Home and Car Sales in Quarantine

Earnest continues to track the impact of the coronavirus epidemic on consumer spending. This week, we drill into insights for the homebuilding industry through our unique proprietary dataset collected from the web, tracking over 1,200 communities and spanning 30 states. We also investigate recent trends in used car sales observed in our web-sourced data on auto-dealers.

New Home Sales Hit The Wall

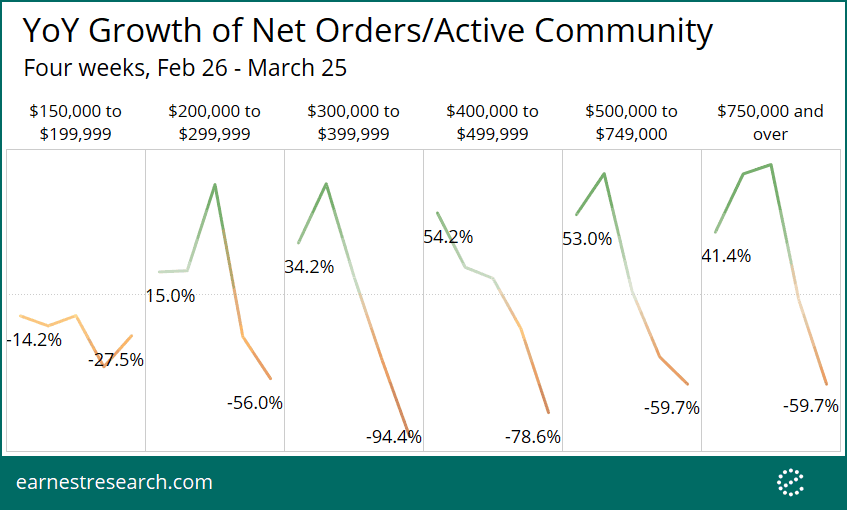

After a strong start of the year, the U.S. homebuilding industry is being hammered in the context of the COVID-19 outbreak. Net Orders per Community were down 33% and 67% YoY for the last two weeks ending March 18 and March 25, respectively. Although the contraction impacts all segments, entry-level homes, which are down 28-56% YoY for the week ending March 25, are holding up better than higher price categories, down 60-90% YoY.

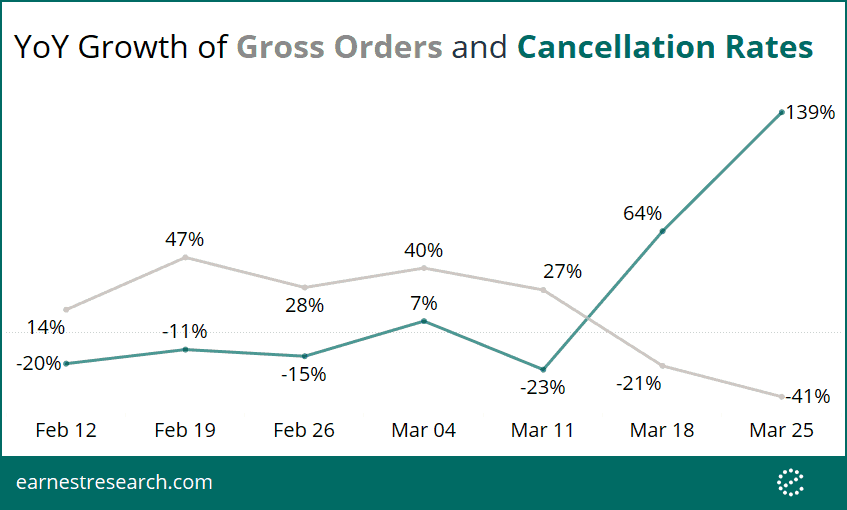

The sharp decline is driven by a combination of decreasing gross orders, down 41% YoY for the week ending March 25, and soaring cancellation rates on existing contracts, up 139% YoY.

Used Car Sales Stall

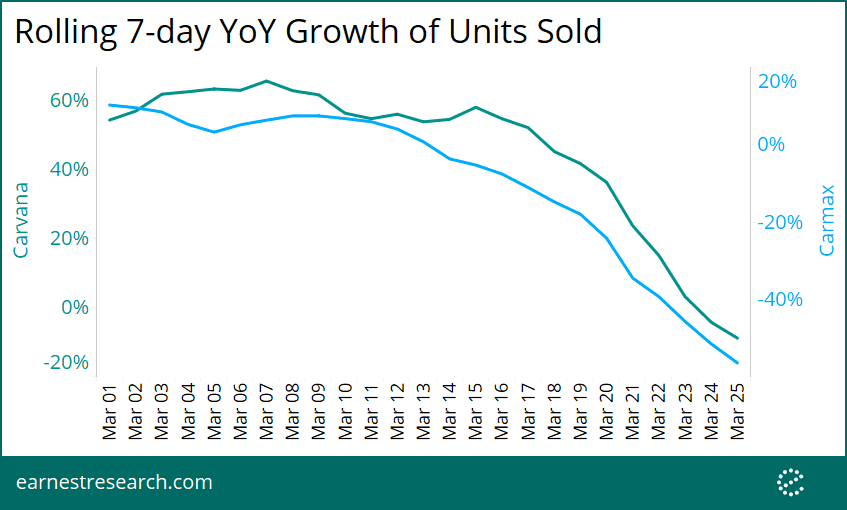

U.S. car dealers hit the brakes with used car sales decelerating double-digits both at CarMax and Carvana over the last two weeks through March 25. For the week ending March 18, CarMax weekly units sold decelerated to -14.7% YoY vs. +6.0% the week prior, mostly driven by the first wave of store closures in key markets such as California. While Carvana’s digital model initially seemed robust to the mandated social distancing efforts, for the week ending March 25, Carvana decelerated more than CarMax, to -8.9% YoY vs +45.1% the week prior. This resulted in both car dealers’ growth dropping ~40% on a 14-day YoY basis and pointing to a fundamental, channel-agnostic, consumer weakness.