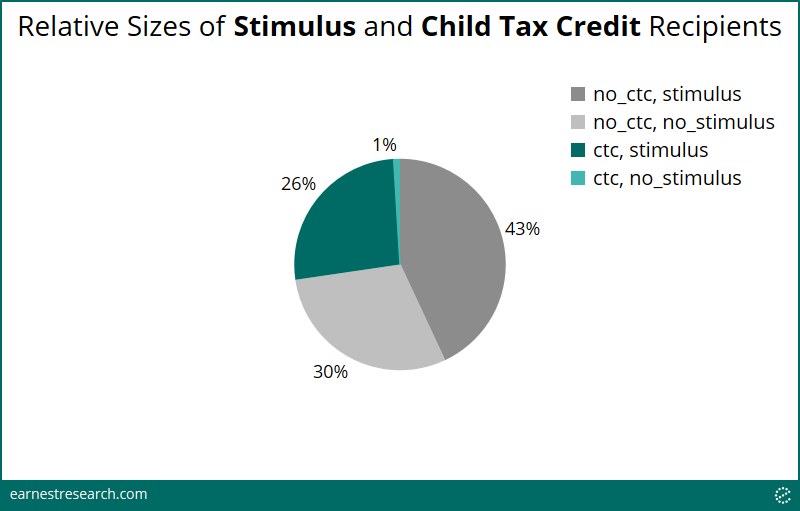

As noted, 27% of panelists received the CTC, of which virtually all of them – 97% of them – also received the stimulus (26% of total panelists). Of the 73% that didn’t receive the CTC, there was roughly a 60/40 split between recipients/non-recipients of the stimulus. [We note that the IRS is still sending the third round of stimulus payments to a long tail of taxpayers who qualify but have yet to receive their payment, thereby continuing to stimulate spending power – albeit to a lesser degree.

Child Tax Credit recipients are driving early back to school spending

The impact of the Child Tax Credit can be seen across relevant B2S retailers** in states that have earlier back to school start dates.***

Among stimulus recipients, the ~50% that also received the Child Tax Credit have historically outspent their non-recipient peers by 11% Yo2Y on average since April of last year, likely a function of larger households necessitating greater spending particularly throughout the pandemic. Further, before the pandemic over the more ‘normal’ 2019 back-to-school period, these recipients outspent their peers by 5% in July ‘19 and 9% in August ‘19. This July, however, following the first CTC deposit, this delta increased to 21%.

(There was also a greater delta in Jan and March of this year, i.e. the months of the stimulus checks, highlighting how households with children still spent their stimulus checks more than households without children particularly during the pandemic.)

It’s perhaps no surprise that households who did not receive the stimulus nor CTC payments (grey line in chart below) show negative or zero growth among B2S retailers in early B2S states, as this cohort likely either doesn’t have school-age children or are high-earners who have not [yet] increased their spending habits, or in fact have reduced their spending over the past year.

Online strong, but all channels see impact

The online channel among B2S retailers saw hyper growth in the early days of the pandemic and continues to grow ~40% Yo2Y, of which CTC recipients (households with children) remain the primary drivers. Meanwhile both channels saw CTC recipient Yo2Y outperformance jump 23 percentage points in July, from a prior in-store average of 11% and online average of 16%.

Largest benefiting sectors include traditional Apparel, but also Electronics and Computers

The largest beneficiaries from the Child Tax Credit were those in the traditional B2S Apparel sector, including Luggage & Bags, Fast Fashion, Teen Apparel, and Footwear, where CTC recipients outspent their peers by over 30 percentage points of Yo2Y growth this July.

Interestingly, General Electronics and Computers & Tablets saw close to 25 percentage points of increased growth from CTC recipients as well, suggesting a continued focus on, or a preparedness for remote-learning. Curiously, Children’s Apparel, such as at Carter’s and The Children’s Place, saw minimal outperformance from CTC recipients.

A healthy wave of CTC impact, from Best Buy to Crocs

We dove further into 30 of the largest B2S retailers that benefited from the Child Tax Credit. Top of the list, with 45+ percentage points of increased Yo2Y growth from CTC recipients, include Crocs, Hot Topic and Fashion Nova (we note that Shein also saw high outperformance but is not charted due to its anomalous growth), Buckle, Tillys, Zumiez, and Footwear’s Adidas and Nike. Again, given the Delta-driven possibility of remote-learning this semester, Electronics’ Newegg and Dell are also at the top of the list.

Skechers, Best Buy, H&M, Finish Line, Famous Footwear, and Zappos, even at the relative bottom of this list, each still saw a healthy ~20 to 30 percentage points of increased Yo2Y growth from CTC recipients in July.

Notes

*The data is limited to direct deposits and does not include mailed checks. The IRS has stated that 86% of July’s payments were sent via direct deposit.

**B2S retailers include those within our Apparel and Department Store categories, as well as within our Book Retailers, Computers and Tablets, E-Books, Education Resources, General Electronics, and Office Supplies subcategories. See our coverage universe here.

***Early B2S States include the East South Central (Alabama, Kentucky, Mississippi, Tennessee), West South Central (Arkansas, Louisiana, Oklahoma, Texas) and Mountain states (Arizona, Colorado, Idaho, Montana, Nevada, New Mexico, Utah, Wyoming). Majority, but certainly not all counties in these states, tend to open their schools by the second week of August.