Supreme customers pull back on apparel spending; brand is sold to Luxottica

Access chart in Dash.

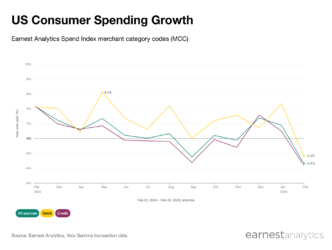

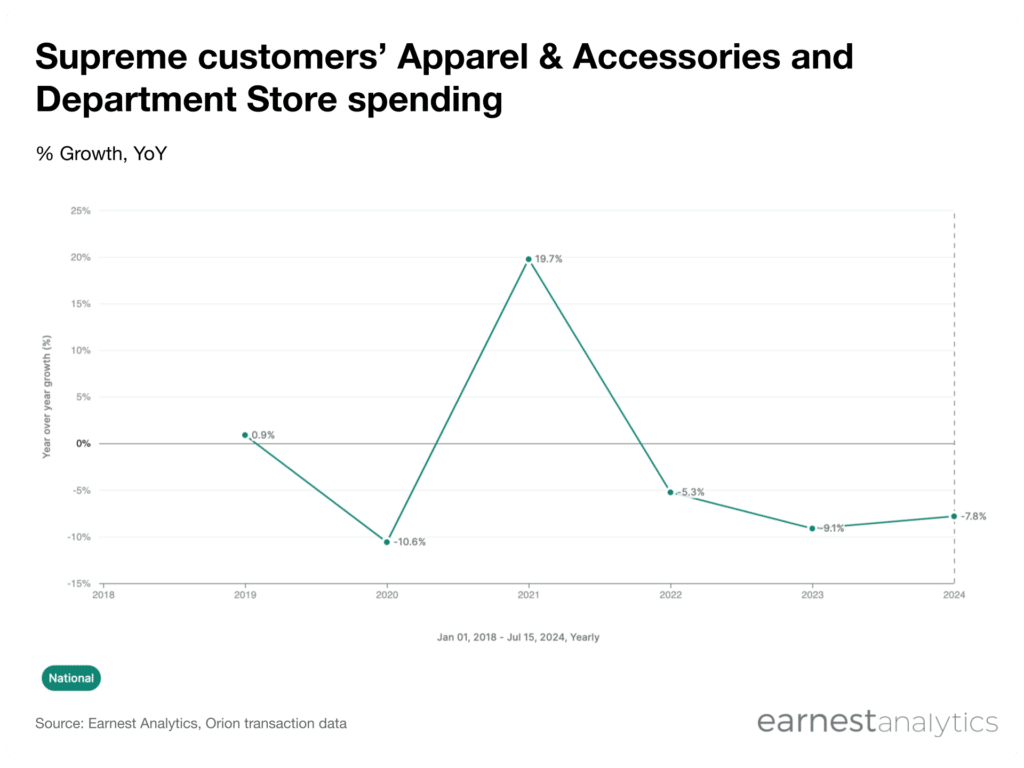

Supreme’s customers were spending less on clothing for years before VF decided to sell the struggling streetwear brand to Luxottica, according to Earnest credit card data. Among Supreme’s DTC customers, their spending on Apparel & Accessories and Department Store chains fell 9.1% YoY in 2023 and is down 7.7% YoY YTD from Jan 1-Jul 8, 2024. This is a steeper deceleration than total Apparel & Accessories and Department Store chains spending decline (-3.1% YoY in 2023 and -3.4% YoY in 2024 YTD).

Access chart in Dash.

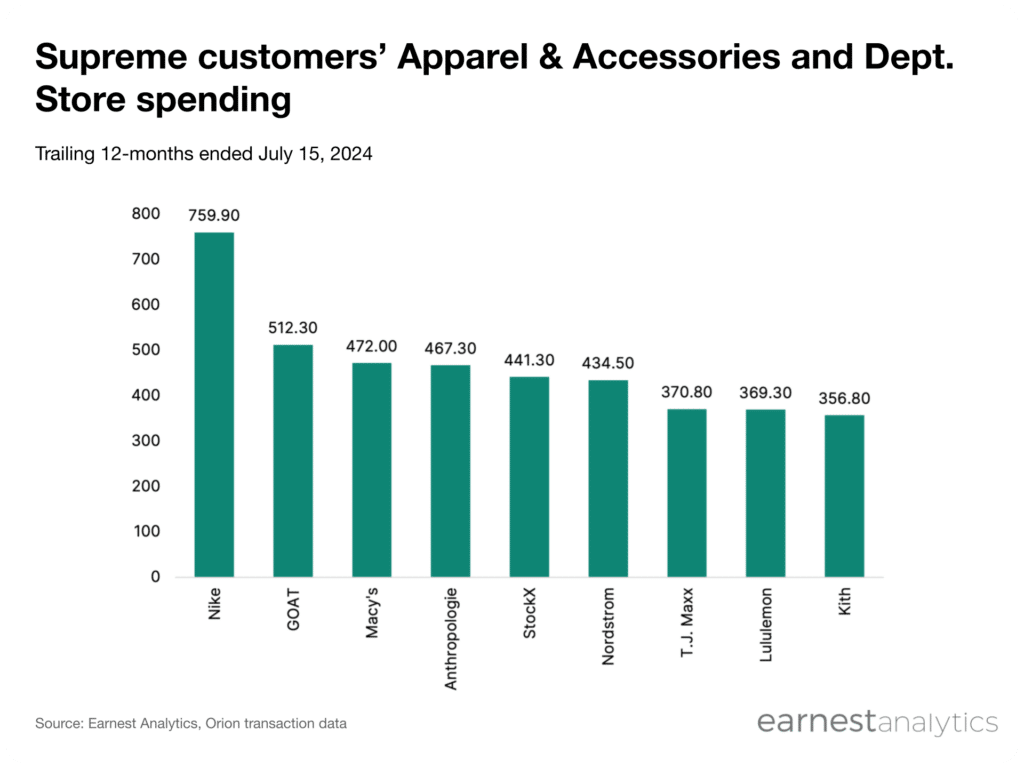

While Supreme customers are significantly more likely to shop at Kith (121x more likely), Grailed (104x), StockX (13.26x), GOAT (8.03x), and Depop (7.61x) than the average US shopper, that’s not where Supreme DTC customers spend most of their apparel dollars.

Instead, Supreme DTC customers spent most of their apparel dollars at Nike in the 12 months ended July 8, 2024 ($772), followed by GOAT ($510.4), Anthropologie ($478.6), Macy’s ($470.8), StockX ($444.2), Nordstrom ($439.4), TJ Maxx ($373), Lululemon ($370.2), and Kith ($350.6). The presence of brands like Anthropologie suggest to me that women were likely purchasing at the mostly male-wear Supreme, possibly as gifts.

Interestingly, Shein, Temu, and TikTok Shop do not appear to be major drivers of falling Supreme spending, as none rank highly among Supreme shoppers’ top brands by dollars spent or overall shopper affinity.

Access chart in Dash.

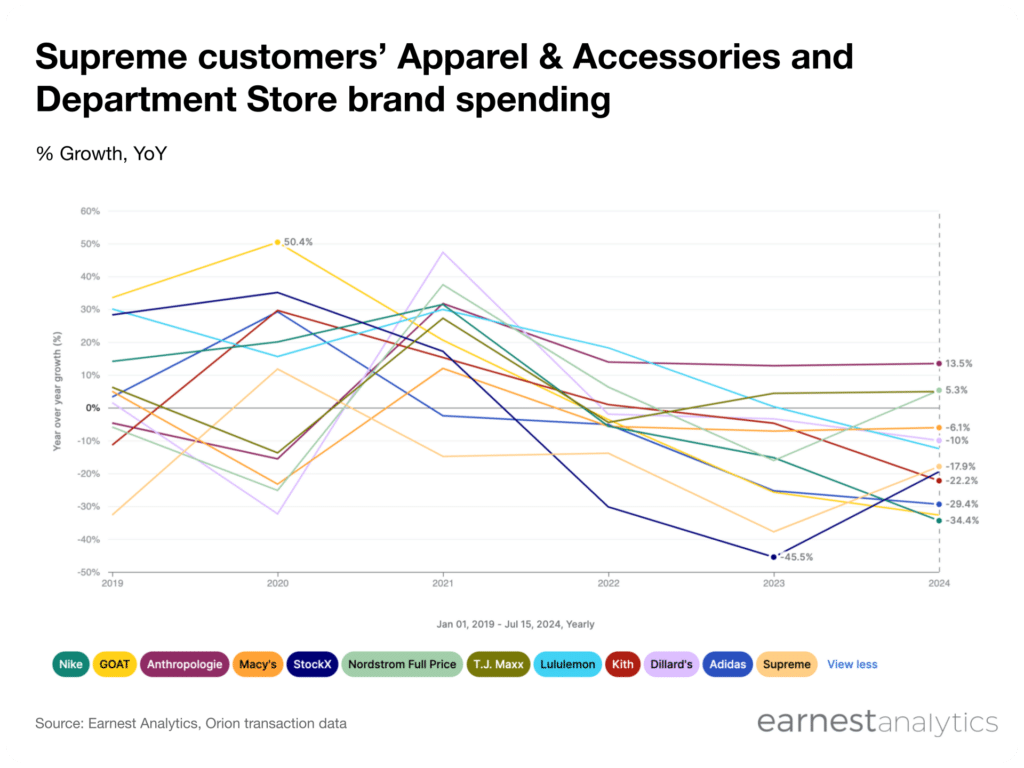

Not surprisingly, Supreme DTC customers’ spending at all of the aforementioned top spending brands is down mid-single to low-double digits YoY in 2024, with the exception of Anthropologie (+15% YoY), Nordstrom (+4.4% YoY), and TJ Maxx (+5% YoY). Spending at Nike fell an incredible 34% YoY so far in 2024. This suggests Supreme buyers are not necessarily moving their dollars to other apparel brands, but rather spending less on apparel in general including collectors sneakers as they look for value at discounters.

Track Apparel & Accessories spending free