Dining In, Still Some Reservations

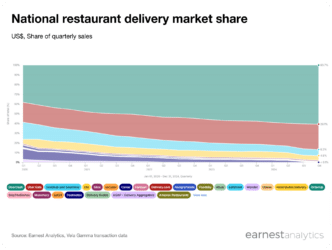

With just under half the US population inoculated as of May 17th, we looked at the state of food spending across the US, particularly across Restaurant Delivery Aggregators, Online Grocers, Indoor Dining and Supermarket In-Store sales*. (See our prior analysis in this series here.)

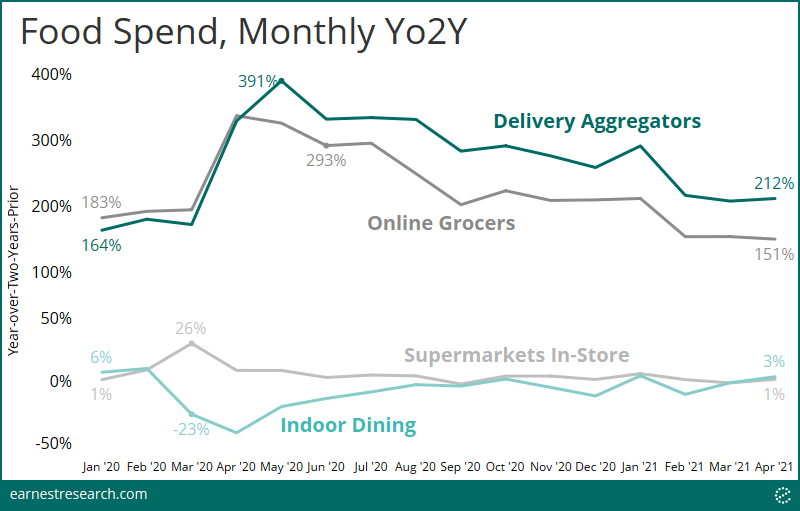

Note that parts of this analysis calculate growth relative to two years prior – written throughout as “Yo2Y” – in order to benchmark current performance against “normal” spend levels.

Key Takeaways

- Delivery Aggregators and Online Grocery orders continue to grow 150% – 200%+ relative to the same period two years prior, though still not quite in-line with pre-COVID levels: the former at higher levels, the latter at lower levels.

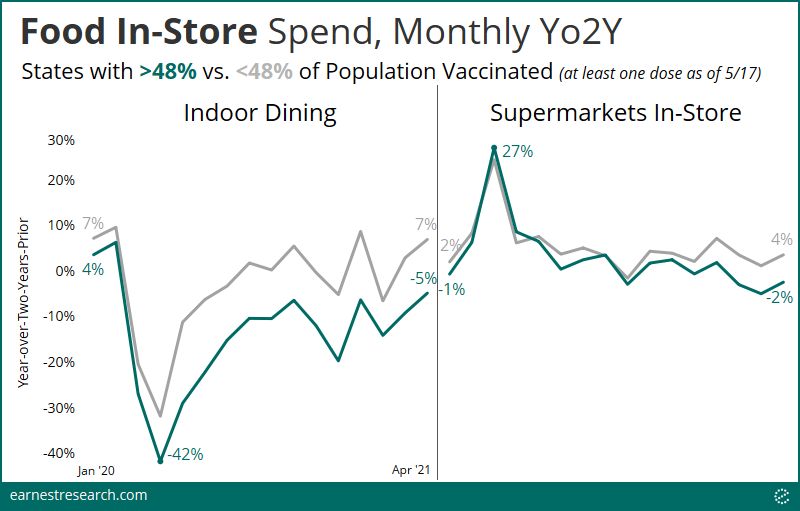

- More vaccinated states still seem hesitant about dining-in with growth for dining languishing at -5% Yo2Y, while less vaccinated states have reached pre-COVID levels at 7% Yo2Y.

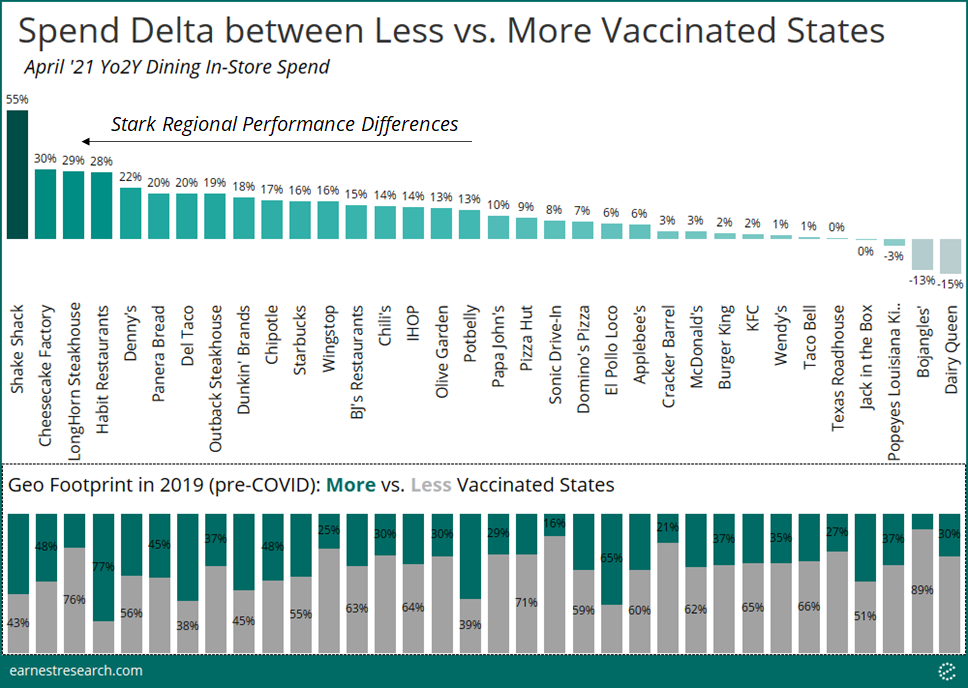

- This current level of dining-in outperformance in the less vaccinated states varies significantly by brand: Shake Shack, Cheesecake Factory, and Habit, saw 25+ points of outperformance, Dunkin, Chipotle, and Starbucks saw 15+ points, and the national QSR brands (McDonald’s, Burger King, KFC, etc.) saw minimal outperformance at under 5 points.

Food for Thought

Are increased vaccination rates changing consumer eating behaviors? Earnest data shows that spending on Delivery Aggregators (DoorDash, Seamless, etc.) as well as online grocery orders continues to grow 150% – 200%+ relative to the same period two years prior, though importantly still not quite in-line with pre-COVID levels. Delivery Aggregators are growing at accelerated levels relative to pre-COVID, and Online Grocery is growing at decelerated levels. Still, growth rates for both categories have been cut in half compared to the pandemic-driven spikes last year.

Restaurants and supermarkets (excluding delivery) continue to grow in the low-single-digits, closer to pre-COVID levels (nationwide at least). Dining at restaurants, however, is still lagging by a few percentage points, exhibiting -1% and 3% Yo2Y in March and April of this year respectively, in comparison to growth levels of appx. 6% before COVID—suggesting dining nationally has yet to see its anticipated resurgence.

To Dine in or Take Out?

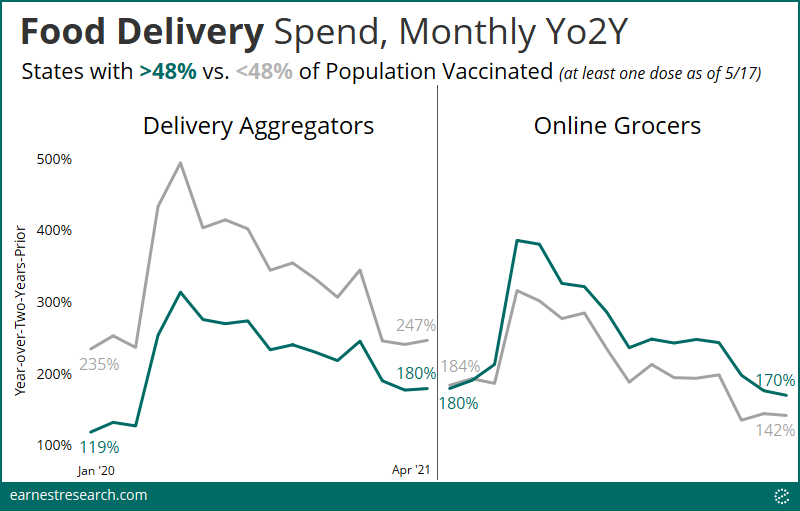

It’s a more complicated picture when looking across different regions.

Delivery Aggregators continue to outperform in the less-vaccinated states (which are also less mature markets for food delivery). Importantly, the more-vaccinated states show much higher spending on food delivery post-COVID compared to before the start of the pandemic.

In more vaccinated states, a hesitancy to return to business as usual shows restaurant dining-in languishing at -5% Yo2Y, while the appetite for indoor dining is back to pre-COVID levels in less vaccinated states, at 7% Yo2Y.

Meanwhile, Online Grocery spend has slowed more drastically in the less vaccinated states, while in-store Supermarket spend has mostly returned to pre-COVID levels, seeing just a few percentage points of divergence across states in recent months.

Regional Preferences

With indoor dining showing material performance differences across states – less vaccinated states are outperforming their more vaccinated counterparts – we bite into our data on some of the largest nationwide chains.

We calculated the spending differences in April’s Yo2Y growth rates between less and more vaccinated states, and displayed the differences in descending order (most stark to least stark). We then quantified the geo-footprint for each of these companies pre-COVID in order to provide context on how meaningful these differences are.

With a significant portion of their pre-COVID footprint in more vaccinated (i.e. lower-performing) states, Shake Shack, Cheesecake Factory, Habit, Denny’s, Panera, and Del Taco saw 20+ points of outperformance across less vaccinated states. Dunkin, Chipotle, Starbucks, and Potbelly, among others, saw 10 to 20 points of outperformance. Several of the national QSR brands, such as McDonald’s, Burger King, KFC, Wendy’s, and Taco Bell saw minimal performance differences at under 5 points. Meanwhile Jack and Popeyes actually saw a few points of underperformance in the less vaccinated states.

With the CDC recently announcing that vaccinated people can stop wearing masks outdoors and in many indoor establishments, will consumers feel more comfortable resuming their daily lives or will we see a prolongment of COVID consumer trends?

Notes

Statistics on state vaccination rollouts are sourced from this NY Times analysis, which sources its data from the Centers for Disease Control and Prevention.

*Indoor dining denotes purchases made on premises, which may include takeout orders. Supermarket in-store denotes all supermarket purchases made on premises.