Weekdays are the New Weekend

Measuring Changing Consumer Habits with Daypart Data

With the recent launch of Earnest Foot Traffic’s new daypart product, we analyzed consumer behavior utilizing hourly visitation data. Daypart data illustrates the distribution of visits by hour to a merchant, how that distribution has changed over time, and how it compares to other merchants. This analysis focuses on COVID disruptions to restaurants, a sector where daypart data is particularly relevant.

Key Takeaways:

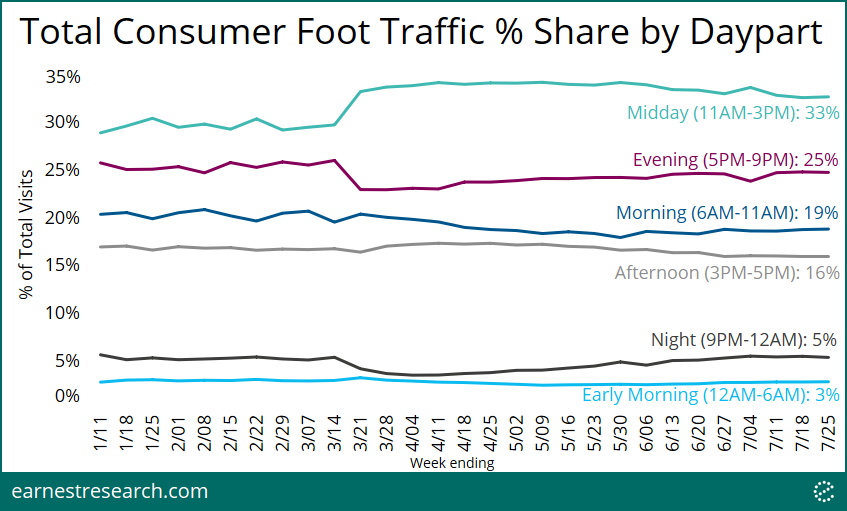

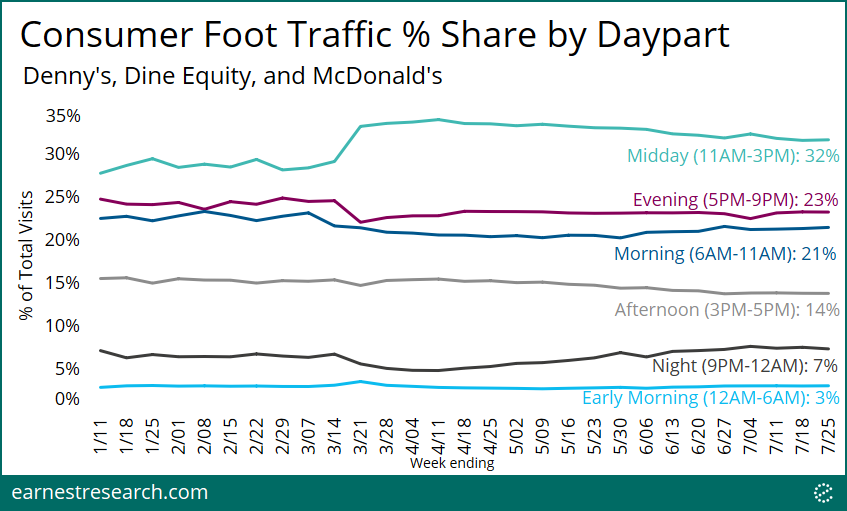

- Shift to Middle of the Day. The overall distribution of consumer traffic (inclusive of all sectors) during COVID has seen morning and evening activity slow, picking up by midday. Midday (11am-3pm) share of traffic has increased about ~400 bps to 33% since the middle of March.

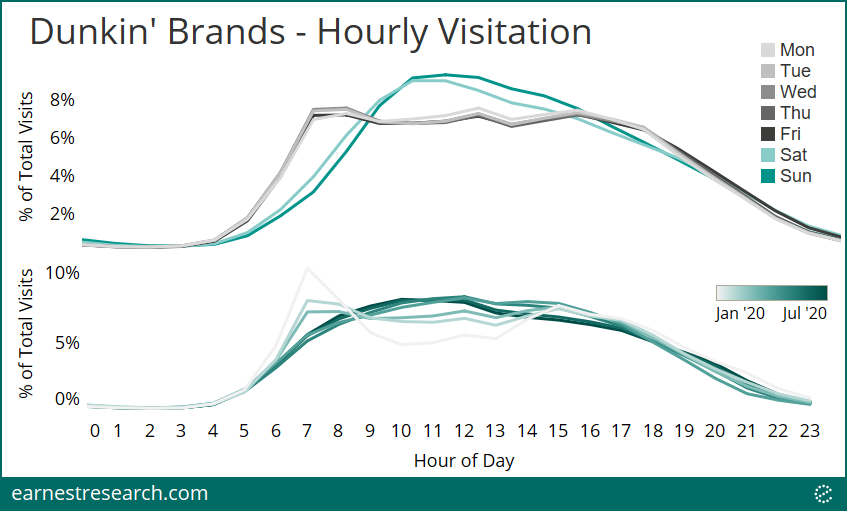

- Weekday Behavior Now Resembles Weekends. As a result of this shift to the middle of the day, weekday visits to restaurants now more closely align with visitation patterns previously seen during weekends.

- Less Breakfast, More Lunch. The disruption in consumers’ morning routines has resulted in a shift away from breakfast towards lunch. The data exhibits this for Starbucks, Dunkin’, McDonald’s, and other QSR concepts.

- Disruption Has Shifted Share Among Competitors. McDonald’s stands out as taking share across both breakfast and lunch, notably taking breakfast share from Starbucks, and lunchtime share from both Starbucks and Chipotle.

Broad Consumer Shift to Midday Shopping and Eating

Across our entire foot traffic data set, we saw an uptick in the midday (11am-3pm) share of traffic, increasing about 400bps to 33% since the middle of March. This has come largely at the expense of evening (5pm-9pm) and morning (6am-11am) traffic.

Weekdays Now Resemble Weekend Patterns

For restaurants in particular, because of COVID’s shift to more midday traffic, weekdays are now more closely aligned with weekend visitation patterns. For example, Dunkin’ Brands typically sees peaks in the morning (around 7-8am) and then later (around 4pm) on weekdays. On weekends, it’s a smoother curve peaking around 1pm. The chart below shows how these distinct weekday peaks are morphing more closely into weekend visitation patterns (lighter going to darker). The company specifically acknowledged this on its 1Q20 earnings call:

“With customers’ daily morning routines disrupted, we are seeing a shift in sales across dayparts. Sales volumes in the early morning are down but have picked up from 10:00 a.m. to 2:00 p.m. as people venture out for a break.”

Dunkin Brands 1Q20

Domino’s Pizza and Restaurant Brands also acknowledged something similar on their 1Q20 calls, implying that weekdays now more closely resemble weekends.

“Weekday sales have been significantly up, while weekends have generally been more pressured. Lunch and dinner dayparts are up.”

Domino’s 1Q20

“Whereas we would typically see sales pick up on Thursday and continue at a higher clip through the weekend, we now see stronger performance on weekdays.”

Restaurant Brands International 1Q20

Less Breakfast, More Lunch

Given the broad shifts in consumer behavior to midday, we analyzed restaurants that offer breakfast and would be most sensitive to this shift. Looking at a selection of casual and fast food restaurants, this is indeed what the data suggests. Denny’s, Dine Equity (owner of IHOP and Applebee’s), and McDonald’s are together showing a sharp increase in lunchtime traffic, offset by decreases in breakfast and dinner traffic. Dine Equity mentioned this specifically on their 2Q20 earnings call, noting:

“Breakfast was approximately 200 basis points behind lunch and dinner, respectively. Mainly due to statewide mandates to remain at home and rising unemployment, there were essentially less people stopping for breakfast on their way to work.”

Dine Equity 2Q20

Disruption Has Shifted Share Among Competitors

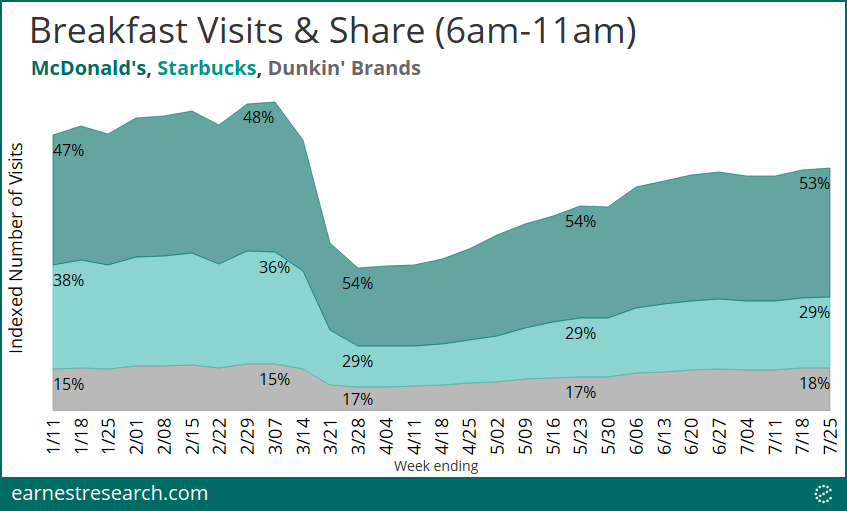

While the morning daypart for restaurants is down overall from pre-pandemic levels, the disruption has created opportunities for share shifts. For, example, comparing breakfast times at Dunkin’, Starbucks, and McDonald’s shows that while all three are down on an absolute basis, Starbucks has been hit particularly hard.

When looking on a share basis, we see McDonald’s, and to a lesser extent Dunkin, more or less steadily taking breakfast share from Starbucks. This was recently acknowledged by McDonald’s on their 2Q20 call, noting:

“If you look at how we’ve performed through the pandemic, even though breakfast is certainly in the U.S. still the most challenged daypart, we’re actually growing our breakfast share.”

MCD 2Q20

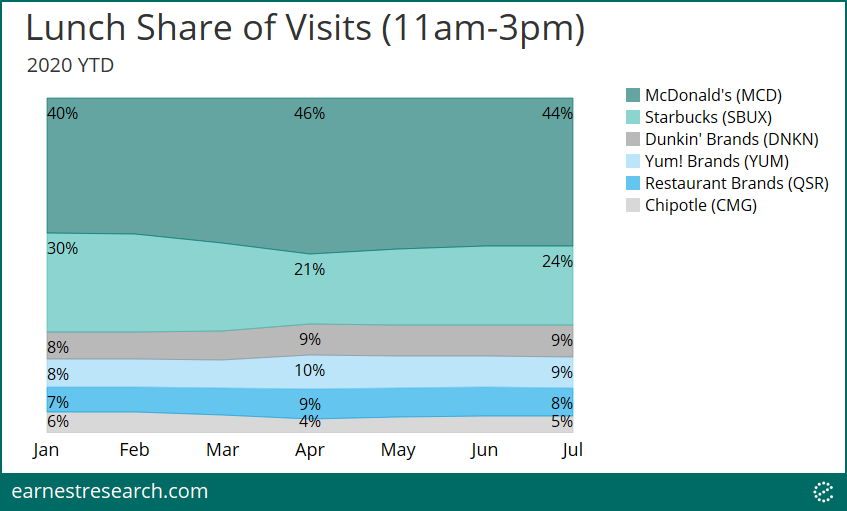

McDonald’s Also Takes Share of Midday / Lunch

Comparing key lunchtime competitors Chipotle, Dunkin, Burger King (Restaurant Brands), McDonald’s, Starbucks, and Taco Bell (YUM) shows McDonald’s as the largest share gainer, gaining about 400 bps of share among these competitors, landing at roughly 44% post-pandemic. The share was taken from Chipotle and Starbucks, while Burger King and Taco Bell held steady. Interestingly, July’s behavior looks to have begun a path towards pre-pandemic levels, at least when compared to the pandemic height in April.