Waymo is officially taking share from Uber in 2025

Data finds Uber users are switching to Waymo

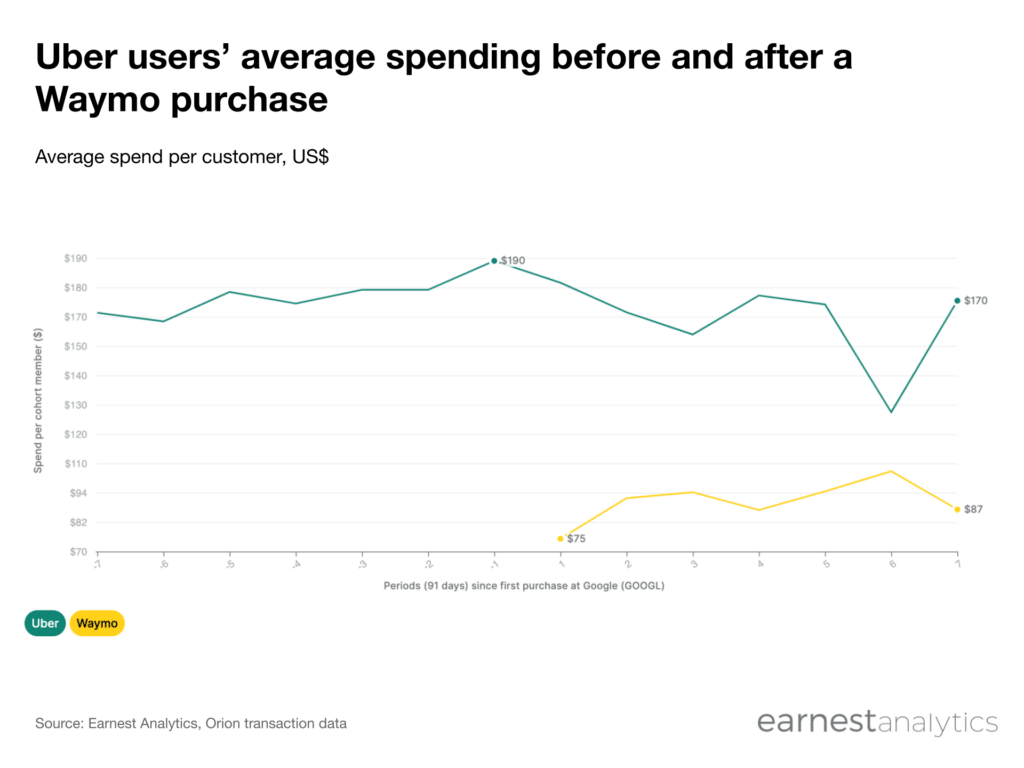

Waymo is taking dollars from Uber according to Earnest credit card data. The average Uber user spent $189 the quarter before their first Waymo purchase. This represents a 7.2% increase from four quarters prior. However, Uber users spent only $174 on the platform four quarters after their first Waymo ride, a 7.5% decrease.

The finding aligns with Waymo’s industry-leading retention figures. Over 33% of Waymo customers returned 13 quarters after their first transaction. This leads both Uber (23%) and Lyft (14%) according to Earnest credit card data.

The data suggests that Waymo is having a meaningful impact on Uber in the markets in which both operate. As of January 2025, Waymo operated in Phoenix, San Francisco, Los Angeles, Atlanta, and Miami. In Austin, Atlanta, and Phoenix, Uber users can hail Waymos through the Uber app. However, San Francisco remains one of the largest markets for both services. Waymo and Uber have no such agreement in that market.

Waymo impacting Uber in San Francisco

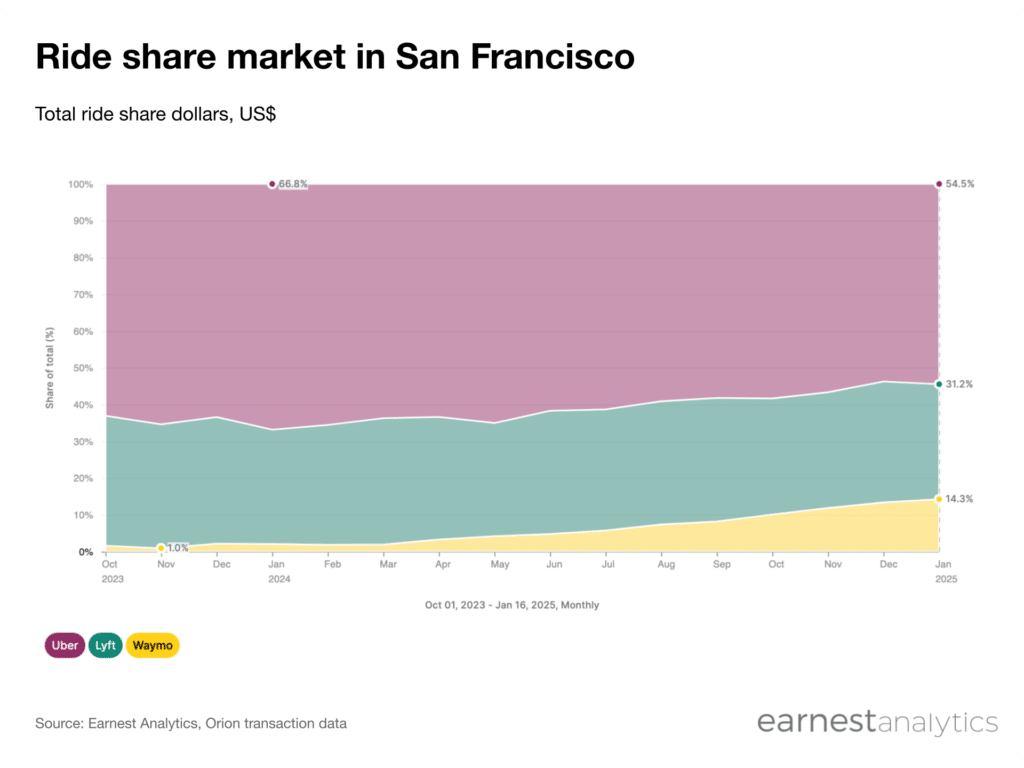

Credit card spending data shows that Uber has lost share to Waymo in several key markets, especially San Francisco. Waymo, which launched in that market in August 2021, operates in most of the San Francisco proper, excluding on freeways.

Waymo was slow to gain share in San Francisco. Two years post-launch, it still controlled around 1% of ride share dollars spent in the market. But the service began to gain steam in early 2024 as it became available to more users. Despite only operating on surface roads, over 14% of SF rideshare dollars went to Waymo in the first two weeks of January.

Waymo’s share gains have mostly come at the expense of Uber. The early moving Uber controlled 63% of San Francisco’s ride share dollars at the end of 2023. However, as of January 2025, Uber controls less than 55%. Lyft also lost some share, falling to 31% from 35% in the same period. If this key market is any indication, Waymo could have a broader impact on Uber as it enters more markets.

Track ride share spending for free