Coronavirus is Changing How We Spend Money. Part 3.

Earnest continues to track the impact of the coronavirus on consumer spending. This week, we take a closer look at food buying behavior across Grocers, Restaurants and Delivery. We also highlight a few merchants that are exhibiting rapidly accelerating ‘hockey-stick’ growth and provide a brief check-in on Amazon and Walmart performance.

(Missed Part 1 and Part 2? See here and here.)

The Coronavirus Menu

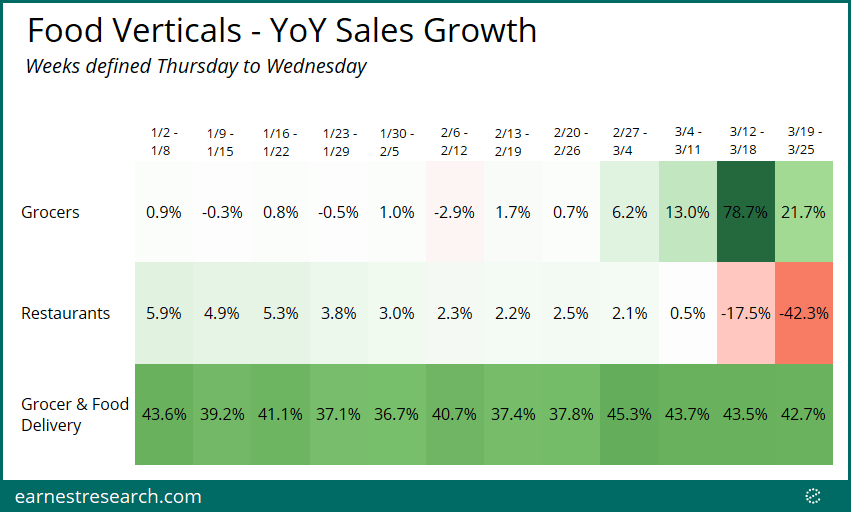

Food buying has never seen such an elaborate menu (of growth). Grocers have seen four weeks of sales growth peaking at an astounding 79% YoY growth in the week ending March 18th. These are significant accelerations from the industry’s zero growth profile year-to-date. Restaurants are declining over 40% YoY from their usual low single-digit growth, and Delivery has slightly accelerated into the most recent weeks.

Coronavirus Comfort Food: Pizza, Wings, and Fried Chicken Sandwiches

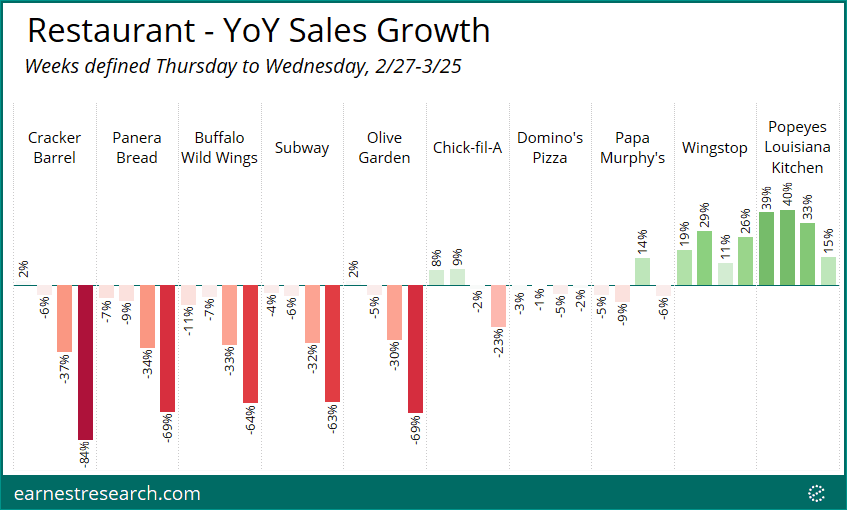

Within Restaurants’ dramatic 40% slowdown, likely a function of both social distancing and store closures, some restaurants are taking it harder than others. Cracker Barrel, Panera, Buffalo Wild Wings, Subway, and Olive Garden have all seen their growth slow more than the rest of the industry.

On the other hand, pizza never goes out of style as Domino’s only decelerated a few points. Wingstop is still showing 20%+ growth and Popeye’s chicken craze, although diminishing, still appears very much alive, showing strong growth over the last four weeks. Lastly, niche pizza brand Papa Murphy’s is of the rare bunch that saw its sales growth accelerate briefly two weeks ago, perhaps a result of its take-home business model, but has not seen this growth repeat in the most recent week.

A Maze of Food Delivery

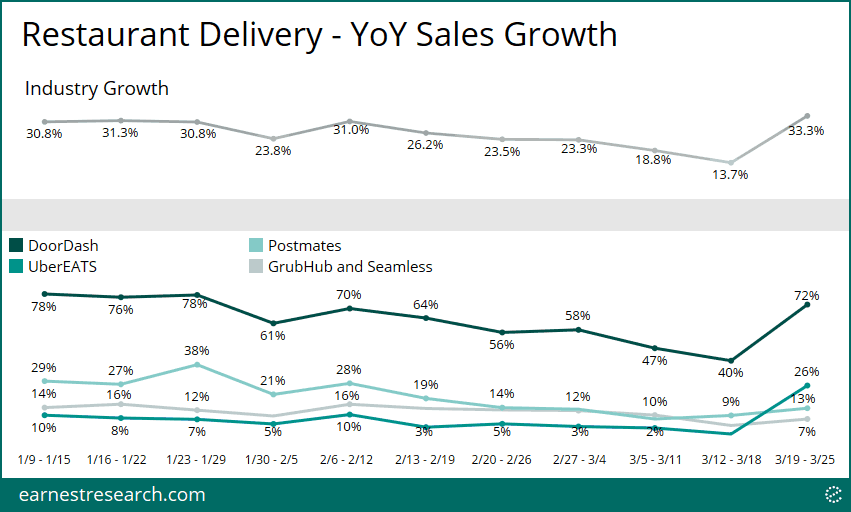

Within delivery, there are some interesting trends emerging.

- After a ~10% slowdown in growth to 14% YoY in the middle of March, Restaurant Delivery Aggregators have popped to over 30% YoY in the most recent week. Doordash and UberEATS appear to be the primary beneficiaries.

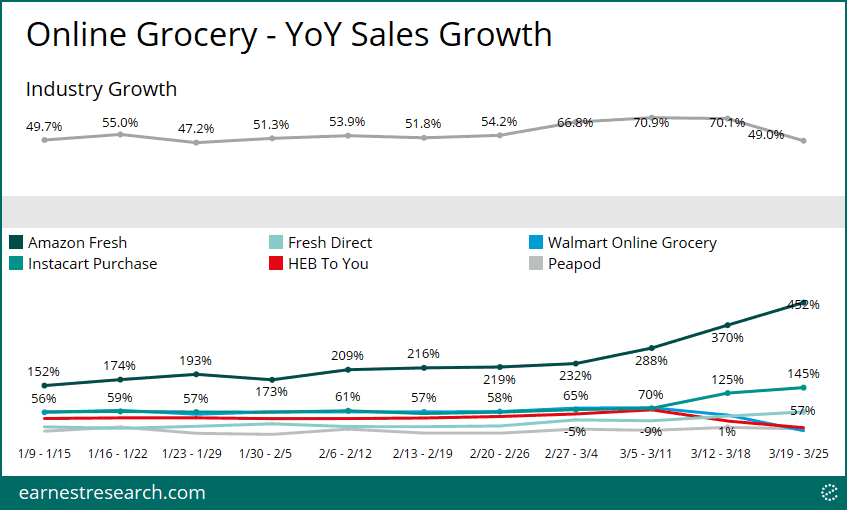

- Online Grocery is seeing diverging trends. Amazon Fresh, Instacart, and Fresh Direct continue to accelerate in the most recent weeks. However, Walmart Online Grocery and HEB-To-You, after accelerating for a few weeks in mid-March, are now sharply decelerating.

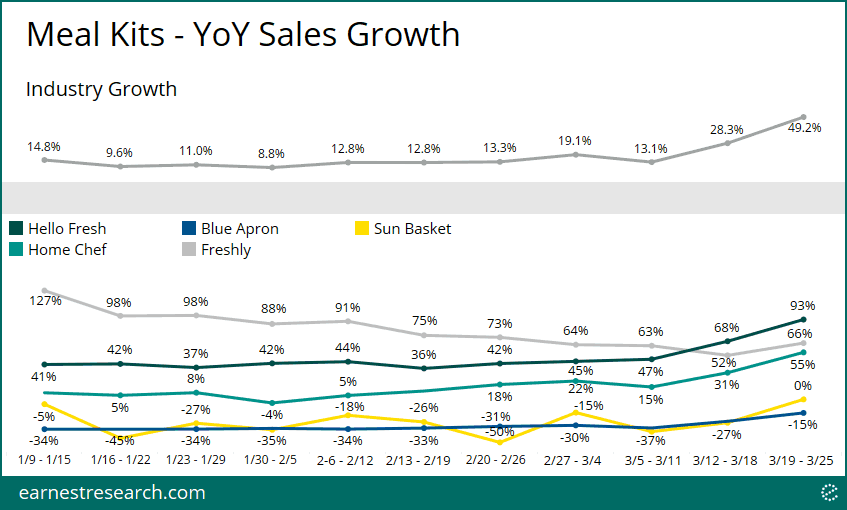

- Meal Kits sales growth accelerated to 50% YoY. Market leader Hello Fresh has seen its sales growth increase to over 90% YoY from 40%, as has trailing leader Home Chef, whose sales growth has increased to over 50% YoY from an average of 10% YTD. The interesting case here is the struggling Blue Apron, which has most recently seen its usual ~35% YoY declines improve step-by-step, to -25% two weeks ago and -15% last week; still largely declining, but moving in the right direction.

COVID Hockey Sticks and Amazon

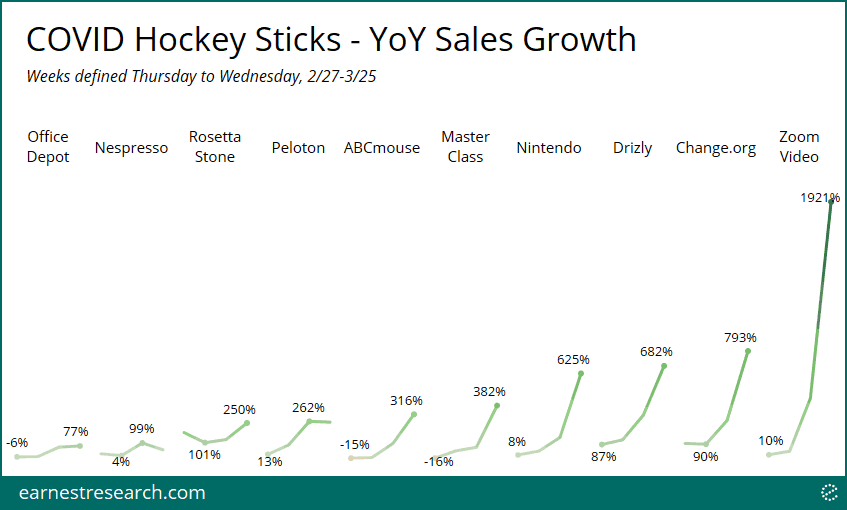

During this highly unstable spending environment, we’ve been analyzing the 2,000+ merchants in our coverage universe looking for companies with material deviations from their usual growth profiles. Beyond the ones we’ve written about in our prior pieces (i.e. grocers, general merchandise, brokerage platforms, sporting goods, etc.), we’ve Zoomed into ten merchants that are showing rapidly accelerating ‘hockey-stick-esque’ growth.

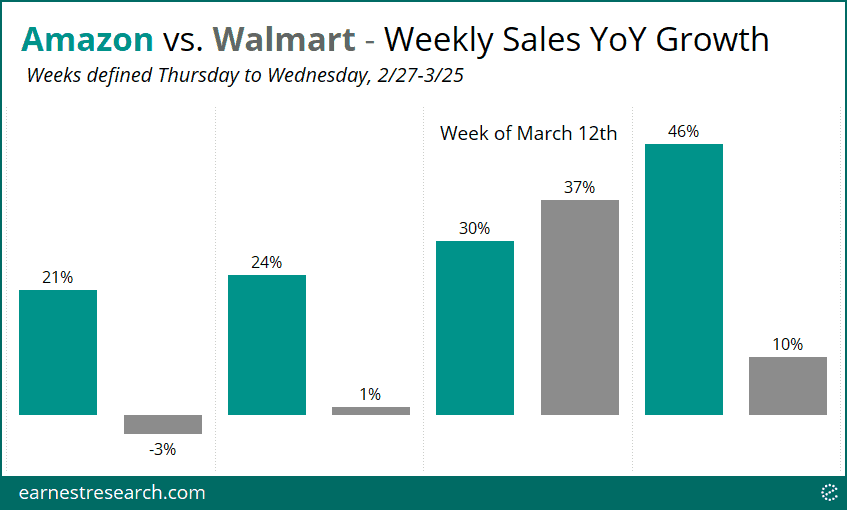

For our final thought: The world has officially turned upside down as Amazon was caught growing slower than Walmart two weeks ago.

Appendix – list of merchants by vertical

Grocers: Acme, Albertson’s, Aldi, Central Market, Cumberland Farms, Dillons, Fairway Market, Food 4 Less, Food Lion, Fred Meyer, Fry’s, Giant Carlisle, Giant Eagle, Giant Landover, Grocery Outlet, Hannaford, Harris Teeter, HEB, Hy-Vee, Ingles Markets, Jewel-Osco, Key Food, King Kullen, King Soopers, Kroger, Lidl, Lowes Foods, Lucky’s Market, Mariano’s, Market Basket, Meijer, Price Chopper Supermarkets, Publix, QFC, Raley’s, Ralphs, Safeway, Save Mart Supermarkets, Schnucks, Shaws, ShopRite, Smart & Final, Smith’s, Sprouts Farmers Market, Stater Bros. Markets, Stop & Shop, The Fresh Market, Tom Thumb Supermarkets, Trader Joe’s, Vons, Wegmans, Weis Markets, WinCo Foods, Winn-Dixie.

Restaurants: Applebee’s, Arby’s, BJ’s Restaurants, Blaze Pizza, Bojangles’, Bonefish Grill, Buffalo Wild Wings, Burger King, California Pizza Kitchen, Carls Jr, Carrabba’s Italian Grill, Cheddar’s Scratch Kitchen, Cheesecake Factory, Chick-fil-A, Chili’s, Chipotle, Chuck E. Cheese’s, Chuy’s, Cold Stone Creamery, Cracker Barrel, Culver’s, Dairy Queen, Del Taco, Denny’s, Domino’s Pizza, Dunkin’ Brands, Dutch Bros. Coffee, El Pollo Loco, Firehouse Subs, Five Guys, Freddy’s Frozen Custard & Steakburgers, Golden Corral, Habit Restaurants, Hardee’s, Hooters, IHOP, In-N-Out Burger, Jack in the Box, Jason’s Deli, Jersey Mike’s Subs, KFC, Krispy Kreme, Little Caesars, LongHorn Steakhouse, Maggiano’s Little Italy, Marco’s Pizza, McAlister’s Deli, McDonald’s, Mellow Mushroom, Miller’s Ale House, MISSION BBQ, Moe’s Southwest Grill, Noodles, Olive Garden, Outback Steakhouse, P.F. Chang’s, Panda Express, Panera Bread, Papa John’s, Papa Murphy’s, Peet’s Coffee, Pizza Hut, Popeyes Louisiana Kitchen, Portillo’s, Potbelly, Pret A Manger, Qdoba, Raising Cane’s, Red Lobster, Red Robin, Ruby Tuesday, Ruth’s Chris, Schlotzsky’s, Shake Shack, Sonic Drive-In, Starbucks, Subway, sweetgreen, Taco Bell, Taco Cabana, Texas Roadhouse, TGI Fridays, Torchys, Twin Peaks, Waffle House, Wendy’s, Whataburger, Wingstop, Yard House, Zaxby’s, Zoe’s Kitchen.

Online Grocery: Amazon Fresh, FoodKick, Fresh Direct, HEB To You, Instacart, Peapod, Walmart Online Grocery.

Restaurant Delivery: Caviar, Delivery.com, DoorDash, GrubHub and Seamless, Postmates, UberEATS, Waitr.

Meal Kits: Blue Apron, Dinnerly, Freshly, Green Chef, Hello Fresh, Home Chef, Purple Carrot, Sun Basket.