The rise of Wellness Wearables in 2024

Wearables growing faster than gym or fitness class spending

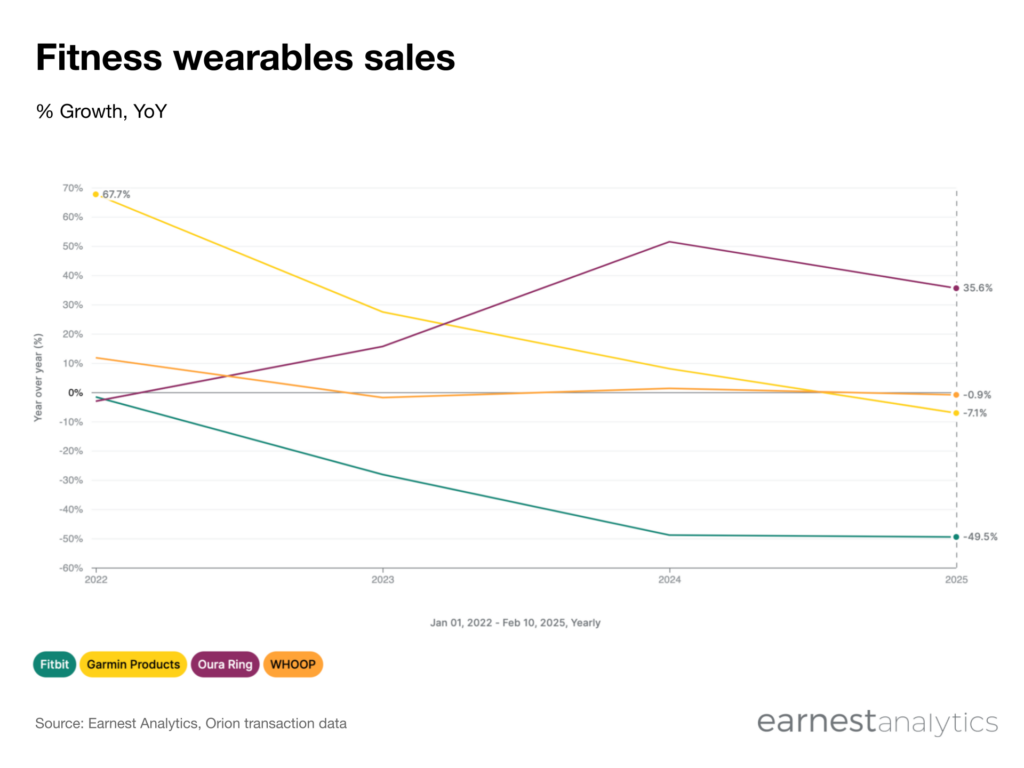

Wellness wearables outgrew Home Fitness, Gyms, and Fitness Classes in 2024. The rise in wellness shopping, not necessarily for fitness but rather for appearance and overall health, drove several companies’ performance.

Credit and debit card users spent 52% more YoY on the sleep and activity tracking Oura Ring in 2024. The year marked an acceleration for the ring maker, which has also had an equally strong start to 2025.

Garmin (GRMN) DTC sales also accelerated in 2024. The tech company sells watches and other fitness accessories for a variety of athletes. Whoop, which experienced strong pandemic sales, also accelerated in 2024.

Legacy fitness tracking hardware maker FitBit DTC sales continued to weaken in 2024, though credit card spending figures, again, do not include wholesale channels.

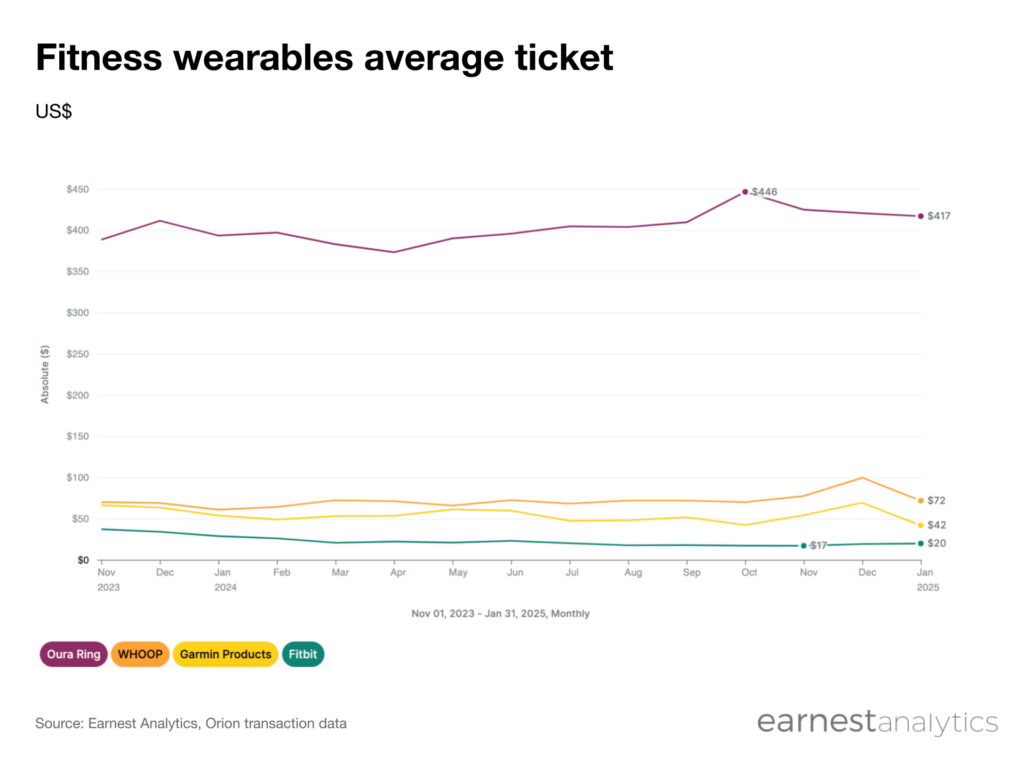

Oura Ring average ticket higher than other wearables

Wellness and fitness wearables have varying pricing structures and business models. Oura Ring tends to have the highest average ticket ranging from $150 to $319. This excludes the monthly or annual membership fee to access the ring’s insights. Together, this pushes average Oura Ring tickets over $400.

Whoop is the next highest average ticket wearable, around $100. This includes the band which can range from $49 to $99 as well as annual $199-$399 memberships.

Garmin tends to be the next lowest price point, with watches starting at $69 and no subscription fee. Fitbit has the lowest monthly average wearable tickets.

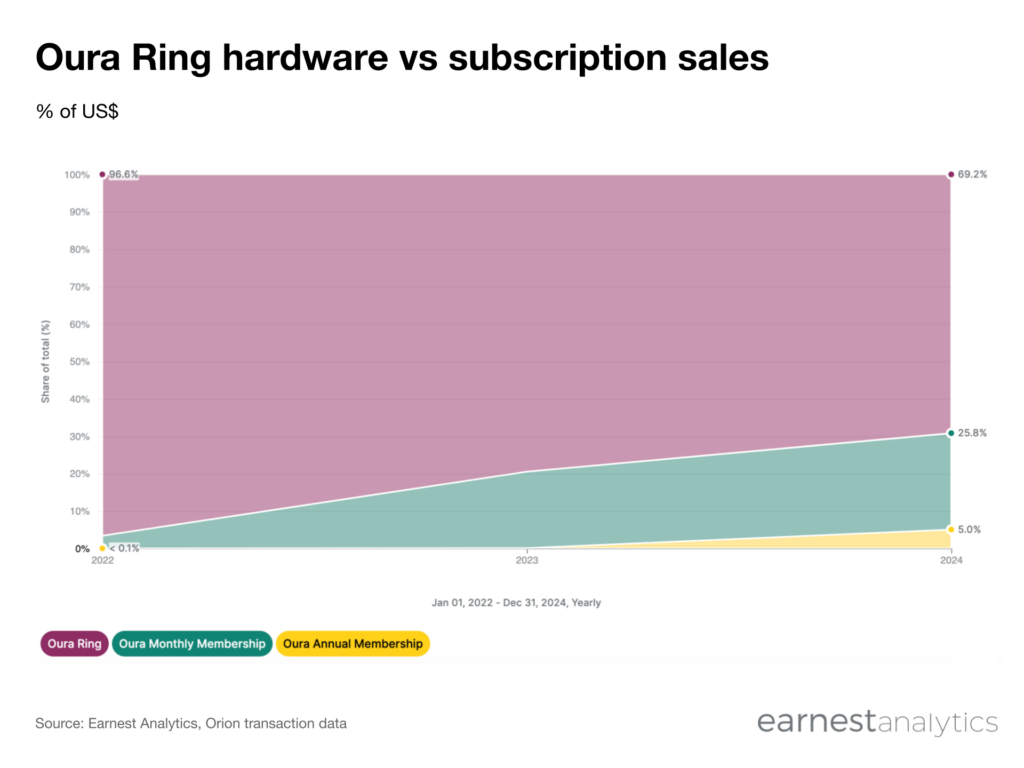

When hardware becomes a subscription

Oura Ring shoppers spent over 30% of their Oura dollars on subscriptions in 2024. That represented an increase from 20% in 2023. Most of those subscriptions are for Oura Ring’s monthly memberships.

Oura Ring’s increasing reliance on subscription dollars mirrors similar trends at other wearable brands like Whoop.

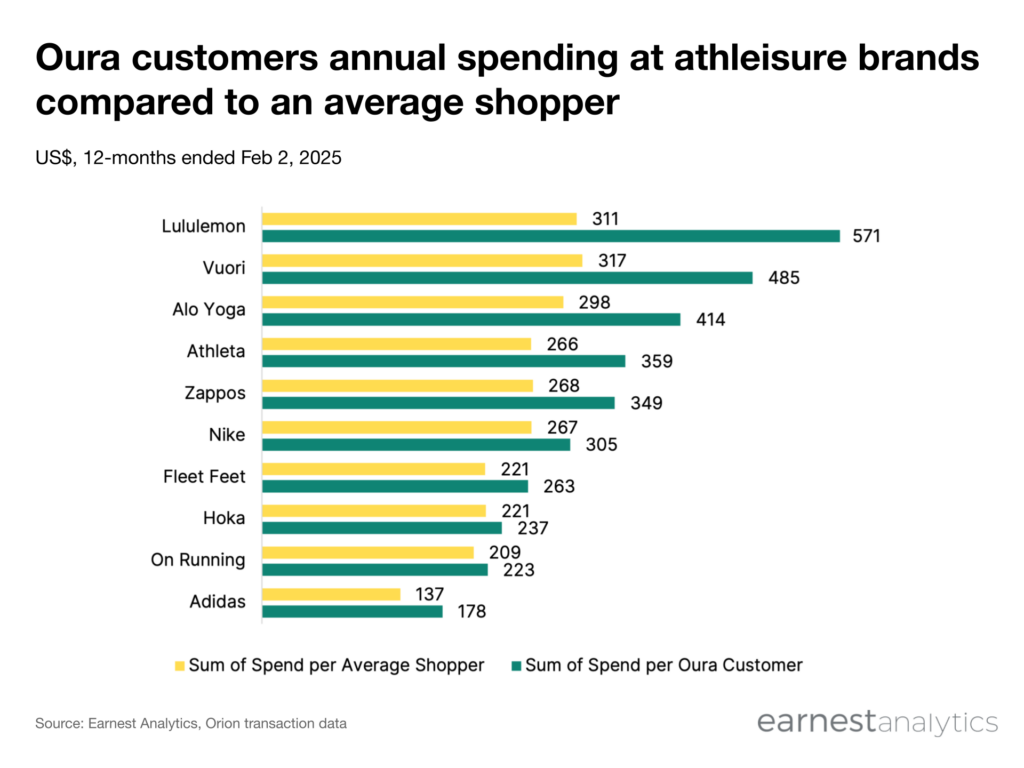

Oura Ring customers outspend at Lululemon, Alo Yoga

Oura Ring customers are highly valuable shoppers outside of wellness devices and subscriptions. Those customers spent $571 at Lululemon (LULU) in the 12-months ended February 2, 2025. This is nearly double the $311 that all the average shopper spent at Lululemon.

The pattern of Oura Ring customers outperforming largely holds true across major athleisure and footwear brands. Oura Ring users spent 1.5x the average shopper at Vuori, 1.4x at Alo Yoga and Athleta, and 1.3x at Adidas and Zappos (AMZN). They also outspent at running shoe stores Fleet Feet, Nike (NKE), Hoka (DECK), and On Running (ONON).