Travel Not Yet Revived Heading into 2021 Holiday Season

The US ended many of its international travel bans on November 8th for vaccinated travelers. The timing, aligned with a holiday season just around the corner, may have given cues for US travelers to book that long awaited vacation after 18 months of a pandemic. We checked the spending and foot traffic trends to see how the industry has fared headed into the holiday travel season.

See our prior analysis on Travel here.

Key takeaways on travel performance heading into the 2021 holiday season

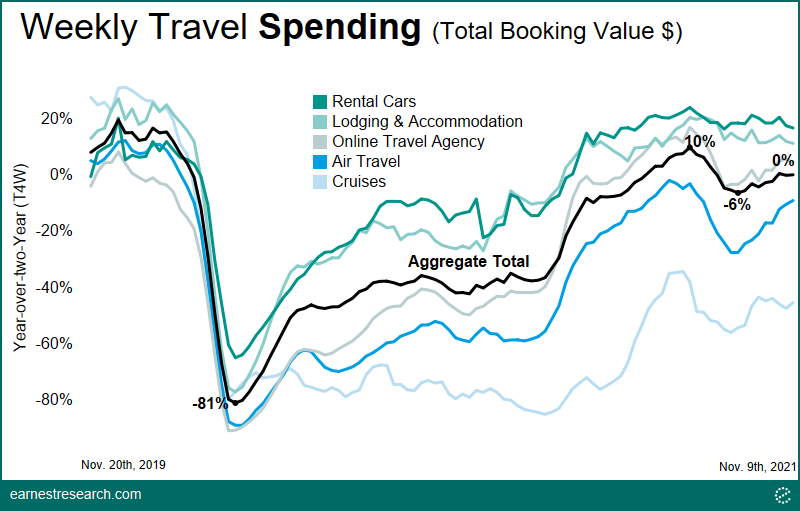

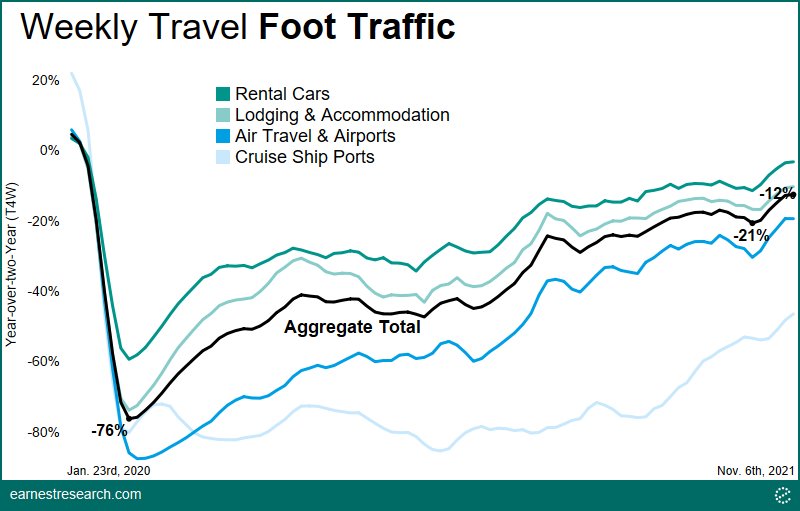

- Travel booking spend growth was flat Yo2Y in early November on a trailing 4 weeks basis, down from pre-pandemic growth levels of 15-20%. Foot traffic, or a measure of actual travel, is still down 12% Yo2Y.

- The travel recovery has not been linear; bookings growth accelerated to 10% Yo2Y in late July, before falling to -6% over the Delta variant-plagued summer.

- Rental Cars and Lodging are the most recovered industries, though inflated booking sizes appear to be its drivers. Air Travel and Cruises are still down 9% Yo2Y and 45% Yo2Y, respectively.

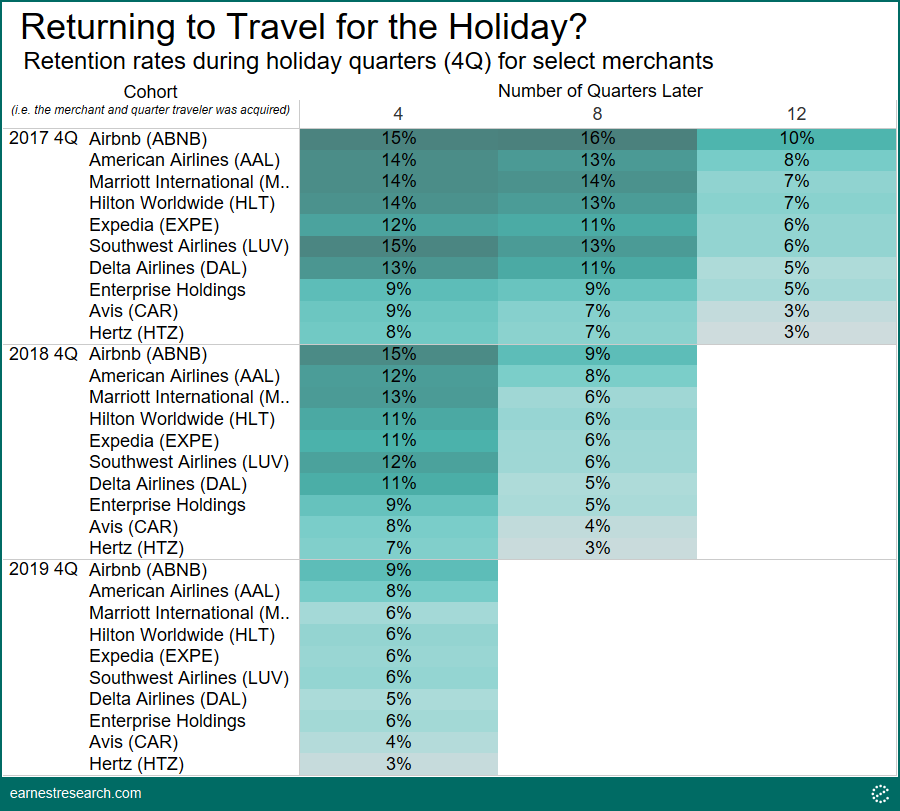

- In the past, 10%-15% of Air Travel and Lodging customers acquired before the pandemic returned the following holiday travel period. However only 5-10% returned in 2020, begging the question about the upcoming holiday travel season.

Travel’s recovery roller coaster

Trailing 4 week travel spend, was flat Yo2Y in early November, significantly improved from -80% in Spring of 2020. Growth remained well below pre-pandemic growth levels of between 15-20%. The recovery was marked by a recent roller coaster of trends, reviving to ~10% Yo2Y in late July before dropping to -6% over the Delta variant-plagued summer, and now having gained back some of those losses with flat growth to date.

Air Travel bookings mirrored total travel’s recovery, peaking at -2% Yo2Y in June, falling to -30% Yo2Y over the summer, and landing at -9% in early November. Rental Car spend remained above pre-pandemic levels, though higher ticket sizes contributed to this growth (see more below). Lodging is pushing close to revival as well, with bookings growth of ~12% vs. pre-pandemic’s ~18%. Cruise spend is still down 45% Yo2Y.

Foot traffic, or a measure of actual travel, is still negative relative to pre-pandemic levels. The pace of recovery accelerated in October after deteriorating during the summer Delta variant scare, though to a lesser extent than travel spend. This suggests that the Delta variant had a bigger impact on future travel spend than actual travel behavior.

Rental Cars and Lodging subcategories were down 3% Yo2Y and 10% Yo2Y, respectively, in October. Airports and Cruise Ship Ports were down 19% Yo2Y and down 46% Yo2Y, respectively, in October.

Inflated bookings for Rental Cars, Lodging; not so for Air Travel

While the total dollar value of rental car bookings was up 19% Yo2Y, and above pre-pandemic levels of 10%, the number of bookings was still well below pre-pandemic levels, down 17% Yo2Y.

The difference, as previously noted and written about in this Data Bite, is inflated booking sizes. Reduced rental fleet sizes, new car supply chain constraints, as well as the current inflationary environment are all likely culprits. Enterprise, U-Haul, and Hertz, each saw their number of bookings grow ~30 points slower than the total dollar value of their bookings.

Lodging spend also outgrew the total number of bookings, mostly driven by Airbnb (60 point gap) and Hilton (20 point gap). These trends are likely due to Airbnb’s extended-stay booking behavior this past year, which carry higher price points.

In contrast, the number of Air Travel bookings actually outgrew their total dollar value during the Fall. American Airlines bookings have so far recovered faster than Delta and Southwest.

Customer retention rates for travel

How many travelers will return this upcoming holiday season?

In the past, between 10%-15% of Air Travel and Lodging customers acquired in pre-pandemic 4th quarter holiday travel periods returned the following holiday travel period. That figure was under 10% for Rental Cars. However only 5-10% returned in 2020. The question remains if those 5% of acquired customers will return to the skies, hotels, and rental car garages this 2021 travel season.

Notes

Total Travel throughout this analysis excludes the following subcategories within our Spend coverage universe: Bike & Scooter Share, Mass Transit, Parking, Taxi, and Tolls, as well as Commuter Train Stations, Ferry Terminals, Intercity Train Stations, and Light Rail Stations within our Foot Traffic dataset.