Budget grocers weather the inflation storm

How is grocery behavior changing as inflation hits customer wallets?

Key takeaways:

- Spending visits at premium grocers saw declines at or below the industry average, while discount grocers saw sharp and sustained increases over the same time frame

- Despite some initial resistance to inflationary pressures, higher income shoppers have started to slow their spending at premium chains

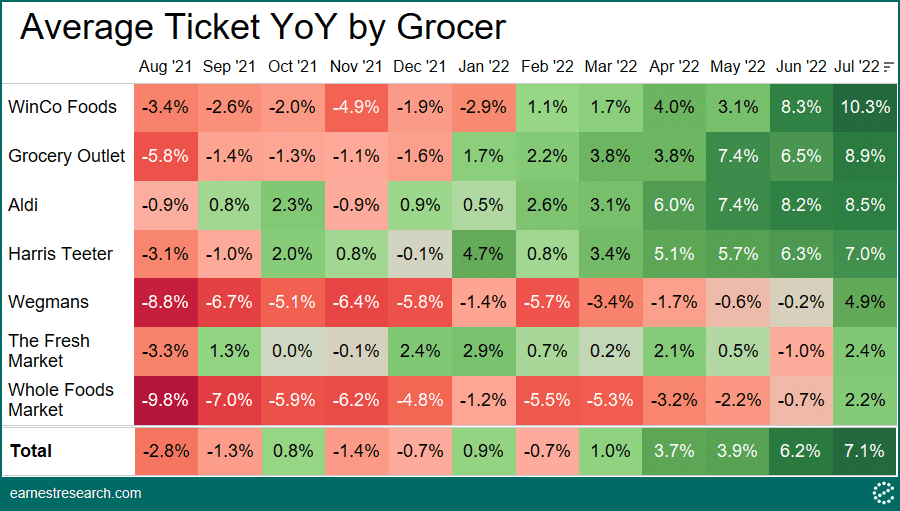

- Budget grocers had already been seeing high single-digit growth in average ticket since May, although ticket growth at premium chains is now starting to catch up

More tickets; less visits

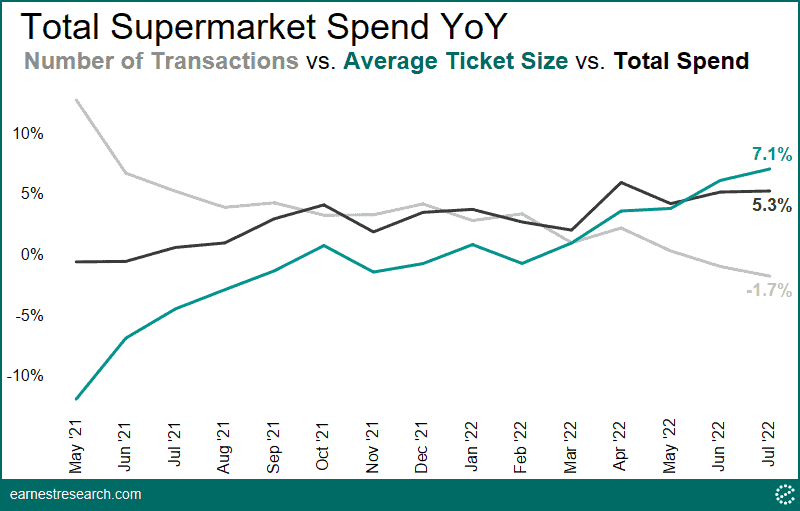

Earnest data exhibited supermarket spending growth of 5.3% YoY in July, boosted by 7.1% growth in average ticket, offset by a 1.7% decrease in the number of transactions. Ticket growth was yet another acceleration from the 6.2% YoY growth in June; similarly, the transaction decline was another slowdown from -0.9% in June.

Shift to budget grocers

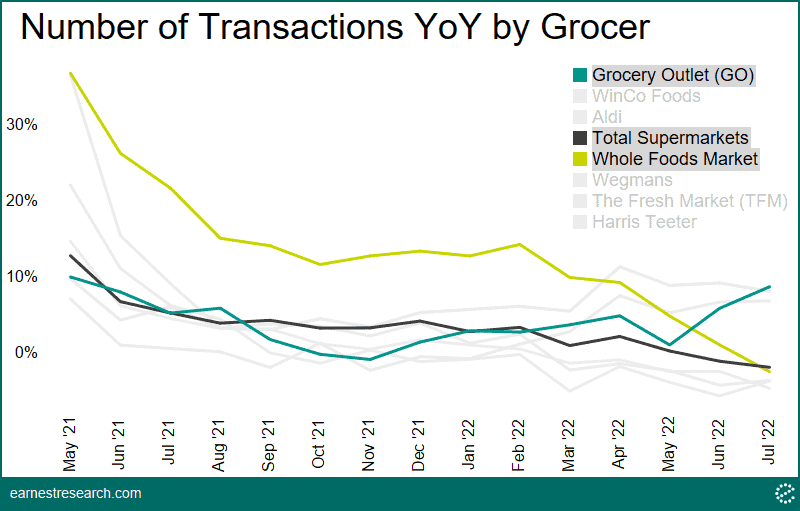

With price levels on the grocery shelf not seen since March 1979 (Food at Home prices increased 13.1% in July, up from 12.2% in June according to the latest BLS figures) forcing some to trade down into value-oriented items, shoppers may find a better deal by switching to more budget-friendly grocers. Using transaction growth as a proxy for store visits, the data suggests that premium* grocers saw declines at or below the industry, while discount grocers saw sharp and sustained increases in visits over the same time frame.

The most striking example is the difference in transaction growth between Whole Foods Market and Grocery Outlet. Whole Foods was sitting at a 14.3% YoY growth in transactions at the end of February, after which it rapidly decelerated each month to a July low of -2.4% (vs. the Supermarket benchmark of -1.7%). At the same time, transactions at Grocery Outlet have accelerated from a 1.1% growth rate in May to an 8.7% growth rate in July.

Other premium grocery chains saw less drastic transaction decelerations than Whole Foods, but still saw steady declines, while value-oriented chains like Aldi (+6.9% July growth) and WinCo (8.1% July growth) have picked up the slack.

Lower income exits first, high income sticks it out

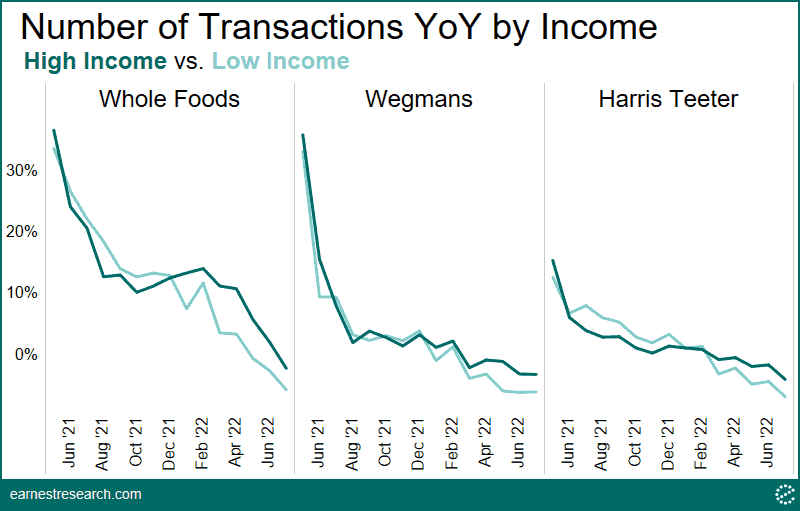

Transaction growth at premium grocery chains coming from lower-income** households tended to drop below their higher-income peers sooner.

Growth at Whole Foods Market coming from lower-income, likely more price-sensitive households, dipped below growth from high-income households in December. The same was true for Wegmans, although lower-income shoppers actually held out until March before slowing against their higher-income peers. And while it is true that price-sensitive customers slowed their spending first, it is worth noting that higher-income shoppers also continued to spend less at the premium chains, just at a slower rate.

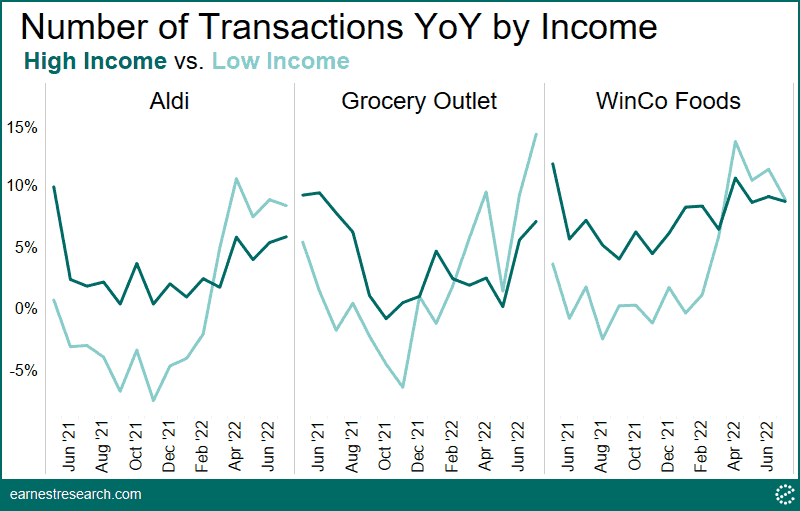

Conversely, while both income groups saw higher growth at discount grocery chains YTD, it was the lower-income group that saw the biggest jump at those grocers, as exhibited below. Large spikes in transaction growth can be seen in the spring months, possibly a result of consumers quickly changing their shopping habits for the inflationary environment.

Budget grocers bear brunt of inflation, but premium catching up

“Our expectation on inflation when we started the year was that the inflation would moderate quite significantly in the back half of our calendar year, right? And we don’t think it’s going to moderate as quickly.”

Albertsons Companies 1Q22 earnings call

“But we haven’t seen it, and we continue to see a level of inflation that’s pretty unprecedented, and we’re not expecting that to change anytime soon.”

Sprouts 2Q22 earnings call

Average ticket*** YoY growth paints a slightly more varied picture. The budget grocers actually have had higher ticket growth than their premium counterparts. WinCo ticket size grew 10.3% in July, while Whole Foods was on the other side of the spectrum with just 2.2% growth. This suggests that cheaper groceries have been absorbing more of the inflationary impact than higher-priced foods that might have already had high sticker prices. It might also suggest that basket sizes, in addition to prices, have increased at more budget friendly grocers. Most notably, however, premium grocers are beginning to catch up, showing high YoY accelerations from June to July. Wegmans accelerated ~5 points (June’s -0.2% to July’s 4.9%), The Fresh Market accelerated 340bps, and Whole Foods Market accelerated 290bps.

Notes

*Premium grocers refer to Whole Foods Market, The Fresh Market, Wegmans, and Harris Teeter. Value or “budget” grocers include Grocery Outlet, Aldi, and WinCo Foods. The distinction between the two groups is evidenced by their formal differentiation strategies, and corroborated by the penetration of spend from high vs. low income cohorts: premium grocers see their highest share of spend from higher income groups, while the value grocers see the inverse.

**Low income is defined as the bottom two income quintiles, and high income is defined as the top three income quintiles. Quintiles are recalculated every month over a trailing 12 month period.

***Average ticket is a function of both price and basket size changes, and the data is not able to delineate between the two. Therefore, any changes in average ticket are not wholly caused by inflationary price pressures, but subject to any basket size changes as well.