The Shift to Digital and Experiential Spending Continues to Shape Consumer Trends

Berlin, Germany & New York City, USA | September 30, 2024 | GetYourGuide, a global online marketplace for discovering and booking travel experiences, has released its latest Travel Experience Trend Tracker report, shedding light on the evolving US consumer spending patterns in the travel industry and global booking patterns. The new research reveals significant trends in American consumer behavior, emphasizing a strong shift towards booking on digital platforms and a growing preference for experiential spending over material goods, even as the global travel industry has seen a deceleration in growth since the post-COVID boom.

According to the report, which analyzed an anonymized sample of approximately 100 million U.S. credit and debit card accounts:

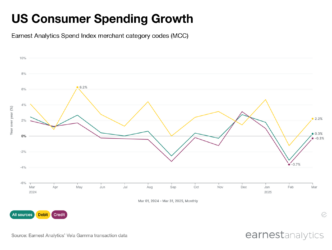

- American consumer spending on experiences during the 12 month-period which ended on Aug. 31 2024 has surpassed pre-pandemic levels, growing by 32% compared to the 12-month period which ended on Jan. 1 2019.

- This growth exceeds Americans’ overall spending on consumer goods, including basic needs like groceries, which saw a 21% increase over the same period.

- The gap widens further when comparing experiences spending against purely discretionary goods spending, which grew by only 5% within that window.

“American consumers’ preferences are shifting from spending on material goods to experiences, driven by a desire for meaningful connections and personal growth,” said Johannes Reck, Co-Founder and CEO of GetYourGuide. “In times when loneliness is considered an epidemic in America, travel experiences provide the human connection we crave for. We’re excited to pave the way in the experience economy, redefining how people bond and create lasting memories.”

Additionally, the report highlights the increasing role of digital platforms in the travel planning and booking process. Consumers are using online travel agencies (OTAs) for booking travel experiences more than ever, with spending across these platforms registering 188% growth in the 12-month period which ended on Aug. 31 compared to the 12-month period which ended on Jan. 1 2019 — a trend further corroborated in newly released analysis by McKinsey and travel industry leader Skift. In stark contrast to the modest growth of spending on flights (+4%) and accommodation (+23%) over the same period, this pull towards OTAs for experience spending underscores the importance of a strong digital presence for travel businesses to capture the modern traveler’s attention.

Another key finding from the report is the emergence of the “super-spenders”, a segment of travelers who spend 18% more on experiences than average travelers, and account for 60% of the entire travel market spend, according to GetYourGuide global data.

“These travelers seek discovery, chasing immersive and authentic experiences that go beyond the bucket list,” says Chief Marketing Officer Emil Martinsek. “Their fear of missing out means they will hunt for the best experiences using a wide variety of resources. If, as an experience creator, you want to reach these “super-spenders”, digital marketing and mutli-channel engagement isn’t just important —it’s critical.”

While their appetite is globally consistent, “super-spenders”’ booking behavior reveals local differences. GetYourGuide’s report provides detailed insights into consumer behavior across major markets, including the USA, UK, Germany, France, Italy, and Spain. Key findings include:

- USA: American “super-spenders” are more likely to spend on guided experiences and tend to use three or more social platforms to find inspiration.

- UK: British “super-spenders” are more influenced by live and streaming TV.

- Germany: German “super-spenders” tend to be more methodical, viewing price as a key factor and relying heavily on online research and customer reviews before making travel decisions

- France: French “super-spenders” value brands that are socially responsible and are the most social and outgoing, yet less likely to spend on guided experiences.

- Italy and Spain: Both markets show a high interest in spending on cultural experiences, with a significant portion of “super-spenders” using social media for travel research.

As the travel industry continues to evolve, GetYourGuide’s research emphasizes the need for travel businesses to adapt to these emerging trends. By leveraging data-driven insights and focusing on digital engagement, companies can better connect with the modern traveler and drive growth in an increasingly competitive market.

Access the full report