T.J. Maxx store openings disrupting Ross, Marshalls

TJX Companies’ (TJX) expansion strategy is reshaping several markets in the retailer’s favor according to Earnest credit card data. TJX CEO Ernie Herrman said in May 2024 he planned to expand “store footprint by at least another 1,300-plus stores.” Earnest ZIP code level sales data suggests that T.J. Maxx store openings in 2024 have already proven relatively successful in winning share.

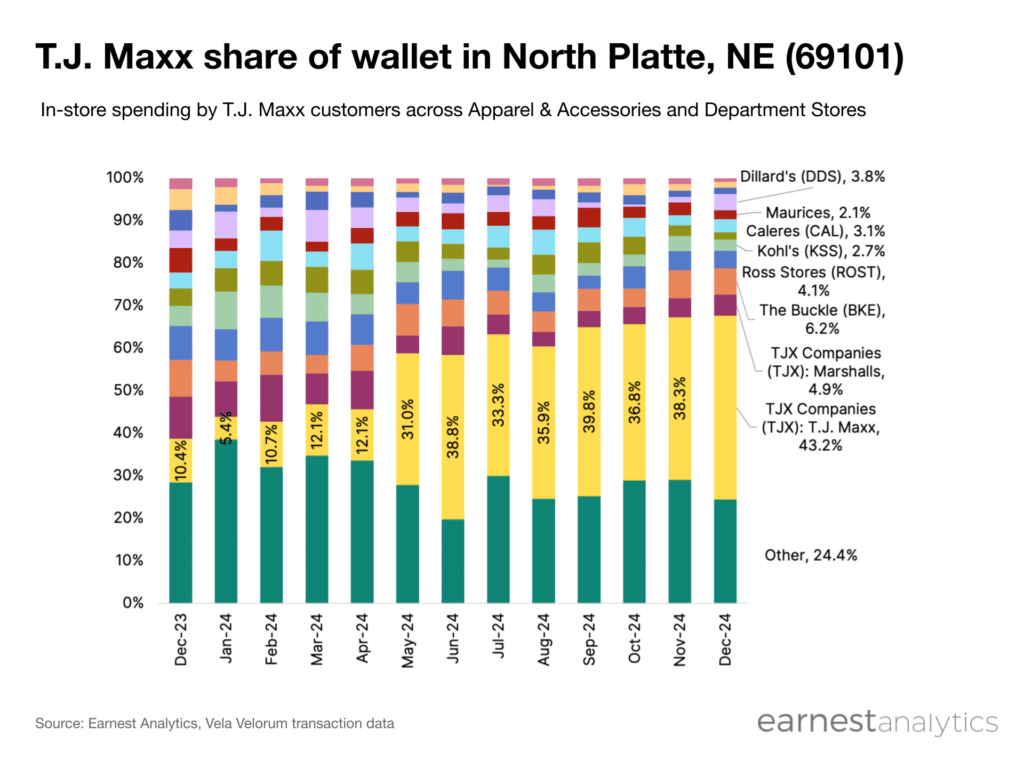

Taking share from Ross and Marshall’s in Nebraska

North Platte, Nebraska customers’ share shifted significantly after a T.J. Maxx store opened in May 2024. T.J. Maxx’s share grew from 12.1% in April to 38.8% by June, up 26.7 points. This suggests the retailer’s expansion strategy in the 69101 ZIP code pulled spending from local competitors.

Ross Stores (ROST) was among the most impacted large stores in the area, followed by Maurice. Both lost nearly 4% of share of wallet from December 2023 to December 2024. Ross sales also fell 4% YoY in December 2024 among T.J. Maxx customers. TJX corporate sister Marshall’s lost nearly 5% of share of wallet in the same period. All other Apparel & Accessories and Department Stores lost 4% of share between holidays.

Before the store opened, T.J. Maxx’s share of wallet remained in the low high single digits. This suggests consumers were shopping at T.J. Maxx locations outside of the ZIP code.

The top Marshalls stores frequented by the new TJX store shoppers were hours away in Kearney and Lincoln, NE. T.J. Maxx store openings could bring value to underserved and rural areas, encouraging local spending and reshaping regional shopping patterns.

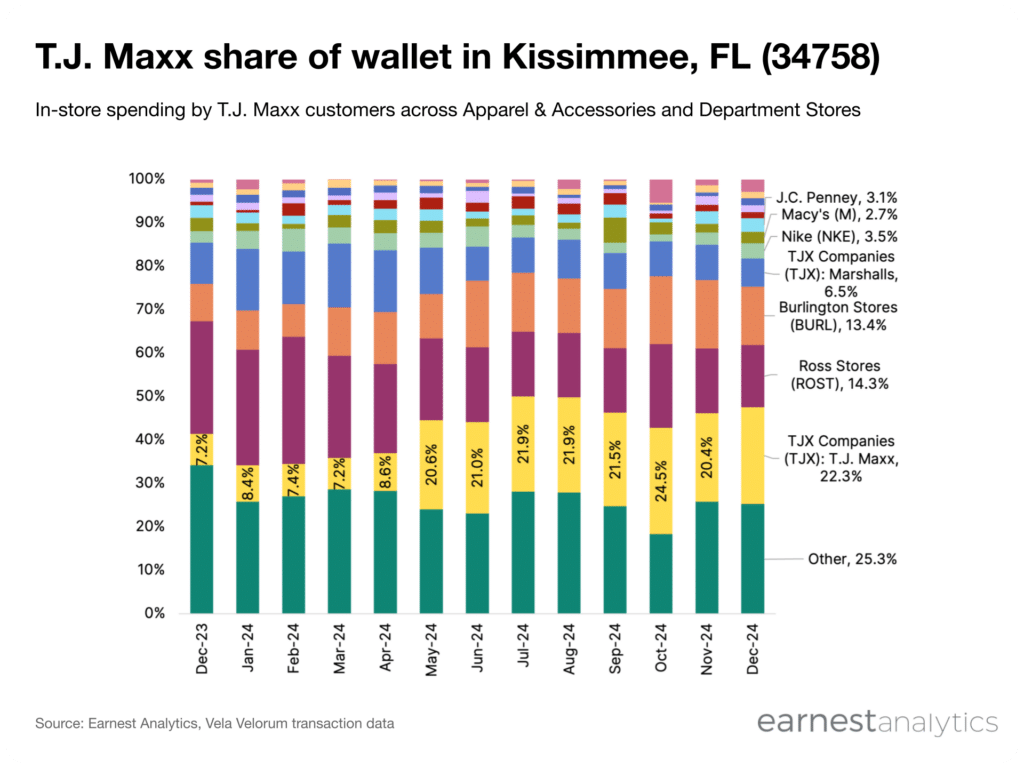

Disrupting smaller, less convenient stores in Florida

In Kissimmee, FL T.J. Maxx customers’ share of wallet similarly surged following a May 2024 opening. Wallet share increased 9 points from 12.0% in April to 21.0% by June 2024

ZIP code 34758 covers southwestern Kissimmee, Intercession City and Poinciana, and borders the Orlando metro area. Before the T.J. Maxx store opening, wallet share hovered in the low high single digits. This suggests customers were shopping at more distant T.J. Maxx locations in Kissimmee proper.

Like in the Nebraska case, Ross Stores lost the most share following the T.J. Maxx opening. Ross Stores controlled 14.3% share of T.J. Maxx shoppers’ wallet in December 2024, down from 26.0% the year prior. As of today, there are 9 Ross stores in Kissimmee, suggesting more T.J. Maxx store openings could further disrupt sales there.

Other smaller retailers were more impacted in Kissimee by T.J. Maxx’s store opening. Sales fell 1% YoY in December 2024, and share declined nearly 9 points. T.J. Maxx’s share of wallet at sister concept, Marshalls, fell only 3% in that same period.

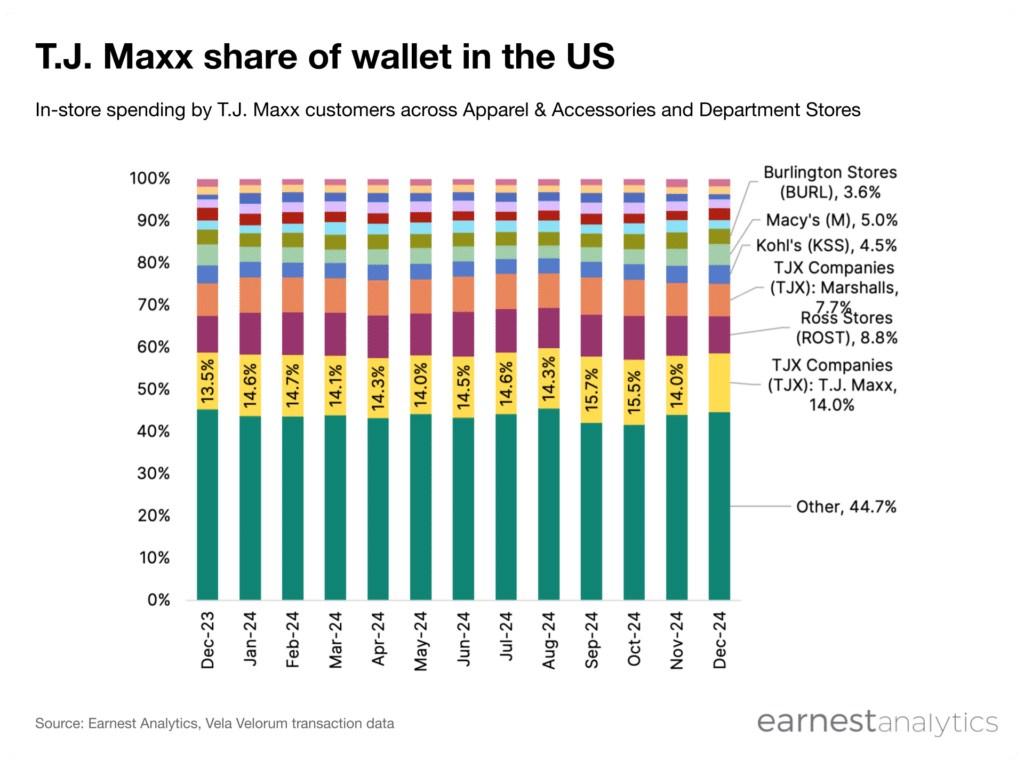

T.J. Maxx taking share in a shrinking national market

Nationally, T.J. Maxx customers spent 14% of their Apparel & Accessories and Department Store wallet at the retailer in December 2024. This is a 0.5% increase from the previous year. T.J. Maxx store openings helped win share of wallet from The Gap (GAP), Dillard’s (DDS), and smaller retailers during the holidays. However on the whole, T.J. Maxx customers’ December 2024 spending was roughly in-line to slightly below December 2023.

Still the retailer is competing in a shifting market. Ecommerce brands outgrew most Apparel & Accessories and Department Stores during the 2024 holiday shopping season. T.J. Maxx’s store openings are the only way the predominantly brick-and-mortar retailer can grow.