TikTok Shop won share, sales heading into Black Friday holiday 2024

Amazon dominated, but TikTok Shop gained holiday share pre-Black Friday

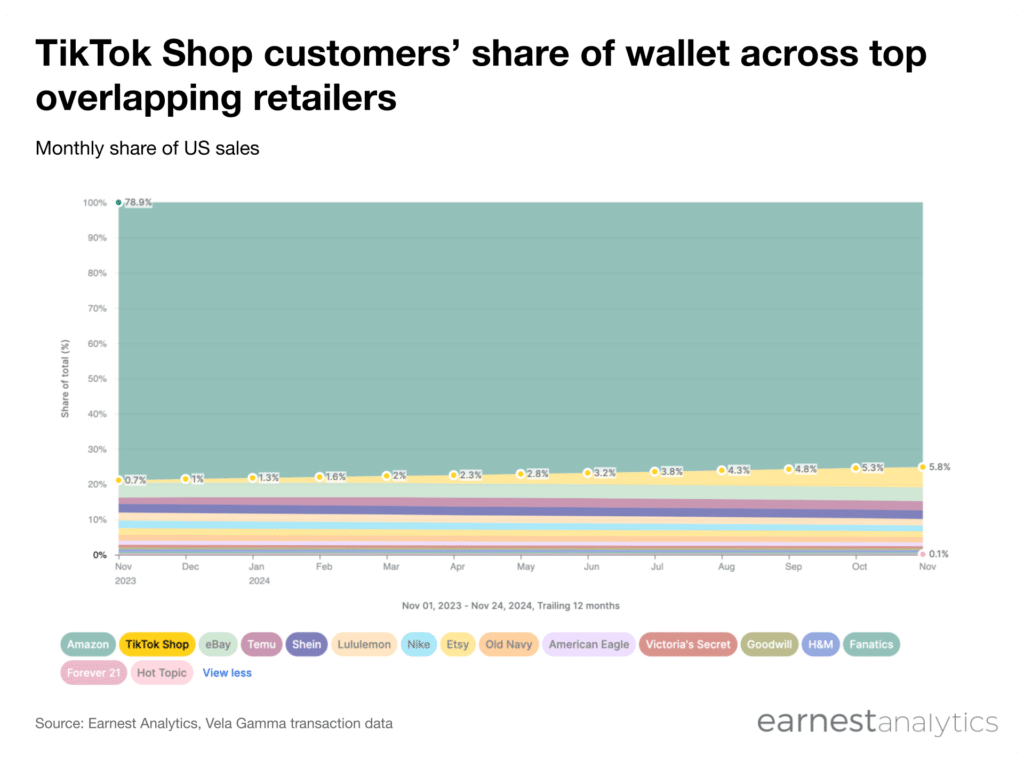

TikTok Shop is taking share of holiday sales from the brands where its users are most likely to shop according to Earnest credit card data. The platform’s customers spent 0.7% of their share of wallet across the top 15 brands by overlap in November 2023. That share of wallet rose to 5.8% in the first 24 days of November, 2024.

TikTok Shop moved from near last place in its customer’s holiday wallet to second place between 2023 and 2024. Amazon (AMZN) still dominates TikTok shoppers’ holiday spending share in 2024, at 75%. Ebay (EBAY, 3.9%), Temu (2.6%), and Shein (2.5%) also led among brands with the highest shared TikTok Shop shoppers percentage.

TikTok Shoppers turn to Temu, Shein, and away from American Eagle

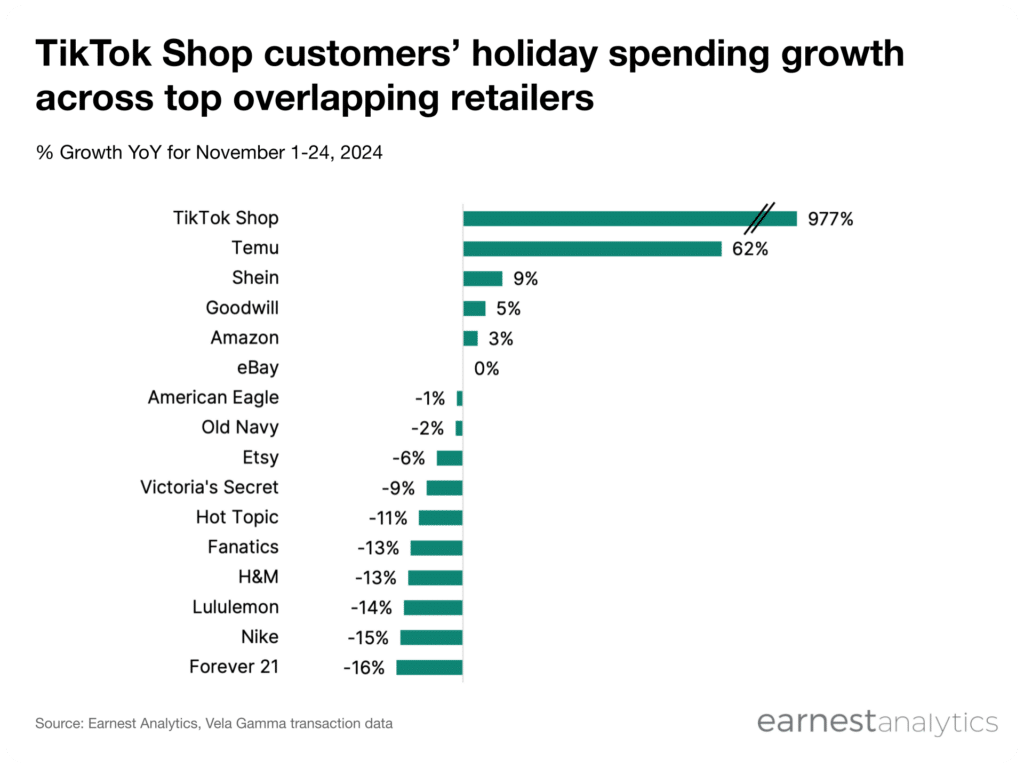

TikTok shoppers spent 977% more on the platform in the first 24 days of November 2024 than in 2023. The same cohort of TikTok shoppers spent 62% more on Temu, suggesting Temu is making inroads with younger shoppers.

TikTok shoppers also spent more at Shein (+9% YoY), Goodwill (+5% YoY), and Amazon (+3% YoY) heading into Black Friday.

However, TikTok shoppers spent less at some retailers that have performed well overall in the early holiday season. TikTok shoppers spent less at American Eagle (AEO) and Victoria’s Secret (VSCO). Both retailers posted growth in the early holiday season more broadly.

TikTok shoppers reduced their holiday spending the most at Lululemon (LULU), Nike (NKE), and Forever 21, a Shein subsidiary. Despite falling, Lululemon and Nike sales among TikTok shoppers outperformed the broader market sales from the first 13 days of November.

Overall, TikTok Shop sales accelerated from the first 13 days of November leading up to Black Friday. Ecommerce sales typically slow relative to brick-and-mortar sales as the holiday continues and shoppers want to ensure on time delivery.

Download early holiday report