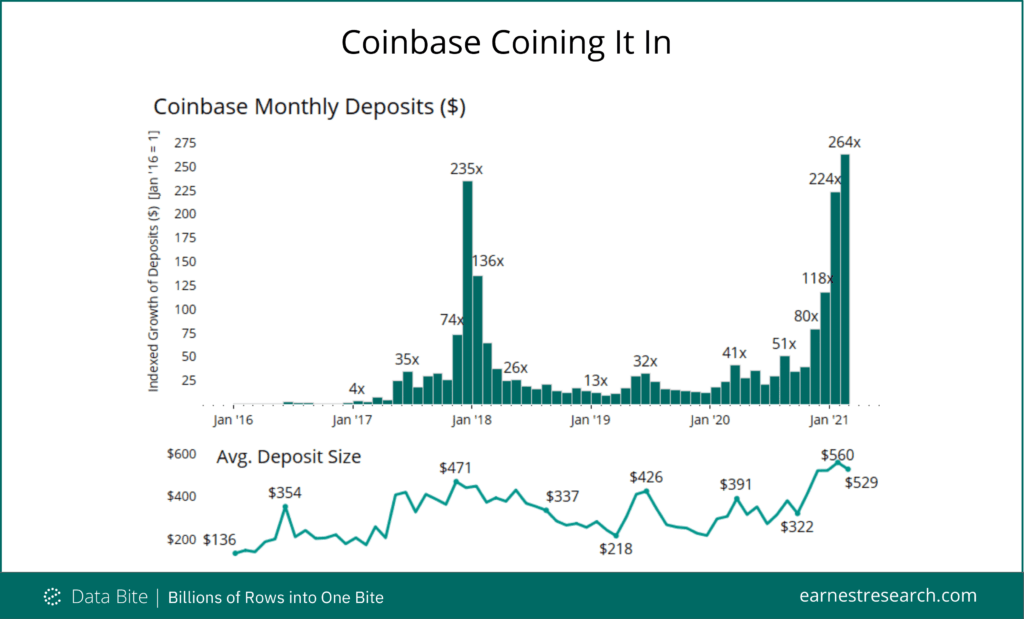

Coinbase Coining it In

With Coinbase ($COIN) filing their S-1 we looked at the pattern of US deposit growth at the cryptocurrency exchange, indexed to January 2016.

While Bitcoin is just one of many cryptocurrencies available on Coinbase (Bitcoin was 41% of Trading Volume in 2020 according to their S-1), and total deposits are not necessarily indicative of Bitcoin deposits nor Trading Volume on the platform, the data does indeed reflect Coinbase’s narrative— emphasized throughout their S-1—that they “have experienced periods of low and high Trading Volume, and therefore transaction revenue, driven by periods of rising or declining Bitcoin prices and/or lower or higher Crypto Asset Volatility.” This was exemplified by the explosion of deposits in late 2017 coinciding with Bitcoin’s previous peak price of $19,783, as well as the recent spike in deposits occurring as Bitcoin prices reached a new peak of over $61,000 in early March.

Interestingly, the average deposit size has also peaked over $500 in the most recent two months: January 2021’s all time high of $560 was ~$90 higher than the previous crypto cycle’s high in late 2017.

While long time crypto enthusiasts continue to Hodl, it’s clear there’s demand from retail investors so long as prices are rising.