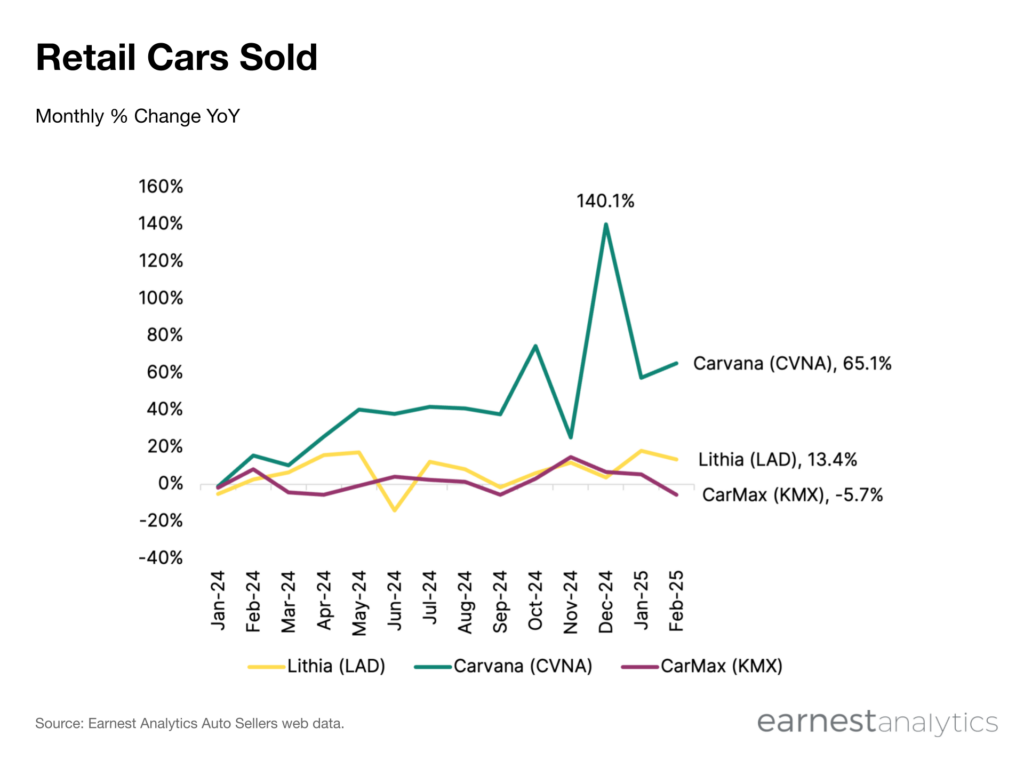

Carvana Car Sales Surge: 65% Growth in 2024

Carvana car sales surged towards the end of 2024

Carvana (CVNA) sold around 42,740 cars in February, a 65.1% YoY increase, according to Earnest Auto Sellers web data. The news continues Carvana’s upward sales momentum over the last year. It also reflects operational improvements with its inventory.

In 2023 Carvana faced soaring inventory average age and days-to-sell after pandemic demand eased. Inventory issues have since receded thanks to slower acquisition and faster sales. The company is likely also seeing benefits from its ADESA acquisition in 2022, which greatly expanded the online seller’s physical footprint.

As a result, Carvana claims they became the “most profitable” and “fastest growing public automotive retailer” in 2024. So far the trend appears to be continuing in 2025. Carvana’s competitors Lithia (LAD) and Carmax (KMX) North American car sales grew 13.4% YoY and -5.7% YoY, respectively in February.

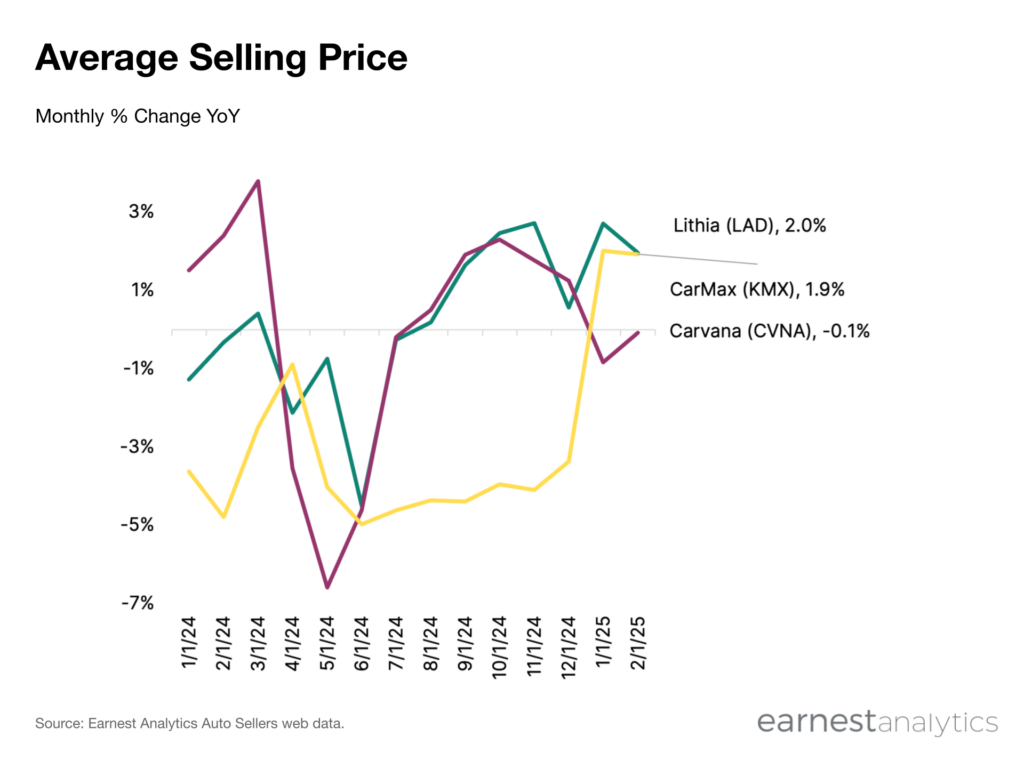

Carvana car sales tend to be cheaper than rivals

Carvana attributed their 2024 growth to their vertically integrated business model. In part, this is because the cost advantages are passed to the customers by way of lower car prices. In 2025, Carvana continues to pass along cost-saving. Carvana’s average selling price declined 0.1% YoY in February, from $24,908 to $24,888. This is in contrast to Lithia and CarMax, where prices rose 2.0% YoY, from $35,044 to $35,732, and 1.9%YoY, from $25,524 to $26,016, respectively. All three companies sell used cars, but only Lithia also sells new cars, partially explaining its higher prices.