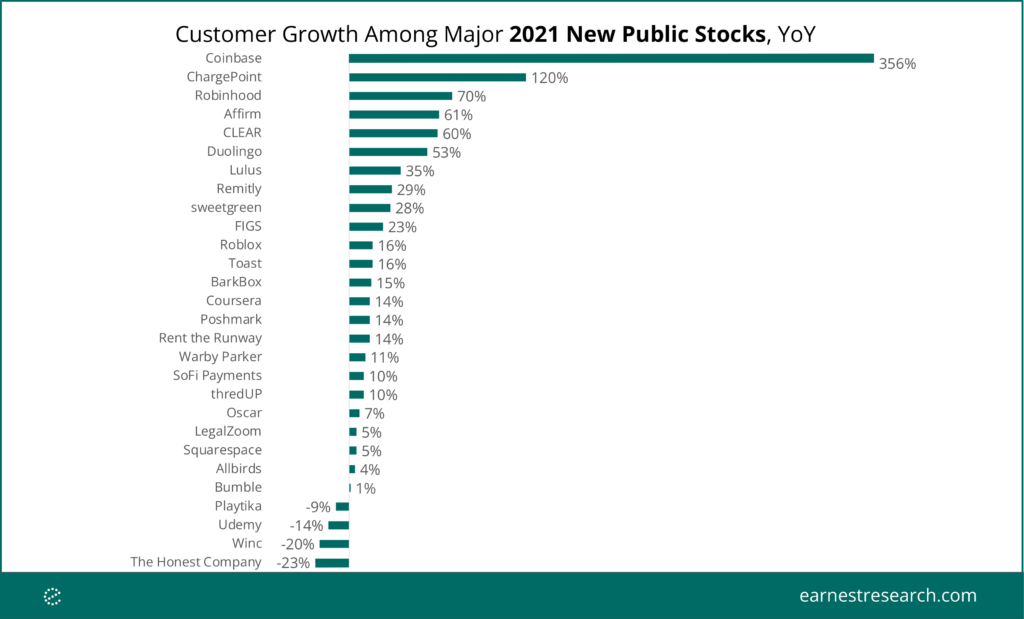

Among new stocks, FinTech added most customers in 2021

Key takeaways:

- Investment FinTech firms Coinbase and Robinhood outperformed major 2021 new stocks in terms of customer growth

- Many companies posted large customer growth based on easy comps vs 2020 such as CLEAR and sweetgreen

In the US 68 companies went public in 2021, including 17 major retailers, despite it being a tumultuous year for markets. Earnest Analytics (FKA Earnest Research) spend data showed most major new stocks managed to grow their customer base relative to 2020. Payment Facilitators, millennial focused Broker-Dealers, and POS Lender (Buy Now, Pay Later providers) outperformed in customer growth among the fledgling stocks, while DTC beauty and home goods, online education, and alcohol delivery struggled after materially growing their customer base in 2020.

Among financial services companies, Coinbase (+365% YoY) and Robinhood (+70% YoY) lead new public major consumer companies with the fastest customer growth between 2020 and 2021 as consumers invested their stimulus checks in Bitcoin and the stock market. Buy Now, Pay Later (BNPL) lender Affirm posted double digit customer growth as they benefited from higher online spend where their services are displayed more prominently than at in-store checkouts, leading to higher customer frequency.

After a challenging 2020, Apparel & Accessories stocks Lulus and Rent the Runway joined 2020 outperformers FIGS and Poshmark with significant customer growth YoY in 2021. Warby Parker was noteworthy for its customer growth off of an already large customer base as its customer retention remained high.

Electric vehicle charging station provider ChargePoint (+120% YoY) was the only non-Finance stock in the top three major consumer brands by consumer growth, in part perhaps due to a slowdown in travel and commuting in 2020, but also buoyed by increased interest in electric vehicles and the promise of an upcoming stimulus package.

Salad fast casual brand sweetgreen was the only restaurant on the new stock list for 2021, posting low double digit customer growth after 2020 brought massive changes to the traditional fast casual model. Despite several initiatives to reach customers who made fewer trips to the office, visits to sweetgreen locations remain below pre-pandemic levels.

Mobile apps CLEAR (+60% YoY), DuoLingo (+53% YoY), and Roblox (+16% YoY) outperformed as event providers looked for new ways to verify vaccination credentials, customers sought to pick up new skills during quarantine, and Gen-x spent more time and money in the metaverse.

In contrast, customer levels fell by double digits YoY for online class provider Udemy, wine delivery service Winc, and beauty and home goods supplier The Honest Company. All three companies faced tough comparisons vs 2020 as the quarantine initially drove increases in cleaning supply purchases, food and beverage delivery, and online classes that did not necessarily hold into 2021.