Leaving Las Vegas: Foot Traffic on and off the Strip

After two months of closure from coronavirus concerns, Las Vegas officially opened back up on June 4. Using Earnest Foot Traffic data, we examined the first two weeks since the city’s reopening to better understand its road to recovery, regional dynamics, and local vs. tourist behavior.

Key Takeaways

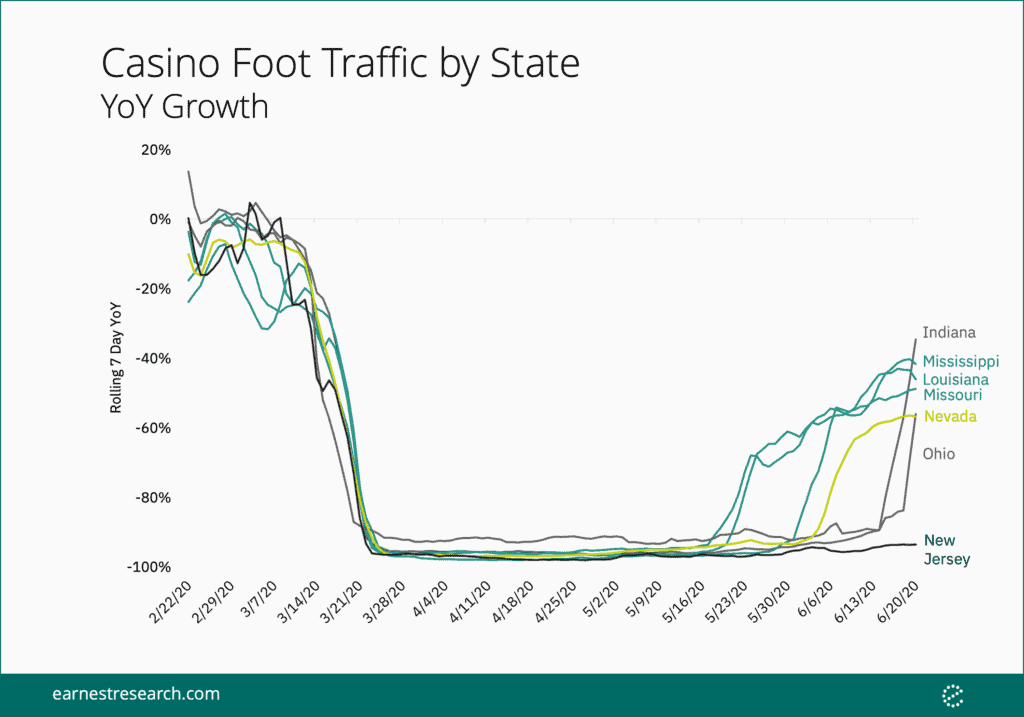

- In aggregate, foot traffic to Nevada casinos remains down 60% YoY, and while still improving, the data is seeing growth plateau.

- Smaller regional casinos have nearly bounced back, while the larger resorts on the Strip are recovering much more slowly.

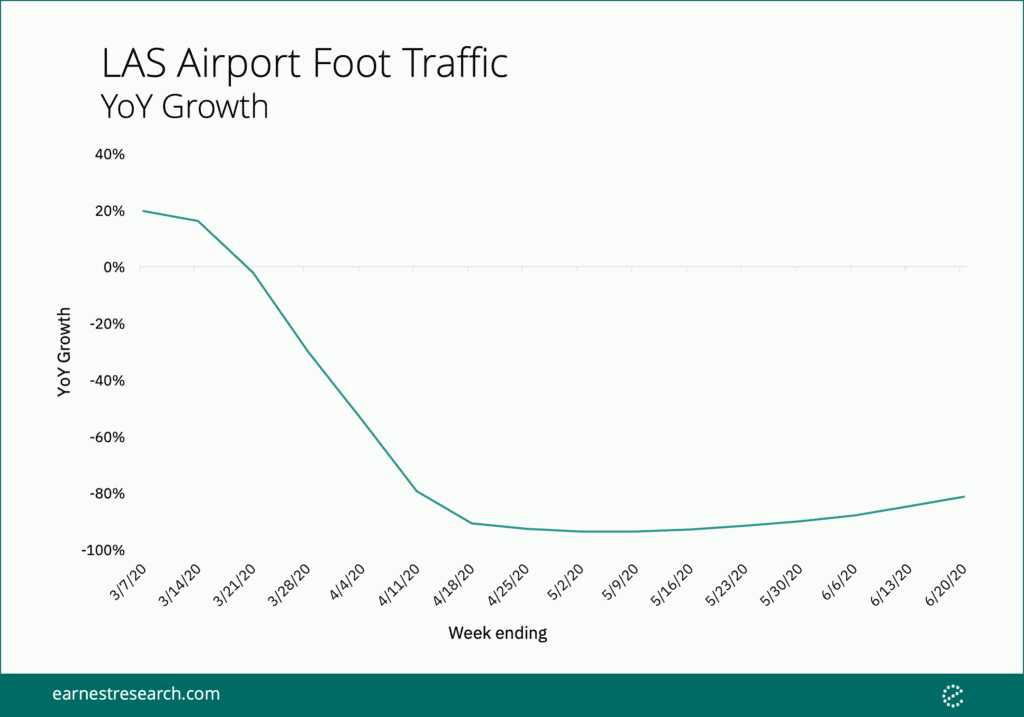

- The implication is that locals are visiting casinos, but few out-of-towners are travelling to Vegas to visit and stay at the larger casino brands. This is further corroborated by LAS Airport foot traffic, which while recovering modestly, remains down 80%+ YoY.

Nevada casinos are still down, but steadily recovering

In aggregate, foot traffic to Nevada casinos remains down 60% YoY, and while still improving, foot traffic growth has plateaued. Below we highlight Nevada’s performance coming out of lockdown relative to other states with large gaming sectors. Notably Mississippi, Louisiana, and Missouri show similar trends to Nevada while Indiana and Ohio reopened later and are growing more quickly. Meanwhile, New Jersey remains completely locked down.

Local casinos are bouncing back while major resorts continue to struggle

Diving deeper into the casino data, we see a big divide between the marquee casinos on the Strip vs. more rural casinos on the outskirts of Vegas and in smaller cities in Nevada like Laughlin and Reno. Earnest analyzed casino data by Nevada zip code, segmented by The Strip vs. local casinos.

This can be observed below, where the main Vegas Strip remains down 60%+(zip code 89109), while the zip codes bouncing back the fastest— 89121, 89451, and 89029—are all outside Vegas. Given its reliance on tourism and travel, the Strip is still down meaningfully while local casinos have snapped back quickly. This suggests that local consumers may not shy away from visiting casinos and spending time there, but concerns remain for tourists who frequented the Strip as a destination spot.

Airport traffic tells the same story

The idea that locals are driving the casino recovery is largely corroborated by LAS Airport foot traffic, which while recovering modestly, remains down 80%+ YoY. While we see a trend of gradual improvement, it remains to be seen how this trajectory will fare with new surges in coronavirus and potential restrictions on interstate travel.

Our data is based on observing traffic to the gaming brands below:

Brand:

Caesars Entertainment

Boyd Gaming

Penn National Gaming

Eldorado Resorts

Pinnacle Entertainment

MGM Resorts

Golden Entertainment

Tropicana Entertainment

Full House Resorts

Churchill Downs

Monarch Casino & Resort

Wynn Resorts

Las Vegas Sands

Red Rock Resorts

Empire Resorts

Casinos Observed:

26

22

21

17

14

11

7

5

4

4

2

1

1

1

1