The (Un)Vaccinated Consumer

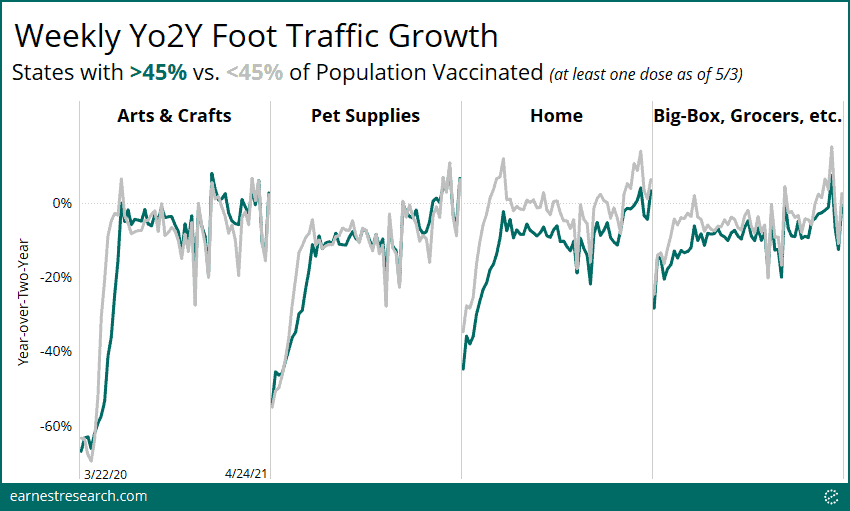

As vaccine rollouts continue and pandemic restrictions ease across the U.S. we looked across various states to understand how local economies are responding. With 44% of the nation inoculated with at least one dose as of May 3rd, we grouped states above and below this national average, then looked at consumer behavior, particularly foot traffic, across the sectors that most signify a return-to-normal consumer environment.

Note that parts of this analysis calculate growth relative to two years prior – written throughout as “Yo2Y” – in order to benchmark current performance against “normal” foot traffic levels.

Key Takeaways

- States with higher vaccination rates continue to underperform compared to states with lower vaccination rates. Yo2Y visitation behavior across Travel & Leisure and Gyms are ~20% more negative in the more vaccinated states, and 10% more negative in broad Apparel and Restaurants. Few sectors (Arts & Crafts, Pets, Home, Big-Box, etc.) are showing close to or equivalent levels of performance.

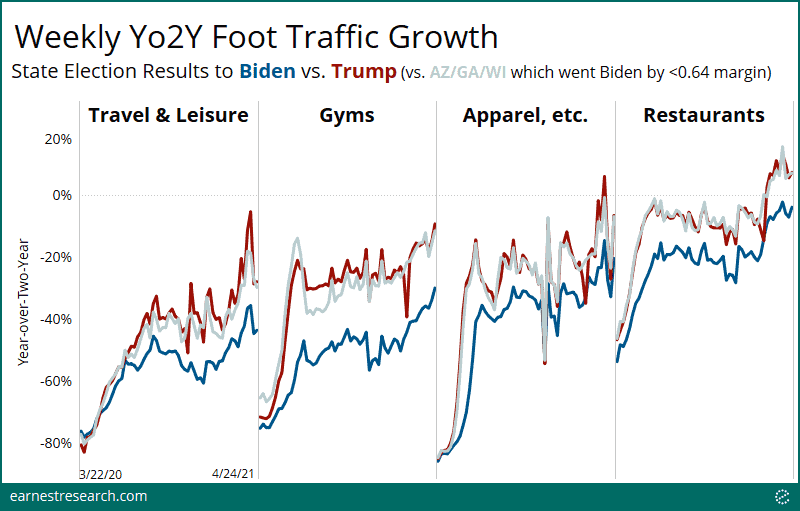

- Vaccine rollouts correlate to politics: almost all the Red states have lower vaccination rates, while Blue states have higher vaccination rates. Viewing regional performance with a political lens, we see that consumers in Red states have been, and continue to outperform their more vaccinated Blue state counterparts.

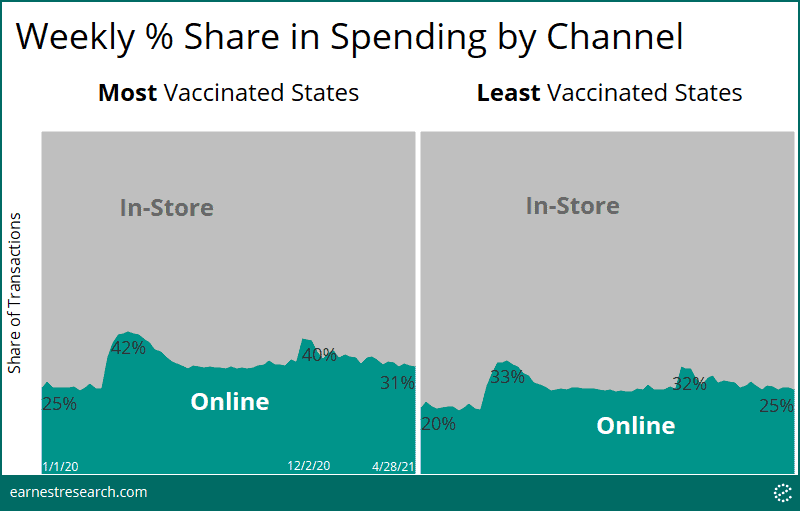

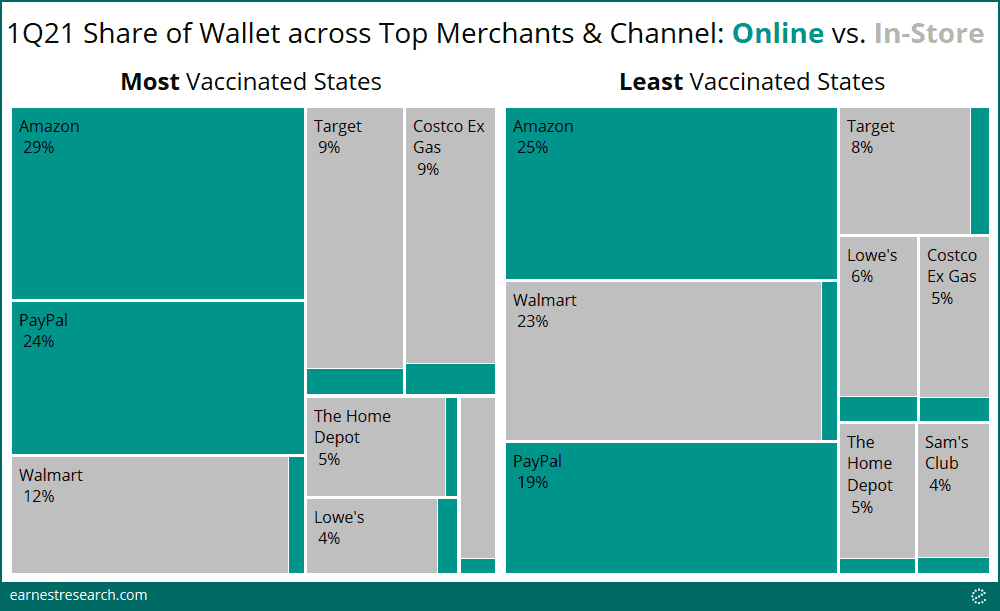

- The preference to purchase online (vs. in-store) persists in the more vaccinated states. The share of online spend was and continues to be ~6 to 8% higher in the more vaccinated states. In 1Q21, the share of Amazon and PayPal in the more vaccinated consumer’s wallet was ~5% higher than the share these platforms accounted for in his/her lower vaccinated counterpart. Walmart in-store was 11% lower, and Target and Home Depot in-store were interestingly at equivalent levels.

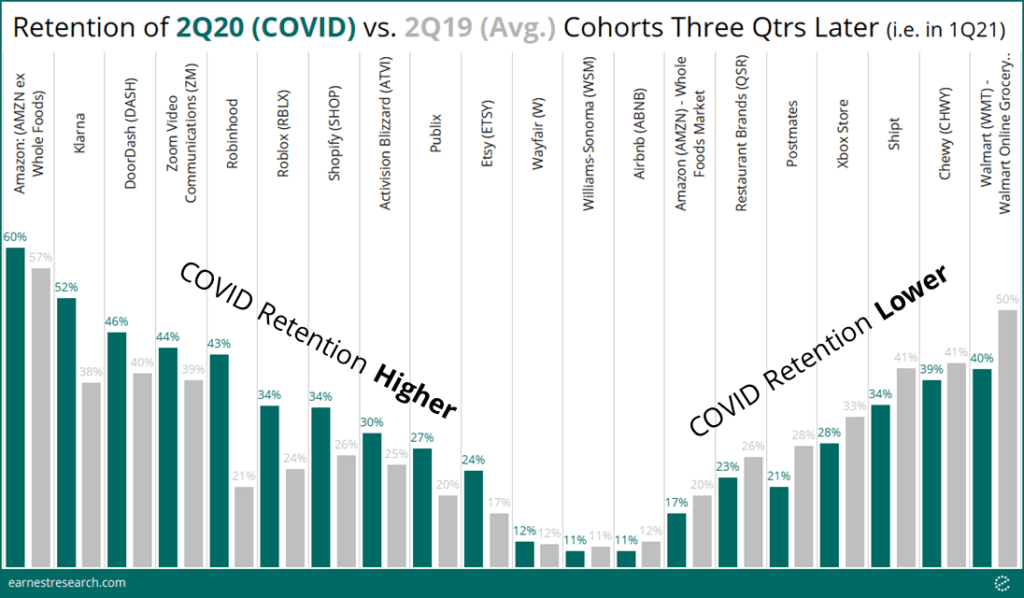

- The 1Q21 retention of COVID-acquired shoppers was 6%+ higher at Robinhood, Klarna, Roblox, DoorDash, Shopify, Publix, and Etsy, relative to prior cohorts. Amazon’s retention was a healthy 3% higher. Wayfair’s retention was on par with prior cohorts, notably not higher, despite the huge number of shoppers Wayfair acquired in 2Q20 due to the nationwide lockdown.

Vaccines Not a Booster

As was the case in March, states with higher vaccination rates* continue to underperform the states with lower vaccination rates, implying again that other variables besides vaccination rates are the primary drivers to date of reviving local economies.

Visitation behavior across Travel & Leisure (airports, hotels, theaters, etc.) and Gyms, while still exhibiting negative Yo2Y growth nationwide, are ~20% more negative in the more vaccinated states, with perhaps minimal improvements in recent weeks. In broad Apparel (Apparel & Accessories, Department Stores, Cosmetics, etc.) and Restaurants, growth is ~10% lower in the states most vaccinated.

The few sectors that saw and continue to see equivalent performance include Arts & Crafts (a school-closure beneficiary) and Pet Supplies, as well as essential categories Home, Big-Box, and Supermarkets, which all saw very minimal underperformance (5% or less) from the most vaccinated states.

Political Overlap

The question of what other variables may be driving state outperformance is complex, but we noticed an interesting political overlap: all but one (SD) of the more vaccinated states went for Biden in the 2020 U.S. Presidential election, and all but four (AZ, GA, MI, and NV) of the less vaccinated states voted for Trump (and both AZ and GA went Biden by a small 0.24 – 0.31 margin, less than ~12K votes; and have historically voted Republican).

In other words, almost all the Red states are also the less vaccinated states, and consumers there have, and continue, to outperform their more vaccinated Blue state counterparts, to the tune of ~15-20% Yo2Y in Travel & Leisure and Gyms, and ~10% Yo2Y in Apparel and Restaurants.

An Online Preference

The preference to purchase online (vs. in-store) persists in the more vaccinated states. Looking at the number of transactions across various sectors** the share of online spend was and continues to be ~6 to 8% higher in the more vaccinated states.

Thus, while online levels remain ~5% above pre-pandemic levels across the nation, a result of the COVID-driven shift to online, it’s possible this online preference may persist longer in states where this shift was more acute, even if vaccines are being administered more quickly there.

To highlight this, we looked at a basket of some of the largest merchants nationwide (Amazon, Walmart, Target, Costco, Home Depot, Lowe’s and Sam’s Club) as a proxy for the average consumer’s wallet, and then broke out sales by channel*** as well, in order to assess how this share of wallet by merchant and channel differs between the most and least vaccinated states.

Indeed, in the latest quarter of 1Q21, core online platforms Amazon and PayPal accounted for 29% and 24% of the more vaccinated consumer’s wallet, respectively, notably ~5 points higher than the share these platforms accounted for in the lower vaccinated consumer’s wallet. Walmart in-store was 23% of the lower vaccinated consumer’s wallet, 11 points more than his/her higher vaccinated counterpart. Target in-store (~8%) and Home Depot in-store (~5%) were interestingly at equivalent levels.

Retention Refresh

As we have asked in the past, a crucial question remains: are COVID-acquired shoppers remaining loyal and true, or are they proving difficult to retain particularly as vaccines are rolling out and the economy begins to return to normal? (See our prior retention analyses here and here).

We looked at retention rates in this most recently completed quarter (1Q21), among shoppers acquired in 2Q20 across a variety of COVID-related sectors. We compared their retention rates to the 2Q19 acquired cohort as a benchmark.

Robinhood, Klarna, and Roblox saw 10+ points of higher retention from the COVID shopper relative to the prior year’s cohort. DoorDash, Zoom, Shopify, Activision, Publix, and Etsy saw a 5+ point increase, and Amazon saw a healthy 3 point increase, now with 60% of its COVID-acquired shoppers retained.

Many competitors saw decreased retention however: Walmart Online Grocery, Shipt, Xbox, and Postmates saw 5+ points of lower retention, while Chewy, QSR, and Whole Foods saw a ~3 points decrease. Interestingly, Wayfair’s retention was on par with the 2Q19 cohort, notably not higher, despite the huge number of shoppers Wayfair acquired in 2Q20 due to the nationwide lockdown.

Notes

*Statistics on state vaccination rollouts are sourced from this NY Times analysis, which sources its data from the Centers for Disease Control and Prevention.

**Sectors include Apparel & Accessories, Department Stores, Events & Attractions, Fitness, General Merchandise, Hobbies & Toys, Home, Pets, Restaurants, and Travel & Transportation.

***Analysis excludes spend made on store-branded cards.