Total consumer spending slowing despite refunds

See data in Dash.

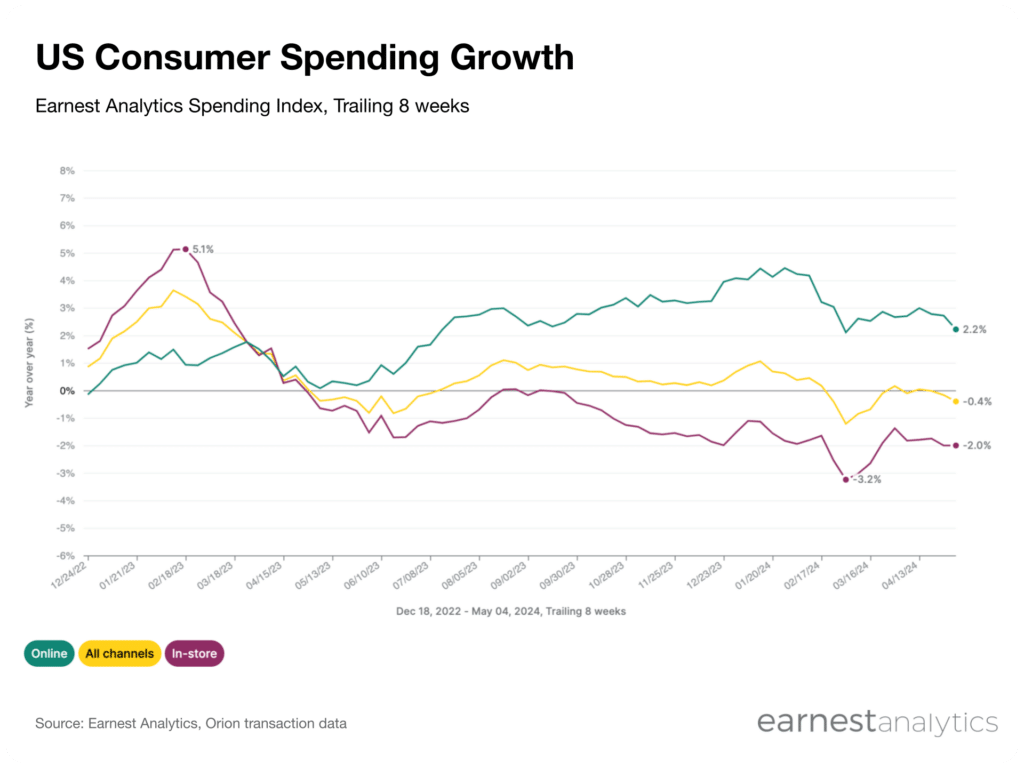

Consumer spending has accelerated since the start of the tax season, but this growth is still one to two percentage points slower relative to the back half of 2023, according to Earnest Analytics Spending Index. This deceleration was exacerbated by a slow start to tax refund spending.

With only a marginal increase in the total tax dollars refunded this season, any further accelerations in spending may prove to be a bit more difficult. Online spending continues to outpace in-store by around 4 points.

See data in Dash.

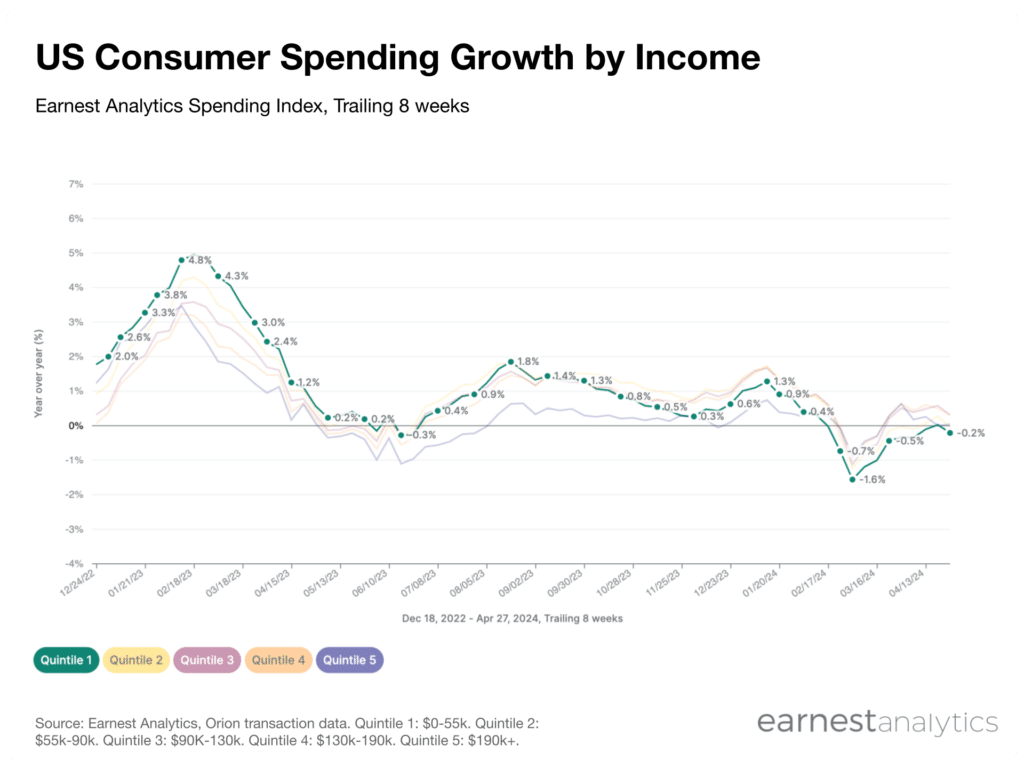

Consumers earning less than $55k per year (Quintile 1) transitioned from the fastest growing spending cohort to the slowest in the past 6 months, despite tax return boosts. Quintile 1 spend fell 0.2% in the 8 weeks ended April 27th, 2024. This aligns with several recents earnings reports where lower income consumers have begun to show signs of breaking in the face of price increases, regardless of the tax refunds. McDonald’s CEO Chris Kempczinski admitted on their 1Q24 earnings call that they saw the “cohort [of customers making $45,000 or less] decrease in the most recent quarter”.

Conversely, customers earning between $55k-$130k (Quintiles 2 and 3) are increasing their total spending the fastest, at a paltry 0.3% YoY in the same time 8 weeks ended April 27th, 2024, an acceleration from the slow-starting tax refund spending season.

Express, Adidas, Wayfair, Macy’s, Lululemon benefited in April, as noted in the full report.

About the Earnest Analytics Spend Index:

The Earnest Analytics Spend Index (EASI) is an alternative data-driven measure of consumer spending that tracks spend across 2,500+ large national brands in major consumer discretionary and staples subcategories. The near real-time data is derived from the credit and debit spend of millions of de-identified U.S. consumers. Advantages of using EASI include better representation of e-commerce spend, disaggregation by geography, and online versus in-store breakouts.

Historical numbers could vary slightly due to methodology updates.

Download report to see which brands won refund season