Restaurants’ key to success in 2025? Value

The QSR category faced mixed results in 2024 as brands relied on value deals to counter declining sales. Meanwhile, Casual Dining gained traction, with its value perception reaching a five-year high.

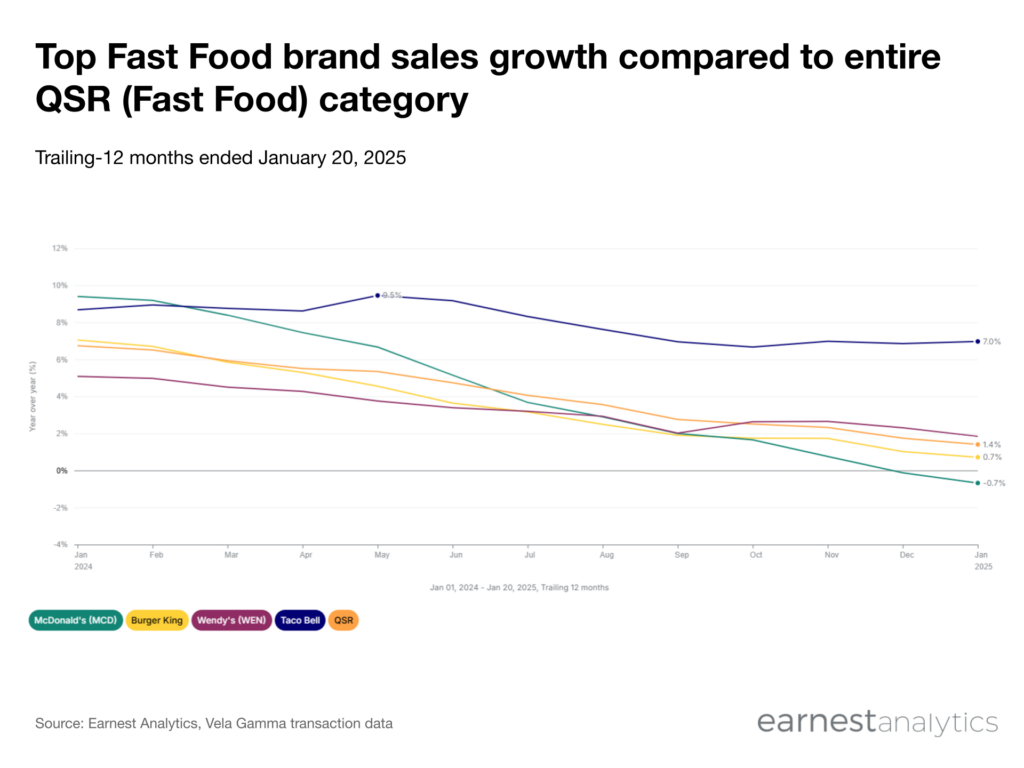

QSR Trends: Value deals drove mixed results amid industry decline

The QSR category softened over the past year, with many brands turning to value deals to boost sales. Taco Bell (YUM) stood out, maintaining high single-digit sales growth on a trailing-12-month (T12M) basis. Its $7 Luxe Cravings Box helped increase loyalty sales by over 30% in 2Q24 and drive growth across all income cohorts.

McDonald’s and Burger King (QSR) struggled to maintain momentum even with both launching $5 value meals in June 2024. McDonald’s sales fell 10.1% over the year, amplified by an E. Coli outbreak in December. Despite the $5 “Your Way Meal” promotion, Burger King sales declined 6.3% over the past year. The broader QSR category saw a 5.3% decline on a T12M basis.

Wendy’s saw a temporary sales boost from its October Krabby Patty promotion, but sales have since decelerated into 2025.

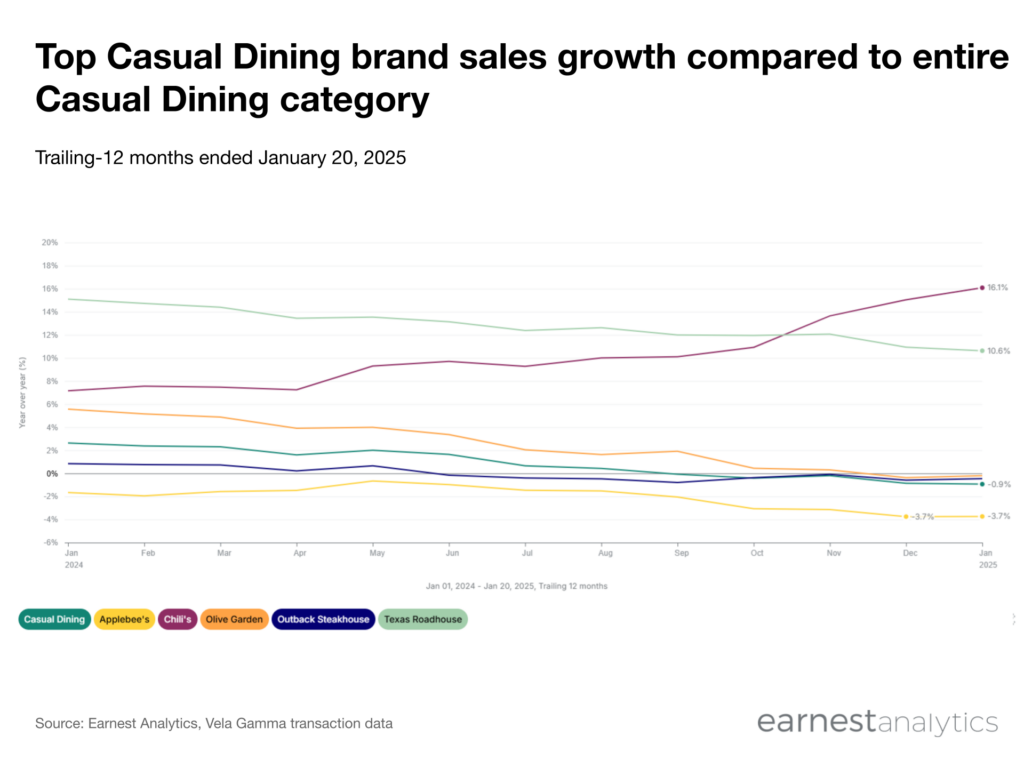

Casual Dining’s value perception rises as fast food’s falters

The search for value is not confined to QSR (Fast Food). Customers are increasingly turning to Casual Dining for perceived better value. In 2024, casual dining’s value perception hit a five-year high, while fast food reached a historic low. Over the past year, Casual Dining sales decelerated -3.5% on a T12M basis, outperforming the QSR category’s -5.3% decline.

Many Casual Dining brands slowed, including Outback Steakhouse (BLMN, -1.3%), Applebee’s (DIN, -2%), and Olive Garden (DRI, -5.8%). However, Chili’s and Texas Roadhouse (TXRH) entered 2025 with strong growth, with T12M sales up 16.1% YoY and 10.6% YoY, respectively. Texas Roadhouse attributed its performance to strong customer demand across all regions, day parts, and income levels…download report to continue reading.

Download 2025 Restaurant Rankings and Trends