Valentine’s Day Disrupted: Venture-Backed Flower Firms Blossom as Incumbents Wither

- The 2019 bankruptcy of the combined FTD and ProFlowers entity created a windfall for new and established flower names alike

- New venture-backed flower delivery services are further eroding high ticket sales from premium suppliers, especially around the high volume during Valentine’s Day

The flower delivery business has been in the midst of upheaval for years, with major players like FTD buying upstart rivals like ProFlowers and later declaring bankruptcy in the face of declining sales. Now a crop of venture-backed startups are looking to further disrupt incumbent flower delivery names. This Valentine’s Day, perennially one of the largest holidays for flower sales, is set to be the biggest yet for these newcomers.

Using Earnest Query for Consumer Brands we investigated which companies are poised to win and lose customers’ dollars this Valentine’s Day.

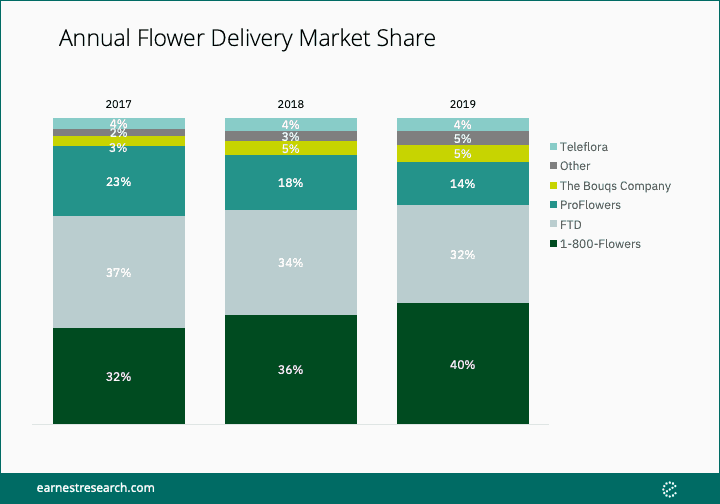

A Venture-Backed Green Thumb

Since 2017, Florists’ Transworld Delivery’s (FTD) well-publicized sales declines opened up a vacuum in the flower delivery and gifting market. ProFlowers, one of the first online-based disruptor companies, and its corporate cousin FTD continued to cede share to industry incumbents 1-800-Flowers and Teleflora. Meanwhile, a new crop of flower disruptors sprang up to fill the void, including upstarts Farmgirl Flowers, The Bouqs Company, and UrbanStems, which collectively commanded 10% of online flower sales among national flower retailers in 2019, vs 5% in 2017.

Other includes Farmgirl Flowers, Bloom Nation, and Urban Stems.

Numbers cited may not add to 100% due to rounding.

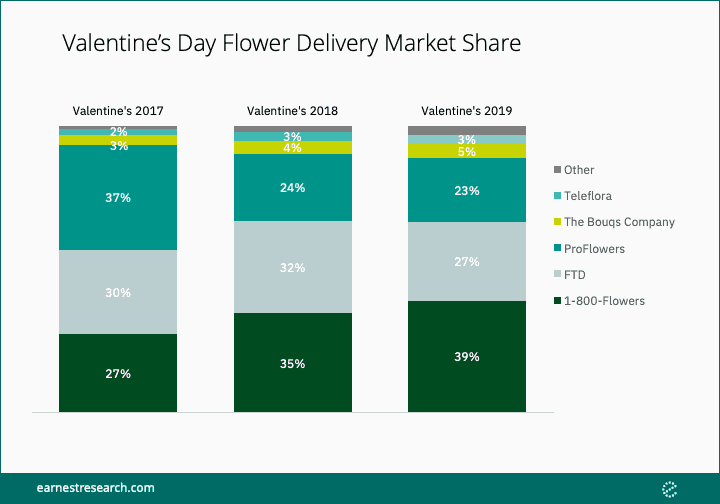

Seizing the Valentine’s Day Market

The seismic shift in flower sales over the past three years played out most visibly during one of the business’s busiest holidays, Valentine’s Day. As the second largest operator, 1-800-Flowers was uniquely well-positioned to increase its share of holiday spend, from 27% in 2017 to 39% in 2019. Meanwhile, the small disruptor flower names grew their share of Valentine’s spend from 4% in 2017 to 7% in 2019, with upstarts like Farmgirl Flowers increasing sales by 41% YoY in 2019, according to Earnest data.

Other includes Farmgirl Flowers, Bloom Nation, and Urban Stems.

Numbers cited may not add to 100% due to rounding.

On to Their Next Love

ProFlowers’ market share loss is even more pronounced when looking at its own shoppers. ProFlowers’ shoppers used to spend the largest share of their flower dollars at the struggling retailer, but since 2017 have been migrating their Valentine’s spend elsewhere. In 2019, ProFlowers customers spent 68% of their Valentine’s flower dollars at ProFlowers, down from 81% in 2017. Earnest data also shows that ProFlowers customers largely flocked to 1-800-Flowers, which took 18% of ProFlowers customers’ Valentine’s spend in 2019, up from 8% in 2017.

Numbers cited may not add to 100% due to rounding.

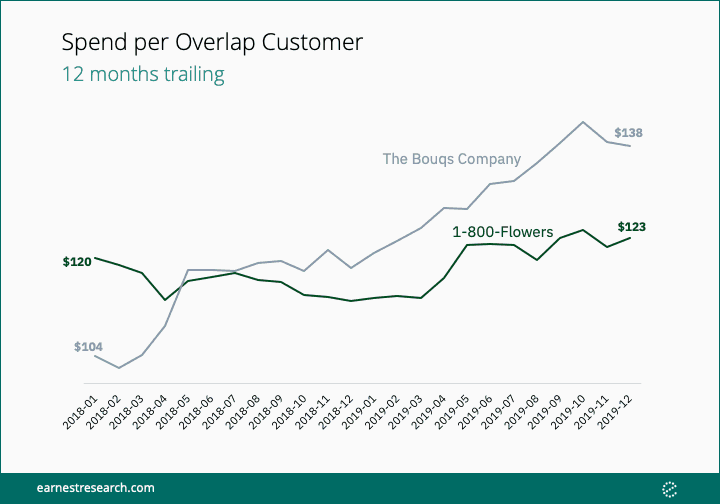

However, the data suggests 1-800-Flowers’ success at attracting new customer dollars may not last forever. The fastest growth in 2019 spend among 1-800-Flowers customers was at Bouqs (+25% YoY), Farmgirl Flowers (+66% YoY), and UrbanStems (+30% YoY)–though the three disruptors still only comprised 4% of 1-800-Flowers’ customer spend in 2019.

1-800 Flowers Not Feeling the Love

A little over 1% of 1-800-Flowers customers transacted at the largest of the DTC flower disruptors, The Bouqs Co, in 2019. However, average spend at Bouqs among those shared customers increased from $104 to $138 during that period, exceeding average spend of shared customers at 1-800-Flowers by $14. This price point sits significantly higher than the average of $82 per transaction at 1-800-Flowers during 2019. This trend suggests a significant risk for incumbent flower companies as their highest ticket customers increasingly turn to trendy startups.

Numbers cited may not add to 100% due to rounding.

Notes

- Analysis is derived from the credit and debit card spend of millions of de-identified U.S. Consumers.

- Valentine’s Day Sales Period defined as the three weeks between 2017-01-26 to 2017-02-16, 2018-02-01 to 2018-02-22, and 2019-01-31 to 2019-02-21

This analysis was created utilizing transaction data products and solutions offered by the Earnest Consumer Brands team. For more information on our Consumer Brands products, click here.