Uber Eats and Instacart partnership caters to shared customers

Uber Eats sales see continued growth since Instacart partnership

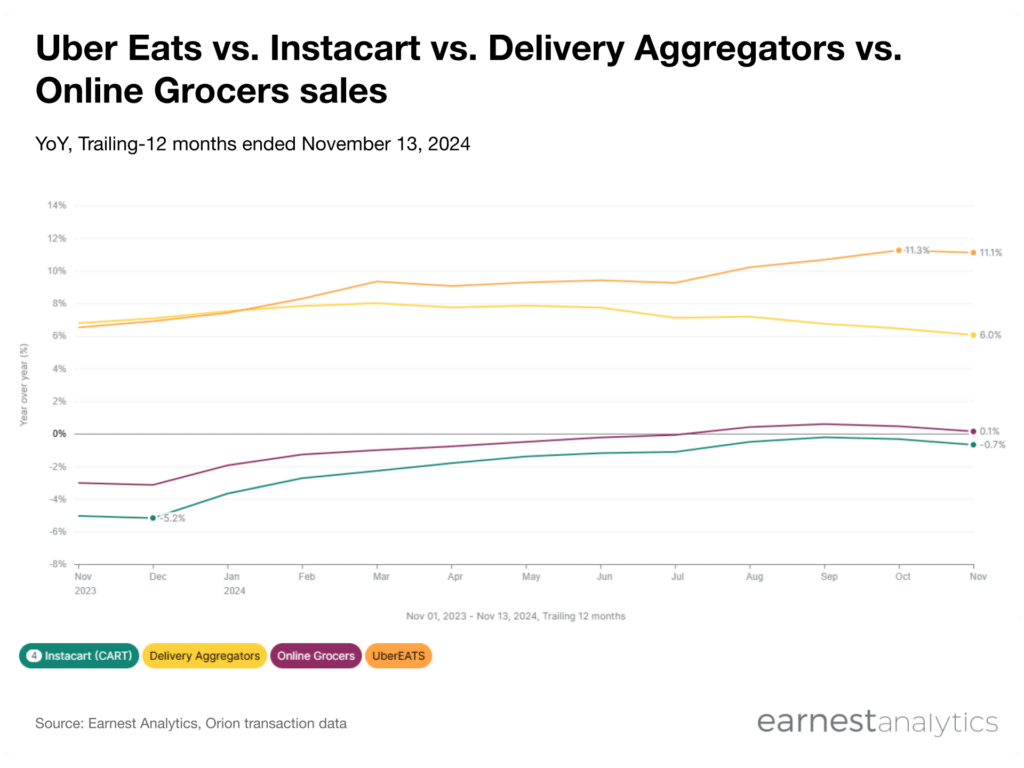

Uber Eats sales are accelerating on the heels of its partnership with Instacart, announced in May. The restaurant delivery service’s sales accelerated 1.8 points on a trailing-12-month (TTM) basis from May to November 2024. Uber Eats TTM sales (ended November 13th) grew 11.1% YoY, according to Earnest credit card data.

Through the partnership, the pair introduced a new “Restaurants” tab in the Instacart app that redirects customers to Uber Eats. Now Instacart+ members benefit from $0 delivery on grocery and restaurant orders over $35.

Uber Eats’ sales growth contrasts with the broader Delivery Aggregator category, which decelerated 1.9 points over the same period. Sales at online grocery aggregator Instacart accelerated 0.7 points, improving to -0.7% YoY on a TTM basis.

More customers are spending at both Instacart and Uber Eats

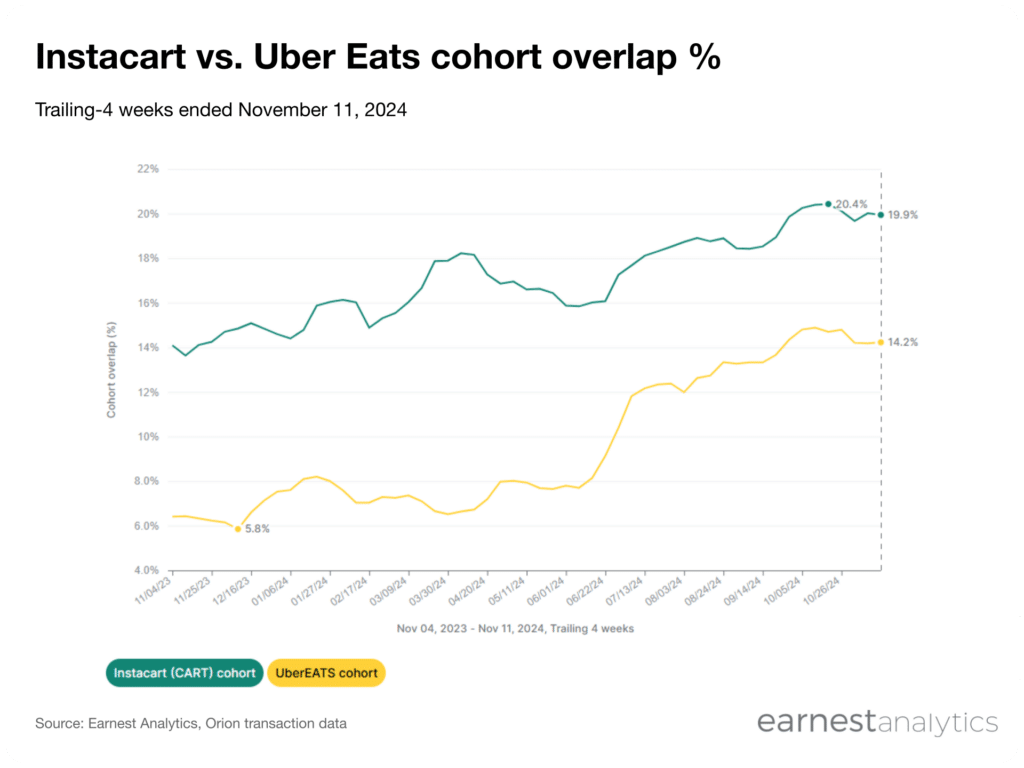

Earnest credit card data indicates the partnership has been mutually beneficial, driving increased customer overlap between Instacart and Uber Eats. Over the past year, the share of Instacart shoppers using Uber Eats grew by 6.3 points, reaching 19.9%. Similarly, Uber Eats shoppers who also spend on Instacart increased by 7.8 points, rising to 14.2%.

Fidji Simo, CEO of Instacart, noted in the company’s 3Q24 earnings call “People who adopt restaurants on our platform spend more and more frequently.” She added that this cross-use “creates a very interesting flywheel for us” as restaurant adoption increases grocery engagement.

Instacart customers are spending more at Uber Eats

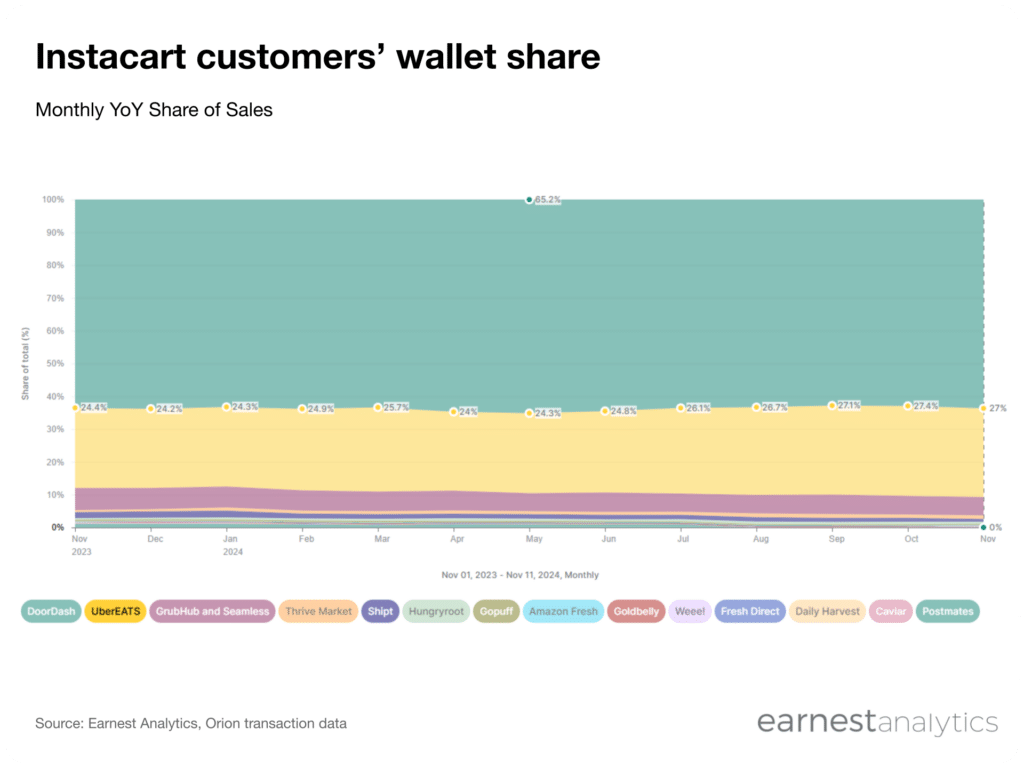

Earnest’s share of wallet analysis isolates spend from a brand’s own customers. This analysis shows Instacart customers spent 27% of their restaurant delivery wallet at Uber Eats in November 2024. That is an increase from 24% in November 2023. Share of spending at DoorDash for these customers, however, remained the same at 64%.

Since the partnership announcement in May, Instacart customers’ spending at Uber Eats accelerated around 10 points. Over the same period, spending at DoorDash has decelerated around 4 points.

It is noteworthy that Instacart did not ink a partnership with DoorDash given most Instacart shoppers spend more at DoorDash.

Both services retain customers at much higher rates than Grubhub, which keeps 11% of its customers in the long-term. Wonder’s acquisition could bring new customers to the platform and increase retention by leveraging its in-store eaters.

Track delivery aggregator spending for free