From Reopening to Resurgence: Part Two

Earnest continues to monitor the consumer response to the resurgence of coronavirus cases across parts of the U.S. In this refresh, we take a look at spending and foot traffic in the first half of July across states and categories, and drill-down into Restaurant and Home categories in Florida and New York. Additionally, we provide a brief check-in on Amazon’s delayed Prime Day, and review how alcohol sales are performing in light of the resurgence.

Key Takeaways

- Total consumer spending growth looks as it did a month ago, declining 8% in the week ending July 13th, up from its 33% declines in late March, but still roughly flat to the ~6 to 8% declines in mid-June.

- Foot traffic shows signs of plateau as well. Much like the spend data, in-person consumer activity as measured through foot traffic data has largely leveled off at the levels we saw in June, roughly -25% on a national basis.

- Looking across categories, there does not appear to be a renewed lockdown-driven uptick in spending heading into July. If anything, categories that require a reopened economy (Restaurants, Apparel, etc.) continue to climb back up to revived levels.

- Despite the vast differences in daily new Covid cases in Florida vs. New York, Florida continues to outperform New York in Restaurant spending, and Home continues to grow strong in both states.

- Amazon’s delayed Prime Day this year can be understood in the following way: they’ve actually been enjoying Prime Day sales levels every week since April.

- The resurgence of the pandemic is, perhaps appropriately, keeping alcohol sales elevated into July, led by online-only suppliers Drizly and Wine.com

Stuck in June

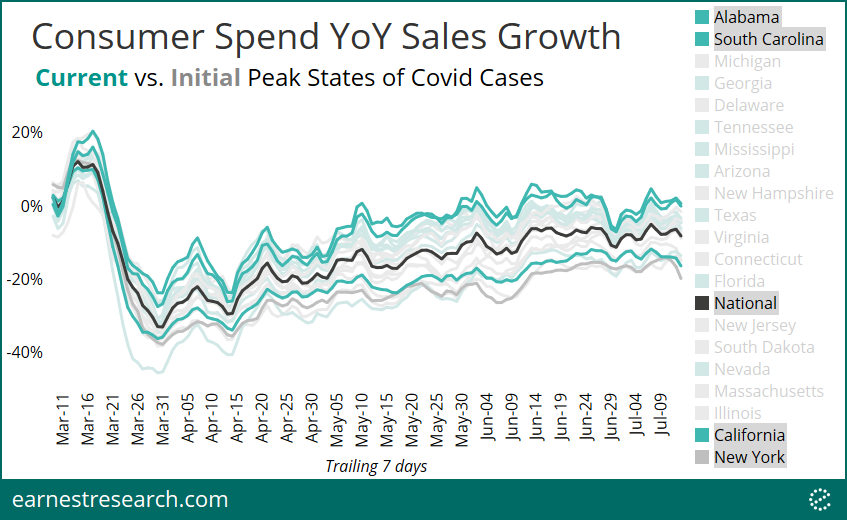

Growth looks as it did a month ago. Nationally, total consumer spending growth declined 8% in the week ending July 13th, up from its 33% declines in late March, roughly flat to the ~6 to 8% declines observed in mid-June. Of the twenty states analyzed (ten that saw peak cases initially in April/May; ten that are seeing peak cases now*), those currently experiencing peak Covid cases continue to broadly outperform (except for California and Nevada). However, almost all states are exhibiting growth rates equal to or lower than where they were in mid-June.

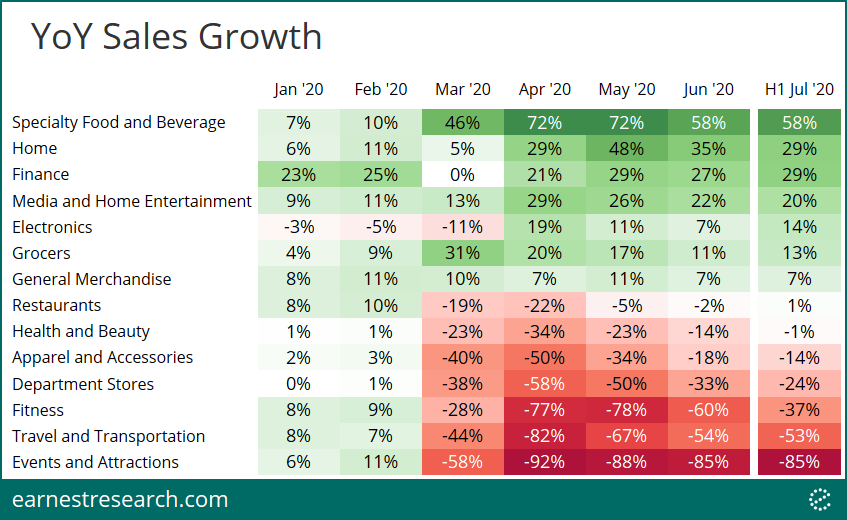

Looking into select categories**, (and as we touched on in part one) there does not appear to be a renewed lockdown-driven uptick in spending heading into July. If anything, categories that require a reopened economy, such as Restaurants, Health & Beauty, Apparel, Fitness and Department Stores, continued to climb back up to revived levels, although Travel and Events remain depressed.

Foot Traffic Showing Signs of Plateau as New Hot Spots Drag on Growth

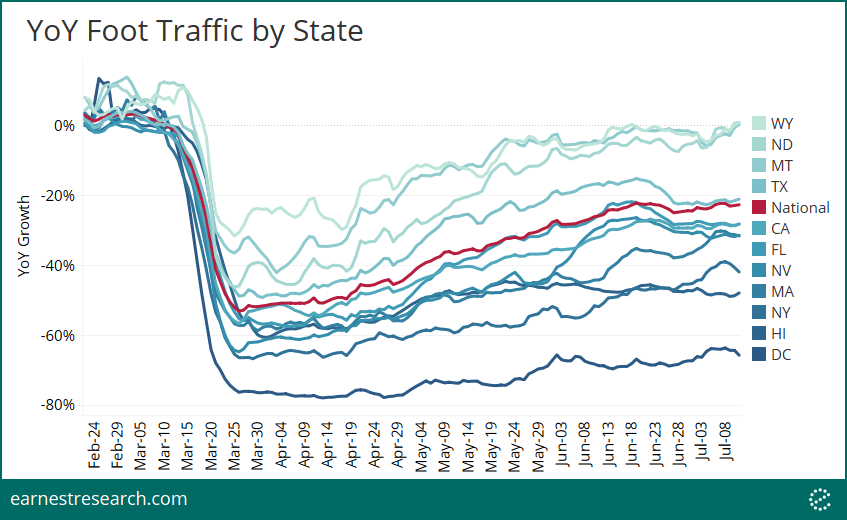

In-person consumer activity as measured through Earnest foot traffic data has largely leveled off at levels we saw in June, roughly -25% on a national basis. This includes all sectors that we observe, including retail, dining, and entertainment. While the fastest growing states (Wyoming, North Dakota, and Montana) continue to recover, and actually just turned positive on the year, Texas, Florida, California, and Nevada started to recede in July. The net result is stagnating foot traffic growth nationally.

Covid Poles: New York and Florida

Drilling down into two states that represent the initial and current poles of the pandemic: New York and Florida. Both states saw the highest number of daily new cases peak relative to other states: New York on April 4th with over 12K cases, and Florida on July 12th with over 15K cases.

Are Floridians behaving like New Yorkers were in March?

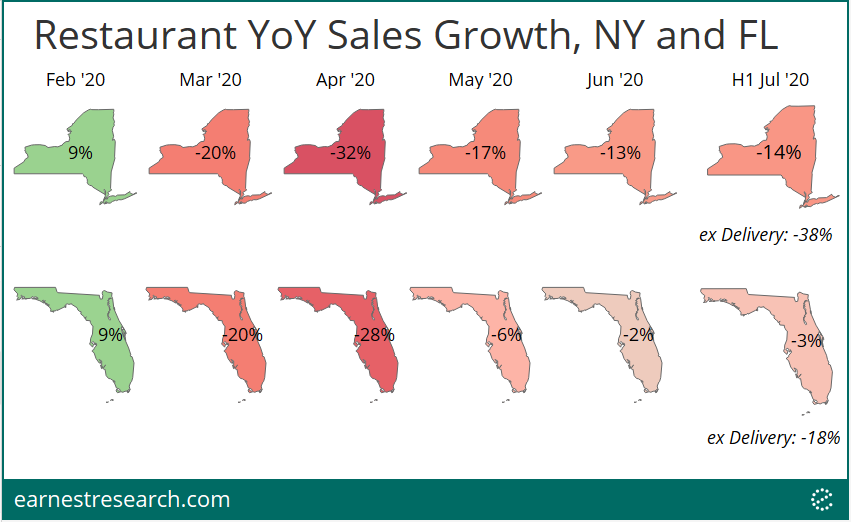

Focusing on Restaurants, after identical performance in February, March, and April, New York is recovering at a relatively slow pace, currently exhibiting mid-teens declines (NY’s stay-at-home order expired on 5/28). Florida, on the other hand, has been reviving fairly quickly, currently exhibiting low single-digit declines (FL’s stay-at-home order expired on 5/4, but is now reversing parts of its reopening, including reinstating some dining-in restrictions in certain cities).

We note that delivery aggregators are materially helping restaurants recover in both states; July’s decline would have been ~15 to 25 points lower if not for delivery.

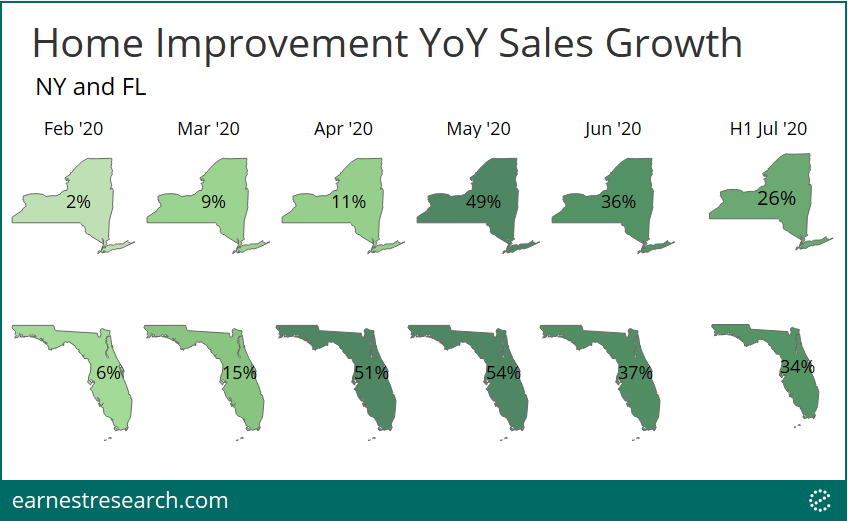

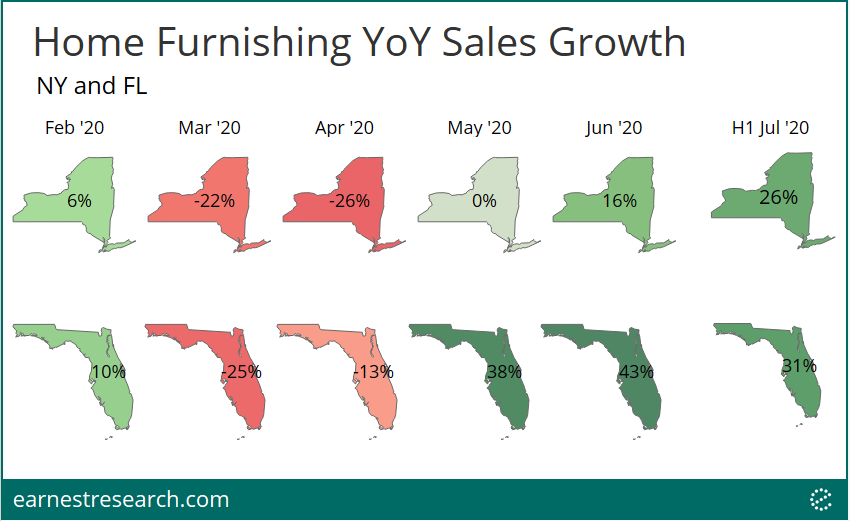

Looking at Home, as we have written about previously, while the sector was poised to benefit from the pandemic (after all, we were all stuck at home), it manifested quite differently across Home Improvement vs. Home Furnishing subcategories: the former steadily accelerated throughout the lockdown, peaked in May, and is growing strong into July; the latter fell throughout the lockdown but meaningfully accelerated afterward.

In both cases, Florida outperformed New York, before, during, and after the lockdown, particularly with Home Improvement in April and with Home Furnishing in May. And despite the vast differences in the number of new Covid cases, July’s performance (in both subcategories) remains strong at ~30% YoY in both states.

No [Need For] Prime Day

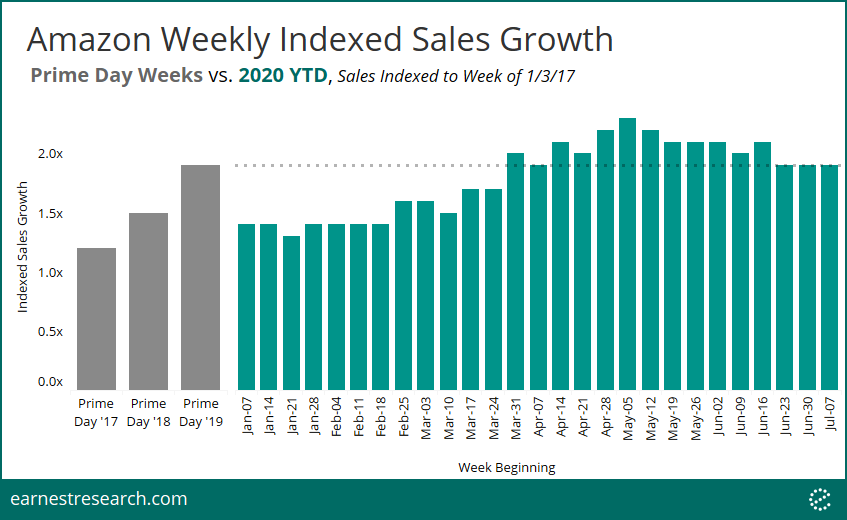

Amazon says it will be delaying Prime Day this year to an unspecified later date due to the pandemic. However, they’ve actually been enjoying Prime Day sales levels every week since April.

Relative to the first week of January 2017 sales levels, the week of Prime Day saw sales grow 1.5x in 2018, and just under 2.0x in 2019. With the lockdown-driven ecommerce uptick this year, Amazon saw the same 1.9x – 2.3x growth since the beginning of April, and has continued to see these elevated sales levels heading into July.

Alcohol Surge

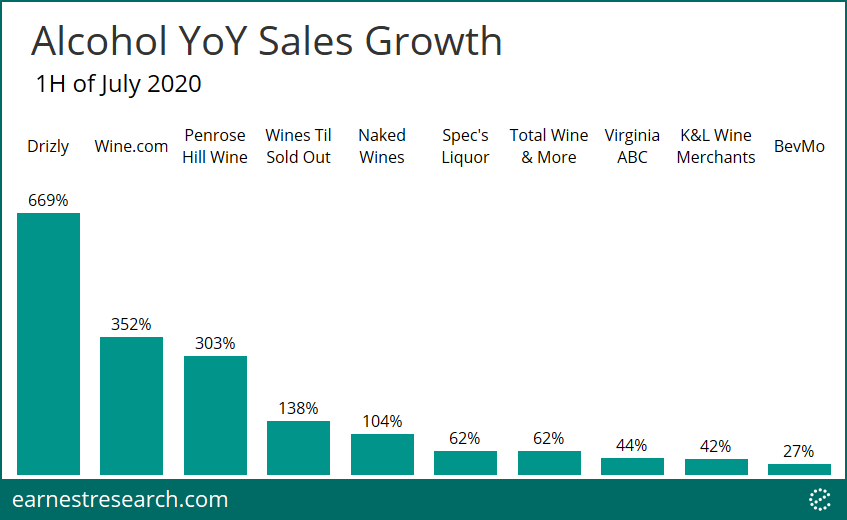

The resurgence of the pandemic is, perhaps appropriately, keeping alcohol sales elevated. Looking at the top ten alcohol-selling merchants under coverage, alcohol sales remain strong (healthy?) in the first half of July, led primarily by online-only alcohol suppliers.

Notes

*Data on Covid cases by state were sourced from this NY Times piece.

**Earnest coverage recently launched an improved taxonomy of categories and subcategories, which our analysis here utilizes but which will not exactly align with prior categorizations of earlier Insight posts.

Full coverage list available upon request.