LLY bridge program: Zepbound patients more willing to pay out-of-pocket

Key takeaways

- Comparing Zepbound and Mounjaro’s bridge programs highlights LLY’s more conservative approach with the newer obesity product

- Zepbound’s bridge program only subsidizes around half the drug’s cost; yet Zepbound patient are more willing to pay out-of-pocket than those on Mounjaro

- Zepbound’s launch with a lower subsidy bridge program has resulted in greater stability in net pricing and share of bridge program claims according to Earnest market access data

Patient assistance programs’ net price impact

Eli Lilly (LLY) facilitated the rollout of both its blockbuster GLP-1 drugs Mounjaro and Zepbound with bridge programs to drive early sales. But the two programs were not created equal. Eli Lilly took a more disciplined approach to supporting patient access in Zepbound’s rollout according to Earnest market access data from Leo pharmacy claims. As a result, Zepbound’s net prices in its first year have been more stable than those for Mounjaro.

Novo Nordisk’s (NVO) Ozempic and Wegovy were already on the market when Mounjaro launched in June 2022. Eli Lilly needed to drive adoption quickly in order to gain share. To do so, Eli Lilly launched Mounjaro with a manufacturer bridge program. The program allowed commercially insured patients without coverage to start on therapy while Eli Lilly worked to establish access. The program was instrumental in quickly getting patients on therapy. However this bridge program had a temporary negative effect on the net price of Mounjaro.

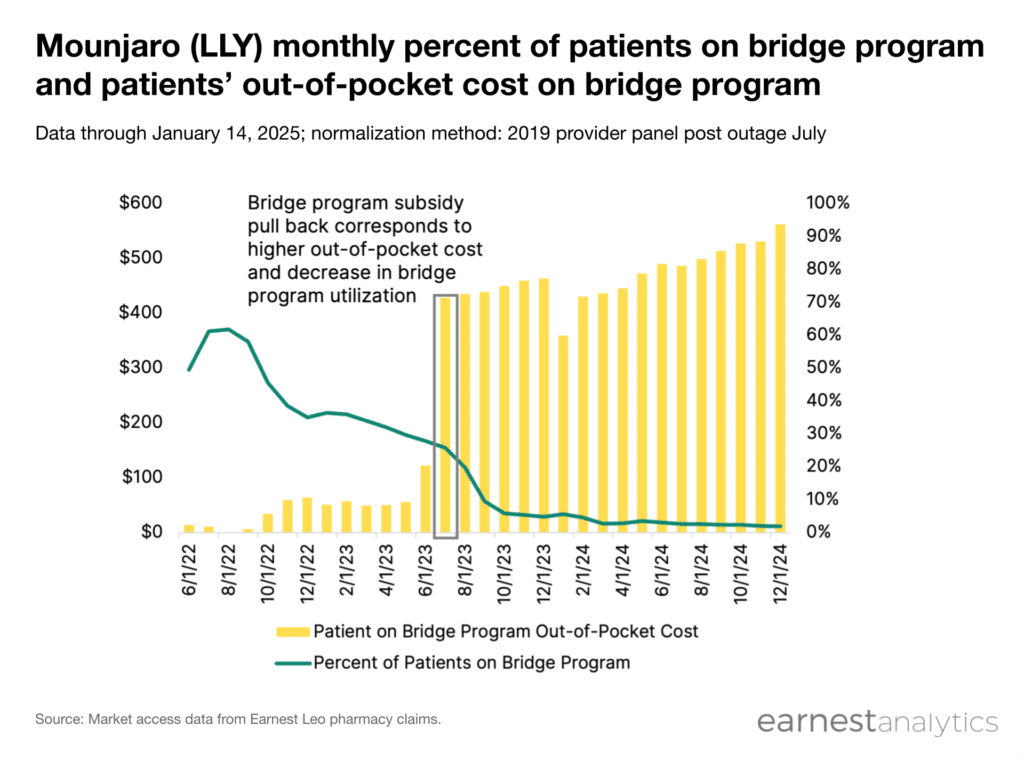

Increased out-of-pocket cost for Mounjaro led to decline in bridge program utilization

Mounjaro bridge program reduction led to a steep increase in out-of-pocket costs. Earnest market access data from Leo pharmacy claims shows 60% of Mounjaro patients on the bridge program three months post launch. Eli Lilly paid $1,013 on average relative to the drug’s wholesaler acquisition cost (WAC) of $1,020 based on Earnest market access data. Mounjaro’s bridge program utilization dropped when Eli Lilly reduced subsidies to $473 in July 2023. Earnest data shows Mounjaro bridge program patients fell from 30% to 2% between June 2023 and December 2024.

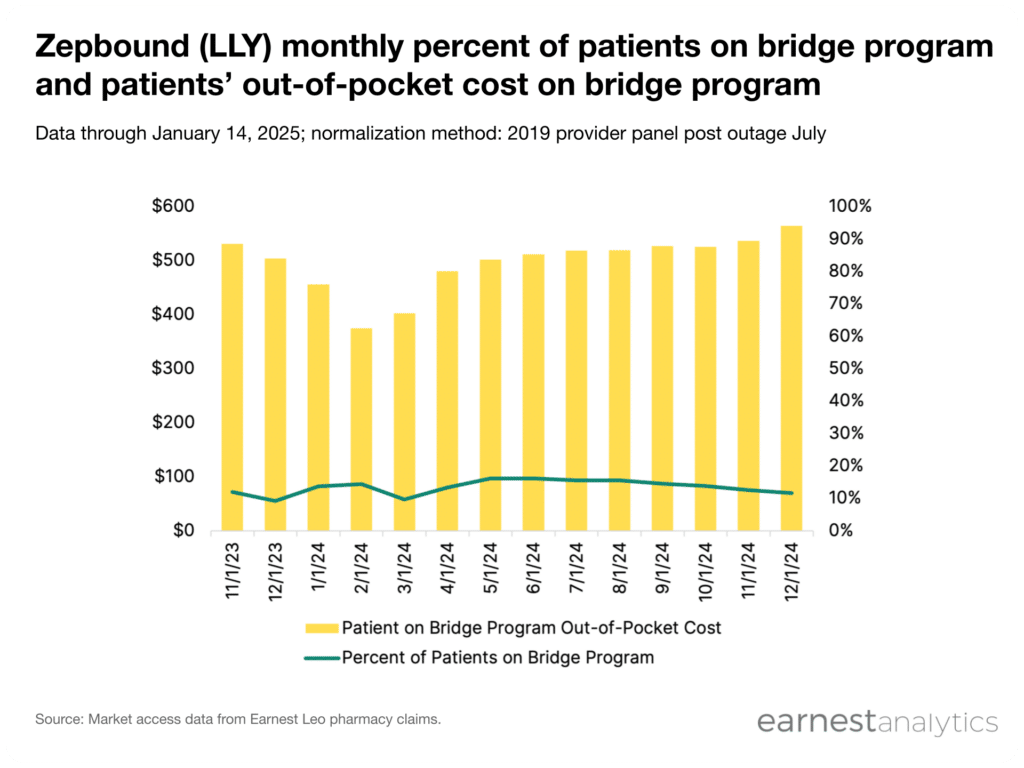

More patients willing to pay out-of-pocket for Zepbound

In contrast, Eli Lilly launched Zepbound with a more conservative bridge program. The program covered up to $463 relative to a wholesaler acquisition cost of $1,000 of Zepbound. The original bridge program was effectively on par with Mounjaro’s reduced bridge program from the start. Despite this less substantial discount, Zepbound has seen consistent 10% to 20% of patients on bridge programming since launch. This suggests that a greater proportion of patients are willing to pay out-of-pocket for Zepbound when not covered by insurance.

Eli Lilly commented in their 3Q2024 earnings call Zepbound has 90% commercial access, but only around 50% of employer plans opted into weight-loss drug coverage. This further supports bridge programming as an access strategy and necessitating patient out-of-pocket payment.

Further, Zepbound’s more cautious upfront discounting had less of an impact on overall gross-to-net. Eli Lilly reported stable pricing for the drug on their 3Q2024 earnings call. The Mounjaro bridge program pull-back has been a tailwind for net pricing, which LLY expects to stabilize in late 2024 according to the same call.

Earnest Leo pharmacy claims data tracks market access programs including bridge programming, commercial couponing and third-party access programs. Leo pharmacy claims give a view into gross-to-net dynamics and allow for an understanding of pricing strategy evolution for drugs like Mounjaro and Zepbound. Zepbound bridge programming has remained a consistent share of claims since launch.

However, proposals for Medicare coverage of GLP-1s for weight loss may be enacted. This is likely to push employers to follow suit leading to more commercially covered patients and a movement away from bridge programming. Continue tracking real-time patient assistance programming for Zepbound as access dynamics evolve with Earnest market access data from Leo pharmacy claims.

Request information on market access data