Mars wants a bite of Kellanova’s crackers

In the context of Mars’ recently announced acquisition of Kellogg’s spin off snack business Kellanova, both companies have been struggling with sluggish sales while having little overlap in their product categories, according to Earnest’s scanner (CPG) data.

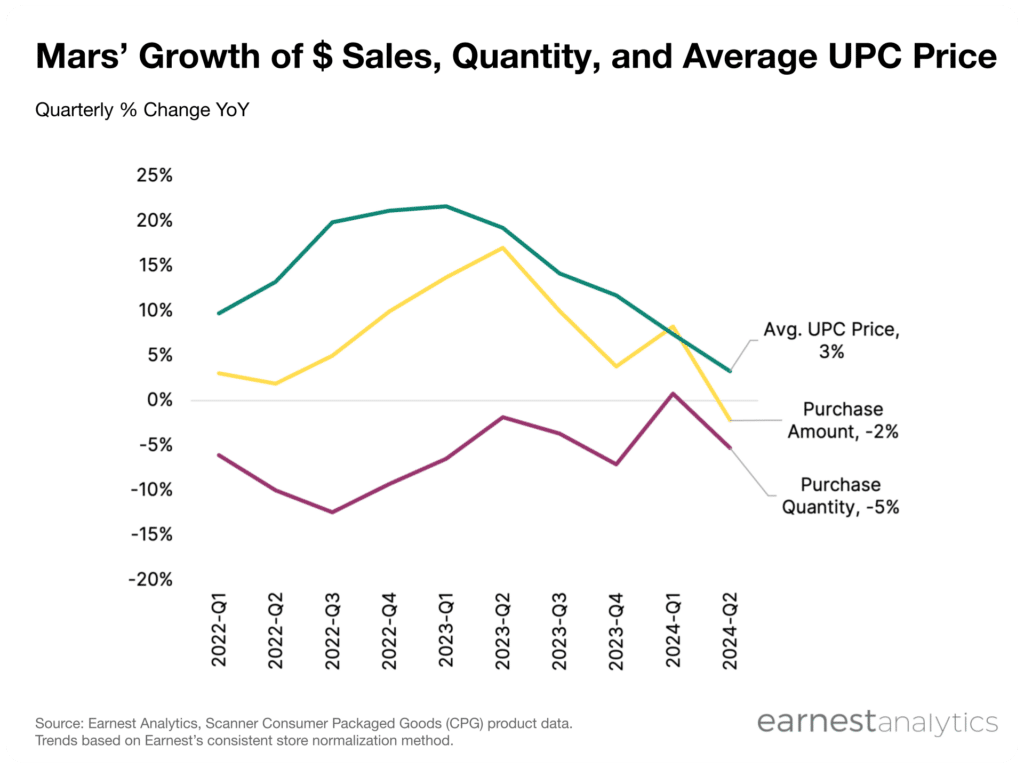

While Mars’ dollar sales grew at an average YoY rate of 5% over the last four quarters, sales growth was largely driven by price increases.

Contact Sales for details.

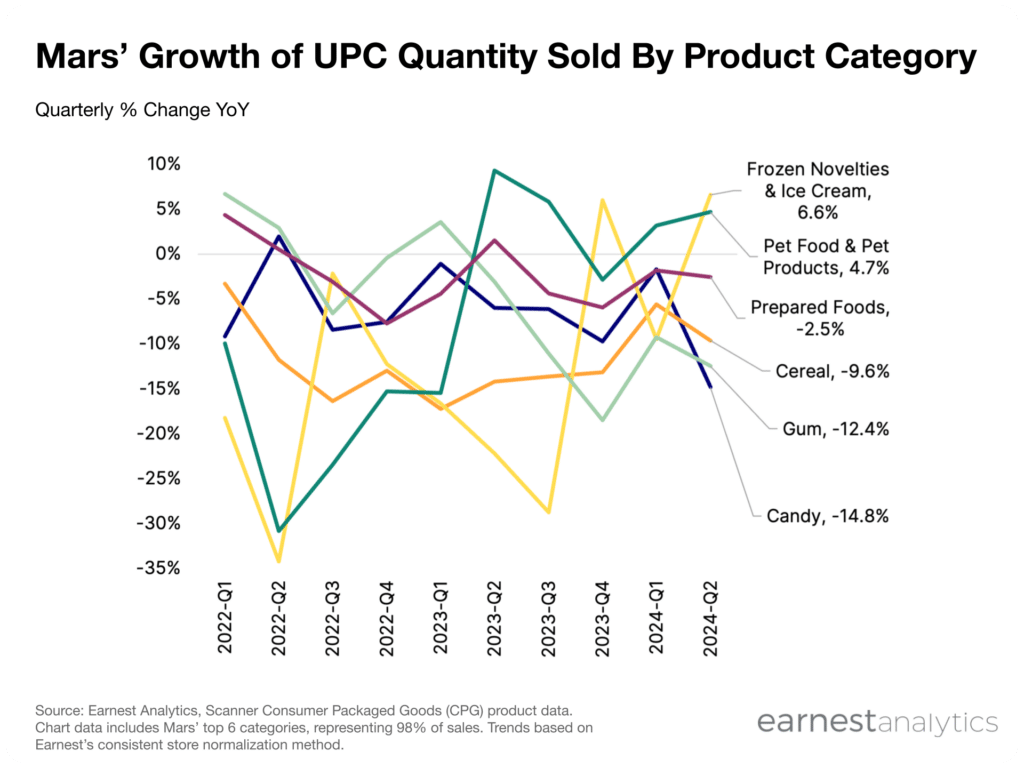

Decoupling quantity and price reveals that Mars’ sales volume has been decreasing across all categories, with pet foods & pet products being the only category showing mid-single digits positive growth over the last year.

Contact Sales for details.

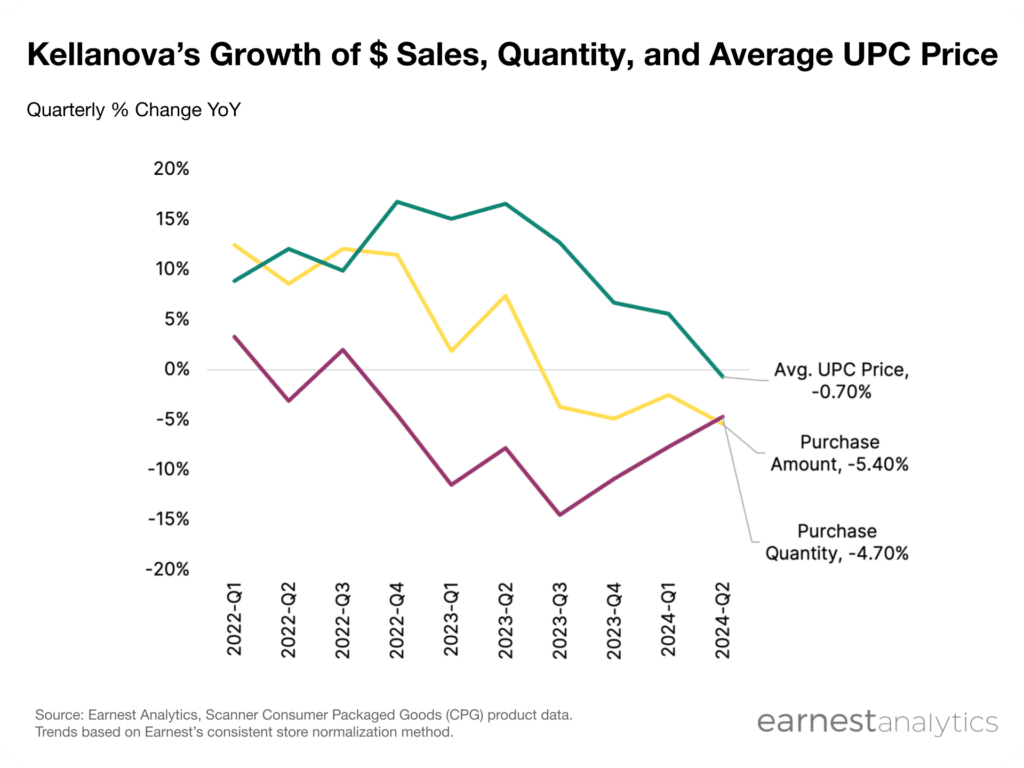

Kellanova is showing similar overall trends but has been comparatively underperforming Mars over the last year.

While Kellanova’s average UPC price remains around 16% higher than two years ago, price appreciation has gradually been eroding over the last year and became flat in 2Q2024. Combined with decreasing volume sales, this resulted in negative dollar sales trends for the company over the last year through 2Q2024.

Contact Sales for details.

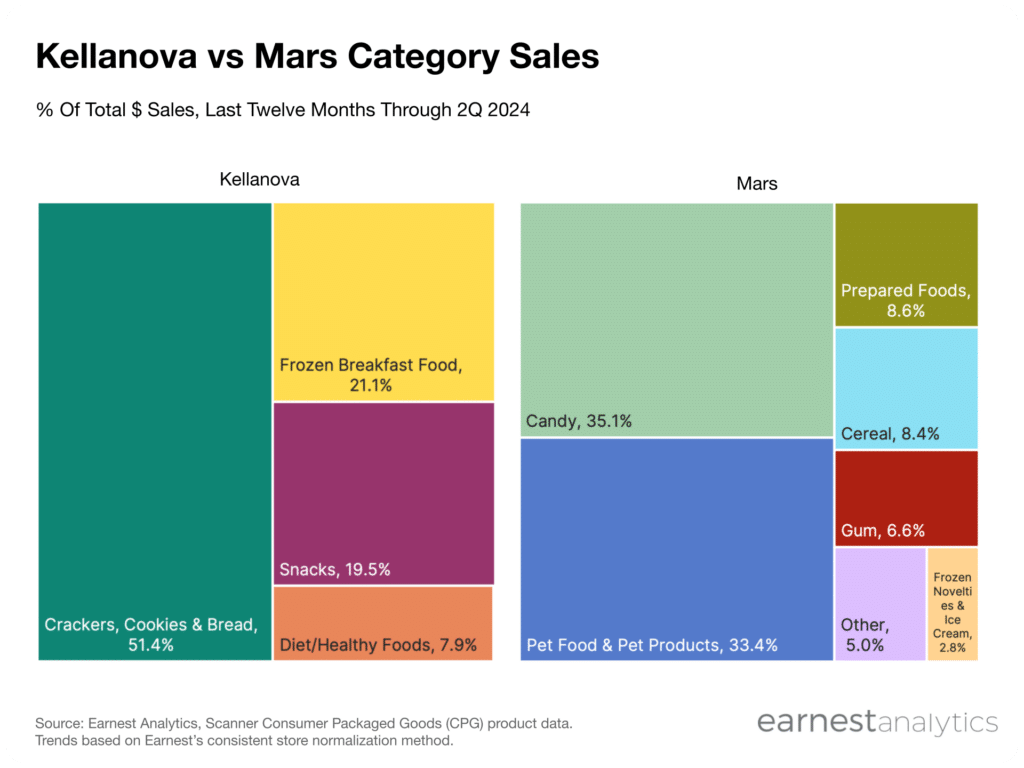

The Kellanova acquisition may not immediately solve Mars’ sales growth problem but it is however diversifying Mars’ business into new categories as there is little overlap between the two companies.

Mars’ sales consist primarily of candy and pet food, together making up close to 70% of the company’s sales for the year through 2Q2024. By acquiring Kellanova, it expands into new categories such as crackers, frozen breakfast foods, and snacks, together representing over 90% of Kellanova’s sales for the same period.

Contact Sales for details.

Request information on Scanner CPG