Retail’s COVID-19 Lifeline: E-commerce. Will It Help?

Earnest Analytics (FKA Earnest Research) continues to track the coronavirus impact on consumer spending. In this analysis we focus on retail spend across the Apparel, Department Store, and Home verticals and dive into one of the retail industry’s primary safeguards: its e-commerce channel.

Key Takeaways

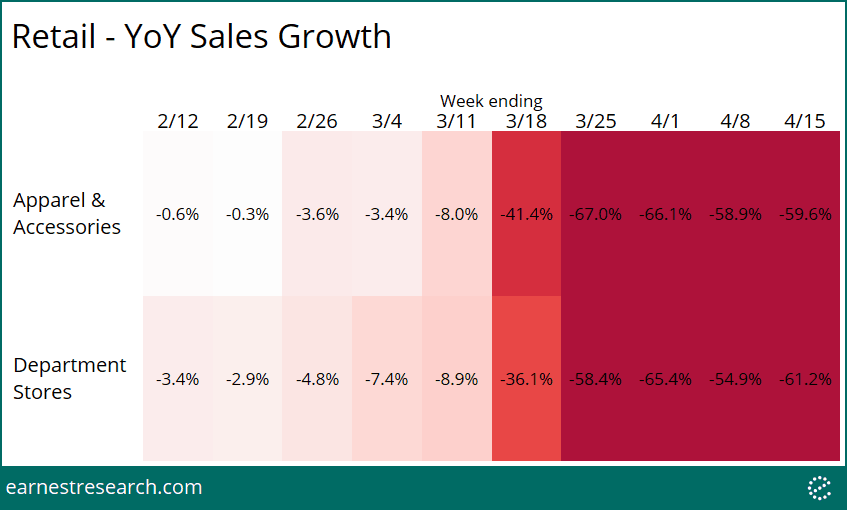

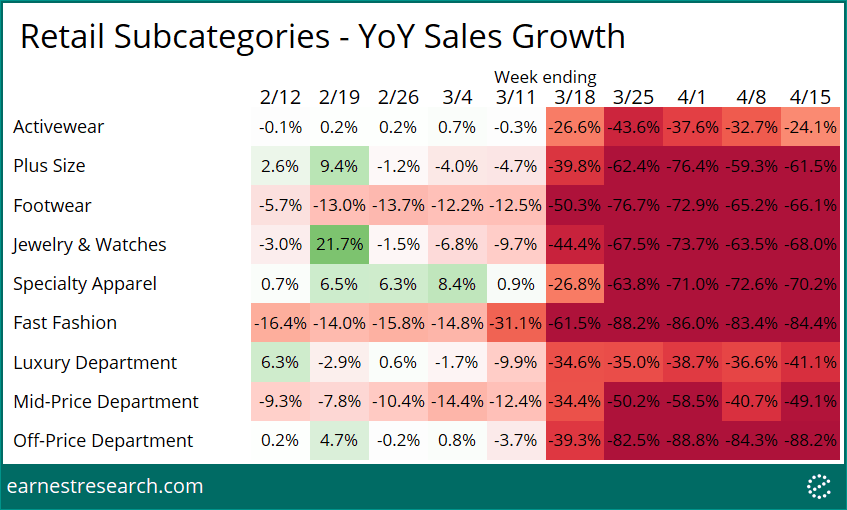

- Apparel and Department Store sales declined 60% YoY with interesting category bookends: Apparel’s Activewear at -25% vs. Fast Fashion’s -85%, and Department’s Luxury at -40% vs. Off-Price’s -90%.

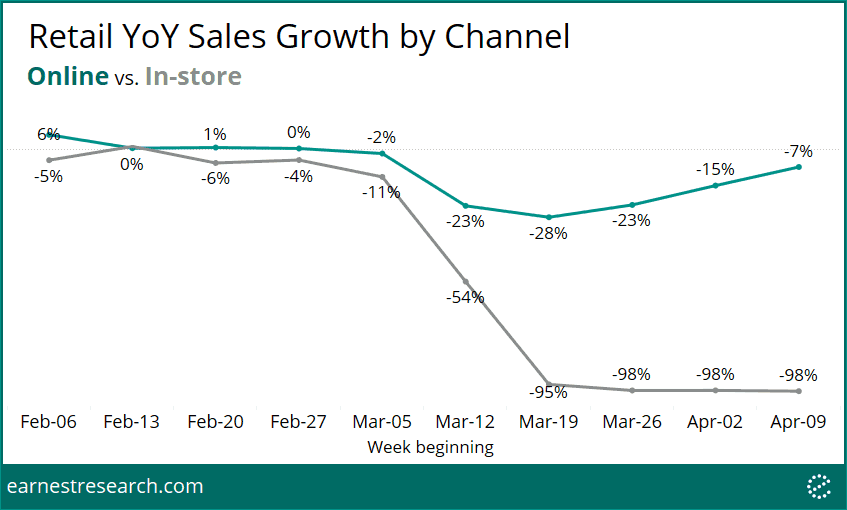

- Online activity bottomed at -30% YoY a few weeks ago when in-store sales went effectively to zero, but that gap has now partially closed. While almost all retailers’ online channels are declining, DSW, Nike, Kohl’s, and Lululemon have managed to accelerate their growth.

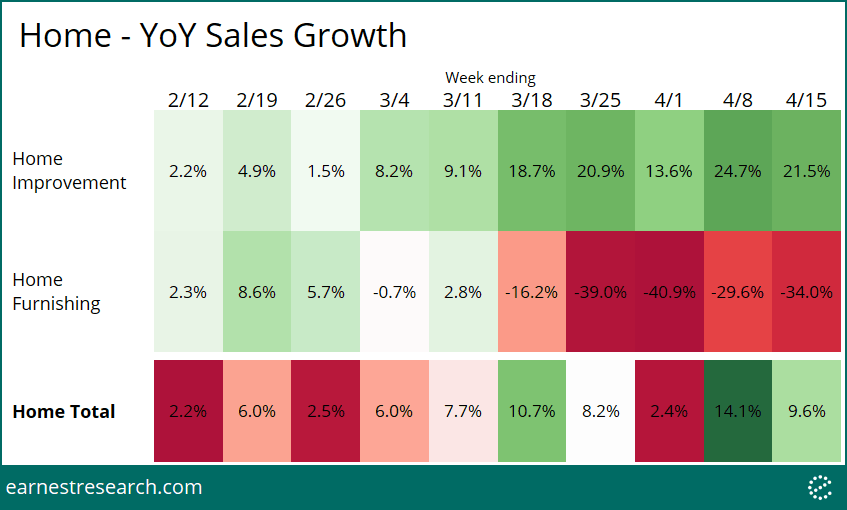

- Home spending continued to accelerate to double-digit growth, but is mostly isolated to Home Improvement rather than Home Furnishing purchases.

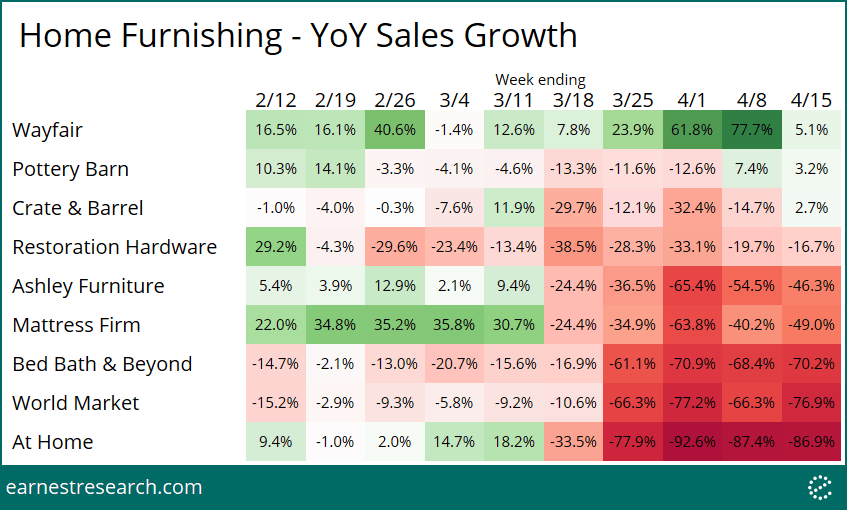

- Online spend at traditional Home Furnishings retailers including Bed Bath & Beyond, Crate & Barrel, Pottery Barn, and Wayfair all exhibited strong growth.

Spending across hundreds of Apparel and Department Store retailers declined 60% YoY over the past several weeks. While the industry is in a free fall, there are some interesting category bookends. Within Apparel, Activewear is down 25% YoY vs. Fast Fashion down 85%. Within Department stores, Luxury stores fared a bit better being down 40% YoY vs. Off-Price declining 90% YoY.

Apparel’s E-Commerce Lifeline

Apparel’s brick and mortar activity is essentially non-existent during quarantine lockdown. The big question is whether the e-commerce channel can keep the industry alive, and if so, for how long. Our data shows that online activity bottomed at -30% YoY a few weeks ago when in-store sales went effectively to zero, and improved to -7% in the most recent week.

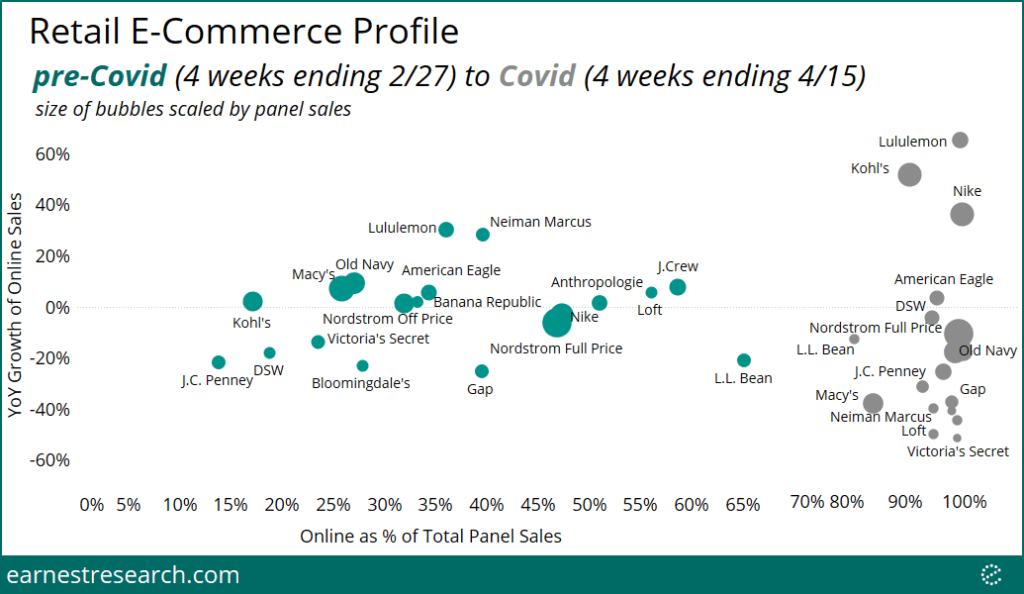

E-commerce Profiles

Online sales now represent about 80% to 100% of retail sales, after retail was deemed ‘non-essential’ and retailers were forced to close most if not all of their stores. In order to appreciate the magnitude of such a swift e-commerce transformation, we looked at the top 20 retailers that had the highest e-commerce sales before the impact of Covid-19 (excluding DTC retailers), and analyzed their YoY growth rates alongside the % share of their online channel. We then looked at how this e-commerce profile shifted into the most recent four weeks.

Before Covid-19, online sales accounted for between 15% and 65% of total sales, and were growing between -25% and +30% YoY. Profiles were pretty evenly distributed throughout. Unsurprisingly, with many retailers struggling to adapt to an online only existence, many retailers exhibited online sales declines of 10% to 50% YoY.

Four retailers, however, have managed to accelerate their online sales growth from pre-Covid levels: DSW, Nike, Kohl’s, and Lululemon, the latter three of which are showing 40% to 70% YoY growth, up from Nike’s -3%, Kohl’s +2%, and Lululemon’s +30%. DSW’s sales growth accelerated from -18% to -5%. Retailers with the highest online sales declines include Victoria’s Secret, Loft, Banana Republic, and Neiman Marcus. American Eagle continued to grow low single digits, and Nordstrom (full-price) continued to decline high single to low double digits.

Home

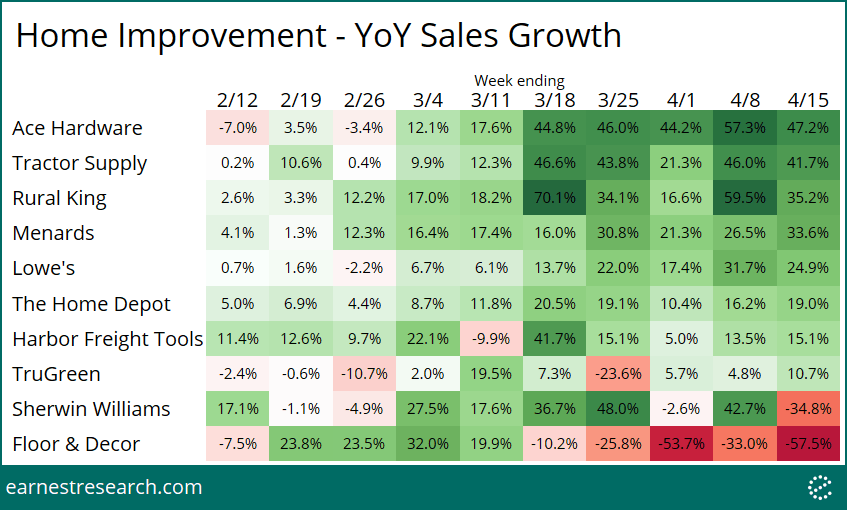

Unlike Apparel and Department Store spending, Home spending continued to accelerate to double-digit growth. (After all, we are all stuck at home). However, the growth is mostly isolated to Home Improvement retailers (now growing 20% YoY), vs. Home Furnishing retailers (now declining 30% YoY).

Home Furnishing

Perhaps the only shining light in the Home Furnishing category is Wayfair. The DTC home retailer has managed to not only protect itself from the fate of its peers, but accelerated to 75% YoY growth in the first week of April. A large portion of Wayfair’s slow down in the most recent week is likely due to Wayfair lapping 2019 WayDay, when its sales grew 150% YoY.

Starting from a far lower base, online sales for Bed Bath & Beyond have actually slightly outpaced Wayfair’s growth over the last several weeks. Crate & Barrel, Pottery Barn, and West Elm’s sales growth also accelerated.

Home Improvement

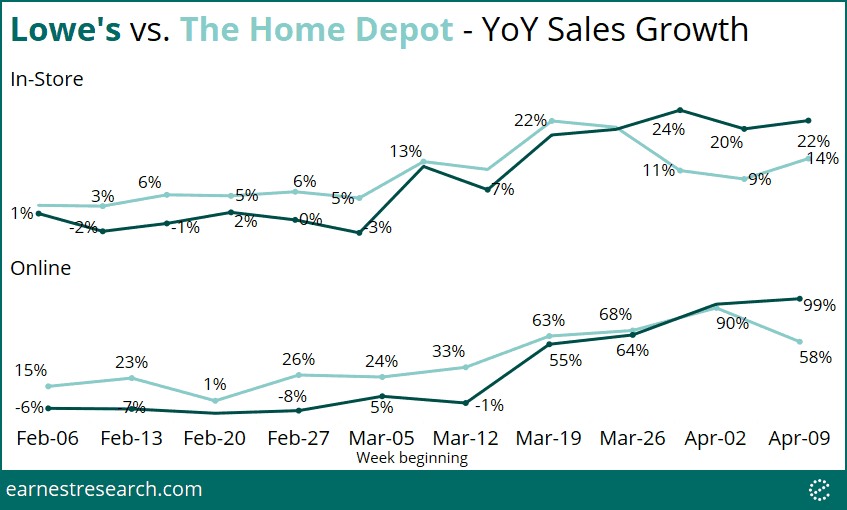

Finally, within Home Improvement, we saw accelerated growth rates across most retailers, including from industry titans Lowe’s and Home Depot.

Interestingly, while both retailers saw their growth rates move in tandem for several weeks, including seeing both of their online channels accelerate to 90% YoY growth, Home Depot’s sales growth slowed down, diverging from Lowe’s’ continued accelerated online growth and its five-week in-store rally of 20% growth.

Notes

Analysis excludes store card activity where the channel (online or in-store) is broken out.

Appendix – List of Merchants

Apparel and Accessories

Activewear: Adidas, Altra, Athleta, Backcountry.com, Bandier, Columbia Sportswear, Fabletics, Fit2Run, Gymshark, Hill City, Hurley, Icebreaker, Ivivva, JackRabbit, L.L. Bean, Lucy Activewear, Lululemon, Nike, North Face, Reebok, SPANX, U.S. Patriot Tactical, Under Armour.

Apparel and Accessories: 6pm.com, & Other Stories, Abercrombie, Aeropostale, America’s Best, American Eagle, Ann Taylor, Anthropologie, Aritzia, Ashley Stewart, Away, Balenciaga, Banana Republic, BCBG, Bespoke Post, Betsey Johnson, Blondo, Bluffworks, Bombas, Bonobos, Boohoo, Brandy Melville, Brian Atwood, Brooks Brothers, Burberry, BVLGARI, Calvin Klein, Cato, Chanel, Charming Charlie, Chico’s, Chubbies Shorts, Citi Trends, Club Monaco, Coach, Cole Haan, Cos, Cotton On, Cupshe, DAILYLOOK, Dior, Dressbarn, Eagle Creek, Eddie Bauer, EVEREVE, Everlane, Express, Fanatics, Farfetch, Fashion Nova, Ferragamo, Fila Outlet, Forward, Francesca’s, Free People, Fruit of the Loom, Gap, Gilt Groupe, Giorgio Armani, GoJane, Gucci, GUESS, Hanes, Hermes, Hollister, Hot Topic, Huckberry, Hugo Boss, Indochino, Intermix, It’s Fashion, J.Crew, J.Jill, Jansport, Jimmy Choo, Jockey, Jos. A. Bank, Joseph Abboud, JustFab, Justice, K&G Fashion Superstore, Kate Spade, Kate Spade, Kipling, Kit and Ace, Lands’ End, Lee Jeans, Levi’s, Lids, Lilly Pulitzer, Loft, Louis Vuitton, LuLaRoe, Lulus, Mack Weldon, Madewell, MATCHESFASHION, Maurices, Men’s Wearhouse, Michael Kors, Missguided, Modcloth, MR PORTER, Mytheresa, Nasty Gal, Nautica, NET-A-PORTER, New York & Company, Nuuly, Of a Kind, Old Navy, Poshmark, Prada, PrettyLittleThing, Printify, Puma, Rainbow, Rainbow Shops, Ralph Lauren, Reef, Rent the Runway, Revolve, Romwe, Rue La La, Rue21, Samsonite, Savers, SAXX Underwear Co., Shopbop, Smartwool, Spencer’s, Stance, Stitch Fix, Suit Supply, Tailgate Clothing, Talbots, THE OUTNET, The RealReal, thredUP, Tilly’s, Tommy Bahama, Tommy Hilfiger, Tory Burch, True Religion, TUMI, Unique, Urban Outfitters, Value Village, Vera Bradley, Versace, Versona, VF Outlet, Vici, White House Black Market, Williamson-Dickie, Wrangler, YOOX, ZAFUL, Zumiez.

Eyewear: Eye Safety Systems, Eyemart Express, Felix Gray, Glasses.com, GlassesUSA, Ilori, Lenscrafters, Oakley, Oliver Peoples, Pearle Vision, Ray Ban, Sears Optical, Sunglass Hut, Target Optical, Visionworks, Warby Parker.

Fast Fashion: Asos, Charlotte Russe, Forever 21, H&M, Uniqlo, Zara USA.

Footwear: Aldo, Allbirds, Asics, Baskins, Boot Barn, Champs, Converse, Country Outfitter, Crocs, Deckers Generic, Dolce Vita, Drysdales, DSW, Eastbay, Famous Footwear, Final-Score, Finish Line, Foot Locker, Footaction, Hoka, Hush Puppies, Johnston & Murphy, Journeys, Keds, Lone Star Western & Casual, M. Gemi, Merrell, NOBULL, Pacific Sunwear, Payless ShoeSource, Rothy’s, Sanuk, Saucony, Sheplers, Shoe Carnival, ShoeBuy, ShoeDazzle, Six:02, Skechers USA, Steve Madden, StockX, Stride Rite, Stuart Weitzman, Superga, Tamara Mellon, Tecovas, Teva, Thursday Boot Co., Timberland, TOMS, Ugg, Vans, VKTRY, Wolverine World Wide, Wood’s Boots, Zappos.

Intimate Apparel: 2UNDR, Adore Me, Aerie, Bare Necessities, Duluth Trading Company, Maidenform, MeUndies, Soma, ThirdLove, Tommy John, True & Co, Victoria’s Secret, Wacoal, Yandy.

Jewelry and Watches: AUrate New York, Barclay Jewelers, Ben Bridge, Betteridge, Blue Nile, Cartier, Claire’s, Dakota Watch, David Yurman, Fossil, Helzberg Diamonds, Icing, James Allen, Jared, Jomashop, JTV, Kay Jewelers, Kendra Scott Design, Littman Jewelers, London Jewelers, NIQUEA.D, Omega, Pandora Jewelry, Pura Vida Bracelets, Qalo, Reeds Jewelers, Rocksbox, Shinola, Sterling Regional, Swatch, Tiffany & Co., Timex, Tourbillon, Tourneau, Watch Station.

Plus Size: Bargain Catalog Outlet, Casual Male XL, Catherines, Destination XL, Ellos, Fashion to Figure, Fullbeauty.com, Jessica London, King Size, Lane Bryant, Roaman’s, Rochester Clothing, Swimsuits For All, Torrid, Woman Within.

Specialty Apparel: Alton Lane, BHLDN, Brideside, Canada Goose, David’s Bridal, Dolls Kill, Fame & Partners, FIGS, Generation Tux, Goodwill, LA Police Gear, Mayvenn, Moncler, OROS Apparel, Patriot Outfitters, Scrubs, Summersalt, The Black Tux, Uniform Advantage.

Department Stores

Luxury Department Stores: Bergdorf Goodman, Bloomingdale’s, cusp, Lord & Taylor, Neiman Marcus, Nordstrom Full Price, Nordstrom Store Card, Saks Fifth Avenue.

Mid-Price Department Stores: Bealls, Belk, Bergner’s, Bon-Ton, Boston Store, Carson’s, Century 21, Dillard’s, Elder-Beerman, Goody’s, Herberger’s, J.C. Penney, Kohl’s, Macy’s, Palais Royal, Peebles, Sears, Stage Stores, Younkers.

Off-Price Department Stores: Burlington Stores, Dd’s Discounts, Last Call, Marshalls, Nordstrom Off Price, Off/Aisle, Ross Stores, Saks Off 5th, Sierra Trading Post, Stein Mart, T.J. Maxx.

Home

Home Furnishings: Aaron Brothers, American Frame, American Signature, Arhaus, Art Van, Artifact Uprising, Ashley Furniture, At Home, Bed Bath & Beyond, Bedjet, Bob’s Discount Furniture, Brylane Home, CanvasPop, Casper, CB2, Chef Central, Chefs Catalog, Cooking.com, Crane & Canopy, Crate & Barrel, Decorist, Everything But The House, Framebridge, GhostBed, Gordmans, Grove Collaborative, Havertys, Helix Sleep, Home Reserve, HomeGoods, HomeSense, Horchow, Houzz, Kirkland’s, La-Z-Boy (LZB), Leesa, Mark and Graham, Mattress Firm, MightyNest, Mitchell Gold + Bob Williams, One Kings Lane, Personalization Mall, Pier 1 Imports, Pottery Barn, Purple, Raymour & Flanigan, Rejuvenation, Restoration Hardware, Rooms To Go, Rove Concepts, Ruggable, Saatva, Sealy Cocoon, Sleep Number, Sleep Train, Sleepy’s, Sur La Table, Tempur-Pedic, Terrain, The Citizenry, The Container Store, The RoomPlace, The Sill, Tuesday Morning, Tuft & Needle, Value City, Waterworks, Wayfair, West Elm, Williams-Sonoma, World Market.

Home Improvement: Abacus Plumbing, Ace Hardware, All Around Landscape Supply, All Pro Horticulture, Allied Building Products, Alterra, American Builders, Angelo’s Supply, Aspen Valley Landscape, ATGStores.com, Atlantic Irrigation, Auto-Rain Supply, Bissett Nursery, Blinds.com, Boston Irrigation Supply, Build.com, C&C Sand and Stone, Calloway’s Nursery, Care.com, Central Pump and Supply, Comex, Cutting Edge, Do it Best, Fastenal, FilterEasy, Floor & Decor, Green Resource, Harbor Freight Tools, Harmony Gardens, HD Supply, Home Decorators, Homee, Hydro-Scape Products, KeyMe, Kirkwood Material Supply, Landscape Express, Landscaper’s Choice, LawnStarter, Leslie’s Swimming Pool Supplies, Lowe’s, Marshall Stone, Menards, Northwest Exterminating, Northwest Marble, Orchard Supply Hardware, Orkin Pest Control, Plowz & Mowz, Rural King, Shemin Nurseries, Sherwin Williams, SiteOne Landscape Supply, Solar City, South Coast Supply, Southwood Valley Turf, Stanley Black & Decker, Stone Center, Sunrun, The Home Depot, Thecompanystore.com, Tractor Supply, TrueValue, TruGreen, Village Nurseries, Zoro Tools.