The RealReal’s mid-market appeal could save it from a wider luxury slowdown

Access chart in Dash.

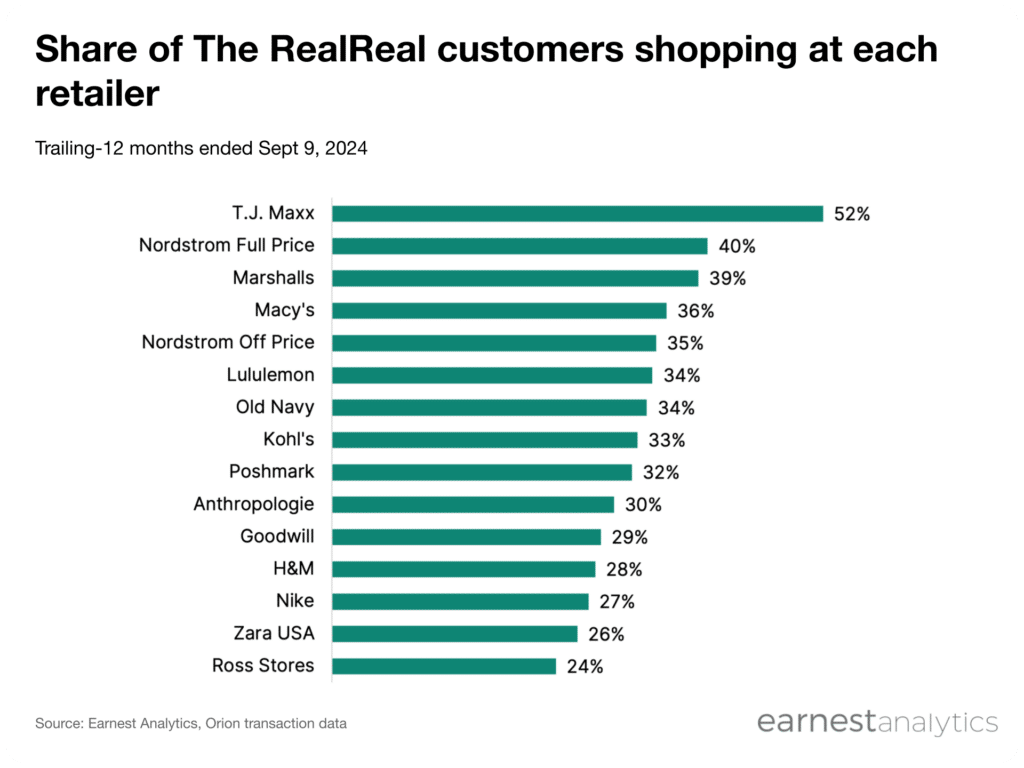

Over half of The RealReal’s customers shopped at T.J. Maxx in the 12 months ended Sept 9, 2024 according to Earnest credit card data. The RealReal, a fashion reseller specializing in high end vintage finds, rode a wave of luxury spending during the pandemic that slowed along with the broader luxury market in 2023. Now fashion resellers are looking to appeal to a different buyer as luxury retail headwinds continue.

T.J. Maxx is just one of several middle market general apparel retailers that make up the top 15 highest overlapping brands with The RealReal in the last year, suggesting that the luxury reseller has attracted a larger following of shoppers looking for value than luxury shoppers trading down. A handful of upper mid-market retailers such as Nordstrom and Anthropologie do rank highly among the highest customer overlap with The RealReal, but the highest overlap remains with mid-market and discount stores.

The broader appeal for The RealReal means it could be better positioned to weather the overall downturn in luxury spending after disappointing holiday and tax refund seasons which drove consolidation in the US luxury market.

Track Fashion Resale growth for free