Temu takes share of wallet from Dollar General, Dollar Tree customers

Dollar General shoppers are increasingly buying from online deep discounter Temu according to Earnest credit card data. Since the Pinduoduo-owned online marketplace Temu entered the US market in late 2022, it has shaken up the discount sales space. Temu sells rock-bottom priced home goods and clothing through its gamified app and website, which rewards customers for adding to their cart. The brand recently surpassed fast fashion brand Shein as the largest Chinese discounter in the US.

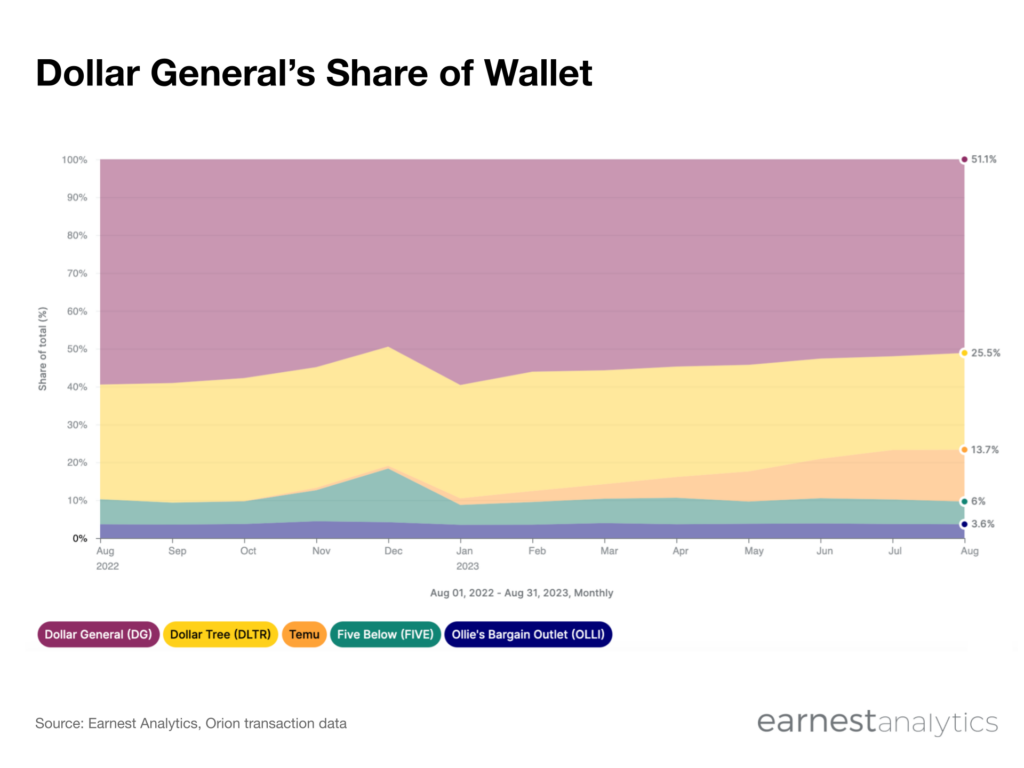

Earnest’s share of wallet analysis, which isolates spend by a brand’s existing customers across that brand’s competitors, suggests that Temu’s rise has had the most impact on Dollar General and Dollar Tree so far. Dollar General customers spent 51% of their discount wallet at the retailer in September 2023, down from 60% a year earlier. Dollar General customers spending at Dollar Tree declined similarly YoY, from 30% to 26%. Meanwhile, the share of Dollar Tree (including Family Dollar) customer dollars going to Temu rose from 0% to 14% during the same period. Surprisingly the share of spending by Dollar General customers at more specialty discounters like Five Below and Ollie’s Bargain Outlet remained fairly constant during that time.

The data suggests that Temu has initially had the biggest sales impact on general merchandise dollar stores like Dollar General, Dollar Tree, and Family Dollar. Despite its industry leading retention and lifetime value, Temu has yet to take meaningful wallet share from retailers like Five Below that specialize in toys and Ollie’s, which has a more home furnishings focus.