Stimulus Round 2: A Booster Shot for Retail?

In the ongoing fight against the COVID-19 pandemic, an additional $900B of stimulus relief funds were signed into law on December 27th, exactly nine months after and at roughly half the size of the original $2.2T stimulus package that Congress passed in March 2020.

The new funds include direct stimulus payments of $600/$1200 to individuals/couples (vs. the first round’s $1200/$2400) plus an additional $600 per child (vs. the first round’s $500). It also includes $300 per week in unemployment insurance through March 14th (vs. the first round’s $600 which lasted until the end of July), renewed small business loans, funding for schools, eviction protection, increased SNAP benefits, and aid for vaccine production and distribution, among other grants as well.

This analysis focuses on the second round of direct stimulus payouts the IRS began delivering to taxpayers around December 30th.

Key Takeaways

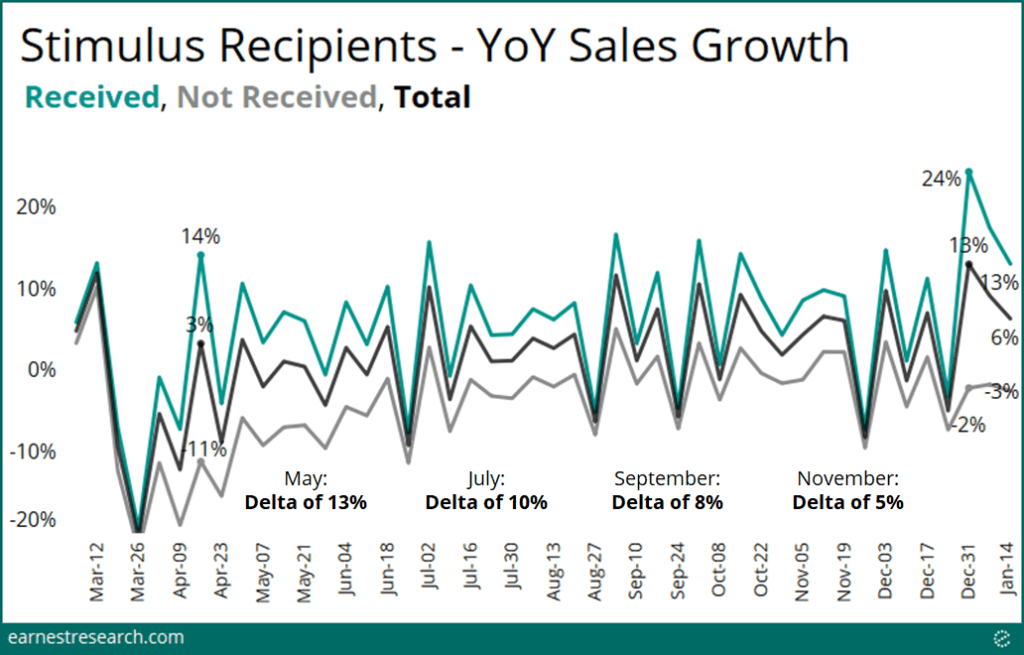

- The stimulus recipients outspent non-recipients by 22% YoY across our total consumer universe in the initial week (similar to the 25% YoY in the first round). Put another way, stimulus recipients lifted YoY growth a full 15 points (similar to the 14 points in the first round). This lift subsequently decreased to 11 points and then to 9 points, in the subsequent two weeks, respectively.

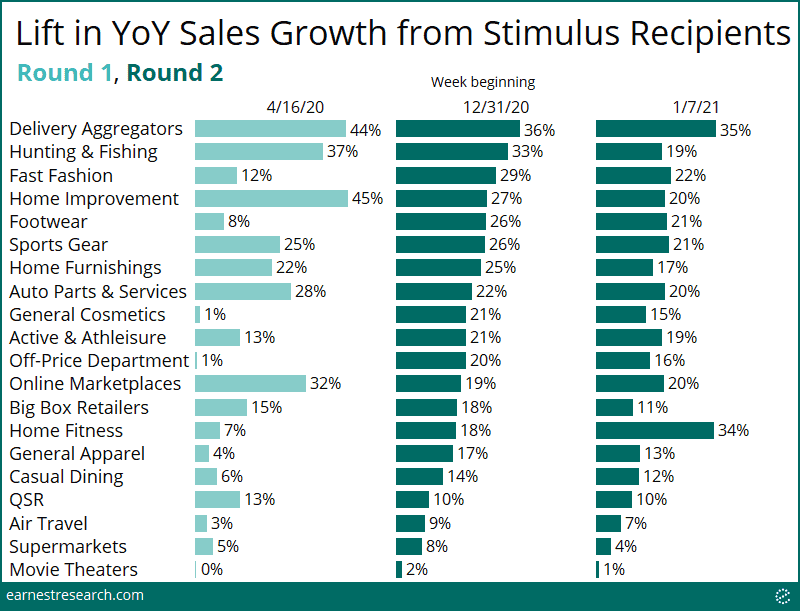

- Sector beneficiaries included Restaurant Delivery, Sporting Goods, and Home with 25+ points of added growth, mirroring the first round. However, unlike the first round, this round included Apparel, Beauty, and Department Stores, with ~15 to 25 points of added growth, primarily because stores are now open in contrast to April’s lockdown. Indeed, in-store sales growth among stimulus recipients was +12% YoY vs. the 27% YoY decline among non-recipients.

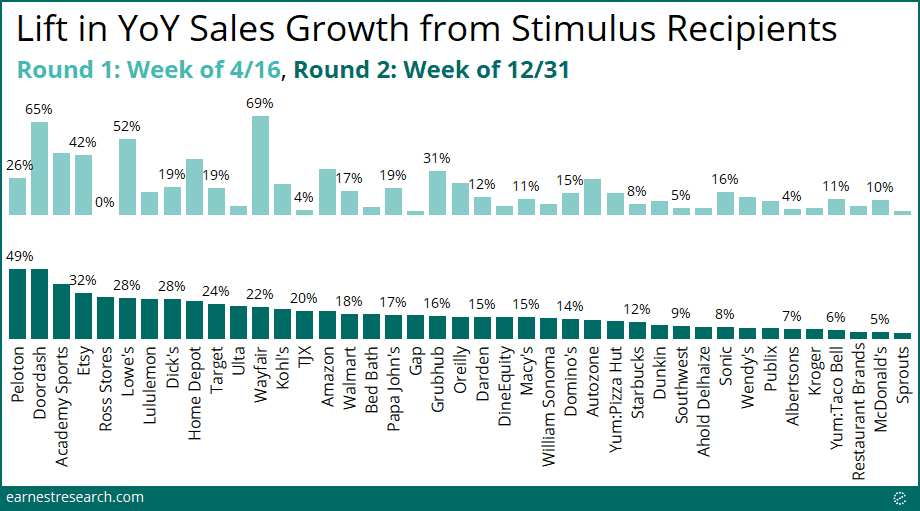

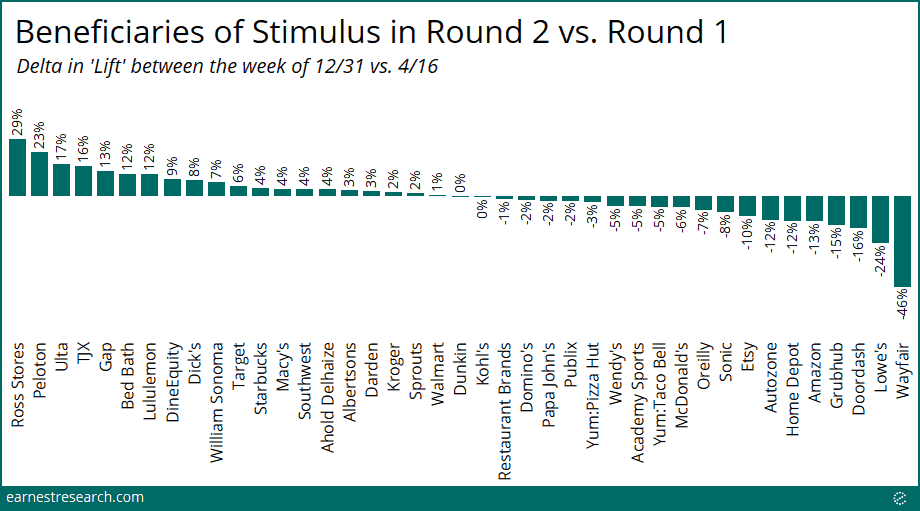

- Merchants that most benefited from the stimulus included Peloton, Doordash, Academy Sports, Etsy, Ross, Lowe’s, and Lululemon; the least stimulus benefit was seen at Sprouts, McDonald’s, and Restaurant Brands, among other Fast Food and Grocery chains. In contrast to the first round, Wayfair and Amazon were not at the top of the list this time around. New top additions this round included Ross, Peloton, Ulta, TJX, and Gap

Another 15% Lift in Spending Growth

Both stimulus checks (and weekly UI benefits) heavily impacted consumer spending. In the first round, peak impact was seen during the week of 4/16, when stimulus recipients outspent by 25% YoY (stimulus recipients +14% – non-recipients’ -11%), and lifted* total spending growth** a full 14 points. Naturally, this impact faded over the subsequent weeks and months, particularly once UI benefits expired at the end of July.

In the second round, the peak impact was felt almost immediately, during the week of 12/31, where recipients outspent by 22% YoY, and lifted total spending growth 15 points again.

This lift continued through the most recent two weeks, fading to 11 points in the week ending 1/13, then to 9 points during the week ending 1/20.

Delivery, Home, and now Apparel

As with the first round of stimulus, Restaurant Delivery, Sporting Goods (Hunting & Fishing/Sports Gear), and Home Improvement/Furnishing, all benefited from the second round of payments with 25%+ of increased growth.

The striking difference this stimulus round is that Apparel, Beauty, and Department Stores were clear beneficiaries; in contrast they saw minimal to no benefit back in April. Footwear, General Cosmetics, Active & Athleisure, Off-Price Department Stores, and General Apparel all saw increased growth of 17% to 26% this stimulus round versus a minimal lift in the last round.

The still struggling Movie Theaters and Air Travel, as well as the essential Supermarket sector, were once again least impacted by the stimulus, although we note that they still received slightly more of a benefit this time around relative to the first round.

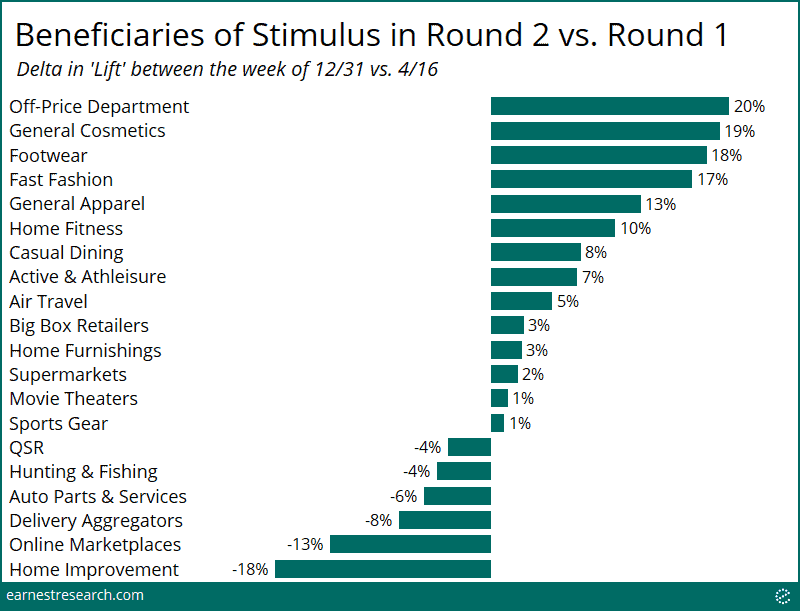

Comparing the magnitude of the lift this time around versus the first round, as depicted below, it’s apparent that Apparel, Beauty, and Department Stores were the clearest round-two beneficiaries. Additionally, Home Fitness saw 10 points of an increased lift this time around.

Interestingly, it’s evident how much Home Improvement, Online Marketplaces (Amazon, Etsy, etc.), and Restaurant Delivery benefited from the nation’s lockdown during the first round, as the benefit the second time—though strong—was still 10 to 15 points lower

Why Did Apparel, Beauty, and Department Stores benefit?

Looking at Apparel, Beauty, and Department Store performance by channel makes it clear why this sector saw a benefit this time around, in contrast to the first. In-store spending was non-existent back in April, and thus any stimulus impact happened solely through the still relatively small online channel (stimulus recipients actually outspent by 64% online during the week of April 16th).

With most stores now open, stimulus recipients were able to spend at these retailers; and indeed they did: in-store spending was +12% YoY for recipients vs. -27% for non-recipients, and online was +37% for recipients vs. +1% for non-recipients.

Peloton and Ulta Replace Wayfair and Amazon

Finally, digging into the largest retailers*** among the above sectors, the round two recipients contributed the most growth to Peloton, Doordash, Academy Sports, Etsy, Ross, Lowe’s, and Lululemon; the least growth was seen by Sprouts, McDonald’s, and Restaurant Brands, among other Fast Food and Grocery chains.

In contrast, Wayfair, the largest beneficiary back in April, was [only] number twelve this time around. Similarly, Amazon was number seven in April but is now number fifteen. Top new growth additions this time around included Ross, Peloton, Ulta, TJX, and Gap.

Notes

*“Lift” is calculated as the total spending growth for the entire panel minus the growth for those that did not receive the stimulus. This captures, in other words, how much the stimulus recipients contributed to (i.e. ‘lifted’) overall growth.

**Total spending here utilizes our entire Query coverage universe excluding the Finance, Gig Economy Income, and Charitable Giving categories.

***Analysis done at the parent merchant level.