US food shoppers adjust to financial pressures

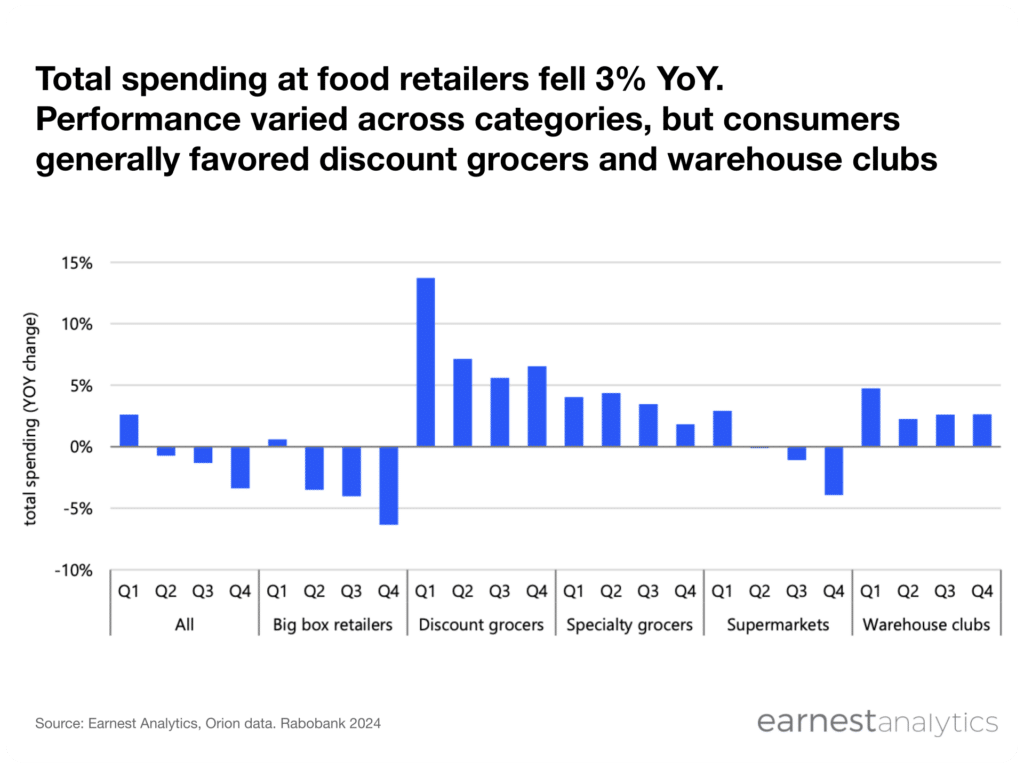

The numbers of transactions at physical grocery stores slipped by 2% in Q4 compared to the same quarter in 2022, continuing a downward trend. Performance varied significantly according to retailer type, reflecting a consumer landscape that resembles an hourglass-persistent demand for both premium and value, driven by the divergence in consumer wealth.

Discounters accelerated their growth in transactions over recent quarters (+11% in Q4 YoY vs +8% in Q3 2023), followed by warehouse clubs (+4+), as consumers continued to look for value.

Similarly, specialty grocers – not known for low prices –also added visits (+2% YoY), although growth slowed quarter-on-quarter in 2023. This uptick can be interpreted as more affluent shoppers retaining their spending power. But it may also reflect consumers saving non-food items, eating out less often, and using those savings to make a fancy meal at home, splurging and treating themselves with superior at-home items as part of a saving strategy (anything at home will be cheaper than the equivalent away from home).

In contrast, supermarkets lost ground in Q4 (-2%), as the holiday season was also marked by value and bulk shopping. As detailed in our previous Earnest Files edition, big box retailers (such as Walmart, Target, Kmart, and Meijer) seem to be caught between these trends, as they continued to lose share and faced shrinking baskets throughout 2023.

Download US Shoppers Adjust to Financial Pressure report