Black Friday and Cyber Monday — Retail Ranking 2018

Amazon could surpass Walmart as shoppers’ First Choice Retailer for Cyber-5 — the week of Black Friday and Cyber Monday — in 2019. Earnest Analytics (FKA Earnest Research) ranked shoppers’ historical First Choice Retailers by online, in-store, and omnichannel spend in anticipation of the 2019 race for first place.

Earnest Analytics (FKA Earnest Research) First Choice Retailer Methodology

The Earnest Analytics (FKA Earnest Research) First Choice Retailer Rankings are based on the credit and debit card spend of millions of de-identified U.S. consumers. Earnest identifies each shoppers’ First Choice Retailer by comparing their spend across 300 retailers between Thanksgiving and Cyber Monday (Cyber 5). For example, if Shopper A spent $700 at Amazon, $500 at Walmart and $300 at Target, their First Choice Retailer would be Amazon.

Here’s what our data showed about shopping preferences over this busy retail week.

Walmart Reigns, Amazon Grows

For 22% of shoppers, Walmart was the First Choice Retailer in 2018, slightly edging out Amazon, which won 20% of shoppers. Target and Costco rounded out the top four most highly ranked First Choice Retailers. Amazon saw the largest increase year-over-year, upping its share of First Choice customers from 15% to 20% between 2017 and 2018. (The remaining approximately 40% of spending not included in this ranking is distributed across the long tail of smaller national retailers.)

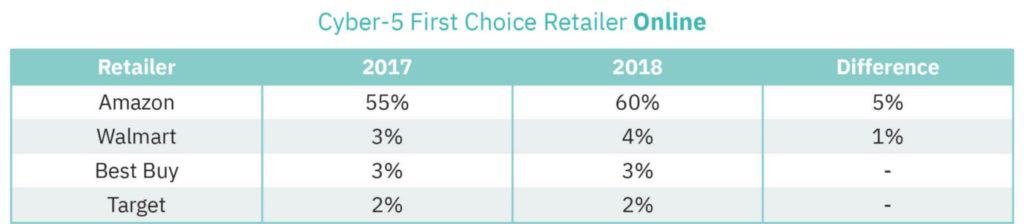

Amazon Sweeps Online

Online shoppers overwhelmingly preferred Amazon during Cyber-5 2018, which represented the First Choice ranked retailer for 60% of shoppers. Walmart, Best Buy, and Target were distant second, third, and fourth most highly ranked retailers. Both Amazon and Walmart grew their share of First Choice customers between 2017 and 2018.

Walmart is Still the Place to Go

Walmart and Target dominated in-store spend during Cyber-5 2018. Walmart and Costco both grew their share of First Choice customers between 2017 and 2018 by 1% each.

Stay tuned for our post Cyber-5 2019 follow up to see if more U.S. shoppers choose Amazon as their top retailer, as well as other ways shopping preferences evolve during this holiday shopping season.

Appendix

- Data is derived from a panel of nearly 6 million de-identified U.S. consumers.

- Cyber-5 analysis includes 7 days spanning Thursday, November 22, 2018, to Wednesday, November 28, 2018.

- Analysis conducted over the 300 largest retailers in Earnest coverage, excluding retailers that primarily sell groceries.

- Walmart’s sales do not include sales made through Walmart’s Online Grocery platform.

- Does not include spend made on store-branded store cards that will likely not be paid down until after the Cyber-5 period.

- Analysis excludes Apple and eBay retail sales.