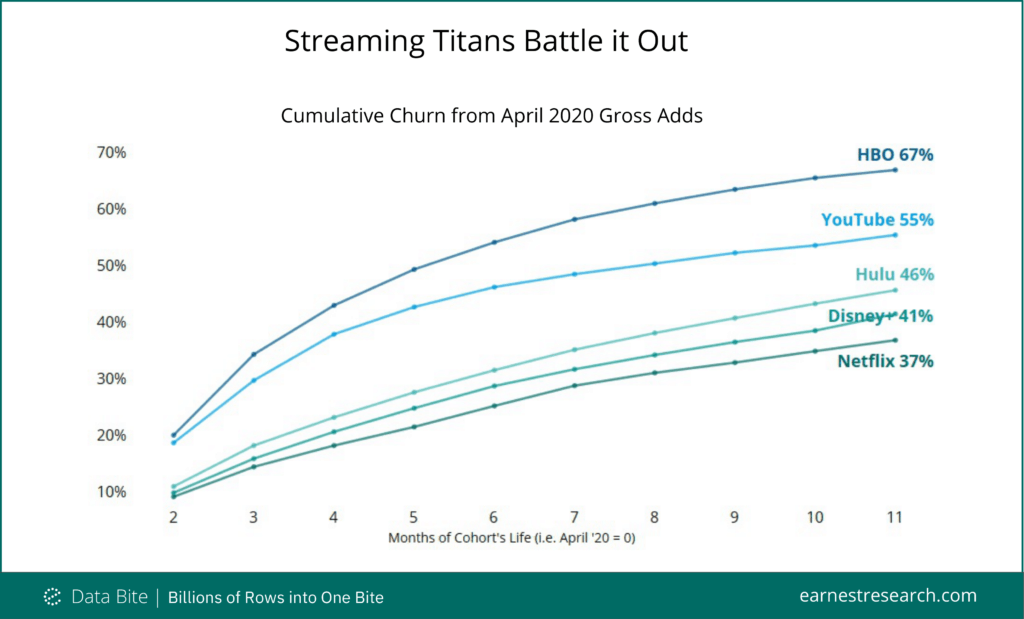

Streaming Titans Battle it Out

Blows were exchanged between the streaming giants in 1Q21 with AT&T reporting 2.7 million additional HBO Max and HBO subscribers in the US, while Netflix reported just 448k net adds in the US & Canada. We looked at how long subscribers stay with the leading providers in SVOD (Subscription Video on Demand).

We focused on new subscribers that signed up for a streaming service in April 2020, during the initial U.S. COVID outbreak, a literal captive audience due to national lockdown orders. From this cohort, stalwart Netflix led the way with the fewest churned subscribers at 37% after 11 months, while newcomer Disney+ lost 41%, followed by Hulu at 46%, and YouTube TV losing 55% of subscribers.

With AT&T’s HBO Now and expanded HBO Max offering losing around two thirds of their April’20 new subscribers, it will be interesting to see how their 1Q21 new subscribers, driven by the Snyder Cut and record-setting Godzilla vs. Kong releases, stick with the service longer term.

Note: Churn here is cumulative, calculated from a fixed cohort, and doesn’t take into account subscribers that may have later rejoined. It thus may appear overstated. This analysis includes only SVOD subscriptions, and not subscriptions bought via cable providers.