A Recipe for Success?

In November 2019, Chick-fil-A began preparing orders in a DoorDash ghost kitchen in Northern California, launching a new partnership model for the national chain. The move into the non-customer facing kitchen is a novel one, but Earnest data shows the choice in partners is a no-brainer for the chicken brand.

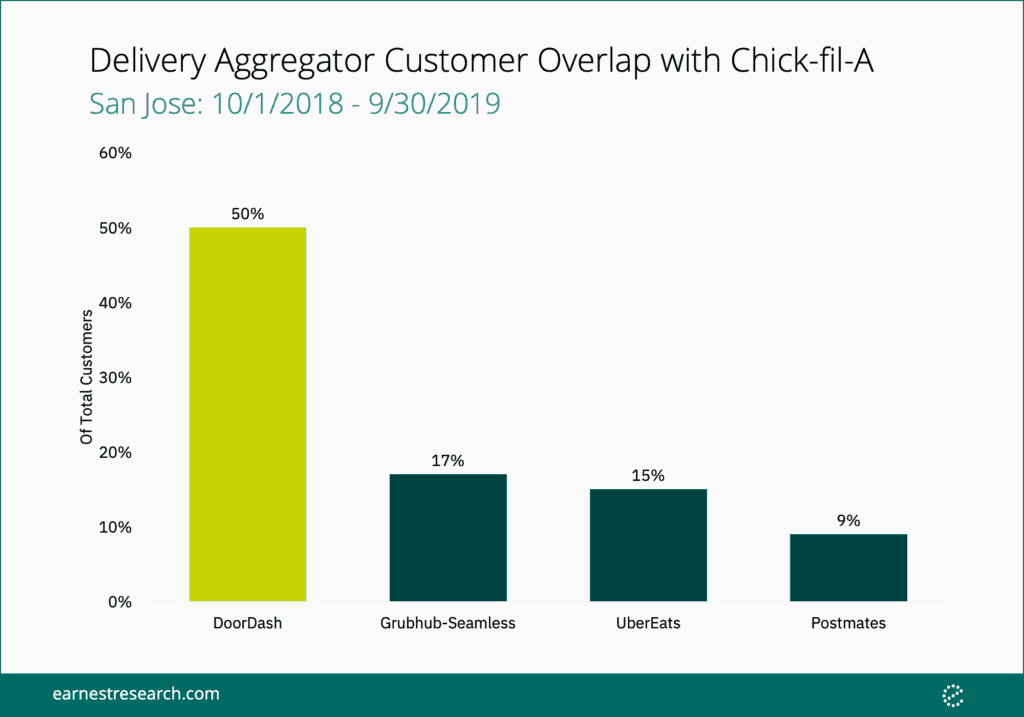

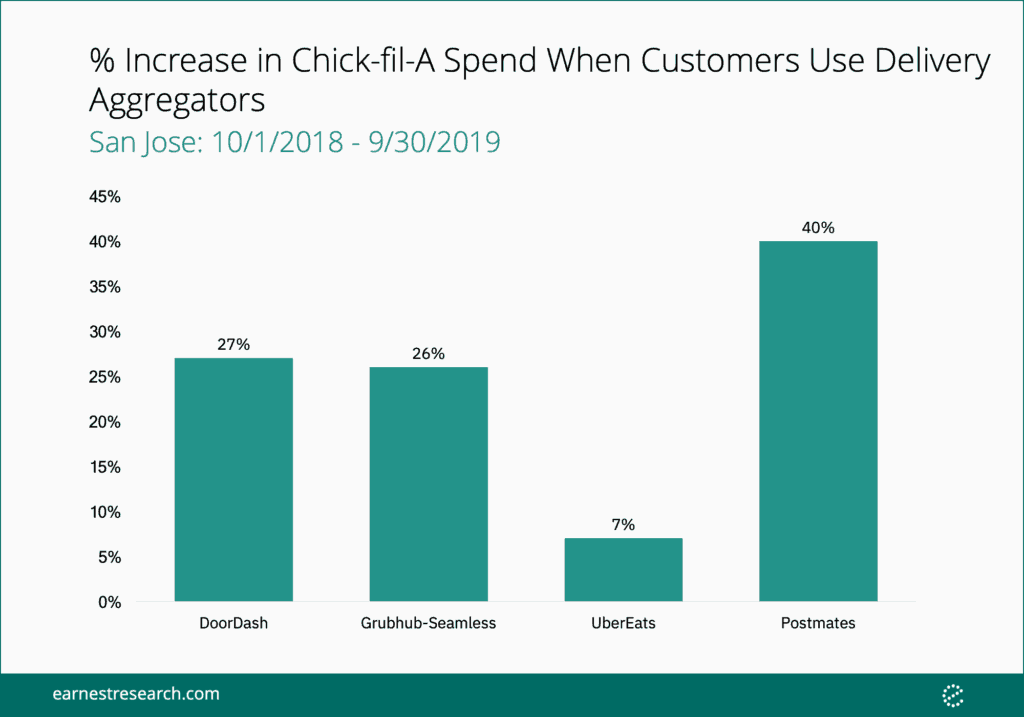

Chick-fil-A currently shares 50% of its customer base in the San Jose area (where the new kitchen is located) with San Francisco based DoorDash. Furthermore, customers of Chick-fil-A that also use DoorDash spend 27% more at Chick-fil-A than customers who don’t use the delivery aggregator, suggesting this move helps the QSR brand benefit from a significantly higher spending customer base.

In comparison to other delivery services in the San Jose region, Chick-fil-A shares 17% of customers with Grubhub (spending 26% more at Chick-fil-A than non-Grubhub customers), 15% with UberEats* (spending 7% more at Chick-fil-A than non-UberEats customers), and 9% with Postmates (spending 40% more at Chick-fil-A than non-Postmates customers).

Chick-fil-A’s tie-up with DoorDash increases the access to the Original Chicken Sandwich for some of its highest spending customers.

Notes

UberEats spend and overlap could be understated as a result of billing changes during the time period analyzed.

This analysis was created utilizing data products and solutions offered by the Earnest Consumer Brands team. For more information on our Consumer Brands products, click here.