Wholesale clubs sales climb despite lower consumer hurricane spending

Key Takeaways

- Florida consumer spending fell significantly during both recent major hurricanes

- Online, apparel, and restaurant businesses’ sales declined during hurricanes

- Costco, Sam’s Club, and BJ’s Wholesale had noteworthy surges in sales post hurricane

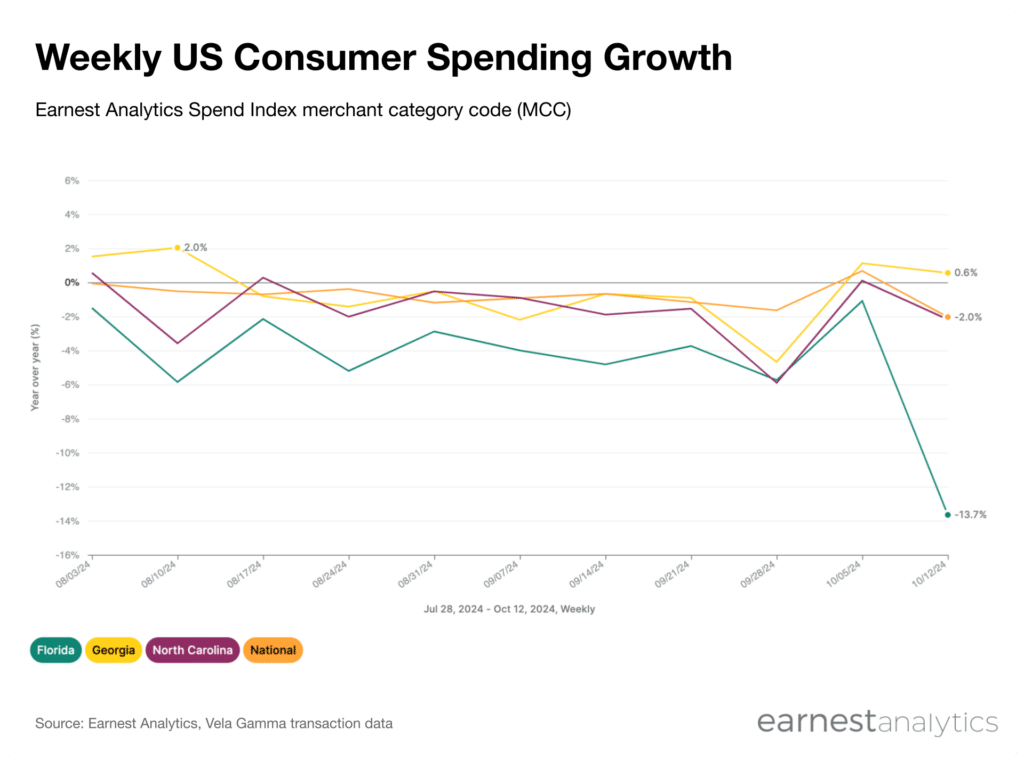

Florida consumer spending fell 13.7% YoY post Milton

Access chart in Dash.

Consumer spending in Florida fell to a multi-week low of -5.7% YoY during the week of Hurricane Helene, before falling 13.7% YoY two weeks later when Hurricane Milton hit the Tampa Bay region according to Earnest credit card data. Major weather events can drive consumers to stores just before and after as they stock up and later buy items for repairs, but the events themselves can have a chilling effect on spending. Georgia (-4.7% YoY) and North Carolina (-5.9% YoY) both recorded meaningful decelerations in spending growth during the week ended September 28th when Hurricane Helene hit–before accelerating as consumers returned to store and normalizing two weeks later.

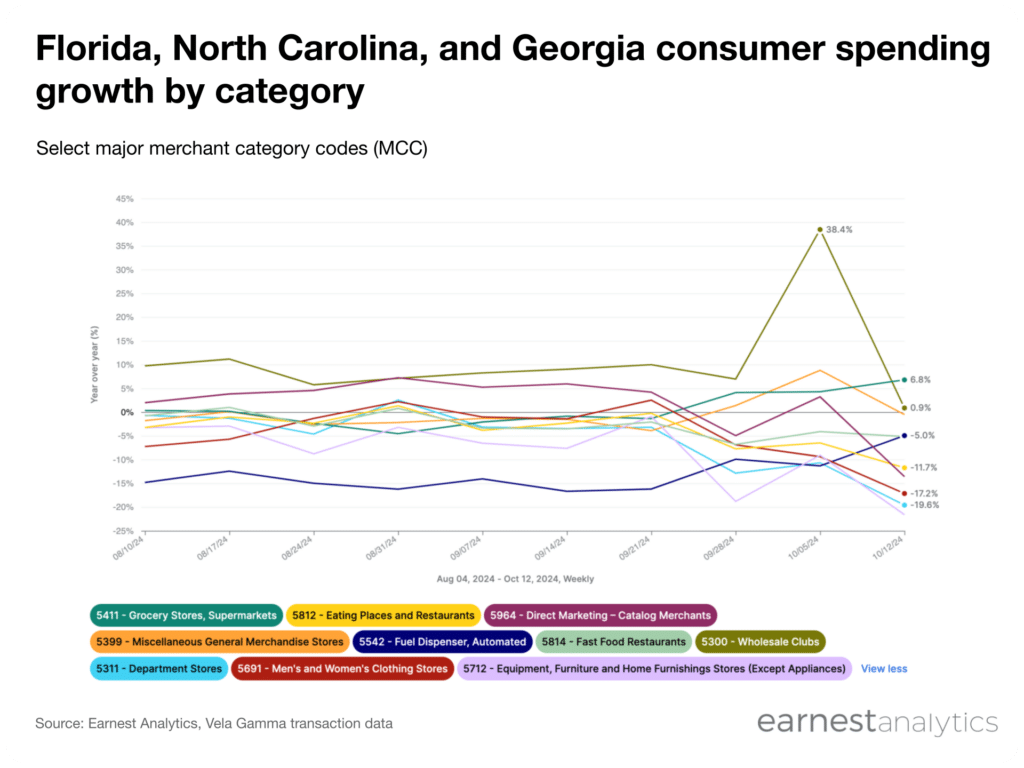

Online, restaurant, apparel spending fell; wholesale clubs rose

Access chart in Dash.

Consumers in Florida, Georgia, and North Carolina spent less the week of Hurricane Helene on major categories like apparel furniture, restaurants, and online marketplaces like Amazon, while increasing their spending at grocery stores, fuel, and general merchandisers like Walmart. Sales at wholesale clubs like Costco, BJ’s, and Sam’s Club in Florida, Georgia, and North Carolina stood out in the week after Hurricane Helene, spiking 38.4% YoY after post-hurricane demand resumed, and concerns that the International Longshoremen’s Association strike could cause future shortages.

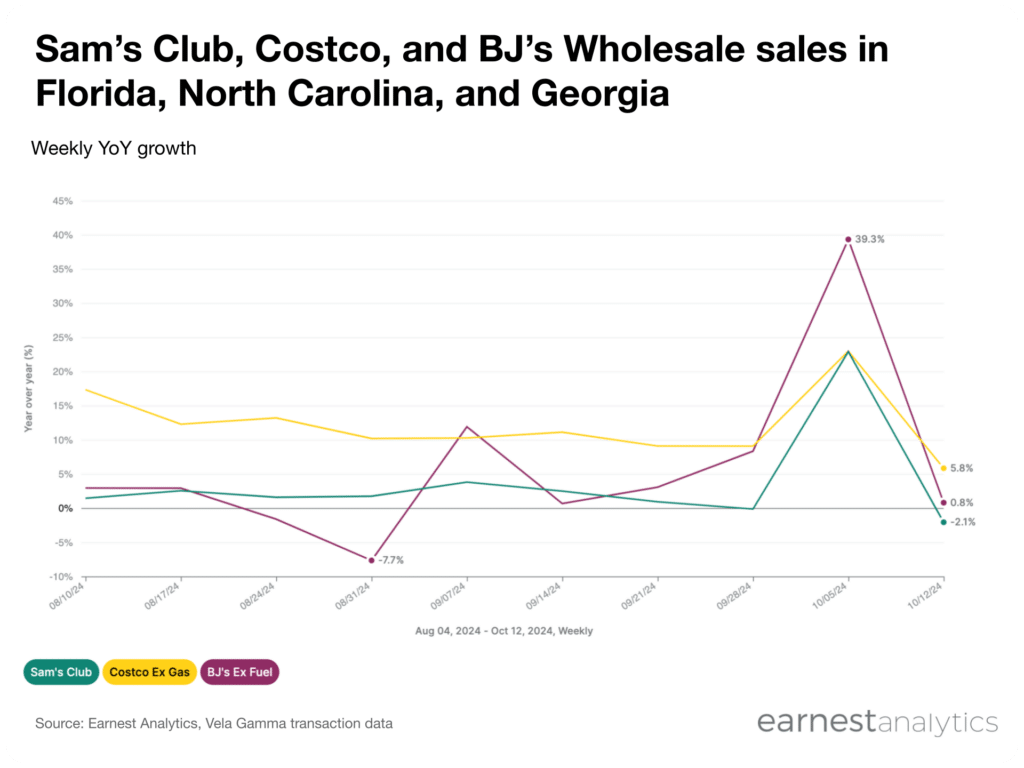

Sam’s Club, Costco, and BJ’s Wholesale sales surged

Access chart in Dash.

Shoppers flocked to Sam’s Club (+22.9% YoY), Costco Wholesale (+23% YoY), and BJ’s Wholesale Club (+39.3% YoY) in the week after Hurricane Helene across Florida, North Carolina, and Georgia. Sales at all three wholesale clubs decelerated to more normal growth levels again the week of Hurricane Milton.

About the Earnest Analytics Spend Index:

The Earnest Analytics Spend Index (EASI) is an alternative data-driven measure of consumer spending that tracks spend across 80 merchant category codes (MCC), encompassing thousands of US merchants. The near real-time data is derived from the credit and debit spend of millions of de-identified US consumers. Advantages of using EASI include faster macro signals and insight into geographic, shopper income, and credit vs debit trends.

Historical numbers can vary due to methodology updates.

Sign up for consumer spending updates